India Powder Metallurgy Market Size, Share, Trends and Forecast by Type, Material, Manufacturing Process, Application, and Region, 2025-2033

India Powder Metallurgy Market Overview:

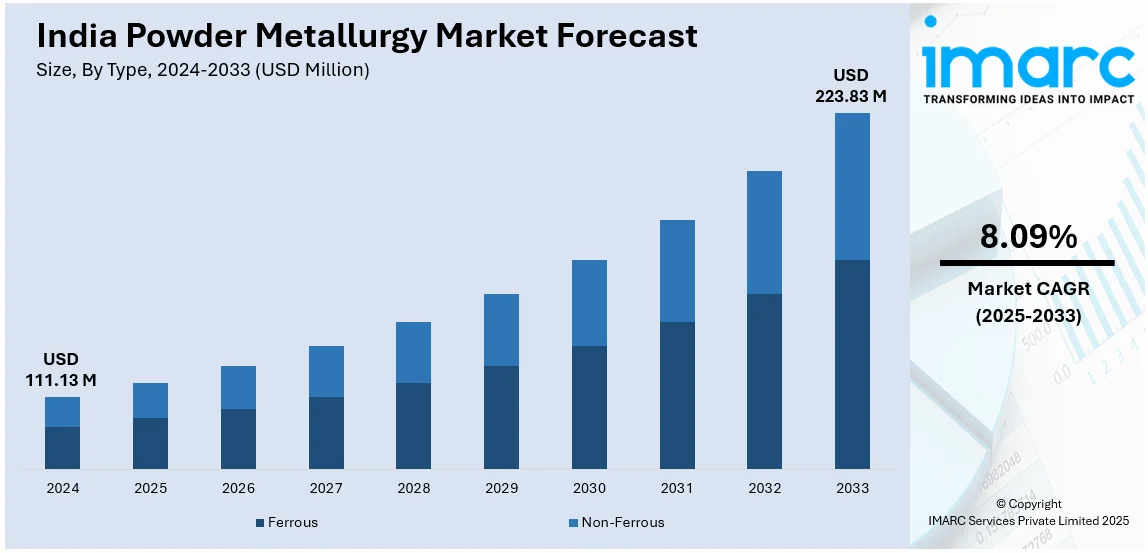

The India powder metallurgy market size reached USD 111.13 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 223.83 Million by 2033, exhibiting a growth rate (CAGR) of 8.09% during 2025-2033. The market is witnessing significant growth, driven by advancements in additive manufacturing and metal injection molding and rising demand for high-performance powder metallurgy components in the automotive sector

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 111.13 Million |

| Market Forecast in 2033 | USD 223.83 Million |

| Market Growth Rate 2025-2033 | 8.09% |

India Powder Metallurgy Market Trends:

Advancements in Additive Manufacturing and Metal Injection Molding (MIM)

The Indian powder metallurgy market is undergoing steep growth because the present adaptation in advanced manufacturing techniques like additive manufacturing (AM) and MIM in particular. These enable better design flexibility and reduce waste for such reduced complexity in material geometries, thus being apt for sectors such as automotive, aerospace, medical devices, and electronics. This offers advantages promising for high-performance metal components since technologies like binder jetting and selective laser sintering are now coming into play. Driven by the demand for lightweight and fuel-efficient vehicles, the same sector in India's automotive is incorporating AM based solutions about powder metallurgy for structural components and engines. And so, among others, MIM technology is growing at a rapid rate so as to cater to the production of very tiny components with intricate geometries with extremely high precision. The advent of exceptional metal powders like stainless steel, titanium- and nickel-based alloys also broadens the scope of the technologies. Along with Quoting the Production Linked Incentive (PLI) program for production as well as the promotion of auto-sufficiency in the critical industrial sectors, the government of such country is further motivating increased investments in AM and MIM technologies. For instance, in November 2024, India's manufacturing sector is transforming with the PLI Scheme, driving innovation, efficiency, and competitiveness under Atmanirbhar Bharat, reducing import reliance, and strengthening domestic production for global leadership and sustainability. As a result, these innovations are shaping the future of powder metallurgy in India, enhancing production efficiency and material utilization across industries.

To get more information on this market, Request Sample

Rising Demand for High-Performance Powder Metallurgy Components in the Automotive Sector

The Indian automotive industry is a key driver of the powder metallurgy market, with rising demand for high-performance and lightweight components. With stringent emission regulations such as Bharat Stage VI (BS-VI) and increasing focus on electric vehicles (EVs), automakers are actively seeking advanced powder metallurgy solutions to enhance fuel efficiency, reduce emissions, and improve overall vehicle performance. Powder metallurgy enables the production of high-strength, wear-resistant, and lightweight components such as transmission gears, engine parts, valve seats, and bearings. The growing penetration of EVs is further driving the need for soft magnetic powder metallurgy components used in electric motors, transformers, and inductors. For instance, India aims for over 28 million electric vehicles by 2030, with rising demand, incentives, and better charging infrastructure. EV sales surpassed 4.1 million units in FY 2023-2024, led by electric two-wheelers. The shift towards localized manufacturing, driven by initiatives like “Make in India” and the Automotive Mission Plan (AMP), is fostering investments in powder metallurgy-based component production. Additionally, the rising adoption of sintered components in two-wheelers and commercial vehicles is fueling market expansion. With leading automotive manufacturers and suppliers investing in R&D to develop advanced metal powders and sintering technologies, India’s powder metallurgy industry is poised for significant growth. The increasing use of hybrid materials and new alloy compositions is expected to further enhance the performance and cost-effectiveness of powder metallurgy-based automotive components.

India Powder Metallurgy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, material, manufacturing process, and application.

Type Insights:

- Ferrous

- Non-Ferrous

The report has provided a detailed breakup and analysis of the market based on the type. This includes ferrous and non-ferrous

Material Insights:

- Titanium

- Steel

- Nickel

- Aluminum

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes titanium, steel, nickel, aluminum, and others.

Manufacturing Process Insights:

- Additive Manufacturing

- Powder Bed

- Blown Powder

- Metal Injection Molding

- Powder Metal Hot Isostatic Pressing

- Others

A detailed breakup and analysis of the market based on the manufacturing process have also been provided in the report. This includes additive manufacturing, powder bed, blown powder, metal injection molding, powder metal hot isostatic pressing, and others.

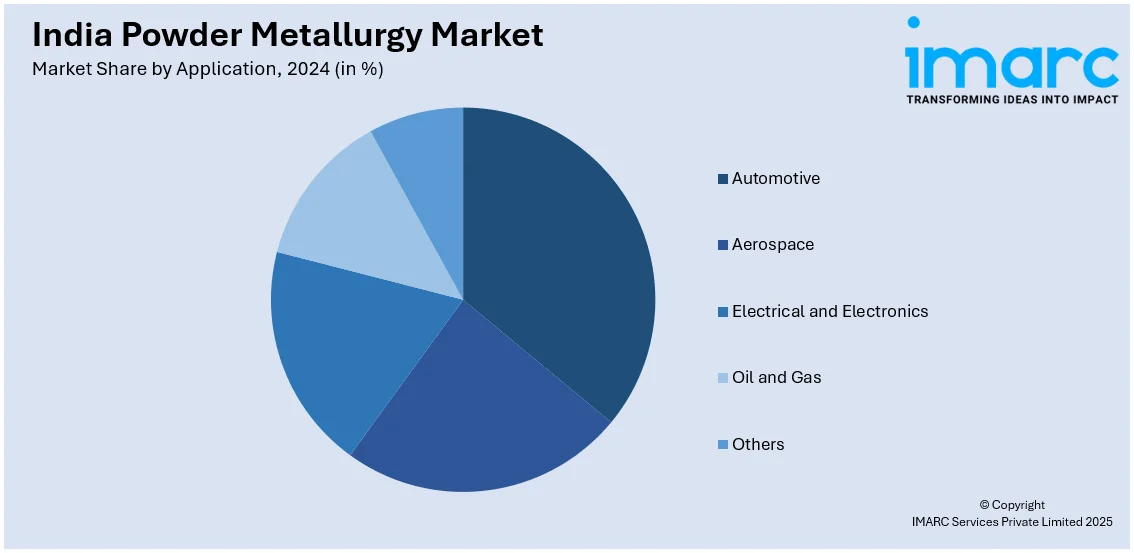

Application Insights:

- Automotive

- Aerospace

- Electrical and Electronics

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, aerospace, electrical and electronics, oil and gas, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Powder Metallurgy Market News:

- In February 2025, PMAI International Powder Metallurgy Conference (PM2025) held an event at CIDCO Exhibition Centre, Navi Mumbai, aimed to bring together experts and stakeholders to discuss advancements in powder metallurgy, including AM and MIM technologies.

- In December 2023, Indo-MIM, based in Bangalore, showcased its Metal Injection Moulding (MIM) and metal Additive Manufacturing capabilities at AMTech 2023, India’s largest AM trade show. They highlighted additively manufactured parts using Laser Beam Powder Bed Fusion (PBF-LB) and Binder Jetting (BJT), alongside metal powder production and other advanced manufacturing technologies.

India Powder Metallurgy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ferrous and Non-Ferrous |

| Materials Covered | Titanium, Steel, Nickel, Aluminum, Others. |

| Manufacturing Processes Covered | Additive Manufacturing, Powder Bed, Blown Powder, Metal Injection Molding, Powder Metal Hot Isostatic Pressing, Others |

| Applications Covered | Automotive, Aerospace, Electrical and Electronics, Oil and Gas, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India powder metallurgy market performed so far and how will it perform in the coming years?

- What is the breakup of the India powder metallurgy market on the basis of type?

- What is the breakup of the India powder metallurgy market on the basis of material?

- What is the breakup of the India powder metallurgy market on the basis of manufacturing process?

- What is the breakup of the India powder metallurgy market on the basis of application?

- What is the breakup of the India powder metallurgy market on the basis of region?

- What are the various stages in the value chain of the India powder metallurgy market?

- What are the key driving factors and challenges in the India powder metallurgy?

- What is the structure of the India powder metallurgy market and who are the key players?

- What is the degree of competition in the India powder metallurgy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India powder metallurgy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India powder metallurgy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India powder metallurgy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)