India Power Cables Market Size, Share, Trends, and Forecast by Installation, Voltage, Material, End-Use Sector, and Region, 2026-2034

India Power Cables Market Size and Share:

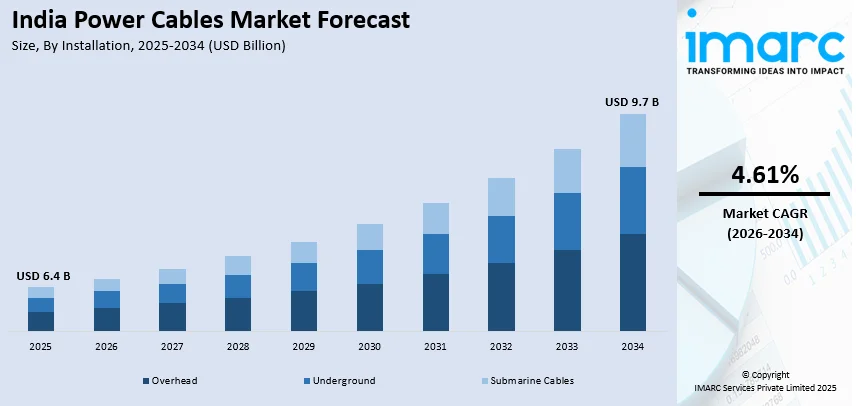

The India power cables market size reached USD 6.4 Billion in 2025. The market is expected to reach USD 9.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.61% during 2026-2034. The market growth is attributed to rising investments in transmission infrastructure, renewable energy expansion, urban electrification projects, increasing demand for high-voltage, fire-resistant, and underground cables driving innovation, ensuring efficient energy transmission, reduced losses, and enhanced grid reliability across industrial and residential sectors.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of installation, the market has been divided into overhead, underground, and submarine cables.

- On the basis of voltage, the market has been divided into high, medium, and low.

- On the basis of material, the market has been divided into copper and aluminum.

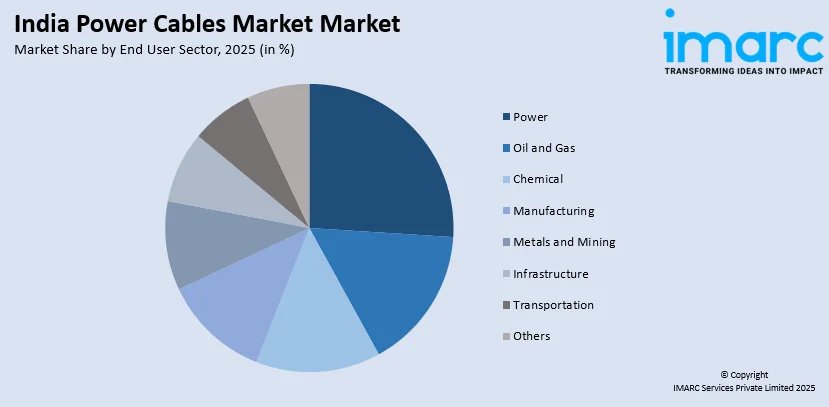

- On the basis of end-use sector, the market has been divided into power, oil and gas, chemical, manufacturing, metals and mining, infrastructure, transportation, and others.

Market Size and Forecast:

- 2025 Market Size: USD 6.4 Billion

- 2034 Projected Market Size: USD 9.7 Billion

- CAGR (2026-2034): 4.61%

India Power Cables Market Trends:

Increasing Investments in Power Infrastructure and Grid Modernization

The India power cables market analysis reveals substantial growth due to rising investments in power infrastructure and grid modernization. With the Indian government's focus on strengthening transmission and distribution networks, the demand for high-quality power cables is increasing across urban and rural regions. Initiatives such as the Revamped Distribution Sector Scheme (RDSS) and Green Energy Corridor projects are driving large-scale installations of high-voltage and ultra-high-voltage power cables to enhance grid reliability. For instance, in November 2024, the Revamped Distribution Sector Scheme (RDSS) announced sanction of projects worth INR 2.77 lakh crore for loss reduction and smart metering, with 17% physical progress. Additionally, the push for smart grid technology is accelerating the adoption of fiber-optic power cables for improved monitoring and automation. Moreover, rising investments in underground cable networks in urban areas, aimed at minimizing power losses and improving aesthetics, are fueling market growth. With private and public sector collaborations boosting infrastructure projects, the demand for durable, high-performance power cables is expected to remain strong, ensuring efficient energy transmission across India.

To get more information on this market Request Sample

Expansion of Renewable Energy and Demand for Specialized Cables

The rapid expansion of renewable energy projects is creating significant demand for specialized power cables in India. As the country aims to achieve 500 GW of non-fossil fuel capacity by 2030, solar and wind energy projects are scaling up, driving the need for high-efficiency, weather-resistant power cables. The India power cables market share is expanding as renewable energy installations require specialized solutions for optimal performance. For instance, in March 2025, India's Oil and Natural Gas Corporation (ONGC) announced the acquisition of the clean energy company PTC Energy for ₹9.25 billion ($106 million). PTC Energy operates 288 MW of wind capacity across three states, which aims to support India's target of reaching 500 GW of non-fossil fuel capacity by 2030. Solar farms require DC solar cables that can withstand extreme temperatures and UV exposure, while wind power installations need flexible, high-durability cables to handle mechanical stress and harsh environmental conditions. Additionally, the integration of battery storage systems with renewable power plants is leading to an increased need for high-performance energy storage cables that can manage fluctuating loads. Hybrid power cable solutions, combining electrical and fiber-optic components for data transmission, are also gaining traction in smart renewable installations. As India continues expanding its solar parks, offshore wind projects, and hybrid energy systems, the India power cables market growth is set to accelerate, ensuring efficient transmission and long-term reliability of green energy infrastructure.

Advanced Technology Integration and Sustainable Cable Innovation

The India power cables market is experiencing a transformative shift toward advanced technology integration and sustainable cable design, driven by evolving industry requirements and regulatory standards. The increasing preference for Low-Smoke Zero Halogen (LSZH) and fire-retardant cables is gaining significant momentum in metros, airports, and high-rise construction projects, addressing safety concerns and meeting stricter Bureau of Indian Standards (BIS) and International Electrotechnical Commission (IEC) safety standards. Government focus on disaster-resilient infrastructure is accelerating the adoption of flame-resistant underground power cables for smart city projects across tier-I and tier-II cities. Simultaneously, the rising demand from electric vehicle (EV) charging infrastructure and rapidly expanding data center facilities is creating specialized market segments requiring high-capacity, reliable power transmission solutions. The proliferation of smart grid technology and digital cable monitoring systems is driving innovation in intelligent power cables equipped with IoT sensors for real-time performance tracking and predictive maintenance capabilities. Furthermore, sustainability initiatives are reshaping manufacturing practices, with industry leaders prioritizing recyclable materials, eco-friendly cable designs, and energy-efficient production processes to align with environmental regulations and corporate sustainability goals. This technological evolution is positioning India as a hub for next-generation power cable solutions, supporting the country's digital transformation and green energy transition while ensuring enhanced safety, reliability, and environmental compliance.

Growth, Opportunities, and Challenges in the India Power Cables Market:

- Growth Drivers of the India Power Cables market: The primary growth drivers include massive government investments in power infrastructure modernization, renewable energy expansion targeting 500 GW capacity by 2030, and rapid urbanization creating demand for underground power distribution systems. The Revamped Distribution Sector Scheme (RDSS) allocation of INR 2.77 lakh crore for grid modernization and smart metering is significantly accelerating market expansion. Rising industrial manufacturing and the government's Make in India initiative are further boosting demand for specialized high-voltage power cables.

- Opportunities in the India Power Cables market: The market presents substantial opportunities through the expansion of electric vehicle charging infrastructure requiring specialized cables, growing data center investments driven by digital transformation, and smart city development projects across tier-II and tier-III cities. Export potential to global markets leveraging competitive manufacturing costs and quality standards offers significant revenue diversification opportunities. The integration of IoT-enabled smart cables and fiber-optic hybrid solutions creates premium product segments with higher profit margins, enhancing the India power cables market demand.

- Challenges in the India Power Cables market: The industry faces challenges including volatile copper and aluminum raw material prices causing margin pressures, intense competition from unorganized sector players offering substandard products at lower prices, and complex regulatory compliance requirements across different states. Supply chain disruptions and the need for substantial capital investments in manufacturing capacity expansion pose additional operational challenges. The market also confronts issues related to skilled labor shortage and the requirement for continuous technology upgrades to meet evolving industry standards.

India Power Cables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on installation, voltage, material, and end-use sector.

Installation Insights:

- Overhead

- Underground

- Submarine Cables

The report has provided a detailed breakup and analysis of the market based on the installation. This includes overhead, underground, and submarine cables.

Voltage Insights:

- High

- Medium

- Low

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes high, medium, and low.

Material Insights:

- Copper

- Aluminum

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes copper and aluminum.

End-Use Sector Insights:

Access the comprehensive market breakdown Request Sample

- Power

- Oil and Gas

- Chemical

- Manufacturing

- Metals and Mining

- Infrastructure

- Transportation

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use sector. This includes power, oil and gas, chemical, manufacturing, metals and mining, infrastructure, transportation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Power Cables Market News:

- July 2025: Dynamic Cables sanctioned capacity expansion at its Reengus, Rajasthan manufacturing unit, strengthening production capabilities to meet growing demand from energy and power sector clients across domestic and international markets.

- March 2025: Adani Enterprises announced the incorporation of joint venture company "Praneetha Ecocables Limited" with planned investment in cables and wire segment, marking entry of major industrial conglomerate into power cables market with significant competitive implications.

- November 2024: Apar Industries announced tripling of planned CTC conductor capacity to 20,490 MT by Q3 FY26, demonstrating significant capacity expansion to capitalize on transmission infrastructure development and renewable energy project requirements.

- March 2024: Raychem RPG received approval from Central Power Research Institute (CPRI) for its locally manufactured 245 KV extra high voltage cable accessories, reducing India's dependence on European imports under 'Make in India' initiative.

- In October 2024, NKT, a Denmark-based power cable manufacturer, announced the expansion in India by opening a new office in Chennai and strengthening operations in Gurugram and Mumbai. It aims to support offshore wind and interconnector projects, positioning itself as a key supplier for renewable energy infrastructure.

- In November 2023, Finolex Cables announced plans to commission a new electrical cable plant in Urse, Maharashtra, by March 2024, focusing on high thermal stability applications such as solar power and automobiles.

India Power Cables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Overhead, Underground, Submarine Cables |

| Voltages Covered | High, Medium, Low |

| Materials Covered | Copper, Aluminum |

| End-Use Sectors Covered | Oil and Gas, Chemical, Manufacturing, Metals and Mining, Infrastructure, Transportation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India power cables market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India power cables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India power cables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The power cables market in India was valued at USD 6.4 Billion in 2025.

The India power cables market is projected to exhibit a CAGR of 4.61% during 2026-2034, reaching a value of USD 9.7 Billion by 2034.

The ongoing shift towards underground cabling in urban areas to reduce power outages and enhance safety is supporting the market growth. Additionally, the rise in industrial automation and data centers is adding to the demand for specialized power cables with better conductivity and insulation. The expansion of the real estate sector and increasing investments in power generation, transmission, and distribution infrastructure continue to influence the market positively.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)