India Prepaid Cards Market Size, Share, Trends and Forecast by Card Type, Purpose, Vertical, and Region, 2026-2034

India Prepaid Cards Market Summary:

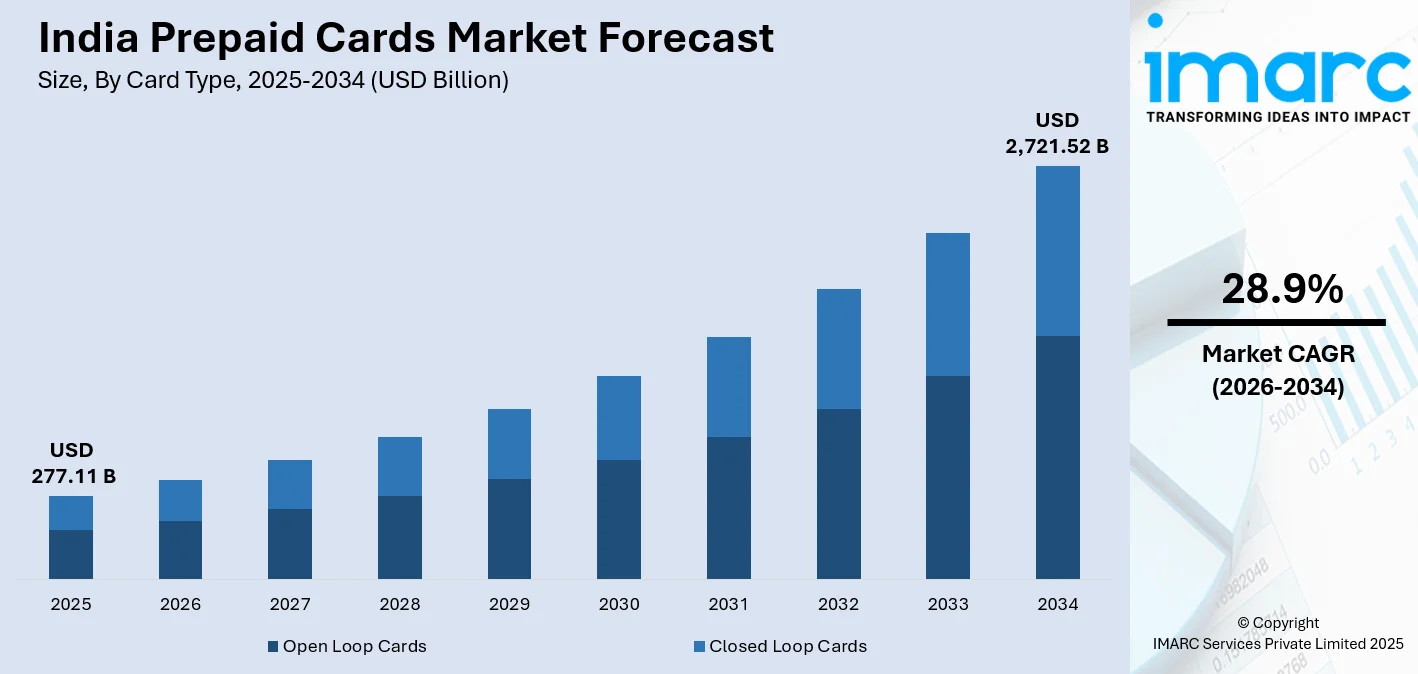

The India prepaid cards market size was valued at USD 277.11 Billion in 2025 and is projected to reach USD 2,721.52 Billion by 2034, growing at a compound annual growth rate of 28.9% from 2026-2034.

The India prepaid cards market is experiencing remarkable transformation driven by the country's accelerating shift toward a cashless economy and expanding digital payment infrastructure. Government initiatives promoting financial inclusion through programs like Digital India and BharatNet have significantly enhanced digital connectivity, with approximately 95.15% of villages gaining access to 3G or 4G mobile connectivity as of 2024. The proliferation of smartphones, coupled with rising consumer awareness about secure payment alternatives, is reshaping transaction behaviors across urban and semi-urban regions. Corporate adoption of prepaid solutions for expense management, employee disbursements, and payroll functions continues to strengthen market momentum. Financial technology companies are introducing innovative products that combine multiple functionalities, attracting diverse consumer segments including students, working professionals, and unbanked populations. The integration of prepaid cards with mobile wallets and unified payment interfaces enhances convenience while maintaining transaction security. Growing e-commerce penetration and increasing acceptance at merchant outlets further support market expansion, positioning India as one of the fastest-growing prepaid cards markets globally and driving sustained India prepaid cards market share.

Key Takeaways and Insights:

- By Card Type: Open loop cards dominate the market with a share of 72% in 2025, owing to their flexibility and widespread acceptance across multiple merchant networks, payment platforms, and international transactions. The interoperability of open loop cards with major payment networks like Visa, Mastercard, and RuPay enhances consumer convenience and merchant adoption.

- By Purpose: General purpose reloadable (GPR) cards lead the market with a share of 30% in 2025. This dominance is driven by their versatility in everyday transactions, budget management capabilities, and appeal to consumers seeking alternatives to traditional banking products while maintaining control over spending limits.

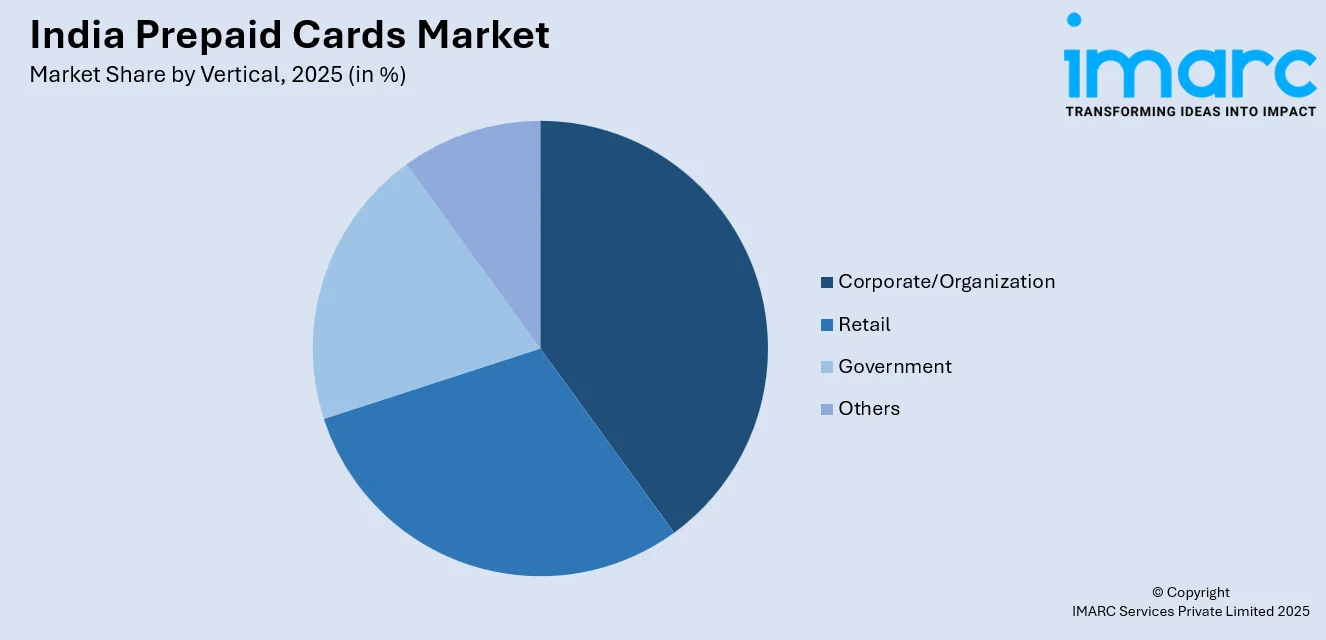

- By Vertical: Corporate/organization represents the biggest segment with a market share of 36% in 2025, reflecting strong enterprise adoption for streamlined expense management, employee reimbursements, travel allowances, and payroll disbursements that reduce administrative overhead and enhance financial visibility.

- By Region: North India comprises the largest region with 32% share in 2025, driven by high population density, significant concentration of corporate headquarters, advanced digital infrastructure in metropolitan areas, and strong consumer adoption of digital payment solutions across commercial and retail sectors.

- Key Players: Key players drive the India prepaid cards market by expanding product portfolios, enhancing card functionalities, and strengthening distribution networks. Their investments in technology integration, strategic partnerships with fintech companies, and compliance with regulatory frameworks ensure product innovation and market penetration across diverse consumer segments. Some of the key players operating in the market include American Express Company, Axis Bank Limited, EbixCash, HDFC Bank Ltd., ICICI Bank Ltd, Kotak Mahindra Bank Limited, Pluxee India, Punjab National Bank, State Bank of India, and Yes Bank Ltd.

To get more information on this market Request Sample

India Prepaid Cards Market Trends:

Integration of Prepaid Cards with Mobile Wallets and Digital Platforms

The convergence of prepaid cards with mobile wallet applications represents a transformative shift in India's payment ecosystem. Users can seamlessly track spending, manage balances, and reload funds through smartphone applications, enhancing transaction convenience. Major digital payment platforms now support prepaid card integration, allowing consumers to manage multiple payment instruments from unified interfaces. Regulatory frameworks mandating interoperability between prepaid payment methods and unified payment interfaces have further strengthened this integration. This technological convergence supports the India prepaid cards market growth by expanding accessibility and improving user experience across demographic segments.

Rising Adoption of Multipurpose Card Solutions

Financial technology companies are introducing multipurpose card solutions that combine payment, identification, and access functionalities into single products. These innovative offerings target corporate employees and students seeking streamlined solutions for professional and financial transactions. In September 2024, CARD91 launched a three-in-one card platform at the Global Fintech Fest, integrating ID card, access control, and prepaid payment capabilities including National Common Mobility Card functionality. Such products reduce the need for multiple cards while enhancing security through consolidated credential management and mobile-first design approaches.

Expansion of Contactless Payment Infrastructure

Contactless payment technology adoption is accelerating across India's prepaid card ecosystem, driven by consumer preferences for faster and more hygienic transaction methods. Near-field communication enabled prepaid cards allow tap-and-pay functionality at retail outlets, transit systems, and entertainment venues. At the Global Fintech Fest 2024, Airtel Payments Bank launched a smartwatch with an embedded RuPay chip enabling direct contactless payments and National Common Mobility Card transactions. This expansion of contactless infrastructure supports increased transaction volumes while enhancing consumer convenience across urban and semi-urban markets.

Market Outlook 2026-2034:

The India prepaid cards market outlook remains robust, supported by favorable regulatory frameworks, technological advancements, and expanding digital infrastructure across the country. Government initiatives continue prioritizing financial inclusion through digital payment promotion, creating substantial opportunities for market expansion. The market generated a revenue of USD 277.11 Billion in 2025 and is projected to reach a revenue of USD 2,721.52 Billion by 2034, growing at a compound annual growth rate of 28.9% from 2026-2034. Entry of international fintech companies is intensifying competition while driving product innovation and service quality improvements. Corporate adoption for expense management solutions, expanding merchant acceptance networks, and integration with emerging payment technologies position the market for sustained growth throughout the forecast period.

India Prepaid Cards Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Card Type |

Open Loop Cards |

72% |

|

Purpose |

General Purpose Reloadable (GPR) Cards |

30% |

|

Vertical |

Corporate/Organization |

36% |

|

Region |

North India |

32% |

Card Type Insights:

- Open Loop Cards

- Closed Loop Cards

Open loop cards dominate with a market share of 72% of the total India prepaid cards market in 2025.

Open loop prepaid cards have established dominance in the India prepaid cards market due to their versatility and widespread acceptance across diverse merchant networks and payment platforms. These cards operate on major international payment networks, enabling transactions at numerous acceptance points domestically and internationally. The flexibility to conduct purchases at retail outlets, e-commerce platforms, automated teller machines, and point-of-sale terminals drives consumer preference for open loop solutions over restricted alternatives. Their interoperability across banking infrastructure and digital payment ecosystems enhances utility for consumers seeking seamless transaction experiences.

The growth trajectory of open loop cards is supported by increasing financial technology innovation and regulatory frameworks promoting interoperability. Mobile wallet providers now offer support for open loop prepaid cards, enhancing convenience and expanding usage scenarios across consumer segments. Government initiatives specifically targeting the promotion of domestic card networks and low-value digital transactions demonstrate institutional support for open loop payment instruments and their integration with broader digital payment ecosystems, further strengthening market adoption and acceptance infrastructure development.

Purpose Insights:

- Payroll/Incentive Cards

- Travel Cards

- General Purpose Reloadable (GPR) Cards

- Remittance Cards

- Others

General purpose reloadable (GPR) cards lead with 30% share of the total India prepaid cards market in 2025.

General purpose reloadable cards have captured the largest share in the purpose segment owing to their versatility for everyday financial transactions and budget management capabilities. These cards serve consumers seeking alternatives to traditional banking products while maintaining control over spending through predetermined loading limits. The reloadable nature allows continuous usage without requiring new card issuance, reducing costs and enhancing convenience for frequent users across diverse transaction scenarios. Users benefit from the flexibility to add funds as needed, making these instruments ideal for recurring expenses and discretionary spending management.

The appeal of GPR cards extends across multiple demographic segments including students, working professionals, and individuals without access to traditional credit facilities. Strong consumer demand for flexible payment solutions continues driving adoption across urban and semi-urban markets. Financial institutions and fintech companies continue expanding GPR card offerings with enhanced features including mobile application integration, reward programs, and real-time transaction notifications that improve user experience and drive adoption. The accessibility of these cards without stringent credit requirements further broadens their consumer base significantly.

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Corporate/Organization

- Retail

- Government

- Others

The corporate/organization exhibits a clear dominance with 36% share of the total India prepaid cards market in 2025.

Corporate adoption of prepaid cards has emerged as a significant market driver, with organizations leveraging these instruments for streamlined expense management, employee disbursements, and operational efficiency improvements. Businesses utilize prepaid cards for managing travel allowances, fleet operations, and performance-linked incentives, eliminating cash handling complexities while enhancing financial visibility and control. The ability to configure spending limits and monitor transactions in real-time enables organizations to enforce compliance and reduce administrative overhead. These solutions provide finance teams with comprehensive oversight capabilities that traditional reimbursement processes cannot match effectively.

The corporate segment continues experiencing strong growth as enterprises recognize the operational benefits of prepaid payment solutions. Business-to-business payment providers have introduced corporate prepaid cards specifically designed to optimize organizational spending and deliver savings to users. Fintech platforms are increasingly developing API-driven architectures that allow businesses to automate payouts, enforce usage restrictions, and integrate prepaid solutions seamlessly into enterprise workflows, further accelerating corporate adoption across small, medium, and large enterprises. The scalability of these solutions makes them attractive for organizations of varying sizes seeking modernized payment infrastructure.

Regional Insights:

- West and Central India

- South India

- North India

- East India

North India represents the leading segment with 32% share of the total India prepaid cards market in 2025.

North India has established market leadership driven by high population density, concentration of corporate headquarters in the National Capital Region, and advanced digital payment infrastructure across metropolitan and tier-two cities. The region benefits from strong consumer adoption of digital payment solutions, robust banking penetration, and extensive merchant acceptance networks that facilitate prepaid card transactions across retail, hospitality, and commercial sectors. Urban centers demonstrate particularly high adoption rates among corporate and individual consumers seeking convenient cashless payment alternatives for daily transactions and business operations.

Regional growth is further supported by government initiatives enhancing digital connectivity and financial inclusion across northern states. Infrastructure development programs have significantly expanded internet accessibility across rural and semi-urban areas, enabling prepaid card adoption in previously underserved communities. This connectivity improvement supports the expansion of e-commerce and digital payment acceptance throughout the region. The presence of major financial institutions, technology companies, and thriving commercial ecosystems creates favorable conditions for continued market expansion. Strong educational infrastructure and growing workforce populations further contribute to sustained demand for versatile prepaid payment instruments across diverse consumer segments.

Market Dynamics:

Growth Drivers:

Why is the India Prepaid Cards Market Growing?

Government Initiatives Promoting Digital Financial Inclusion

Government-led initiatives represent a fundamental driver of prepaid cards market expansion in India, with substantial investments directed toward building digital payment infrastructure and promoting cashless transactions. National digital connectivity programs have transformed accessibility across the country, enabling users in rural and semi-urban areas unprecedented access to digital financial services. Regulatory frameworks established by the Reserve Bank of India continue evolving to support prepaid payment instrument adoption while ensuring consumer protection and transaction security. Domestic payment network-based prepaid cards are being extensively utilized for welfare program disbursements targeting lower-income populations, demonstrating institutional commitment to financial inclusion through prepaid payment solutions. Government budgetary allocations specifically target promotion of domestic card networks and low-value digital transactions, providing financial incentives to banks that encourage prepaid card usage at point-of-sale terminals and e-commerce platforms.

Rising Corporate Adoption for Expense Management Solutions

Corporate organizations across India are increasingly adopting prepaid cards as efficient tools for managing employee expenses, disbursements, and operational payments. Businesses leverage these instruments to streamline fund distributions for travel allowances, fleet operations, and payroll functions without traditional cash handling complexities. Prepaid cards enable organizations to enforce spending limits, monitor real-time transactions, and maintain enhanced oversight of corporate expenditure patterns. This operational efficiency improvement reduces administrative overhead while ensuring compliance with internal financial controls and external regulatory requirements. Financial technology companies are developing sophisticated platforms that integrate prepaid card management with enterprise resource planning systems, enabling automated expense tracking and simplified reconciliation processes that appeal to finance teams seeking cost-effective solutions for corporate spending management.

Expanding Digital Payment Infrastructure and Smartphone Penetration

The expansion of digital payment infrastructure coupled with increasing smartphone penetration creates favorable conditions for prepaid cards market growth across India. Mobile connectivity improvements have reached unprecedented levels across villages nationwide, enabling digital payment access in previously underserved regions. E-commerce growth continues accelerating, driving demand for secure online payment instruments that prepaid cards effectively address. Merchant acceptance networks are expanding beyond metropolitan areas into tier-two and tier-three cities, creating additional usage opportunities for prepaid cardholders. The integration of prepaid cards with unified payment interface and mobile wallet applications enhances convenience and accessibility, allowing consumers to manage multiple payment instruments through smartphone applications while conducting transactions seamlessly across physical and digital commerce channels. Rising consumer confidence in digital transactions and growing awareness of prepaid card benefits further support market penetration across diverse demographic segments.

Market Restraints:

What Challenges the India Prepaid Cards Market is Facing?

Intense Competition from UPI and Mobile Wallets

Prepaid cards face significant competitive pressure from unified payment interface and mobile wallet solutions that offer convenient, instantaneous transaction capabilities. UPI witnessed substantial transaction volumes, demonstrating strong consumer preference for real-time payment alternatives. The zero-cost nature of UPI transactions for end-users creates pricing challenges for prepaid card issuers seeking market share expansion. Mobile wallets provide similar functionality with added convenience features, potentially limiting prepaid card adoption among digitally-savvy consumer segments.

Stringent Regulatory Compliance Requirements

The Reserve Bank of India has implemented comprehensive compliance measures including Know Your Customer norms that create operational challenges for prepaid card providers. Small-scale businesses and non-bank prepaid card issuers face difficulties meeting documentation and verification requirements necessary for card issuance. Regular policy modifications impose usage limits and operational constraints that affect market growth trajectories. Compliance costs associated with anti-money laundering standards, cybersecurity requirements, and interoperability integration increase operational expenses for issuers.

Limited Merchant Acceptance in Rural Areas

Despite infrastructure improvements, prepaid card acceptance remains limited in rural and remote regions where digital payment infrastructure development lags urban centers. Many merchants in smaller towns lack point-of-sale terminals necessary for card-based transactions. Consumer awareness about prepaid card benefits and usage procedures remains lower in underserved areas. The cost of acquiring and maintaining acceptance infrastructure discourages small merchants from enabling card payments, creating geographic constraints on market expansion.

Competitive Landscape:

The India prepaid cards market exhibits an increasingly competitive landscape as established banking institutions and emerging fintech companies intensify efforts to capture market share. Major players including HDFC Bank, ICICI Bank, Axis Bank, State Bank of India, and Kotak Mahindra Bank continue strengthening their prepaid card portfolios through product innovation and distribution expansion. Competition is driven by investments in technology integration, mobile application development, and enhanced card functionalities that improve customer experience. International fintech companies are entering the market, drawn by substantial growth potential and supportive regulatory frameworks. Strategic partnerships between banks, payment networks, and technology providers foster innovation while accelerating product launches and improving after-sales support capabilities across diverse consumer segments.

Some of the key players include:

- American Express Company

- Axis Bank Limited

- EbixCash

- HDFC Bank Ltd.

- ICICI Bank Ltd

- Kotak Mahindra Bank Limited

- Pluxee India

- Punjab National Bank

- State Bank of India

- Yes Bank Ltd

Recent Developments:

- In April 2025, Revolut received full authorization from the Reserve Bank of India to issue domestic prepaid cards and wallets in India. The approval builds upon existing licenses for multi-currency forex cards and cross-border remittance services, positioning the UK-based fintech to offer integrated domestic and international payment solutions on a single platform targeting premium Indian consumers.

India Prepaid Cards Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Card Types Covered | Open Loop Cards, Closed Loop Cards |

| Purposes Covered | Payroll/Incentive Cards, Travel Cards, General Purpose Reloadable (GPR) Cards, Remittance Cards, Others |

| Verticals Covered | Corporate/Organization, Retail, Government, Others |

| Region Covered | West and Central India, South India, North India, East India |

| Companies Covered | American Express Company, Axis Bank Limited, EbixCash, HDFC Bank Ltd., ICICI Bank Ltd, Kotak Mahindra Bank Limited, Pluxee India, Punjab National Bank, State Bank of India, Yes Bank Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India prepaid cards market size was valued at USD 277.11 Billion in 2025.

The India prepaid cards market is expected to grow at a compound annual growth rate of 28.9% from 2026-2034 to reach USD 2,721.52 Billion by 2034.

Open loop cards dominated the market with a share of 72%, driven by their widespread acceptance across multiple merchant networks, compatibility with major payment platforms, and flexibility for both domestic and international transactions.

Key factors driving the India prepaid cards market include government initiatives promoting digital payments, expanding digital infrastructure, rising corporate adoption for expense management, increasing smartphone penetration, and growing e-commerce activities.

Major challenges include intense competition from UPI and mobile wallets, stringent regulatory compliance requirements, limited merchant acceptance infrastructure in rural areas, and high operational costs associated with card issuance and maintenance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)