India Precision Gear Manufacturing Market Size, Share, Trends and Forecast by Gear Type, Manufacturing Process, Material Type, Precision Level, End-Use Industry, and Region, 2025-2033

India Precision Gear Manufacturing Market Overview:

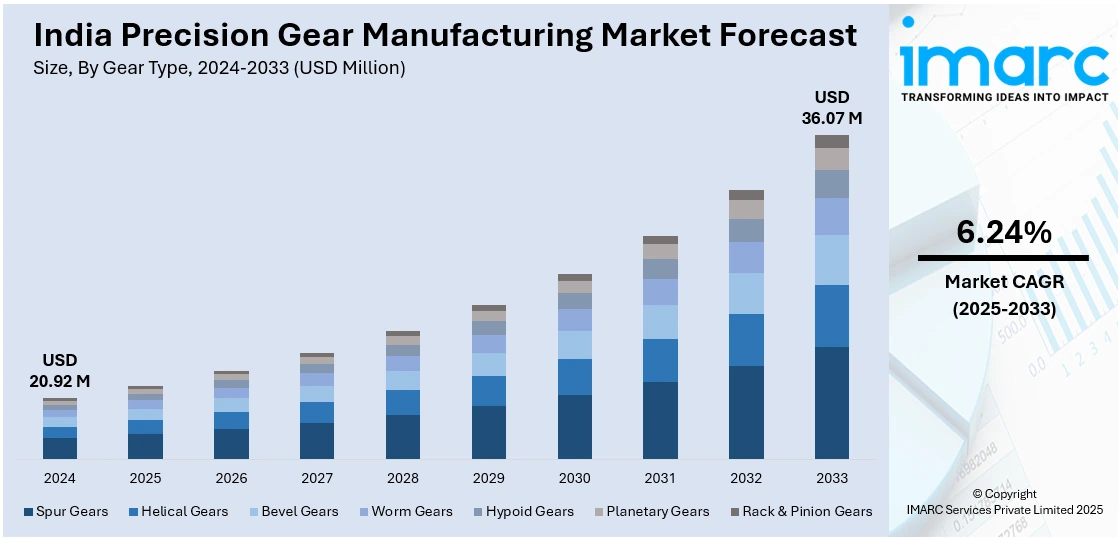

The India precision gear manufacturing market size reached USD 20.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 36.07 Million by 2033, exhibiting a growth rate (CAGR) of 6.24% during 2025-2033. The market is experiencing steady growth with the help of advances in automation, robotics, and high-performance machinery across sectors. The demand for high-precision parts in the automotive, aerospace, and industrial sectors continues to grow. Domestic manufacturing prowess, technological innovation, and increasing exports are bolstering the sector's base. Precision engineering and material innovation also add to its competitiveness, making steady momentum which is evident in the India precision gear manufacturing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 20.92 Million |

| Market Forecast in 2033 | USD 36.07 Million |

| Market Growth Rate 2025-2033 | 6.24% |

India Precision Gear Manufacturing Market Trends:

Adoption of Advanced Manufacturing Technologies

India's precision gear manufacturing sector is witnessing a profound change with the adoption of latest manufacturing technologies. For instance, in September 2023, Skanda Aerospace officially opened a high-precision gear and gearbox manufacturing plant in Hyderabad, the first private-sector aerospace-grade gear-making plant of India. Moreover, the application of CNC gear cutting, multi-axis machining, and precision grinding technology is helping the manufacturers achieve higher accuracy, tight tolerances, and complex geometry gears. Such capabilities are particularly critical in aerospace, robotics, and medical equipment industries, where precision and reliability are essential. Along with mechanical improvements, computer-aided tools such as CAD/CAM software and real-time monitoring systems are being implemented to enhance productivity and minimize lead times. Advanced testing procedures further guarantee adherence to international standards, increasing export potential. The drive towards automation, combined with investments in high-speed equipment and cleanroom facilities, is enhancing India's role in international supply chains. India precision gear manufacturing market growth is spurred by these technologies, laying a strong platform for long-term competitiveness in both high-volume and high-precision production settings.

To get more information on this market, Request Sample

Increasing Demand from Automotive and E-Mobility Markets

The growing automotive sector, especially the transition towards electric mobility, is strongly influencing India's precision gear manufacturing scenario. Electric vehicles (EVs), hybrid drivetrains, and fuel-efficient internal combustion systems require small, noiseless, and extremely durable gear assemblies. These precision parts are part of e-axles, differential units, and transmission systems, which need minimum backlash and reliable performance over extended lifecycles. With India's automotive industry adopting localization and cleaner technologies, gear makers are turning to advanced metallurgy, precision forging, and computer-aided gear design to address the changing needs. For example, in August 2024, Weiler Abrasives launched its Precision Express Program, reducing gear grinding wheel lead times from months to days while improving quality with advanced V59 bond technology. Furthermore, government incentives for electric vehicle (EV) adoption and production are increasing the demand for specialized gear components. Precision gear suppliers are thus experiencing more collaboration opportunities with original equipment manufacturers (OEMs) and Tier-1 suppliers. The India precision gear manufacturing contribution to the automotive value chain keeps growing, playing a key role in enabling sustainable mobility solutions and enhancing the overall resilience of local manufacturing ecosystems.

Integration of Sustainable and High-Performance Materials

The use of sustainable and high-performance materials is becoming the hallmark trend in India's precision gear-making industry. Manufacturers are turning to new-age materials such as engineering-grade thermoplastics, light aluminum alloys, and high-performance composites that minimize wear and optimize efficiency in mechanical systems. These materials are beneficial in terms of corrosion resistance, noise dampening, and energy conservation which is most useful for medical devices, renewable energy equipment, and aerospace parts. The change fits both environmental imperatives and performance requirements, supporting lower lifecycle expenses and enhanced system integration. In addition, innovations in surface treatment technologies, including nitriding and PVD coatings, are being applied to enhance gear longevity without sacrificing weight or size. This material innovation is driving the creation of compact, high-load-capacity gears for use in today's engineering applications. Consequently, India precision gear manufacturing market prospects are positive, driven by material innovation that drives sustainability and expands application horizons across various high-growth industries.

India Precision Gear Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on gear type, manufacturing process, material type, precision level, and end-use industry.

Gear Type Insights:

- Spur Gears

- Helical Gears

- Bevel Gears

- Worm Gears

- Hypoid Gears

- Planetary Gears

- Rack & Pinion Gears

The report has provided a detailed breakup and analysis of the market based on the gear type. This includes spur gears, helical gears, bevel gears, worm gears, hypoid gears, planetary gears, and rack & pinion gears.

Manufacturing Process Insights:

- Gear Cutting

- Gear Grinding

- Injection Molding

- 3D Printing of Gears

- Heat Treatment & Surface Finishing

A detailed breakup and analysis of the market based on the manufacturing process have also been provided in the report. This includes gear cutting, gear grinding, injection molding, 3d printing of gears, and heat treatment & surface finishing.

Material Type Insights:

- Steel Gears

- Brass & Bronze Gears

- Aluminum Gears

- Plastic & Composite Gears

- Ceramic & Advanced Material Gears

The report has provided a detailed breakup and analysis of the market based on the material type. This includes steel gears, brass & bronze gears, aluminum gears, plastic & composite gears, and ceramic & advanced material gears.

Precision Level Insights:

- High-Precision Micro Gears

- Medium-Precision Industrial Gears

- Standard Gears for General Applications

A detailed breakup and analysis of the market based on the precision level have also been provided in the report. This includes high-precision micro gears, medium-precision industrial gears, and standard gears for general applications.

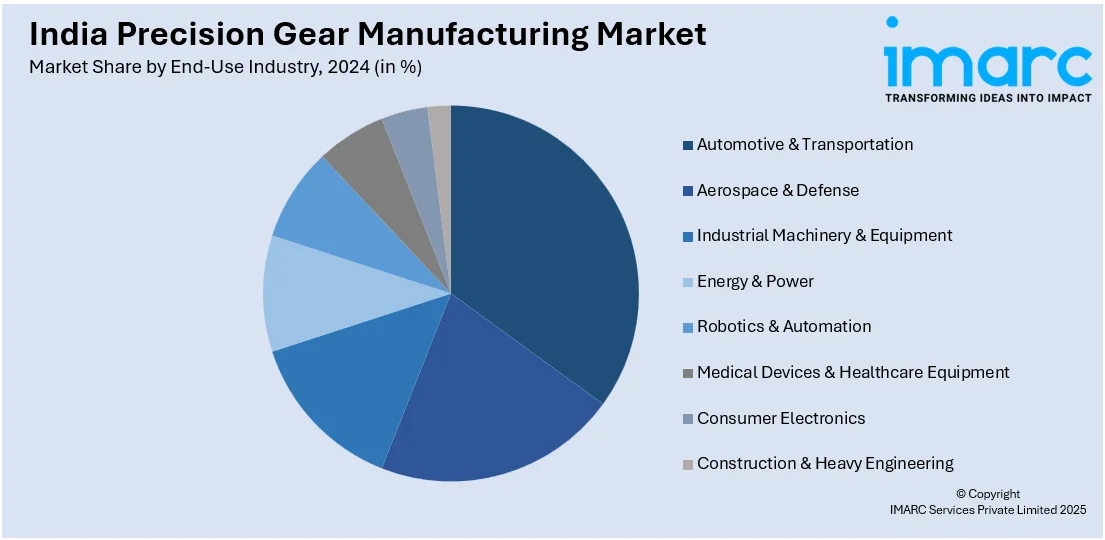

End-Use Industry Insights:

- Automotive & Transportation

- Aerospace & Defense

- Industrial Machinery & Equipment

- Energy & Power

- Robotics & Automation

- Medical Devices & Healthcare Equipment

- Consumer Electronics

- Construction & Heavy Engineering

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes automotive & transportation, aerospace & defense, industrial machinery & equipment, energy & power, robotics & automation, medical devices & healthcare equipment, consumer electronics, and construction & heavy engineering.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Precision Gear Manufacturing Market News:

- In April 2025, RENK Gears Private Ltd. and Quantum Systems concluded a strategic MoU in Bengaluru, India, to work together on research, production, software development, and digitalization. The collaboration, which was witnessed by Bavaria's State Minister, underlines "Make in India" initiatives and acknowledges India as a principal market for defense and aerospace innovation.

- In October 2024, Nidec Machine Tool officially introduced the ZFA160 and ZFA260 gear grinders, which are high-precision gear machining machines. These world-class machines lower non-machining time by 50%, have automated inline measurement, and accommodate advanced EV and robotics applications, showcasing Nidec's dedication to automation, precision, and eco-friendly manufacturing technologies.

India Precision Gear Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gear Types Covered | Spur Gears, Helical Gears, Bevel Gears, Worm Gears, Hypoid Gears, Planetary Gears, Rack & Pinion Gears |

| Manufacturing Processes Covered | Gear Cutting, Gear Grinding, Injection Molding, 3D Printing of Gears, Heat Treatment & Surface Finishing |

| Material Types Covered | Steel Gears, Brass & Bronze Gears, Aluminum Gears, Plastic & Composite Gears, Ceramic & Advanced Material Gears |

| Precision Levels Covered | High-Precision Micro Gears, Medium-Precision Industrial Gears, Standard Gears for General Applications |

| End-Use Industries Covered | Automotive & Transportation, Aerospace & Defense, Industrial Machinery & Equipment, Energy & Power, Robotics & Automation, Medical Devices & Healthcare Equipment, Consumer Electronics, Construction & Heavy Engineering |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India precision gear manufacturing market performed so far and how will it perform in the coming years?

- What is the breakup of the India precision gear manufacturing market on the basis of gear type?

- What is the breakup of the India precision gear manufacturing market on the basis of manufacturing process?

- What is the breakup of the India precision gear manufacturing market on the basis of material type?

- What is the breakup of the India precision gear manufacturing market on the basis of precision level?

- What is the breakup of the India precision gear manufacturing market on the basis of end-use industry?

- What is the breakup of the India precision gear manufacturing market on the basis of region?

- What are the various stages in the value chain of the India precision gear manufacturing market?

- What are the key driving factors and challenges in the India precision gear manufacturing?

- What is the structure of the India precision gear manufacturing market and who are the key players?

- What is the degree of competition in the India precision gear manufacturing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India precision gear manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India precision gear manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India precision gear manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)