India Primer Market Size, Share, Trends and Forecast by Resin Type, Pack Size, Price Category, Type, End Use, and Region, 2025-2033

India Primer Market Overview:

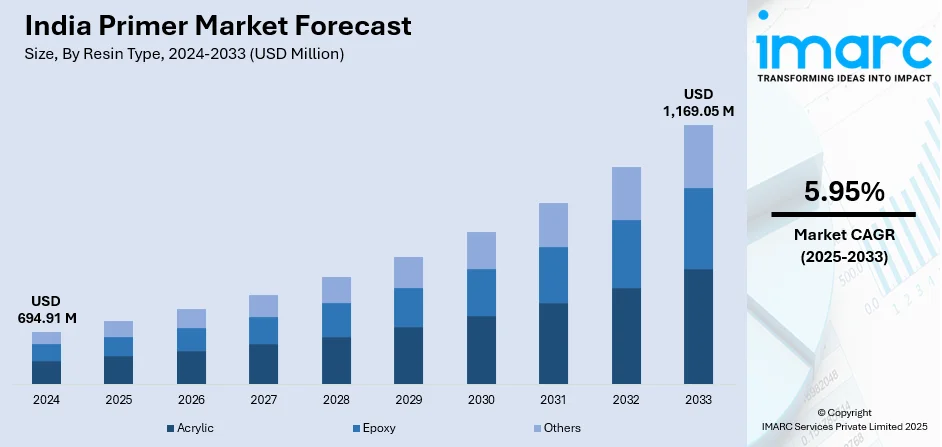

The India primer market size reached USD 694.91 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,169.05 Million by 2033, exhibiting a growth rate (CAGR) of 5.95% during 2025-2033. The market is driven by rapid urbanization, growing real estate and infrastructure projects, emerging go-it-yourself (DIY) home improvement trends, increasing disposable incomes, elevating demand for durable and high-performance finishes, the launch of favorable government initiatives promoting affordable housing, and the widespread availability of advanced and eco-friendly primer formulations for both residential and commercial applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 694.91 Million |

| Market Forecast in 2033 | USD 1,169.05 Million |

| Market Growth Rate 2025-2033 | 5.95% |

India Primer Market Trends:

Booming Infrastructure and Real Estate Development

India's primer market is largely fueled by the high growth of infrastructure and real estate construction. The government of India has been investing heavily in massive infrastructure projects like Smart Cities Mission, Pradhan Mantri Awas Yojana (PMAY), and highway expansions, which have increased the demand for primers in construction and repainting. Also, urbanization patterns and growing disposable incomes have contributed to high demand for residential and commercial property development, hence a steady demand for high-quality primers that will improve the adhesion of paint, its durability, and appearance. More people are turning to modern and visually attractive houses, and so the demand for wall preparation items such as primers has accelerated. Contractors and builders are extensively adopting superior primers to achieve enduring finishes, prevent moisture, and enhance the performance of paint in humid conditions. Further, the expanding middle class in India is choosing premium quality primers with advanced features such as resistibility against stain, waterproofing, and anti-microbial properties.

To get more information on this market, Request Sample

Rising Popularity of DIY Home Improvement Trends

The growing DIY culture among Indian consumers is another major propelling factor of the primer market. With the emergence of social media channels such as Instagram, Pinterest, and YouTube, people are inclined toward home improvement and interior design projects. People are now trying out innovative wall textures, furniture painting, and other visual changes that involve the use of primers to achieve smooth and professional finishes. Besides this, easy-to-apply primer products, like water-based and fast-drying types, have motivated home owners to embark on painting tasks on their own. Major paint brands are leveraging the trend by making instructional materials, DIY packs, and novel primer formulations that first-time users would find useful. The proliferation of online commerce has also placed primers in reach of more buyers in urban and semi-urban areas, again broadening the market. Another factor influencing is the lifestyle change caused by the pandemic, whereby individuals with greater time spent indoors started making investments in indoor renovations.

India Primer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on resin type, pack size, price category, type, and end use.

Resin Type Insights:

- Acrylic

- Epoxy

- Others

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes acrylic, epoxy, and others.

Pack Size Insights:

- Up to 1 Liter

- 1 Liter

- 4 Liter

- 10 Liters and Above

A detailed breakup and analysis of the market based on the pack size have also been provided in the report. This includes up to 1 liter, 1 liter, 4 liter, and 10 liters and above.

Price Category Insights:

- Premium

- Mid-Range

- Economy

A detailed breakup and analysis of the market based on the price category have also been provided in the report. This includes premium, mid-range, and economy.

Type Insights:

- Water Based

- Solvent Based

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes water based and solvent based.

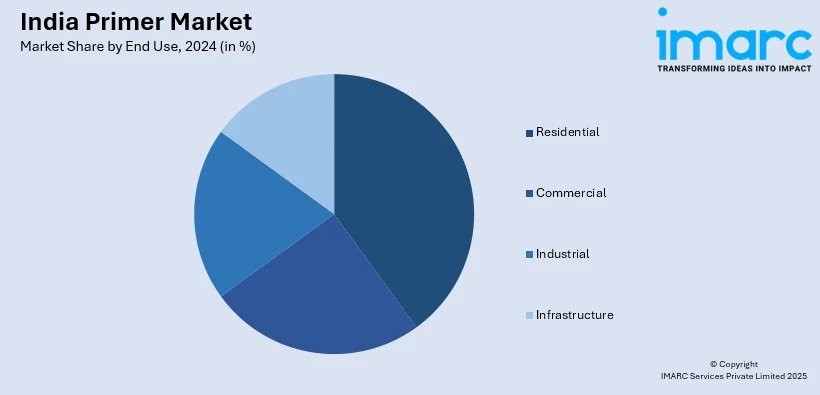

End Use Insights:

- Residential

- Commercial

- Industrial

- Infrastructure

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial, industrial, and infrastructure.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Primer Market News:

- February 2025: Walplast Products Pvt. Ltd. launched its HomeSure MasterTouch range, including new emulsions and primers, to offer high-quality and affordable wall solutions. This expansion increased competition in the Indian primer market, encouraging innovation and price competitiveness. The availability of advanced primers drove consumer demand, supporting market growth across residential and commercial segments.

- May 2024: Astral Limited, a leading company in the building construction segment, launched a new paint line, Astral Paints, offering a wide range of colors and undercoats like primers and putties. The launch was a strategic move to diversify and strengthen Astral Limited's presence in the Indian market, with the initial phase starting in Bengaluru and plans to expand across India in phases.

India Primer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Acrylic, Epoxy, Others |

| Pack Sizes Covered | Up to 1 Liter, 1 Liter, 4 Liter, 10 Liters and Above |

| Price Categories Covered | Premium, Mid-Range, Economy |

| Types Covered | Water Based, Solvent Based |

| End Uses Covered | Residential, Commercial, Industrial, Infrastructure |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India primer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India primer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India primer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The primer market in India was valued at USD 694.91 Million in 2024.

The India primer market is projected to exhibit a CAGR of 5.95% during 2025-2033, reaching a value of USD 1,169.05 Million by 2033.

Rise in renovations and remodeling activities is fueling the market expansion, as primers are essential for repainting old surfaces. Innovations in water-based and eco-friendly primers appeal to environmentally conscious people, while the broadening of retail networks and online platforms improves product accessibility. The growing influence of interior design trends and aesthetic preferences is encouraging both individual and professional users to opt for primers that enhance final paint appearance and performance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)