India Polysilicon Market Size, Share, Trends and Forecast by Manufacturing Technology, Form, Application, and Region, 2025-2033

India Polysilicon Market Overview:

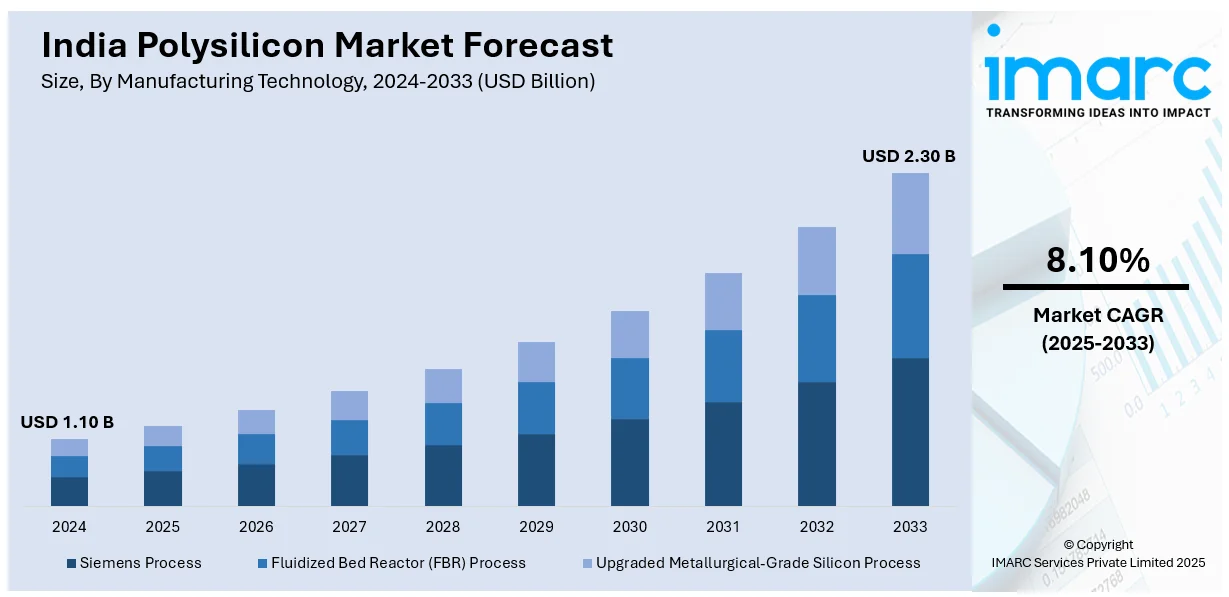

The India polysilicon market size reached USD 1.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.30 Billion by 2033, exhibiting a growth rate (CAGR) of 8.10% during 2025-2033. Growing investments in renewable energy projects, along with financial incentives and regulatory support, are driving the demand for polysilicon in India, while expanding domestic wafer and ingot manufacturing is improving supply chain efficiency and reinforcing the country’s position in the international solar market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.10 Billion |

| Market Forecast in 2033 | USD 2.30 Billion |

| Market Growth Rate 2025-2033 | 8.10% |

India Polysilicon Market Trends:

Rising Investments in Renewable Energy Projects

Increasing investments in renewable energy initiatives are catalyzing the demand for polysilicon in India. The rising emphasis on transitioning to clean energy is driving the expansion of large-scale solar projects, leading to a heightened need for high-purity polysilicon utilized in photovoltaic cells. Utility-scale solar farms, rooftop solar setups, and captive power projects are growing as companies and energy providers dedicate themselves to enduring sustainability objectives. Financial rewards, supportive policies, and regulatory backing are motivating both domestic and international investors to invest in renewable energy infrastructure, speeding up the increase of solar capacity. Firms in the energy and infrastructure industries are obtaining financing for extensive solar installations, resulting in heightened acquisition of solar modules made from polysilicon. Moreover, financial organizations are providing green financing alternatives, reducing the capital cost for solar energy projects. As renewable energy goals become increasingly ambitious, polysilicon producers are expanding their operations to satisfy rising demand. The ongoing influx of investments in solar energy initiatives is enhancing India's standing in the worldwide clean energy arena, guaranteeing a consistent growth of the polysilicon market. In 2025, Oil and Natural Gas Corporation (ONGC) revealed intentions to invest $11.5 billion in renewable energy projects by 2030, significantly increasing its current $137 million investment. The company aims to expand its renewable portfolio to 10GW, including solar, wind, and green hydrogen initiatives. ONGC has also formed a joint venture with NTPC to acquire and develop renewable energy assets.

To get more information on this market, Request Sample

Expansion of Domestic Wafer and Ingot Manufacturing

India is experiencing swift expansion in the production of silicon wafers and ingots, which is catalyzing the demand for polysilicon. Leading companies are setting up complete wafer-to-module manufacturing facilities, guaranteeing that polysilicon is processed locally into wafers and ingots prior to being used in final applications. This change is improving supply chain effectiveness and lowering expenses for Indian producers. Government-supported programs are further encouraging the establishment of wafer and ingot manufacturing facilities, enhancing local polysilicon usage. Moreover, international companies are seeking partnerships with Indian businesses to create vertically integrated solar manufacturing centers. The increasing need for localized wafer and ingot manufacturing is bolstering polysilicon market growth and solidifying India’s role as a significant participant in the solar and semiconductor sector. In line with this trend, in 2024, Adani Group began commercial manufacturing of wafers and ingots for solar cells at its Gujarat factory, with plans to integrate polysilicon production by 2027/28. The company aimed to generate 45 GW of renewable energy by 2030, focusing on its $18.01 billion Khavda renewable energy park. The park, expected to be the world's largest, would generate 26 GW of solar and 4 GW of wind energy.

India Polysilicon Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on manufacturing technology, form, and application.

Manufacturing Technology Insights:

- Siemens Process

- Fluidized Bed Reactor (FBR) Process

- Upgraded Metallurgical-Grade Silicon Process

The report has provided a detailed breakup and analysis of the market based on the manufacturing technology. This includes siemens process, fluidized bed reactor (FBR) process, and upgraded metallurgical-grade silicon process.

Form Insights:

- Chunks

- Granules

- Rods

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes chunks, granules, and rods.

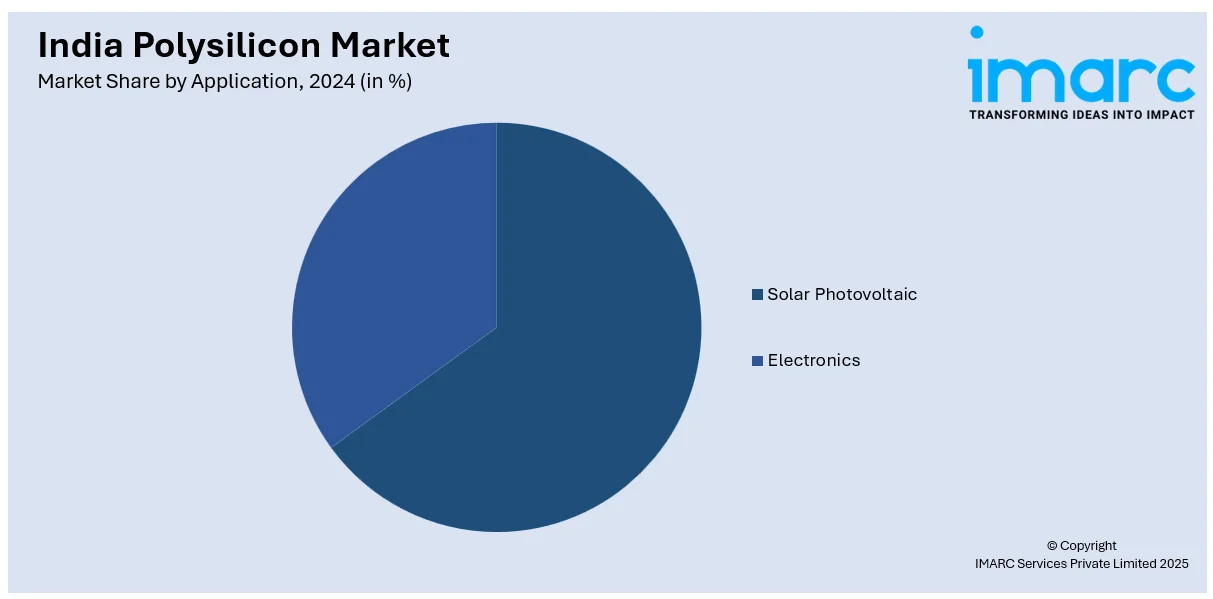

Application Insights:

- Solar Photovoltaic

- Electronics

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes solar photovoltaic and electronics.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polysilicon Market News:

- In August 2024, Reliance Industries began solar module production at its Gujarat giga-factory, with a 10 GW capacity in the first phase, aiming for completion by the end of 2024. The factory produced integrated solar products, including polysilicon, cells, and bifacial panels. Additionally, Reliance developed battery storage and electrolyzer manufacturing facilities, alongside renewable energy projects.

- In March 2024, Kolla outlined plans for a 10GW solar project, which would require 8,000 acres, including facilities for manufacturing modules, cells, wafers, polysilicon, and ingots. The facility was set to produce 1,200 tons of glass panels per day and 30,000 tons of polysilicon annually. The first phase was expected to be completed by the end of 2025, with the second phase slated for completion by the end of 2026.

India Polysilicon Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Manufacturing Technologies Covered | Siemens Process, Fluidized Bed Reactor (FBR) Process, Upgraded Metallurgical-Grade Silicon Process |

| Forms Covered | Chunks, Granules, Rods |

| Applications Covered | Solar Photovoltaic, Electronics |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India polysilicon market performed so far and how will it perform in the coming years?

- What is the breakup of the India polysilicon market on the basis of manufacturing technology?

- What is the breakup of the India polysilicon market on the basis of form?

- What is the breakup of the India polysilicon market on the basis of application?

- What is the breakup of the India polysilicon market on the basis of region?

- What are the various stages in the value chain of the India polysilicon market?

- What are the key driving factors and challenges in the India polysilicon market?

- What is the structure of the India polysilicon market and who are the key players?

- What is the degree of competition in the India polysilicon market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polysilicon market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polysilicon market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polysilicon industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)