India Pneumatic Tools Market Size, Share, Trends, and Forecast by Type, Application, End-Use, and Region, 2026-2034

India Pneumatic Tools Market Overview:

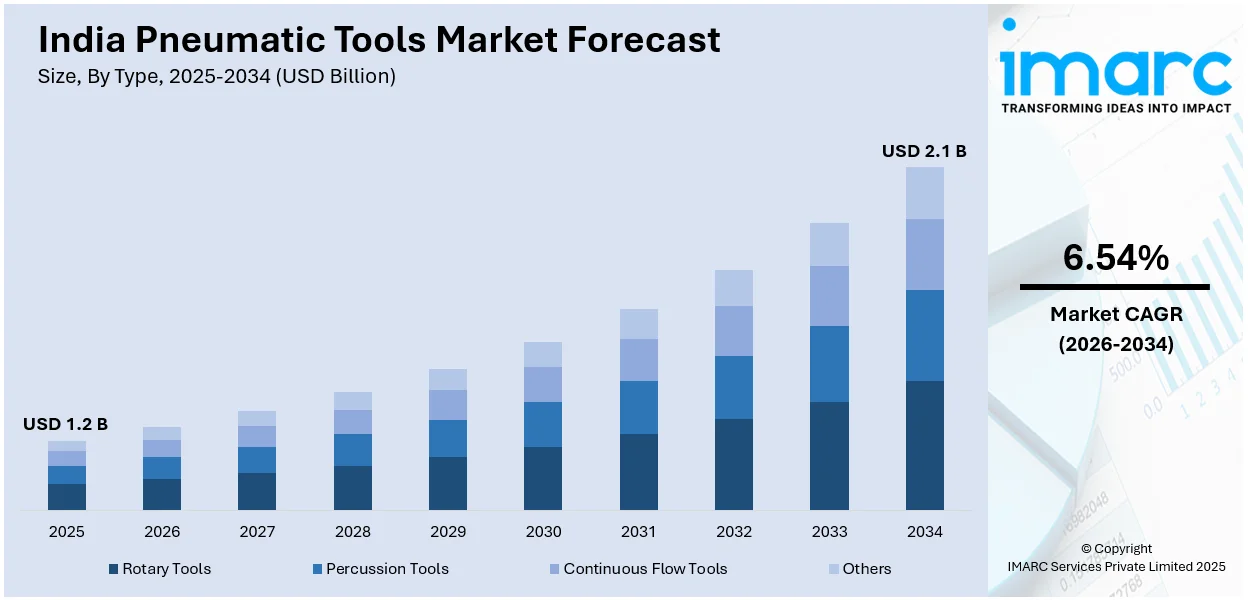

The India pneumatic tools market size reached USD 1.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.1 Billion by 2034, exhibiting a growth rate (CAGR) of 6.54% during 2026-2034. The market is witnessing significant growth, driven by a rising demand for automation in manufacturing and automotive sectors and expansion of construction and infrastructure development projects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2034 | USD 2.1 Billion |

| Market Growth Rate 2026-2034 | 6.54% |

India Pneumatic Tools Market Trends:

Rising Demand for Automation in Manufacturing and Automotive Sectors

Increased automation drives demand for pneumatic tools across numerous manufacturing and automotive segments in India. Industries trying for better productivity, efficiency, and safety in the workplace have turned to pneumatic tools in automated production lines. These features pneumatically apply to certain specific industrial applications: the highest torque, lightweight construction, and lower maintenance costs compared with electric tools. Uses include assembly, painting, and maintenance applications of the automotive industry as well. Government initiatives such as the Automotive Mission Plan 2026 support growth in vehicle production and, therefore, additional impetus for market growth. Increasing volumes of electric vehicles (EV) are increasingly screaming out for more advanced efficient manufacturing solutions that will place pneumatic tools in addition precision components of their possible applications. For instance, as per industry reports, in September 2024, India’s electric vehicle sales may hit 3-4 million units by 2025 and 10 million by 2030. At present, two- and three-wheel vehicles lead the market, accounting for 80% of it and fueling swift industry expansion. In the broader manufacturing sector, the Make in India initiative and the expansion of industrial parks are promoting investment in advanced production technologies, increasing the adoption of pneumatic tools. The emphasis on reducing human intervention in hazardous tasks is another factor contributing to their demand. With automation continuing to expand, pneumatic tools are expected to witness sustained growth, particularly in industries requiring high-speed and precision-based operations.

To get more information on this market Request Sample

Expansion of Construction and Infrastructure Development Projects

Due to the rapid growth of the construction and infrastructure sector in India, the pneumatic tools market is also flourishing. The Government of India's largescale infrastructure-building initiatives like the Smart Cities Mission, Bharatmala, and PM Gati Shakti have spurred demand for high-performance tools required for road laying, urban development, and industrial projects. Pneumatic tools are famous for their robustness and excellent power-to-weight ratio. These are utilized extensively for demolition, drilling, and fastening work in large infrastructure assignments. The real estate sector is also stimulating demand to an extent, as there has been rising demand for both residential and commercial properties. Rapid urbanization and rising foreign direct investment in construction sectors are driving the demand for efficient tools that elevate productivity and minimize labor costs. For instance, in January 2024, Festo India announced an investment of ₹520 crore in a pneumatic components facility in Krishnagiri, Tamil Nadu, producing actuators, valves, and automation equipment, boosting local manufacturing, cutting imports, creating 1,500 jobs, and advancing pneumatic automation. Moreover, the rising adoption of prefabrication and modular construction methods is enhancing further the dependence on pneumatic tools for precision assembly and installation processes. Another critical growth factor is the growth in the construction equipment rental market. Many contractors and developers prefer the rental of pneumatic tools to minimize costs while keeping operational efficiency. Investments in infrastructure will keep rising, and labor shortages will further push the demand for mechanized tools, causing the pneumatic tools' market in India to have stable growth in the coming years.

India Pneumatic Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type, application, and end-use.

Type Insights:

- Rotary Tools

- Percussion Tools

- Continuous Flow Tools

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes rotary tools, percussion tools, continuous flow tools, and others.

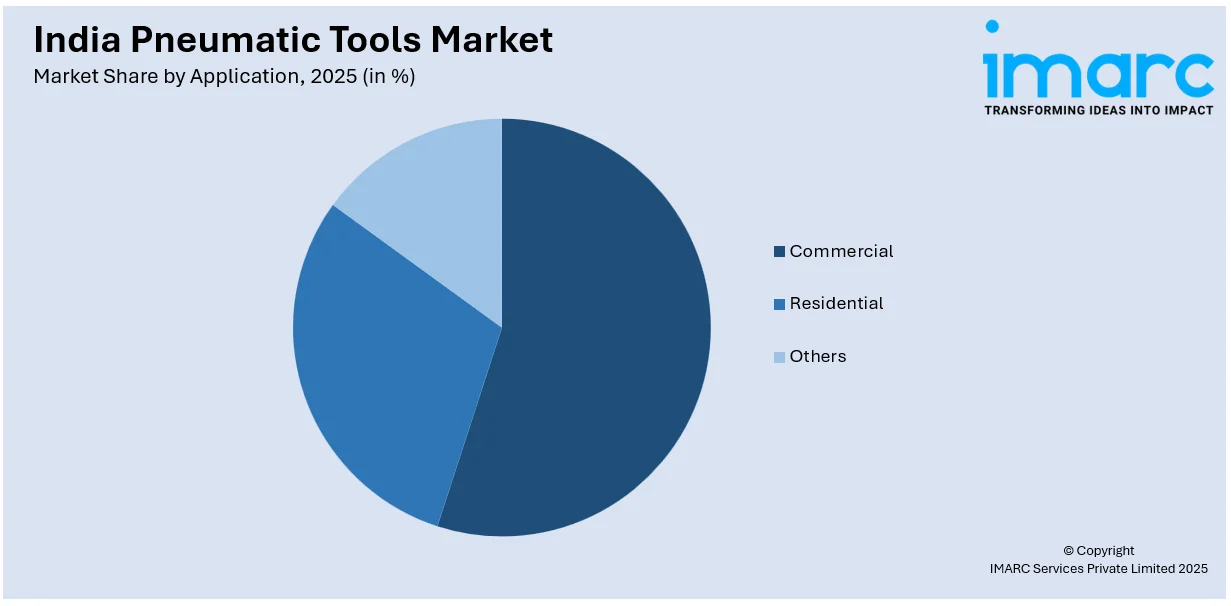

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, residential, and others.

End-Use Insights:

- Manufacturing Industry

- Automotive Industry

- Construction Industry

- Others

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes manufacturing industry, automotive industry, construction industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pneumatic Tools Market News:

- In March 2025, John Cockerill Defense and Electro Pneumatics & Hydraulics Pvt Ltd announced partnership to enhance India’s defense sector, leveraging pneumatic tools and hydraulic systems for advanced manufacturing, automation, and defense applications under ‘Make in India.’

- In January 2025, Atlas Copco announced the acquisition of Trident Pneumatics Pvt. Ltd., enhancing its pneumatic tools portfolio with compressed air treatment and on-site gas generation solutions, strengthening its Indian market presence and expanding air management capabilities for industrial automation.

India Pneumatic Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rotary Tools, Percussion Tools, Continuous Flow Tools, Others |

| Applications Covered | Commercial, Residential, Others |

| End-Uses Covered | Manufacturing Industry, Automotive Industry, Construction Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pneumatic tools market performed so far and how will it perform in the coming years?

- What is the breakup of the India pneumatic tools market on the basis of type?

- What is the breakup of the India pneumatic tools market on the basis of application?

- What is the breakup of the India pneumatic tools market on the basis of end-use?

- What is the breakup of the India pneumatic tools market on the basis of region?

- What are the various stages in the value chain of the India pneumatic tools market?

- What are the key driving factors and challenges in the India pneumatic tools?

- What is the structure of the India pneumatic tools market and who are the key players?

- What is the degree of competition in the India pneumatic tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pneumatic tools market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pneumatic tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pneumatic tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)