India Polycarboxylate Ether Market Size, Share, Trends, and Forecast by Type, Application, and Region, 2025-2033

India Polycarboxylate Ether Market Overview:

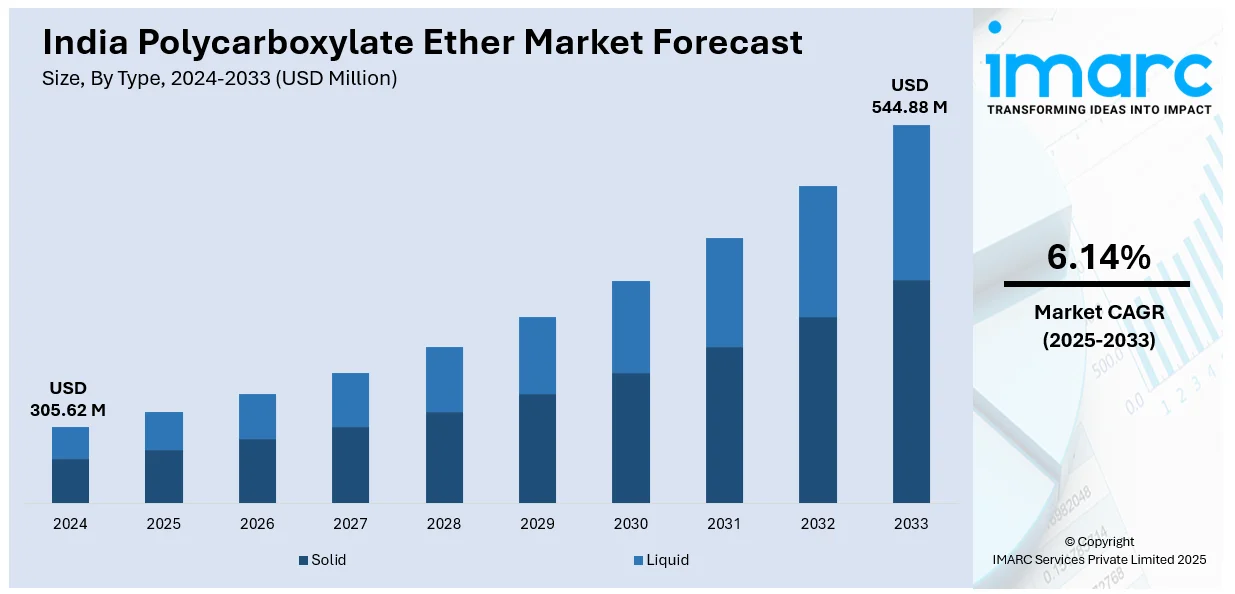

The India polycarboxylate ether market size reached USD 305.62 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 544.88 Million by 2033, exhibiting a growth rate (CAGR) of 6.14% during 2025-2033. The rising construction activities, increasing demand for high-performance concrete, government infrastructure projects, urbanization, advancements in admixture technology, sustainability initiatives, water-reducing properties, improved workability, and the shift toward eco-friendly and energy-efficient building materials in commercial and residential sectors are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 305.62 Million |

| Market Forecast in 2033 | USD 544.88 Million |

| Market Growth Rate 2025-2033 | 6.14% |

India Polycarboxylate Ether Market Trends:

Growing Demand for Eco-Friendly Concrete Solutions

India’s construction sector is increasingly shifting toward sustainable building materials, with polycarboxylate ether (PCE) playing a vital role in the development of eco-friendly concrete solutions. As infrastructure projects prioritize reduced carbon emissions, PCE is being widely adopted in high-performance concrete formulations, particularly in green cement applications. Its ability to lower water-cement ratios while enhancing strength and durability aligns with industry efforts to minimize environmental impact. The market is further driven by government initiatives promoting low-carbon construction practices and the rising use of supplementary cementitious materials like fly ash and slag. With sustainability becoming a key focus in urban development and infrastructure expansion, demand for high-efficiency concrete additives is set to accelerate in the coming years. For example, the global green cement market size reached USD 38.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 102.0 Billion by 2033, exhibiting a growth rate (CAGR) of 10.2% during 2025-2033.

To get more information on this market, Request Sample

Rising Demand for High-Performance Construction Additives

India's construction industry is seeing growing usage of sophisticated chemical admixtures to improve durability, workability, and sustainability of concrete. Polycarboxylate ether (PCE) is emerging as an integral part in new-age infrastructure projects, especially in high-strength and self-compacting concrete applications. Demand is growing with builders looking for solutions that provide better water reduction and cement dispersion while complying with strict environmental rules. Investment in smart infrastructure and urban development is also driving next-generation concrete additive demand. The shift toward sustainable construction materials is also driving innovation in PCE formulations, catering to growing requirements for eco-friendly, high-efficiency solutions. As infrastructure projects scale up, companies focusing on high-performance construction chemicals are well-positioned to capitalize on evolving material needs. For instance, in October 2022, Rite Zone Chemcon India Ltd., specializing in construction chemicals and concrete products, launched its SME IPO, offering 1,195,200 equity shares at INR 75 each, aiming to raise INR 8.96 Crore. The company produces key raw materials like polycarboxylate ether (PCE), essential for high-performance concrete admixtures.

India Polycarboxylate Ether Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Solid

- Liquid

The report has provided a detailed breakup and analysis of the market based on the type. This includes solid and liquid.

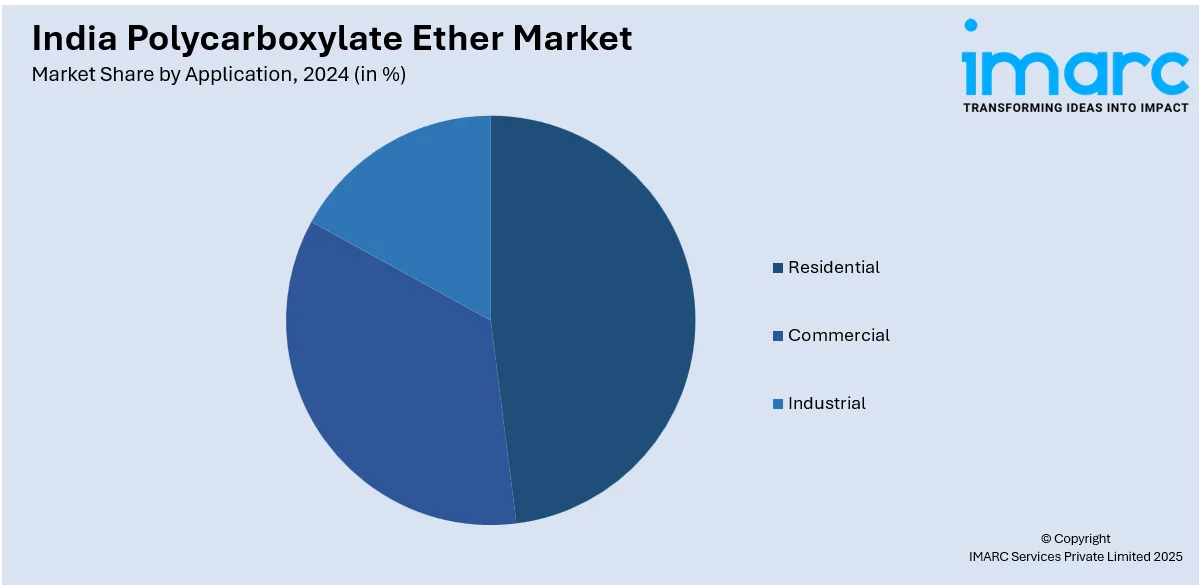

Application Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polycarboxylate Ether Market News:

- In February 2024, JSW One Platforms introduced JSW One Concrete, a ready-mix concrete solution, in the Mumbai Metropolitan Region, with plans to expand to India's top 20 RMC markets by FY 2027. Leveraging in-house resources like cement, GGBS, and chemical admixtures, the product emphasizes quality and timely delivery.

India Polycarboxylate Ether Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solid, Liquid |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polycarboxylate ether market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polycarboxylate ether market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polycarboxylate ether industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The polycarboxylate ether market in India was valued at USD 305.62 Million in 2024.

The India polycarboxylate ether market is projected to exhibit a CAGR of 6.14% during 2025-2033, reaching a value of USD 544.88 Million by 2033.

The India polycarboxylate ether market is driven by rising construction activities, increasing demand for high-performance concrete, and the need for durable and sustainable building materials. Enhanced workability, water reduction, and cost-efficiency offered by polycarboxylate ethers are boosting adoption across residential, commercial, and infrastructure projects.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)