India Print Label Market Size, Share, Trends and Forecast by Raw Material, Print Process, Label Format, End Use Industry, and Region, 2025-2033

India Print Label Market Overview:

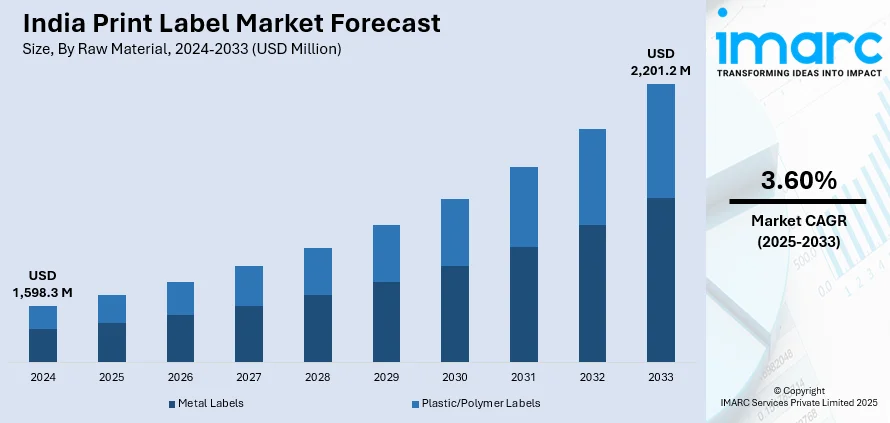

The India print label market size reached USD 1,598.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,201.2 Million by 2033, exhibiting a growth rate (CAGR) of 3.60% during 2025-2033. The market is driven by increasing demand for product customization, shorter print runs, and faster delivery, fueled by digital printing adoption. Growing emphasis on sustainability, eco-friendly materials, and regulatory compliance further augments the India print label market share. Rising FMCG, pharmaceutical, and e-commerce sectors also contribute significantly to the expanding market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,598.3 Million |

| Market Forecast in 2033 | USD 2,201.2 Million |

| Market Growth Rate 2025-2033 | 3.60% |

India Print Label Market Trends:

Increasing Adoption of Digital Printing Technologies

The significant shift towards digital printing technologies is significantly supporting the India print label market growth. Growing pressure for shorter print runs, personalization, and faster turnaround is driving this movement. Digital printing delivers the requisite agility, allowing firms to produce premium-quality labels with intricate designs and variable data. This function is particularly valuable in industries such as fast-moving consumer goods (FMCG), pharma, and e-commerce. On 4th February 2025, FUJIFILM India introduced its cutting-edge printing solutions at Printpack India 2025, featuring the Revoria Press™ series, which offers high-speed, five-color printing capabilities, alongside the Apeos 4620 SX/SZ multifunction devices designed for high-resolution, swift monochrome printing. These innovative products are expected to deliver improved efficiency and quality to meet a variety of printing requirements, encompassing packaging and business functions. Additionally, digital printing reduces waste and saves on operational costs, making it an eco-friendly and cost-effective solution. With enterprises in India focusing more on branding and unique products, the adoption of digital printing is expected to grow, further augmenting the market growth. Also contributing to this trend are advances in digital printing technology and inks, which have become more widely available, enabling manufacturers to respond to consumers' changing preferences.

To get more information on this market, Request Sample

Rising Demand for Sustainable and Eco-Friendly Labels

Sustainability is becoming a significant factor in the marketplace, and businesses and consumers are placing a premium on eco-friendly products. The labels made from recyclable, biodegradable, or compostable materials and those made using eco-friendly printing processes are witnessing an increased demand. Food and beverages, personal care, and pharmaceuticals are three sectors particularly impacted in confluence with this growing awareness that is influencing consumer behavior. On 9th October 2024, the Central Drugs Standard Control Organization (CDSCO) announced plans to implement QR codes on the packaging of medicines sold in India. After launching this technology on 300 leading brands, including Allegra and Calpol, the initiative aims to enhance drug authenticity by providing key information such as manufacturer details and expiration dates. This action is part of a continuous effort to combat fraudulent drugs and enhance quality assurance within the industry. Thus, this is further increasing the demand for printed labels. Manufacturers are increasingly adopting water-based inks, soy-based inks, and other eco-friendly alternatives to reduce their environmental footprint. Government regulations and initiatives promoting sustainability are further creating a positive India print label market outlook. Consequently, the market is experiencing an increase in innovation, as companies create labels that fulfill regulatory standards while also aligning with the sustainability objectives of both brands and consumers. This trend is anticipated to persist in influencing the future of the print label industry in India.

India Print Label Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on raw material, print process, label format, and end use industry.

Raw Material Insights:

- Metal Labels

- Plastic/Polymer Labels

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes metal labels and plastic/polymer labels.

Print Process Insights:

- Offset Lithography

- Gravure

- Flexography

- Screen

- Letterpress

- Electrophotography

- Inkjet

A detailed breakup and analysis of the market based on the print process have also been provided in the report. This includes offset lithography, gravure, flexography, screen, letterpress, electrophotography, and inkjet.

Label Format Insights:

- Wet-Glue Labels

- Pressure-Sensitive Labels

- Linerless Labels

- Multi-part Tracking Labels

- In-Mold Labels

- Sleeves

The report has provided a detailed breakup and analysis of the market based on the label format. This includes wet-glue labels, pressure-sensitive labels, linerless labels, multi-part tracking labels, in-mold labels, and sleeves.

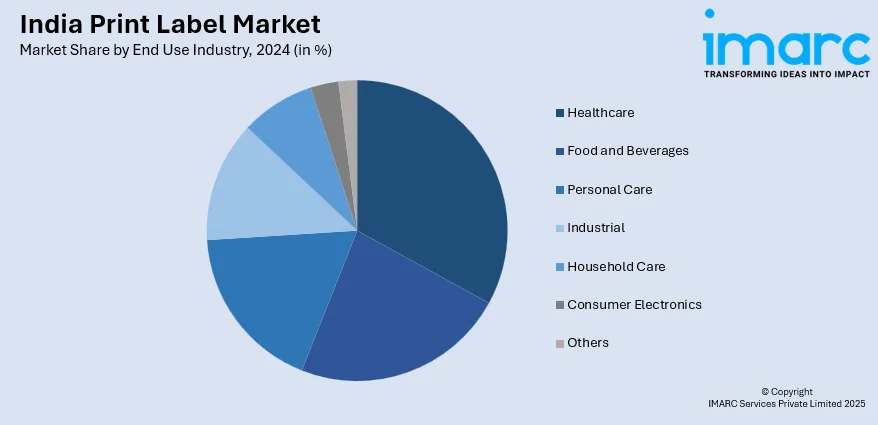

End Use Industry Insights:

- Healthcare

- Food and Beverages

- Personal Care

- Industrial

- Household Care

- Consumer Electronics

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes healthcare, food and beverages, personal care, industrial, household care, consumer electronics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Print Label Market News:

- January 31, 2025: Indore-based level specialist Marks Print, which owns ZED Silver Certification, launched a cutting-edge line of production for RFID tags and labels, in the process becoming the only one to offer such technology in central India. It serves vital sectors, including garments, pharmaceuticals, cosmetics, and automotive, providing customized, technology-enabled labeling solutions. With its RFID-oriented innovations, Marks Print hopes to lead the Indian print label industry to a digital age of enhanced tracking.

- December 10, 2024: Epson India launched the ColorWorks CW-C8050, a high-speed color inkjet label printer at a price of INR 7,88,999 (approximately USD 9,621.94), targeted at industrial segments such as pharmaceuticals and manufacturing. This printer can print up to 3,000 labels per day at a speed of 12 inches per second. It features Epson’s Ink Pack System and Heat-Free technology to help reduce cost, minimize downtime, and maximize operational efficiency. Kaikan hopes to shake up the mid-to-high volume label printing market in India with its outstanding print quality, compatibility with most available software, and smaller environmental footprint.

- March 27, 2024: Brother International (India) Pvt Ltd introduced a new lineup of IoT-enabled label printers designed for specialized high-volume, industry-wide applications. These labeled printers feature, among other things, Wi-Fi and mobile connectivity, sophisticated templates, and resilient laminated labels. Brother India is targeting the B2B segments, including manufacturing, logistics, telecom, and healthcare, to meet the rising need in one of the fastest-growing print label markets in India. Building high-performance labeling solutions for essential industries that positively impact productivity, optimize cost savings, and deliver efficient solutions.

India Print Label Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Metal Labels, Plastic/Polymer Labels |

| Print Processes Covered | Offset Lithography, Gravure, Flexography, Screen, Letterpress, Electrophotography, Inkjet |

| Label Formats Covered | Wet-Glue Labels, Pressure-Sensitive Labels, Linerless Labels, Multi-part Tracking Labels, In-Mold Labels, Sleeves |

| End Use Industries Covered | Healthcare, Food and Beverages, Personal Care, Industrial, Household Care, Consumer Electronics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India print label market performed so far and how will it perform in the coming years?

- What is the breakup of the India print label market on the basis of raw material?

- What is the breakup of the India print label market on the basis of print process?

- What is the breakup of the India print label market on the basis of label format?

- What is the breakup of the India print label market on the basis of end use industry?

- What is the breakup of the India print label market on the basis of region?

- What are the various stages in the value chain of the India print label market?

- What are the key driving factors and challenges in the India print label?

- What is the structure of the India print label market and who are the key players?

- What is the degree of competition in the India print label market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India print label market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India print label market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India print label industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)