India Pressure Pumping Market Size, Share, Trends and Forecast by Pump Type, Pressure, Application, and Region, 2025-2033

India Pressure Pumping Market Overview:

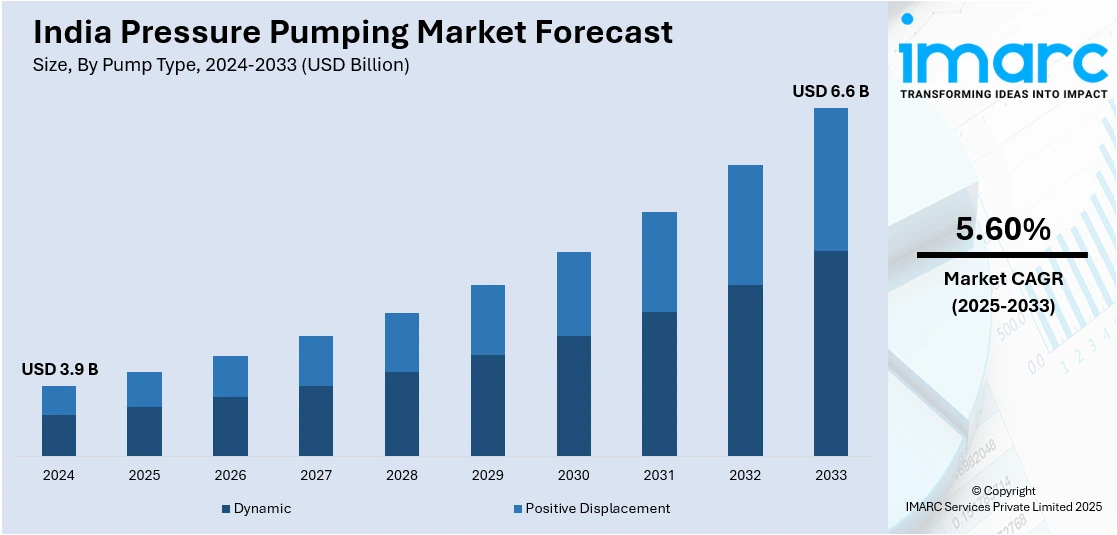

The India pressure pumping market size reached USD 3.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. The rise in exploration and production activities in unconventional hydrocarbon resources is impelling the market growth. This trend, along with an increase in energy demand driven by population growth, is contributing to the market growth. Additionally, the heightened focus on investments in onshore and offshore oil and gas infrastructure is expanding the India pressure pumping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.9 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Market Growth Rate 2025-2033 | 5.60% |

India Pressure Pumping Market Trends:

Heightened Exploration and Production Events in Unconventional Oil and Gas Reservoirs

The rise in production and exploration activities in unconventional hydrocarbon resources, including shale gas and tight oil formations, is impelling the market growth. While traditional reserves keep maturing and reducing their production, Indian energy companies are turning towards exploiting these tougher-to-recover resources. Pressure pumping technologies, particularly hydraulic fracturing and cementing are also driving reservoir productivity through the ability to produce hydrocarbons from low-permeability formations. Government policy initiatives such as the Open Acreage Licensing Policy (OALP) and Hydrocarbon Exploration and Licensing Policy (HELP) are also driving investments in this area further. The tenth round of OALP is launched in 2025 to provide the largest region for oil and gas exploration in the country. Foreign partnerships and state-of-the-art technologies are also used by domestic operators to maximize recovery rates. As a result, the demand for high-pressure pumping services is increasing in India.

To get more information on this market, Request Sample

Expanding Investments in Onshore and Offshore Infrastructure Development

India is seeing significant investment in onshore and offshore oil and gas infrastructure, which is catalyzing pressure pumping services demand. Important national oil companies (NOCs) such Oil India Limited are investing substantial capital to improve drilling capacity and fortify well stimulation methods. At the same time, the Government is focusing on modernizing infrastructure by initiatives such as the National Infrastructure Pipeline (NIP), supporting the construction of pipeline networks, refineries, and production plants. In 2025, the longest liquified petroleum gas (LPG) pipeline was launched in the country, which is also the largest in the world, to reduce fuel transportation expenses and prevent road accidents. These advancements are enabling more complex and deeper drilling operations requiring strong pressure pumping technologies. Additionally, offshore blocks auctioned during recent rounds of licensing are encouraging operators to spend on sophisticated well completion and cementing services. With more depth in operations and complexity, pressure pumping becomes a necessity to maintain structure integrity and optimize hydrocarbon production.

Rising Domestic Energy Demand and Policy Support for Hydrocarbon Development

The rise in energy demand is propelling the India pressure pumping market growth. The nation’s power consumption increased by nearly 7% to 148.48 billion units (BU) in March 2025. India’s commitment to ensuring energy self-sufficiency is aligning with a strategic focus on optimizing domestic hydrocarbon production. To meet these objectives, government bodies are implementing policy measures that incentivize exploration activities and reduce dependency on energy imports. For instance, fiscal reforms like revenue-sharing models and tax relaxations are attracting private and foreign investments into the upstream sector. In response, operators are intensifying drilling programs that require efficient stimulation and cementing operations, thereby driving consistent demand for pressure pumping. Additionally, environmental regulations are encouraging more efficient extraction techniques, further supporting technological upgrades in the sector. The market is also benefiting from government-run capacity-building initiatives aimed at skilling the workforce in oilfield technologies, ensuring that the pressure pumping industry is well-equipped to support India’s energy ambitions.

India Pressure Pumping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on pump type, pressure, and application.

Pump Type Insights:

- Dynamic

- Centrifugal Pumps

- Axial Flow Pumps

- Mixed Flow Pumps

- Positive Displacement

- Gear Pumps

- Diaphragm Pumps

- Piston Pumps

- Screw Pumps

The report has provided a detailed breakup and analysis of the market based on the pump type. This includes dynamic (centrifugal pumps, axial flow pumps, and mixed flow pumps) and positive displacement (gear pumps, diaphragm pumps, piston pumps, and screw pumps).

Pressure Insights:

- Low

- Medium

- High

The report has provided a detailed breakup and analysis of the market based on the pressure. This includes low, medium, and high.

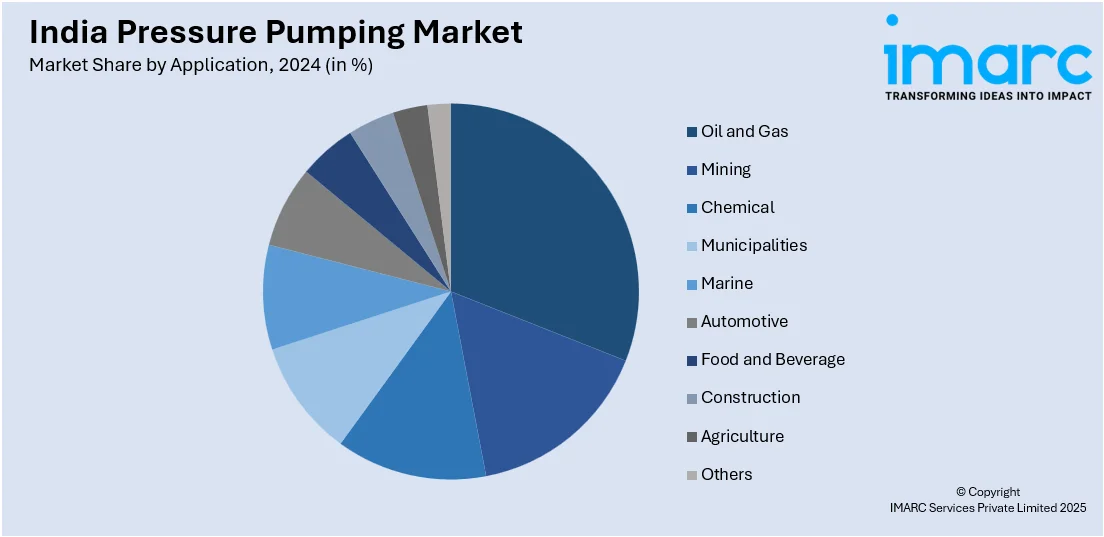

Application Insights:

- Oil and Gas

- Mining

- Chemical

- Municipalities

- Marine

- Automotive

- Food and Beverage

- Construction

- Agriculture

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas, mining, chemical, municipalities, marine, automotive, food and beverage, construction, agriculture, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pressure Pumping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pump Types Covered |

|

| Pressures Covered | Low, Medium, High |

| Applications Covered | Oil and Gas, Mining, Chemical, Municipalities, Marine, Automotive, Food and Beverage, Construction, Agriculture, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pressure pumping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pressure pumping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pressure pumping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pressure pumping market in India was valued at USD 3.9 Billion in 2024.

The pressure pumping market in India is projected to exhibit a CAGR of 5.60% during 2025-2033, reaching a value of USD 6.6 Billion by 2033.

The pressure pumping market in India is propelled by expanding exploration in unconventional oil and gas reservoirs like shale gas and tight oil, boosted by government policies such as the Open Acreage Licensing Policy (OALP) and Hydrocarbon Exploration and Licensing Policy (HELP). Significant investments in onshore and offshore infrastructure and growing energy demand combined with incentives enhancing domestic hydrocarbon production are fueling heightened demand for pressure pumping services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)