India Prefilled Syringes Market Size, Share, Trends and Forecast by Type, Material, Application, Distribution Channel, and Region, 2025-2033

India Prefilled Syringes Market Overview:

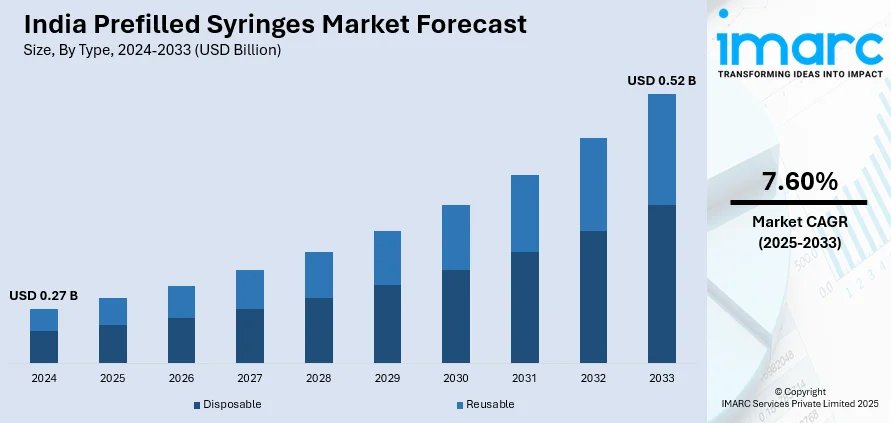

The India prefilled syringes market size reached USD 0.27 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.52 Billion by 2033, exhibiting a growth rate (CAGR) of 7.60% during 2025-2033. The increasing demand for self-dose administration of drugs and home healthcare solutions is impelling the market growth. This trend, along with the ongoing adoption of biologics and injectables is contributing to the market growth. Apart from this, technological advancement in the production of syringes is expanding the India prefilled syringes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.27 Billion |

| Market Forecast in 2033 | USD 0.52 Billion |

| Market Growth Rate 2025-2033 | 7.60% |

India Prefilled Syringes Market Trends:

Increasing Demand for Self-Administration and Home Healthcare

The market for prefilled syringes in India is experiencing growth on account of increasing demand for self-dose administration of drugs and home healthcare solutions. Patients are opting for minimally invasive (MI), time-saving, and convenient drug delivery systems, particularly patients with chronic diseases like rheumatoid arthritis, diabetes, and multiple sclerosis. According to an article published by the Department of Biotechnology in 2025, in India, non-communicable diseases accounts for 53% of all deaths and 44 % of disability-adjusted life-years lost. India is home to more than a sixth of the world’s population and has been witnessing rapid epidemiological transition, which is a shift from communicable to non-communicable diseases (NCDs) along with socio-economic development. To combat these issues, prefilled syringes are providing a safer and easier-to-use alternative to conventional vials and ampoules, hence reducing dosage mistakes and enhancing patient adherence. The Indian healthcare system is also widening its scope in remote care, fueled by increased disposable incomes and a growing population of elderly people. As patients are getting more aware about health alternatives and as online tools for health are making remote monitoring possible, prefilled syringes are also becoming an important component in making at-home treatment possible. The drug makers are making active investments in prefilled syringe presentations to keep up with the trend.

To get more information on this market, Request Sample

Growing Adoption of Biologics and Injectable Drugs

The ongoing adoption of biologics and injectables is impelling the India prefilled syringes market growth. Biologic drugs such as monoclonal antibodies and vaccines are demanding accurate, sterile, and efficient drug delivery systems, which prefilled syringes are consistently offering. Indian drug and biotech companies are gearing up their biologics manufacturing capabilities for both domestic and global markets. This is occurring alongside an increase in the prevalence of chronic diseases like autoimmune diseases, cancer, and infectious diseases, which are more likely treated with injectable biologics. Healthcare professionals are also promoting prefilled syringe use to save preparation time, ensure sterility, and provide accurate dosing. Moreover, Indian regulatory authorities are consolidating processes for biosimilar and biologic approval, further improving the market environment for sophisticated drug delivery systems. The industry is utilizing prefilled syringes to facilitate the safe and effective use of such sophisticated therapeutics, generating sustained market growth. In 2024, Pharma major Venus Remedies announced that it was granted good manufacturing practices (GMP) certification by the Malaysia's National Pharmaceutical Regulatory Agency (NPRA) for its robotic pre-filled syringe facility at Baddi unit. It is the first Pharmaceutical Inspection Co-operation Scheme (PIC/S) certification for Venus Remedies' pre-filled syringe (PFS) facility, the company stated in a release.

Advancements in Syringe Manufacturing Technologies

Technological improvements in the production of syringes are strongly driving the market in India. Companies are innovating with advanced materials, including cyclic olefin polymers and glass substitutes, to improve the stability of syringes, drug compatibility, and patient safety. Automation and precision engineering are being incorporated into production lines to provide improved quality consistency, lower contamination risks, and cope with bulk demand. Moreover, smart packaging, tamper-evident devices, and needle safety functionality are being invested in by more companies to enhance usability and compliance of prefilled syringes. Advances in fill-finish technology are making the scalable and sterile packaging of vaccines and biologics possible, essential to addressing demand during emergencies. In 2024, Serum Institute of India (SII) declared a strategic investment in IntegriMedical, purchasing a 20% equity stake in the corporation, to develop Needle-Free Injection System technology. The association between SII and IntegriMedical extends SII's vision of 'Health for All' and IntegriMedical's mission of 'Transform Healthcare Globally' through patient comfort, improving patient compliance, lowering needle-stick injuries, and maximizing the effectiveness of liquid drugs through needle-free dispersion.

India Prefilled Syringes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, material, application, and distribution channel.

Type Insights:

- Disposable

- Reusable

The report has provided a detailed breakup and analysis of the market based on the type. This includes disposable and reusable.

Material Insights:

- Glass Syringes

- Plastic Syringes

The report has provided a detailed breakup and analysis of the market based on the material. This includes glass syringes and plastic syringes.

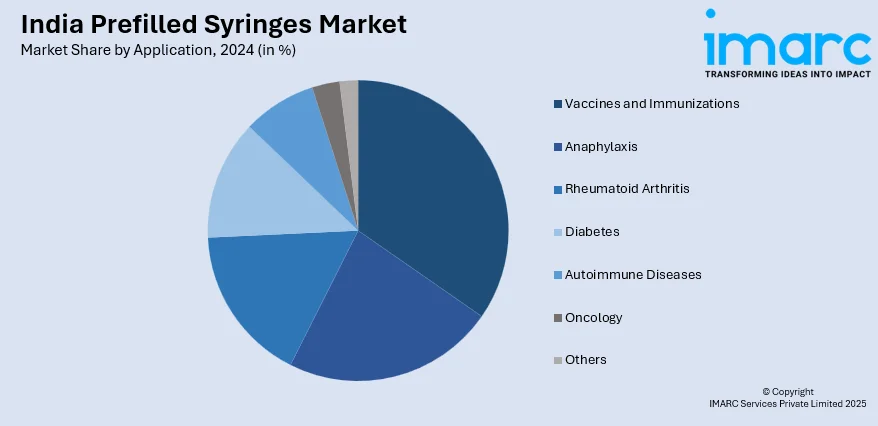

Application Insights:

- Vaccines and Immunizations

- Anaphylaxis

- Rheumatoid Arthritis

- Diabetes

- Autoimmune Diseases

- Oncology

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes vaccines and immunizations, anaphylaxis, rheumatoid arthritis, diabetes, autoimmune diseases, oncology, and others.

Distribution Channel Insights:

- Hospitals

- Mail Order Pharmacies

- Ambulatory Surgery Centers

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospitals, mail order pharmacies, and ambulatory surgery centers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Prefilled Syringes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Disposable, Reusable |

| Materials Covered | Glass Syringes, Plastic Syringes |

| Applications Covered | Vaccines and Immunizations, Anaphylaxis, Rheumatoid Arthritis, Diabetes, Autoimmune Diseases, Oncology, Others |

| Distribution Channels Covered | Hospitals, Mail Order Pharmacies, Ambulatory Surgery Centers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India prefilled syringes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India prefilled syringes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India prefilled syringes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The prefilled syringes market in India was valued at USD 0.27 Billion in 2024.

The India prefilled syringes market is projected to exhibit a CAGR of 7.60% during 2025-2033, reaching a value of USD 0.52 Billion by 2033.

The growing incidence of chronic diseases, the preference for self-administration of drugs, technological improvements in drug delivery methods, and the enhanced safety and convenience of prefilled syringes are key contributors to the market's growth. Regulatory approvals and innovations in packaging also play an important role.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)