India Polyol Sweeteners Market Size, Share, Trends and Forecast by Product, Form, Function, Application, and Region, 2025-2033

India Polyol Sweeteners Market Overview:

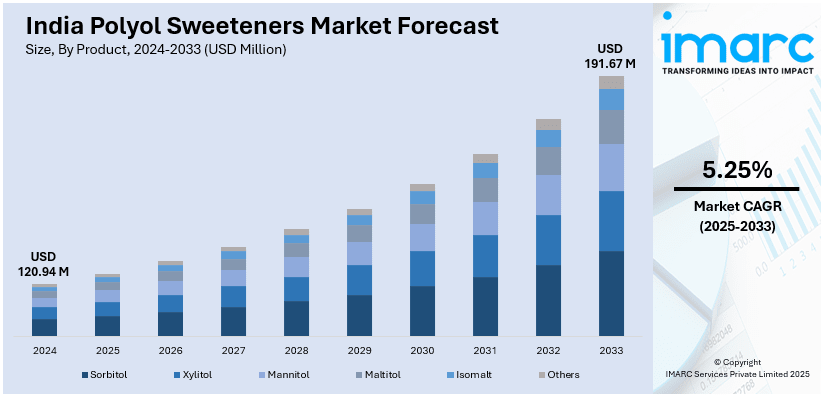

The India polyol sweeteners market size reached USD 120.94 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 191.67 Million by 2033, exhibiting a growth rate (CAGR) of 5.25% during 2025-2033. The market is driven by rising health consciousness, increasing diabetic population, and demand for low-calorie sugar alternatives. Growth in the food and beverage industry, government health initiatives, and expanding functional food sector further propel the India polyol sweeteners market share. E-commerce and disposable income growth also enhance accessibility to sugar-free products, enhancing market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 120.94 Million |

| Market Forecast in 2033 | USD 191.67 Million |

| Market Growth Rate (2025-2033) | 5.25% |

India Polyol Sweeteners Market Trends:

Rising Demand for Low-Calorie and Diabetic-Friendly Sweeteners

The India polyol sweeteners market is experiencing significant growth due to the increasing demand for low-calorie and diabetic-friendly sugar alternatives. On World Diabetes Day 2024, India reiterated the urgent need to further strengthen diabetes prevention, management, and equitable access to healthcare services, with chronic non-communicable disease (NCD) affecting 10.1 Crore (approximately 101 Million) individuals, as revealed by the ICMR-INDAIB study. Due to a rise in diabetes-related complications, the demand for sugar-free products in India is witnessing a significant increase. Polyols, including sorbitol, xylitol, and maltitol, are gaining popularity as they provide sweetness without spiking blood glucose levels. Food and beverage manufacturers are incorporating these sweeteners into products such as sugar-free candies, chewing gums, and baked goods to cater to health-conscious consumers. Additionally, the implementation of favorable government initiatives is promoting healthy eating habits and stricter sugar regulations, which is positively impacting the India polyol sweeteners market outlook. The trend is also supported by the expanding functional food and nutraceutical sectors, where polyols are used as safe sugar substitutes. As consumer awareness about obesity and metabolic disorders rises, the demand for polyol sweeteners is expected to grow steadily in India.

To get more information on this market, Request Sample

Expansion in the Food & Beverage Industry Driving Market Growth

The Indian food and beverage industry is a key driver for the polyol sweeteners market growth, with increasing applications in confectionery, dairy, and beverages. As consumers seek healthier alternatives to traditional sugar, manufacturers are reformulating products with polyols to meet this demand. The confectionery sector, in particular, is witnessing a rise in sugar-free chocolates and candies made with maltitol and erythritol. A research report from the IMARC Group indicates that the market for sugar-free confectionery in India was valued at USD 72.23 Million in 2024. It is projected to grow to USD 120.22 Million by 2033, reflecting a compound annual growth rate (CAGR) of 5.38% from 2025 to 2033. Additionally, the rising popularity of functional beverages and low-calorie drinks increases the usage of polyols as sweetening agents. The growth of e-commerce and organized retail is enabling easy access to sugar-free products for urban and semi-urban consumers. Furthermore, the increasing disposable income and changing dietary preferences are encouraging the adoption of premium sugar-free products. With the food industry’s continuous innovation and product development, the polyol sweeteners market in India is poised for robust growth.

India Polyol Sweeteners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, form, function, and application.

Product Insights:

- Sorbitol

- Xylitol

- Mannitol

- Maltitol

- Isomalt

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes sorbitol, xylitol, mannitol, maltitol, isomalt, and others.

Form Insights:

- Powder

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes powder and liquid.

Function Insights:

- Flavoring and Sweetening Agents

- Bulking Agents

- Excipients

- Humectants

- Others

The report has provided a detailed breakup and analysis of the market based on the function. This includes flavoring and sweetening agents, bulking agents, excipients, humectants, and others.

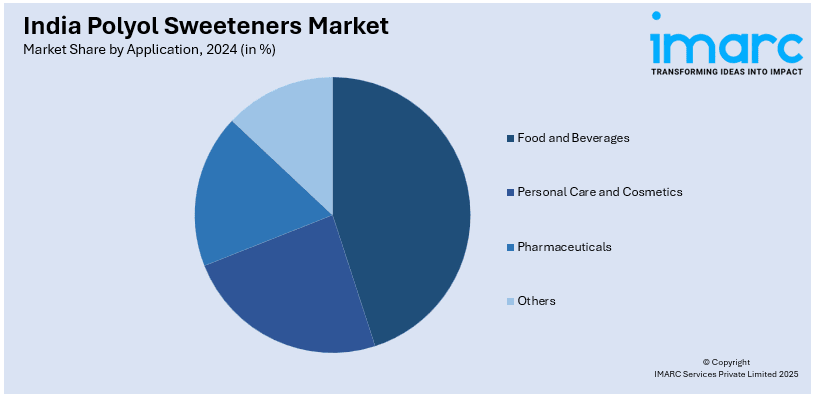

Application Insights:

- Food and Beverages

- Personal Care and Cosmetics

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, personal care and cosmetics, pharmaceuticals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polyol Sweeteners Market News:

- November 26, 2024: Roquette announced co-exhibiting with Signet at CPHI India 2024 and showcased innovations such as PEARLITOL® 200 GT and PEARLITOL® CR-H, which are key polyol-based excipients for the pharmaceutical industry. These are based on mannitol used in fewer formulations (tablets), these highlight advances in polyol sweeteners, offering benefits in diabetic and pediatric patients. This event enhances Roquette's standing in the expanding market for polyol sweeteners in India, addressing the requirements of the pharmaceutical and nutraceutical industries.

- June 27, 2024: Gulshan Polyols established a 250 KLPD grain-based ethanol plant in ASSAM, India, a huge stride towards biofuel growth in the nation. This facility promotes local economic development while meeting the growing demand for ethanol, a green fuel alternative. The company's diversified operations, which span the production of polyols and sweeteners, reinforce its position within India's growing market for polyol sweeteners and biofuels.

India Polyol Sweeteners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Sorbitol, Xylitol, Mannitol, Maltitol, Isomalt, Others |

| Forms Covered | Powder, Liquid |

| Functions Covered | Flavoring and Sweetening Agents, Bulking Agents, Excipients, Humectants, Others |

| Applications Covered | Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polyol sweeteners market from2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polyol sweeteners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polyol sweeteners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The polyol sweeteners market in India was valued at USD 120.94 Million in 2024.

The India polyol sweeteners market is projected to exhibit a (CAGR) of 5.25% during 2025-2033, reaching a value of USD 191.67 Million by 2033.

India polyol sweeteners market is driven by health-conscious consumer demand, increased diabetic population, and high demand for low-calorie, sugar-free food and beverages. Growth in the functional food segment, government support with healthy eating promotion, and product formulation innovation also advance adoption, particularly in confectionery, bakery, and beverages segments in the nation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)