India Powder Coating Equipment Market Size, Share, Trends and Forecast by Resin Type, Component, End-Use Industry, and Region, 2026-2034

India Powder Coating Equipment Market Overview:

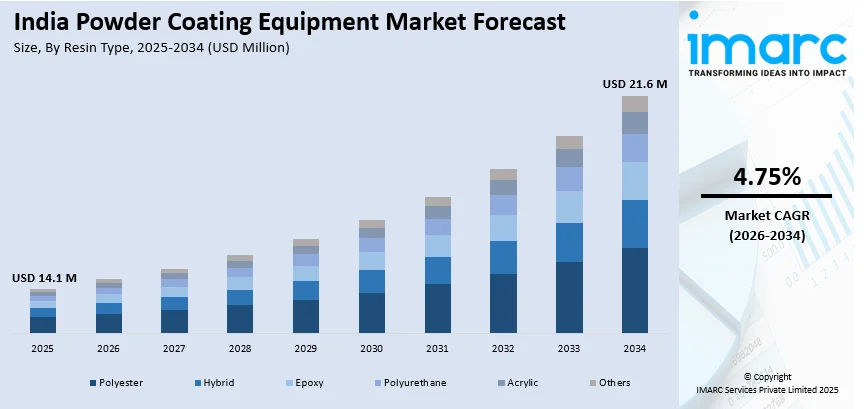

The India powder coating equipment market size reached USD 14.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 21.6 Million by 2034, exhibiting a growth rate (CAGR) of 4.75% during 2026-2034. The market is growing due to the rising demand from automotive, appliances, and industrial sectors. An enhanced focus on eco-friendly coatings, automation, and efficiency is driving adoption. Additionally, manufacturers are investing in advanced spray guns, booths, and curing systems to enhance productivity and meet evolving industry standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.1 Million |

| Market Forecast in 2034 | USD 21.6 Million |

| Market Growth Rate 2026-2034 | 4.75% |

India Powder Coating Equipment Market Trends:

Increasing Adoption of Automated Powder Coating Systems

The India powder coatings equipment industry is experiencing a transition toward automation as companies look for greater efficiency, accuracy, and economy. Automated powder coating equipment is gaining widespread usage in industries such as automotive, appliances, and industrial manufacturing because of its potential to provide uniform thickness, reduce material wastage, and minimize labor dependence. For instance, as per industry reports, the automotive industry generates scrap metal, adding to the 1.3 Billion tons of global metal waste annually, highlighting the need for efficient recycling and waste management solutions. Moreover, robotic powder coating arms and conveyorized systems are becoming popular, enabling manufacturers to increase production without compromising on quality. As industrial automation and smart manufacturing investments continue to grow, the demand for completely integrated powder coating lines with real-time monitoring and process control capabilities is likely to increase. In addition, businesses are focusing on energy-efficient systems with quick curing times and lower operating costs.

To get more information on this market Request Sample

Rising Demand for Energy-Efficient and High-Performance Equipment

Manufacturers are investing in advanced powder coating equipment designed to optimize energy consumption and enhance coating efficiency. Innovations in electrostatic spray guns, recovery systems, and curing ovens are helping industries achieve high transfer efficiency, minimizing powder wastage. For instance, in March 2024, Dürr, with a strong presence in India, announced the launch of the EcoGun AS MAN DC/EC, an electrostatic air spray gun reducing overspray by 40%. It supports solvent and water-based paints, ensuring efficient, precise application with minimal paint consumption. Energy-efficient infrared (IR) and ultraviolet (UV) curing systems are gaining popularity, as they enable faster curing times while lowering electricity consumption. Additionally, advancements in recirculating powder booths and multi-cyclone recovery systems are allowing manufacturers to reuse excess powder, reducing material costs and environmental impact. As energy prices continue to fluctuate, businesses are increasingly adopting high-performance powder coating equipment to achieve sustainable operations and maintain competitive cost structures.

India Powder Coating Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on resin type, component, and end-use industry.

Resin Type Insights:

- Polyester

- Hybrid

- Epoxy

- Polyurethane

- Acrylic

- Others

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes polyester, hybrid, epoxy, polyurethane, acrylic, and others.

Component Insights:

- Kneader

- Extruder

- Cooling Equipment

- Grinder

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes kneader, extruder, cooling equipment, grinder, and others.

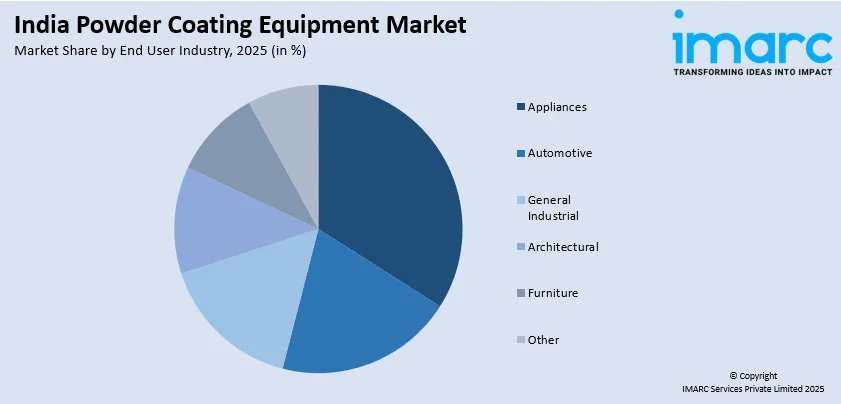

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Appliances

- Automotive

- General Industrial

- Architectural

- Furniture

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes appliances, automotive, general industrial, architectural, furniture, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Powder Coating Equipment Market News:

- In September 2024, Graco, a global supplier of fluid and coating equipment, announced the acquisition with Corob to expand its paint and coating machinery segment. This strengthens its market presence in India and enhances industrial tinting solutions with advanced dispensing, mixing, and shaking equipment.

India Powder Coating Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyester, Hybrid, Epoxy, Polyurethane, Acrylic, Others |

| Components Covered | Kneader, Extruder, Cooling Equipment, Grinder, Others |

| End-Use Industries Covered | Appliances, Automotive, General Industrial, Architectural, Furniture, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India powder coating equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India powder coating equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India powder coating equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The powder coating equipment market in India was valued at USD 14.1 Million in 2025.

The India powder coating equipment market is projected to exhibit a CAGR of 21.6 during 2026-2034, reaching a value of USD 4.75% Million by 2034.

The India powder coating equipment market is shaped by infrastructure development, rapid industrialization, and growth in the automotive, appliance, and furniture sectors. Increased demand for durable, eco-friendly coatings and rising adoption of automated systems also fuel market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)