India Power Plant Equipment Market Size, Share, Trends and Forecast by Technology, Power Plant Type, and Region, 2026-2034

India Power Plant Equipment Market Overview:

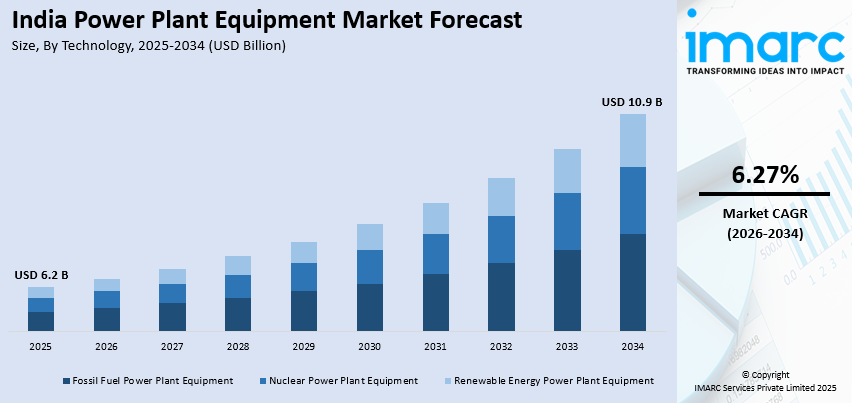

The India power plant equipment market size reached USD 6.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 10.9 Billion by 2034, exhibiting a growth rate (CAGR) of 6.27% during 2026-2034. The market is driven by rising renewable energy demand, supported by government targets. Modernization of aging thermal plants, stricter emission norms, and adoption of high-efficiency technologies are further augmenting the India power plant equipment market share. Additionally, local manufacturing incentives (PLI scheme) and digitalization in power plants are key factors improving equipment demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.2 Billion |

| Market Forecast in 2034 | USD 10.9 Billion |

| Market Growth Rate 2026-2034 | 6.27% |

India Power Plant Equipment Market Trends:

Rising Demand for Renewable Energy Equipment

The significant shift toward renewable energy solutions, driven by government policies and global sustainability goals is favoring the India power plant equipment market growth. The government's ambitious target of achieving 500 GW of renewable energy capacity by 2030 is accelerating investments in solar, wind, and hydropower projects. This rise in renewable energy adoption is increasing the demand for specialized equipment such as solar panels, wind turbines, and energy storage systems. India's solar power generation, with a capacity of 92.12 GW, and wind generation, with a capacity of 47.72 GW, has successfully achieved 200 GW-plus of renewable capacity, currently representing over 46.3% of the total power generation in the country. The rapid growth of the sector is leading to significant demand for critical industrial materials, particularly power plant equipment that is critical to energy storage and grid infrastructure. Also, there is an increased requirement due to the government's ambitious target of achieving 500 GW from non-fossil fuel sources by 2030. With increasing demand for renewable energy, the power plant equipment market in India will witness significant growth to support clean energy progress. Additionally, advancements in technology, such as high-efficiency photovoltaic cells and smart grid integration, are further propelling market growth. Companies are also focusing on local manufacturing under initiatives, including the Production Linked Incentive (PLI) scheme, reducing dependency on imports. As India moves toward a greener energy mix, the power plant equipment market is expected to see sustained growth in the renewable sector, creating opportunities for both domestic and international players.

To get more information on this market Request Sample

Modernization and Retrofitting of Aging Thermal Power Plants

The modernization and retrofitting of aging thermal power plants to improve efficiency and reduce emissions is creating a positive India power plant equipment market outlook. With coal-based power plants contributing significantly to India's energy supply, there is growing pressure to adopt cleaner technologies. In the years 2022-23, India produced 1,043.83 Billion units of electricity from coal, leading to emitting CO2 emissions of 943.04 Million Tonnes. Measures to address these emissions include the promotion of ultra-supercritical units and biomass co-firing, and the retirement of old thermal power plants. The increased contribution of renewable energy, along with these strategies, emphasizes the growing demand and scope for new opportunities in power plant equipment in India. Many power plants are upgrading their equipment with advanced boilers, turbines, and emission control systems to comply with stricter environmental regulations. Supercritical and ultra-supercritical technologies are increasingly adopted to enhance plant efficiency and lower carbon footprints. Additionally, digitalization and IoT-based monitoring systems are being integrated to optimize performance and predictive maintenance. This trend is driven by both regulatory mandates and the need for cost-effective operations, ensuring that thermal power remains viable while aligning with sustainability goals. As a result, the market for high-efficiency, low-emission power plant equipment is expanding rapidly.

India Power Plant Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on technology and power plant type.

Technology Insights:

- Fossil Fuel Power Plant Equipment

- Nuclear Power Plant Equipment

- Renewable Energy Power Plant Equipment

The report has provided a detailed breakup and analysis of the market based on the technology. This includes fossil fuel power plant equipment, nuclear power plant equipment, and renewable energy power plant equipment.

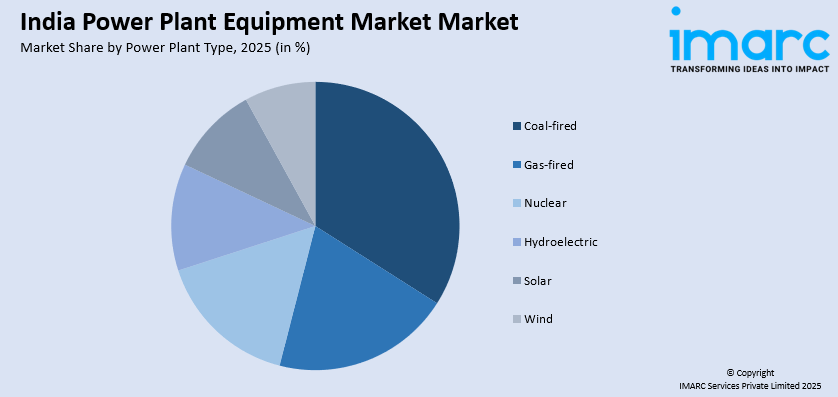

Power Plant Type Insights:

Access the comprehensive market breakdown Request Sample

- Coal-fired

- Gas-fired

- Nuclear

- Hydroelectric

- Solar

- Wind

A detailed breakup and analysis of the market based on the power plant type have also been provided in the report. This includes coal-fired, gas-fired, nuclear, hydroelectric, solar, and wind.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Power Plant Equipment Market News:

- On July 3, 2024, the Indian government ordered power providers to buy equipment valued at USD 33 billion within the year in order to accelerate the expansion of coal-fired power capacity, addressing the nation's increasing electricity demand.Major companies like NTPC and Adani Power are anticipated to lead the procurement process for this effort, which intends to add 31 gigawatts over the next five to six years. The decision highlights the need to strengthen the nation's energy infrastructure in the wake of record-high power demand and recent supply issues.

India Power Plant Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Fossil Fuel Power Plant Equipment, Nuclear Power Plant Equipment, Renewable Energy Power Plant Equipment |

| Power Plant Types Covered | Coal-fired, Gas-fired, Nuclear, Hydroelectric, Solar, Wind |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India power plant equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India power plant equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India power plant equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The power plant equipment market in India was valued at USD 6.2 Billion in 2025.

The India power plant equipment market is projected to exhibit a CAGR of 6.27% during 2026-2034, reaching a value of USD 10.9 Billion by 2034.

The India power plant equipment market is driven by rapid expansion of power generation capacity, government initiatives promoting renewable and thermal energy projects, rising electricity demand, modernization of existing infrastructure, and increased investments in efficient and advanced equipment to ensure reliable, sustainable, and cost-effective energy production.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)