India Polyols Market Size, Share, Trends and Forecast by Type, Application, Industry, Region, 2025-2033

India Polyols Market Size and Share:

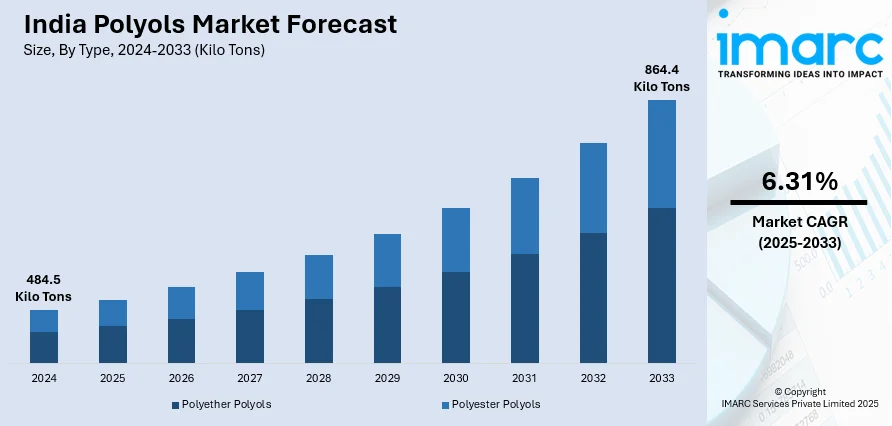

The India polyols market size reached a volume of 484.5 Kilo Tons in 2024. The market is expected to reach a volume of 864.4 Kilo Tons by 2033, exhibiting a growth rate (CAGR) of 6.31% during 2025-2033. The market growth is attributed to the rising demand for polyurethane foams in construction, automotive, and furniture industries, growing insulation needs for energy efficiency, rapid urbanization, infrastructure development, expansion of appliance manufacturing, supportive government policies, increasing consumer spending, shift toward lightweight materials, advancements in production technology, and growth in packaging applications.

Market Insights:

- Based on region, the market is divided into North India, West and Central India, South India, and East India.

- On the basis of type, the market is segmented into polyether polyols and polyester polyols.

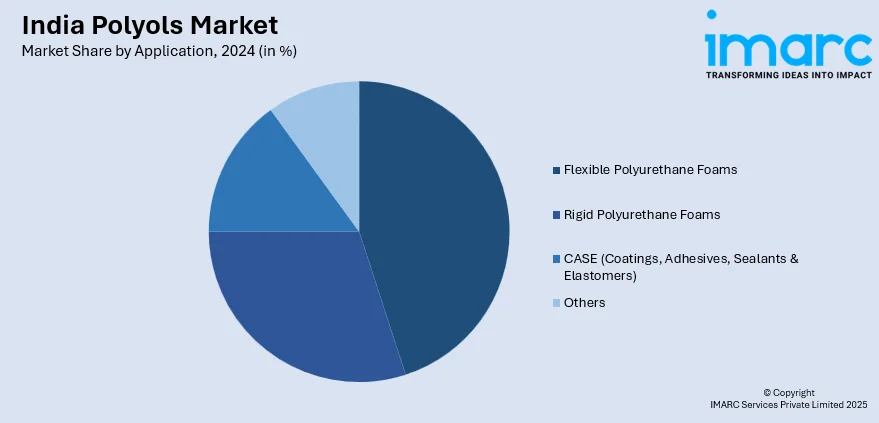

- Based on the application, the market is categorized as flexible polyurethane foams, rigid polyurethane foams, CASE (coatings, adhesives, sealants & elastomers), and others.

- On the basis of industry, the market is segmented into carpet backing, packaging, furniture, automotive, building & construction, electronics, footwear, and others.

Market Size and Forecast:

- 2024 Market Size: 484.5 Kilo Tons

- 2033 Projected Market Size: 864.4 Kilo Tons

- CAGR (2025-2033): 6.31%

Polyols, also known as sugar alcohols, are organic compounds that consist of multiple hydroxyl groups. They contain reduced-calorie carbohydrates that provide the taste and texture of table sugar with less or half of the calories. Consequently, they are utilized in the food and beverage industry as artificial sweeteners to produce sugar-free products like chewing gum, candies, ice cream, baked goods, and fruit spreads. Apart from this, polyols have wide-ranging applications in the packaging, furniture, automotive, electronics, and building and construction industries.

To get more information of this market, Request Sample

The India polyols market growth is primarily driven by the increasing demand for different derivates of polyols, such as flexible polyurethane foams, elastomers, coatings. These products are extensively used by the automotive industry to manufacture interior parts of automobiles. Besides this, the growing construction industry driven by the increasing population and housing requirements has increased the consumption of polyol-based building materials, such as insulation protective components, exterior panels, and housing electronics. As these materials aid in conserving energy and minimizing greenhouse gas emissions, their increased demand is stimulating the growth of the market.

India Polyols Market Trends:

Emerging Uses in Electronics and Automotive Sectors

The industry is seeing significant usage in the automotive and electronics industries as a result of the material's performance properties and versatility. In electronics, polyols are being used to encapsulate, potting compounds, and protective coatings for improving the durability of components and insulation. Additionally, increased demand for energy-efficient consumer appliances and advanced circuit protection is boosting usage further. In the automotive sector, polyols play a critical role in the manufacture of polyurethane foams, which are used in lightweight seating, interior panels, and vibration-dampening components, supporting OEMs' fuel efficiency and comfort enhancement objectives. Aside from this, India's electric vehicle (EV) production is fueling demand, with polyols being used in battery insulation, thermal management, and lightweight composites. The use of sophisticated design methods and manufacturing automation also facilitates the wider use of polyols for precision-molded parts, satisfying precise performance and safety standards in both industries.

Growing Application of Polyols in Renewable Energy

Polyols are increasingly utilized in India's renewable energy sector, especially in solar power and wind energy. Polyols find application in wind energy as it is used in polyurethane resins to create strong, lightweight rotor blades, which enhance turbine performance as well as minimize the maintenance required. Their better adhesion, weathering resistance, and structural integrity make them suitable for high-performance composites operating under extreme conditions. In solar energy, polyols help produce thermal insulation materials used for photovoltaic (PV) modules and concentrated solar power (CSP) systems, which facilitate temperature control and longer lifespan. Apart from this, the government-driven growth of renewable energy, including the National Solar Mission and aggressive wind capacity goals, is driving the India polyols market demand. Moreover, polyols are being researched for bio-based coatings to safeguard renewable energy infrastructure from corrosion, ultraviolet degradation, and mechanical stresses, enabling both performance enhancement and sustainability objectives in India's fast-expanding green energy business.

Shift towards Bio-Based and Sustainability Polyols

The shift toward bio-based polyols in India reflects both regulatory and market-driven imperatives for sustainable materials. Derived from renewable feedstocks such as vegetable oils and biomass, bio-based polyols reduce dependence on petrochemicals while lowering greenhouse gas emissions. This transition is reinforced by the adoption of green chemistry principles and increasing research and development (R&D) investment by domestic producers. Environmental regulations, such as stricter emission norms and waste reduction mandates, are incentivizing industries to replace conventional polyols with sustainable alternatives. Furthermore, government-led programs promoting sustainable construction, including energy-efficient building mandates under the Energy Conservation Building Code (ECBC), and new initiatives such as the Ministry of Power's INR 1,000 Crore ADEETIE scheme, which provides interest subvention and implementation support for energy-efficient technologies, are accelerating adoption in insulation, coatings, and industrial applications. Global supply chain pressure to meet environmental, social, and governance (ESG) standards is also prompting local producers to expand bio-polyol capacity. Collaborations between domestic chemical companies and research institutes are fostering the commercialization of plant-based polyol technologies. These India polyols market trends are ensuring competitive quality and performance levels comparable to conventional alternatives.

Challenges in the India Polyols Market:

According to the India polyols market analysis, the market faces significant challenges, primarily from volatility in raw material prices and intense competition from imported products. Polyols are largely derived from petrochemical feedstocks, making their prices highly sensitive to fluctuations in global crude oil markets, currency exchange rates, and supply chain disruptions. Such volatility impacts production costs and creates pricing uncertainty for both manufacturers and end-users. Additionally, competition from imported polyols—particularly from countries with lower production costs and established export networks- intensifies pressure on domestic suppliers. Imported products often benefit from economies of scale, advanced production technologies, and favorable trade agreements, enabling them to compete aggressively on price and quality. These dynamic challenges local producers to maintain margins while meeting increasingly stringent performance and sustainability requirements. Coupled with infrastructure bottlenecks and limited availability of specialized polyols in India, these factors create a complex operating environment that demands strategic sourcing, cost optimization, and product differentiation.

Opportunities in the India Polyols Market:

The market holds substantial growth opportunities driven by industrial expansion, sustainability trends, and policy support. The government's focus on "Make in India" and initiatives promoting domestic manufacturing present a favorable environment for local producers to reduce dependency on imports. Increasing demand from fast-growing sectors such as construction, automotive, renewable energy, and packaging offers scope for developing specialized, high-performance polyols tailored to sector-specific needs. The rising emphasis on bio-based and eco-friendly solutions, driven by both environmental regulations and consumer awareness, is encouraging investment in renewable feedstock-based polyols, opening premium market segments. Technological advancements in polyurethane applications, ranging from thermal insulation to lightweight automotive parts, further enhance the potential for innovation-led growth. Moreover, the expansion of India's renewable energy capacity and infrastructure development projects creates sustained demand for durable and energy-efficient materials, positioning polyols as a critical enabler in the country's industrial and sustainability-driven transformation.

Government Support in the India Polyols Market:

Government policies and initiatives are playing a crucial role in shaping the growth of the market. The Energy Conservation Building Code (ECBC) and green building certification programs promote the use of energy-efficient insulation materials, many of which utilize polyols. Moreover, fiscal incentives for sustainable manufacturing, such as tax benefits and subsidies for bio-based chemical production, are encouraging investment in eco-friendly polyols. Besides this, initiatives like the Production Linked Incentive (PLI) scheme for chemical manufacturing aim to boost domestic production capacity, reducing reliance on imports. Moreover, government-backed infrastructure projects, renewable energy expansion under the National Solar Mission, and incentives for electric vehicle production are indirectly spurring polyol demand in construction, automotive, and industrial applications. By fostering research and development (R&D) collaborations, streamlining regulatory approvals, and supporting industrial parks dedicated to chemicals, the government is positioning the polyols sector as a strategically important component of India's broader manufacturing and sustainability agenda.

Growth Drivers of the India Polyols Market:

The market is propelled by the rising construction activities across India are significantly driving polyol consumption, particularly in the production of polyurethane foams for insulation, sealants, and coatings that improve energy efficiency in residential, commercial, and industrial buildings. Simultaneously, the automotive industry's growth is fueling demand for polyols used in lightweight seating, interior trims, and thermal management solutions, aligning with the sector's shift toward fuel efficiency and electric vehicles. Additionally, the packaging industry is another major driver augmenting the India polyols market share, as polyols enable the production of durable, lightweight foams and protective materials used in consumer goods, electronics, and e-commerce logistics. Moreover, rapid urbanization, increased infrastructure spending, and expanding manufacturing capacity are amplifying these trends. The convergence of construction, automotive, and packaging sector growth is creating a robust, multi-industry demand base for polyols in India.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India polyols market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on type, application and industry.

Breakup by Type:

- Polyether Polyols

- Polyester Polyols

Breakup by Application:

- Flexible Polyurethane Foams

- Rigid Polyurethane Foams

- CASE (Coatings, Adhesives, Sealants & Elastomers)

- Others

Breakup by Industry:

- Carpet Backing

- Packaging

- Furniture

- Automotive

- Building & Construction

- Electronics

- Footwear

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Developments:

- April 2025: Manali Petrochemicals announced the development of a new systems house in Saykha, Bharuch district, Gujarat, with a planned annual capacity of 30,000 tonnes of formulated polyols, targeting key sectors such as automotive, footwear, and energy efficiency. The company has completed land acquisition and anticipates commencing construction by the end of 2025, with commercial production beginning in early 2027, backed by an investment of approximately INR 1.3 Billion (USD 15.2 Million).

- April 2025: Rymbal launched FluidX, a polyurethane material that is 100 % recyclable via both physical and chemical methods and features a fully water-blown system that reduces carbon footprint and environmental impact. FluidX is ultra-lightweight (density of 260–280 kg/m³), free from harmful chemicals, and designed to promote sustainability and circularity in the footwear polyurethane industry through the use of 100 % biobased polyols. The initiative underscores Rymbal’s commitment to transitioning from non-biodegradable to eco-friendly polymers and fostering environmentally responsible solutions across the value chain.

- October 2024: Manali Petrochemicals Limited (MPL) announced plans to expand its petrochemical portfolio by enhancing its Propylene Glycol (PG) and Polyester Polyol (PP) production capacities. The company is proceeding with a Phase I PG plant featuring 32,000 TPA capacity—funded at INR 94 Crore. Additionally, MPL has completed one polyester polyol plant (4,150 TPA), is advancing a second, and is preparing a Greenfield expansion in West India for 30,000 TPA with an investment of over INR 130 Crore.

- July 2024: Covestro (India) officially inaugurated its Polyol Tank Farm Project in Kandla, situated in the Kutch district of Gujarat. The facility, utilizing ISO and Flexi tanks alongside streamlined drum and IBC (Intermediate Bulk Container) handling, aims to bolster supply chain resilience and operational efficiency by reducing reliance on imports and minimizing lead times. Strategically located, the new tank farm ensures a steady and reliable polyol supply to support Covestro India’s Performance Materials Business, enhancing customer satisfaction and enabling service extension to neighboring markets.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | '000 Tons, Million USD |

| Segment Coverage | Type, Application, Industry, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India polyols market reached a volume of 484.5 Kilo Tons in 2024.

We expect the India polyols market to exhibit a CAGR of 6.31% during 2025-2033.

The rising demand for polyols across the Food and Beverage (F&B) industry as artificial sweeteners for producing various sugar-free products, including chewing gum, candies, ice cream, baked goods, etc., is primarily driving the India polyols market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary halt in numerous production activities for polyols.

Based on the type, the India polyols market can be categorized into polyether polyols and polyester polyols. Currently, polyether polyols account for the majority of the total market share.

Based on the application, the India polyols market has been segregated into flexible polyurethane foams, rigid polyurethane foams, CASE (Coatings, Adhesives, Sealants & Elastomers), and others. Among these, flexible polyurethane foams currently exhibit a clear dominance in the market.

Based on the industry, the India polyols market can be bifurcated into carpet backing, packaging, furniture, automotive, building & construction, electronics, footwear, and others. Currently, the furniture industry holds the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)