India Portable Power Tools Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

India Portable Power Tools Market Overview:

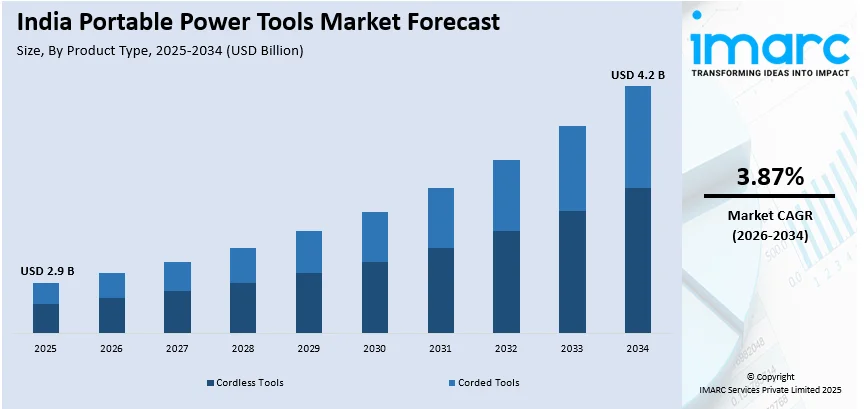

The India portable power tools market size reached USD 2.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.2 Billion by 2034, exhibiting a growth rate (CAGR) of 3.87% during 2026-2034. The market is expanding due to rising construction, automotive, and manufacturing activities. Additionally, the rising demand for cordless tools, improved battery technology, and increased infrastructure investments are driving product adoption. Manufacturers focus on ergonomic designs, energy efficiency, and advanced safety features to enhance productivity and user convenience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.9 Billion |

| Market Forecast in 2034 | USD 4.2 Billion |

| Market Growth Rate (2026-2034) | 3.87% |

India Portable Power Tools Market Trends:

Growing Demand for Cordless and Battery-Powered Tools

The Indian portable power tools market is experiencing a robust transition towards battery and cordless tools because of their portability, ease of use, and enhanced performance. For instance, as per industry reports, DeWalt is a notable power tool brand in India, offering over 300 power tools and 800 accessories, known for reliability, innovation, and extensive industry applications. In addition, with the improvement in lithium-ion battery technology, new tools now have longer runtimes, quicker charging, and greater power output, making them a preferred choice among professionals and DIYers. The building, automotive, and woodworking sectors are increasingly embracing cordless drills, impact wrenches, and grinders to improve productivity and minimize reliance on wired power supplies. Moreover, the focus is on creating lightweight and ergonomic products with brushless motor technology for improved durability and energy efficiency. As businesses give importance to adaptability and safety in the workplace, there will be increased demand for battery-powered tools.

To get more information on this market Request Sample

Increasing Industrial and DIY Applications Driving Market Growth

The rise in infrastructure projects, real estate developments, and growing DIY culture is fueling demand for portable power tools across India. For instance, as per industry reports, approximately 140,000 housing units were sold between April and September 2024, with nearly 130,000 new launches during the same period, further boosting the trend. Professionals in construction and manufacturing are investing in high-powered drills, saws, and impact drivers to enhance productivity and reduce manual labor. Simultaneously, the expanding consumer base for home improvement and repair projects is boosting sales of compact and easy-to-use tools. The availability of power tools through online retail channels has further contributed to market growth, making high-quality products accessible to both professionals and hobbyists. Manufacturers are focusing on providing cost-effective and durable solutions tailored to the diverse needs of industrial users and individual consumers.

India Portable Power Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product and application.

Product Insights:

- Cordless Tools

- Corded Tools

The report has provided a detailed breakup and analysis of the market based on the product. This includes cordless tools and corded tools.

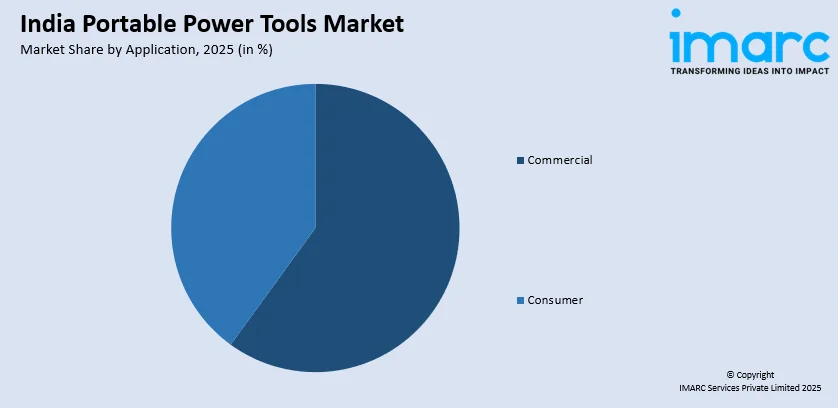

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Consumer

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial and consumer.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Portable Power Tools Market News:

- In January 2023, Bosch Power Tools India announced the launch of the GWS 800 Professional angle grinder, featuring an 800W motor, ergonomic design, and lightweight body. This Make-in-India tool ensures high performance, user comfort, and easy maintenance with a metal flange and quality carbon brush.

India Portable Power Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cordless Tools, Corded Tools |

| Applications Covered | Commercial, Consumer |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India portable power tools market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India portable power tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India portable power tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India portable power tools market was valued at USD 2.9 Billion in 2025.

The India portable power tools market is projected to exhibit a CAGR of 3.87% during 2026-2034, reaching a value of USD 4.2 Billion by 2034.

The India portable power tools market is fueled by government programs like Housing for All and the Smart Cities Mission, as well as by the fast growth of infrastructure and urbanization. The growing DIY culture among consumers and increasing industrial applications further fuel demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)