India Potato Flour Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Potato Flour Market Overview:

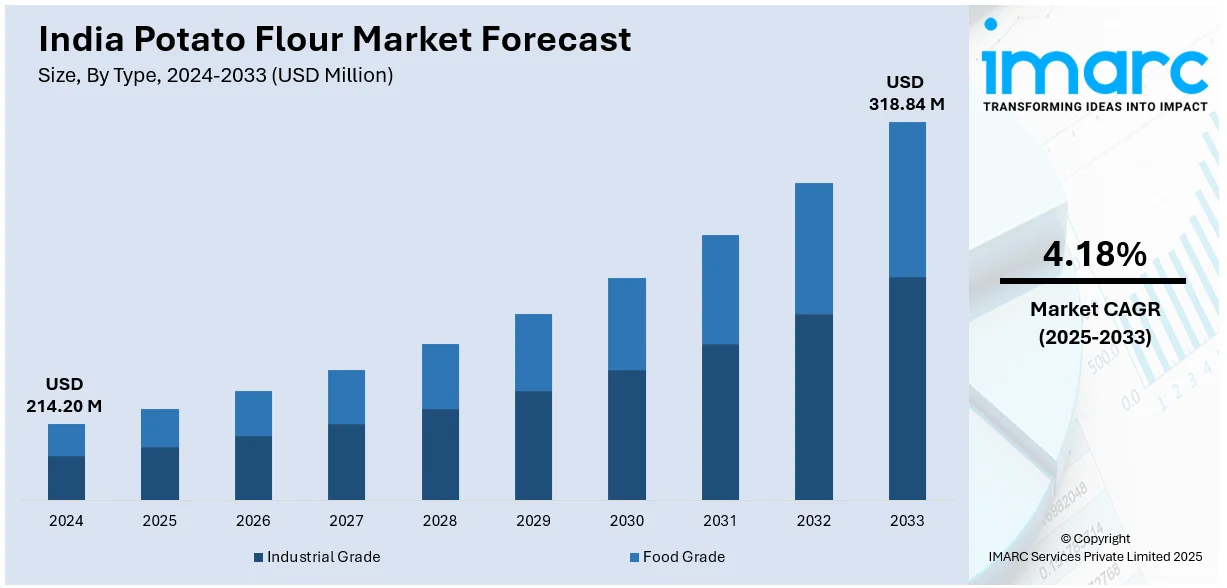

The India potato flour market size reached USD 214.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 318.84 Million by 2033, exhibiting a growth rate (CAGR) of 4.18% during 2025-2033. The market is driven by rising demand for gluten-free products, increasing use in snacks and bakery, expanding food processing industry, growing health consciousness, continuous advancements in food technology, expanding exports, and supportive government policies promoting food innovation and agricultural productivity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 214.20 Million |

| Market Forecast in 2033 | USD 318.84 Million |

| Market Growth Rate 2025-2033 | 4.18% |

India Potato Flour Market Trends:

Rising Demand for Gluten-Free and Healthier Alternatives

The growing demand for gluten-free and healthier alternatives, driven by increasing consumer health awareness, has boosted interest in nutritious options, making potato flour a highly attractive choice for food manufacturers and health-conscious consumers alike. In addition, the food industry is embracing potato flour because of a rising understanding of celiac disease and gluten intolerance as well as a national trend toward healthier food choices. The application of potato flour expands in bakery goods and snacks together with ready-to-eat (RTE) meals because it functions as a natural functional component. For example, the National Agricultural Cooperative Marketing Federation of India (NAFED) deployed mobile vans to sell subsidized grains, including flour and potatoes, in urban areas. This initiative aims to provide consumers with affordable staples, potentially affecting the demand and pricing dynamics for potato flour. Moreover, the Indian government supports food innovation and clean-label product development through their initiatives which has motivated manufacturers to investigate potato flour alternatives to wheat-based components. This market also expands because more people choose plant-based diets along with their preference for foods with high fiber content and necessary nutrients. Furthermore, the potato flour market is experiencing long-term expansion because food brands keep reformulating their products for health-conscious consumers, especially in urban markets where dietary preferences change rapidly, thereby boosting the India potato flour market share.

To get more information on this market, Request Sample

Expanding Applications in Processed and Convenience Foods

The increasing popularity of processed and convenience foods in India is driving higher usage of potato flour across various food segments, which is significantly enhancing the India potato flout market outlook. In line with this, the rising number of people with busy urban lives and working populations drives increasing demand for ready-to-use products with extended shelf lives in which potato flour serves as a vital ingredient. Concurrently, processors use potato flour extensively to improve texture and binding capabilities in instant soups, sauces, and gravies as well as snack foods. Besides this, due to its moisture retention properties and ability to maintain crispness potato flour is selected as a key ingredient by the frozen and fried food industry. Furthermore, food manufacturers use potato flour to meet rising consumer demands because of its clean-label image and beneficial characteristics which help them create better products. For instance, in December 2024, the Himachal Pradesh government announced the plan to establish a Rs 20 crore potato processing plant in Una to produce potato flakes that will enhance food processing capabilities, stabilize prices, and support the potato flour industry by ensuring better returns for farmers. Apart from this, the quick service restaurant (QSR) industry expansion and Western food trend influence have jointly driven the India potato flour market growth.

India Potato Flour Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Industrial Grade

- Food Grade

The report has provided a detailed breakup and analysis of the market based on the type. This includes industrial grade and food grade.

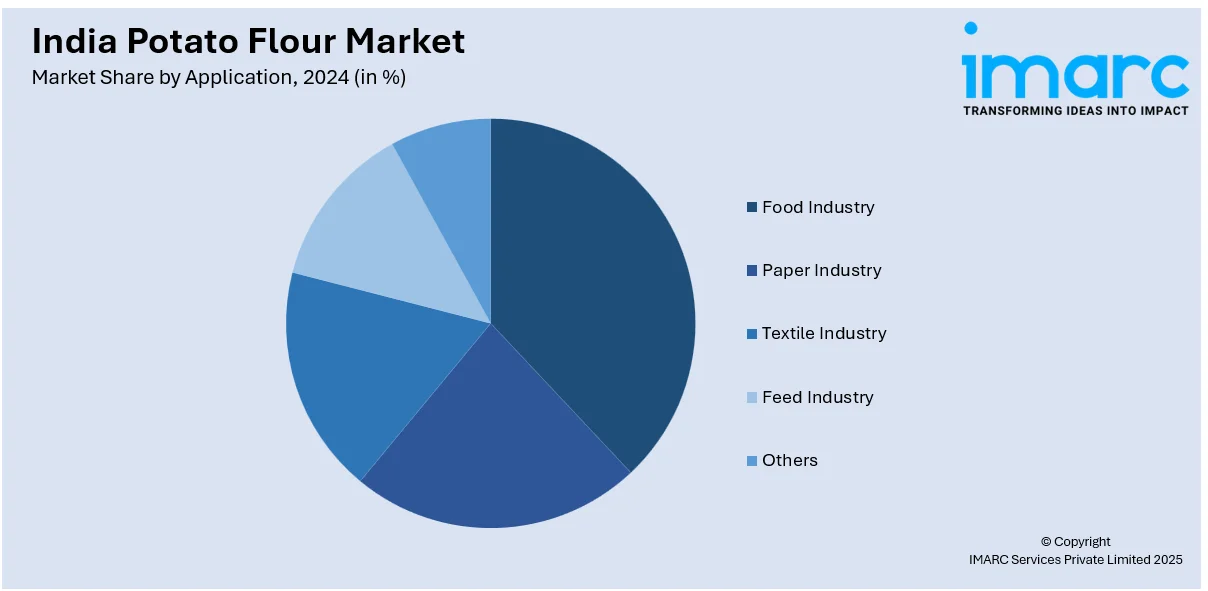

Application Insights:

- Food Industry

- Paper Industry

- Textile Industry

- Feed Industry

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food industry, paper industry, textile industry, feed industry and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Potato Flour Market News

- In November 2024, a Meerut-based entrepreneur partnered with a Dutch company to produce potato powder using advanced technology. This collaboration enhances food processing, provides new opportunities for farmers, and strengthens India's potato flour market by expanding production capacity and improving raw material supply.

- In February 2024, Yara India partnered with Uttar Pradesh's government to enhance potato farming through digital technology and sustainable practices. This initiative improves potato quality and yield, strengthening India's potato flour market by ensuring a consistent, high-quality raw material supply.

India Potato Flour Market Report Coverage

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Industrial Grade, Food Grade |

| Applications Covered | Food Industry, Paper Industry, Textile Industry, Feed Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India potato flour market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India potato flour market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India potato flour industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The potato flour market in India was valued at USD 214.20 Million in 2024.

The India potato flour market is projected to exhibit a CAGR of 4.18% during 2025-2033, reaching a value of USD 318.84 Million by 2033.

Rising demand for gluten-free and healthy food products is boosting potato flour consumption. Increasing use in bakery, snacks, and processed foods, coupled with growing awareness about its nutritional benefits, convenience, and versatility in cooking, is driving market growth across urban and semi-urban regions in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)