India Polycarbonate Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

India Polycarbonate Market Size and Share:

The India polycarbonate market size reached USD 369.35 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 565.66 Million by 2033, exhibiting a growth rate (CAGR) of 4.85% during 2025-2033. The market is driven by growing demand in automotive and electronics, rapid urbanization, increasing infrastructure projects, rising adoption in medical devices, expanding packaging applications, strong government initiatives for domestic manufacturing, and a shift towards lightweight, durable materials in various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 369.35 Million |

| Market Forecast in 2033 | USD 565.66 Million |

| Market Growth Rate (2025-2033) | 4.85% |

India Polycarbonate Market Trends:

Growing Demand for Lightweight and Durable Materials in Automotive and Electronics

The India polycarbonate market outlook is experiencing significant industrial growth from the automotive and electronics sectors due to the material's characteristics of low weight, superior impact resilience, and impressive thermal stability. Automakers implement polycarbonate components throughout their vehicles, especially in headlamp lenses, sunroofs, and interior panels, because these applications help decrease vehicle weight and enhance fuel efficiency. Moreover, the growth of electric vehicles (EVs) has spurred the use of polycarbonate in battery housing and EV charging equipment. Besides this, polycarbonate material is widely used in the electronics industry, including smartphone enclosures and light-emitting diode (LED) light housing, and optical data storage units. Furthermore, under digitalization in India and through the expanding consumer electronics market along with "Make in India" government support of domestic production, polycarbonate is experiencing a rising demand. For instance, in November 2024, India announced plans to offer $4-$5 billion in incentives to companies producing electronic components locally. This initiative aims to reduce dependence on imports, particularly from China, and is expected to bolster the domestic electronics sector, thereby increasing the demand for polycarbonate materials used in electronic components. As a result, the development of improved polycarbonate blends with co-polymers brings better performance features that push innovation forward and boost the India polycarbonate market in India share.

.webp)

To get more information on this market, Request Sample

Sustainability and Recycling Initiatives Driving Market Innovation

The India polycarbonate market is transforming its direction toward environmentally sustainable and recyclable alternatives due to both sustainability concerns and strict environmental regulations. In line with this, factory operations invest in bio-based polycarbonates and innovative recycling methods because they aim to cut down plastic waste and environmental emissions. Moreover, the chemical recycling process that reintroduces used polycarbonate monomers into circulation for reuse has become significantly more popular than mechanical recycling. For example, in 2024, Revalyu Resources commissioned a new PET recycling plant in Nashik with a production capacity of 240 tons per day, utilizing advanced glycolysis-based recycling technology to produce recycled PET with significantly reduced water and energy consumption. Besides this, various firms use post-consumer recycled (PCR) polycarbonates to build electronic products and develop automotive systems and construction materials. Also, sustainable manufacturing programs and Extended Producer Responsibility (EPR) regulations of the government guide industries toward adopting circular economy principles. Additionally, environmental building standards and consumer demand for sustainability boost the market for eco-friendly polycarbonate solutions, which are vital for construction and packaging applications. Apart from this, profitable market positions now depend on sustainability, which motivates companies to develop biodegradable as well as low-carbon-footprint polycarbonate solutions, thereby driving the India polycarbonate market growth.

India Polycarbonate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Sheets and Films

- Fibers

- Blends

- Tubes

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sheets and films, fibers, blends, tubes, and others.

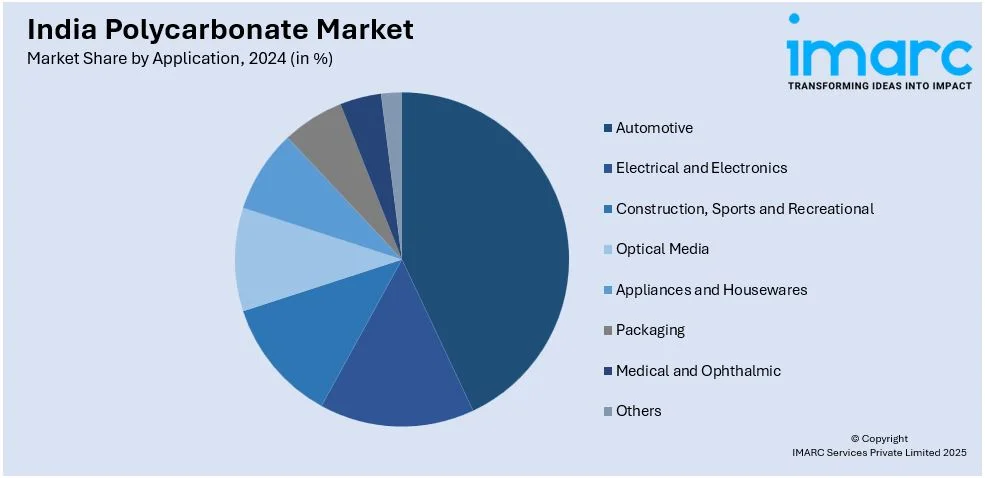

Application Insights:

- Automotive

- Electrical and Electronics

- Construction, Sports and Recreational

- Optical Media

- Appliances and Housewares

- Packaging

- Medical and Ophthalmic

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, electrical and electronics, construction, sports and recreational, optical media, appliance and housewares, packaging, medical and ophthalmic, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polycarbonate Market News:

- In February 2025, Autotech-Sirmax India Pvt. Ltd. inaugurated its expanded Palwal plant in Haryana, doubling production capacity to 30 kTPA. This enhancement aims to meet the rising demand for high-performance thermoplastic compounds across industries like automotive and electronics.

- In November 2024, Deepak Chem Tech Limited (DCTL), a subsidiary of Deepak Nitrite Limited, announced a ₹5,000 crore investment to acquire Trinseo's polycarbonate assets in Stade, Germany. This move is set to bolster India's engineering polymers market, catering to sectors like automotive, electronics, and aerospace.

India Polycarbonate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sheets and Films, Fibers, Blends, Tubes, Others |

| Applications Covered | Automotive, Electrical and Electronics, Construction, Sports and Recreational, Optical Media, Appliance and Housewares, Packaging, Medical and Ophthalmic, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polycarbonate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polycarbonate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polycarbonate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The polycarbonate market in India was valued at USD 369.35 Million in 2024.

The India polycarbonate market is projected to exhibit a CAGR of 4.85% during 2025-2033, reaching a value of USD 565.66 Million by 2033.

The electronics sector relies on polycarbonate for making durable and heat-resistant casings and components. Additionally, the growing urbanization, industrial development, and a rising focus on sustainable, recyclable materials are catalyzing the demand for polycarbonate. The increasing need for high-performance plastics in consumer goods and medical devices is further contributing to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)