India Potassium Chlorate Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Potassium Chlorate Market Overview:

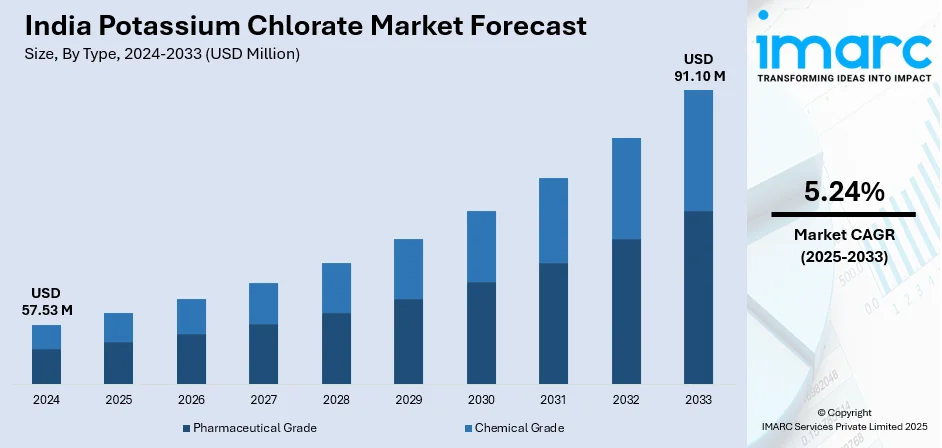

The India potassium chlorate market size reached USD 57.53 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 91.10 Million by 2033, exhibiting a growth rate (CAGR) of 5.24% during 2025-2033. The market is primarily driven by its extensive utilization in the fireworks and pyrotechnics industry, integral to several cultural celebrations, such as Diwali. Additionally, the compound's applications in chemical synthesis and water treatment processes also contribute to its increasing demand across various industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 57.53 Million |

| Market Forecast in 2033 | USD 91.10 Million |

| Market Growth Rate 2025-2033 | 5.24% |

India Potassium Chlorate Market Trends:

Increasing Demand from the Fireworks and Pyrotechnics Industry

Potassium chlorate plays a crucial role as an oxidizing agent in India’s expanding fireworks and pyrotechnics industry, which continues to experience strong demand, owing to the country’s deep-rooted cultural and religious traditions. Various festivals, such as Diwali, Dussehra, and Ganesh Chaturthi, drive annual spikes in fireworks consumption, sustaining a robust market for potassium chlorate. Sivakasi, Tamil Nadu remains the epicenter of fireworks production, accounting for over 70% of the country’s output, with potassium chlorate serving as a key oxidizer in the production process. Despite periodic restrictions, fireworks sales continue to rise across the country. For example, For instance, West Bengal's fireworks industry is projected to have nearly doubled its turnover from INR 8,000 crore in 2023 to INR 15,000 crore in 2024. Additionally, government initiatives aimed at streamlining fireworks production with enhanced safety regulations are supporting steady market expansion. As manufacturers adapt to evolving environmental and safety standards, the demand for potassium chlorate is expected to remain strong, further reinforcing its significance in India’s festive economy.

To get more information on this market, Request Sample

Expanding Applications in Chemical and Agricultural Sectors

Beyond its traditional utilization in fireworks, potassium chlorate is witnessing growing demand across the chemical, pharmaceutical, and agricultural sectors. It serves as a key precursor in chemical synthesis and is increasingly utilized as a defoliant in agriculture, where modernized farming techniques are driving its adoption. Additionally, advancements in water treatment technologies are bolstering its role as a disinfectant, addressing rising concerns over water contamination. India’s specialty chemicals market, valued at USD 64.5 billion in 2024, is projected to reach USD 92.6 billion by 2033, growing at a CAGR of 3.80% during 2025-2033, thereby expanding industrial applications of potassium chlorate. Similarly, the agrochemicals market, estimated at USD 15.5 billion in 2024, is expected to reach USD 23.3 billion by 2033, growing at a CAGR of 4.28%, further reinforcing potassium chlorate’s importance as a defoliant. Meanwhile, India’s water treatment market is set to grow at a CAGR of 7.60% over the same period, driven by increasing contamination levels. The Annual Groundwater Quality Report (2024) highlighted fluoride as a major pollutant, with 9.04% of samples exceeding safe limits, particularly in Rajasthan, intensifying the need for effective purification solutions where potassium chlorate plays a crucial role.

India Potassium Chlorate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Pharmaceutical Grade

- Chemical Grade

The report has provided a detailed breakup and analysis of the market based on the type. This includes pharmaceutical grade and chemical grade.

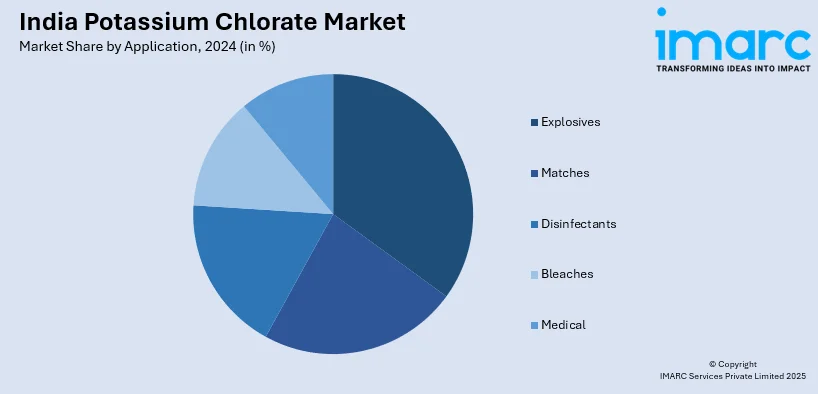

Application Insights:

- Explosives

- Matches

- Disinfectants

- Bleaches

- Medical

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes explosives, matches, disinfectants, bleaches, and medical.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Potassium Chlorate Market News:

- October 2024: In Chandigarh FMC introduced Ambriva® herbicide, featuring Isoflex active, to aid Indian wheat farmers in combating Phalaris minor, a prevalent weed. This product offers a novel mode of action in cereal crops, providing farmers with an additional tool for effective weed management.

- May 2024: Kurita Water Industries Ltd., a Japanese firm, founded Kurita AquaChemie India Private Limited (KAIL) in Chennai, Tamil Nadu, to distribute water treatment chemicals in India. This strategic move aims to cater to the growing demand for water treatment solutions in the region.

India Potassium Chlorate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pharmaceutical Grade, Chemical Grade |

| Applications Covered | Explosives, Matches, Disinfectants, Bleaches, Medical |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India potassium chlorate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India potassium chlorate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India potassium chlorate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The potassium chlorate market in India was valued at USD 57.53 Million in 2024.

The potassium chlorate market in India is projected to exhibit a CAGR of 5.24% during 2025-2033, reaching a value of USD 91.10 Million by 2033.

India’s potassium chlorate market is growing due to high demand from the fireworks industry, especially during festivals like Diwali. Its use in chemical manufacturing, agriculture, and water treatment also fuels growth. Regional production hubs like Sivakasi boosts supply. Government support, including relaxed regulations and FDI policies, encourages local manufacturing. Additionally, rising awareness for eco-friendly products and expanding industrial applications further drive market development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)