India Private Healthcare Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Private Healthcare Market Overview:

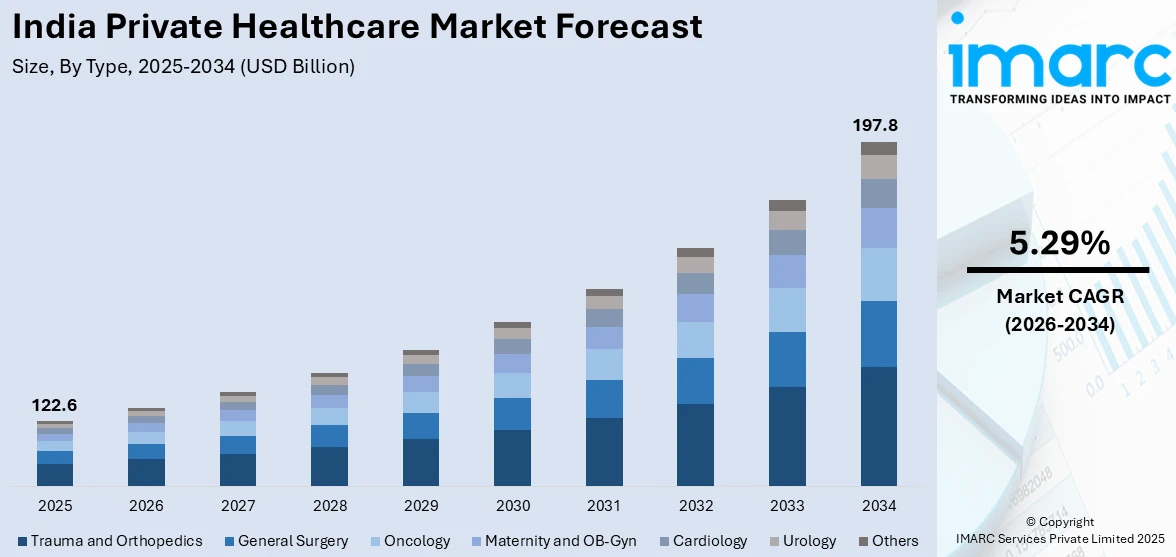

The India private healthcare market size reached USD 122.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 197.8 Billion by 2034, exhibiting a growth rate (CAGR) of 5.29% during 2026-2034. The market growth is primarily driven by the growing popularity of medical tourism, continual technological advancements, and expanding insurance coverage.

Market Insights:

- Based on region, the market is segmented into North India, South India, East India, and West India.

- Based on type, the market is segmented into trauma and orthopedics, general surgery, oncology, maternity and OB-Gyn, cardiology, urology, and others.

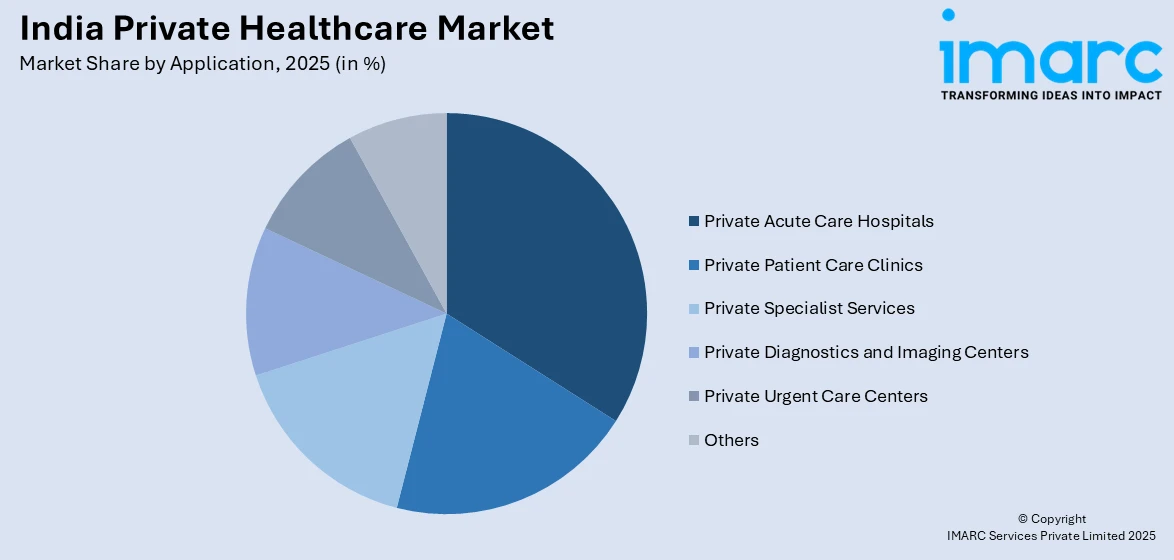

- Based on application, the market is divided into private acute care hospitals, private patient care clinics, private specialist services, private diagnostics and imaging centers, private urgent care centers, and others.

Market Size and Forecast:

- 2025 Market Size: USD 122.6 Billion

- 2034 Projected Market Size: USD 197.8 Billion

- CAGR (2026-2034): 5.29%

India Private Healthcare Market Trends:

Advancement in Medical Technology

Advanced medical technology is significantly driving the India private healthcare market outlook by enhancing diagnosis, treatment, and patient care. Private hospitals are adopting robotic surgeries, AI-driven diagnostics, and telemedicine to improve healthcare efficiency and accuracy. Cutting-edge imaging systems such as MRI and CT scans, enable early disease detection and precise treatment planning. Artificial intelligence (AI)-powered tools assist doctors in diagnosing complex diseases faster, leading to improved clinical outcomes and patient safety. Telemedicine platforms are expanding healthcare access, allowing remote consultations and reducing dependency on physical hospital visits. Wearable health devices and remote monitoring systems help manage chronic diseases and track patient health continuously. Private healthcare providers are investing heavily in automated systems to streamline administrative and operational processes. Personalized treatment approaches including genomics-based therapies, are revolutionizing cancer care and other critical disease management. For instance, in December 2024, Noble Hospitals and Research Centre in Pune introduced Maharashtra's first locally developed surgical robotic system, the SSI Mantra. This advanced system, featuring five compact robotic arms and a high-definition 3D headset, enhances precision and control during surgeries. Minimally invasive (MI) procedures enabled by such innovations are reducing recovery time and improving patient comfort. The integration of electronic health records (EHR) ensures seamless patient data management and enhances treatment coordination, further strengthening the India private healthcare market growth.

To get more information on this market Request Sample

Growing Medical Tourism

India provides quality medical care at reduced prices in contrast to other developed nations such as the US and the UK. Private healthcare institutions are augmenting infrastructure and implementing new-age technologies to serve the growing number of foreign patients. Qualified specialists, state-of-the-art facilities, and internationally certified hospitals are making India a model medical destination. In August 2024, Indian hospitals treated 7.3 foreign patients, a 25% growth over 6 million in 2023. Specialty treatments like cardiac surgery, organ transplantation, and cosmetic procedures are drawing patients from nearby and Western nations. Shorter waiting times in Indian hospitals compared to developed countries render it an attractive healthcare destination. Government policies such as e-medical visas and simplified processes further enhance international patient flows. Pricing competitiveness and low-cost post-treatment care make India a favored choice for budget-conscious medical travelers. Rising demand for wellness tourism including Ayurveda and alternative therapies, is also bolstering the private healthcare industry growth in India. With the medical travel sector worth ₹87,000 crores in 2024, it is expected to grow to ₹4,25,000 crores by 2034, propelling heavy investments in high-quality medical infrastructure, according to the market report.

Expansion of Healthcare Accessibility and the Role of Technology

The private healthcare market share in India is augmented by technology playing a crucial role in bridging gaps in service delivery. The growing adoption of telemedicine, especially in remote and underserved areas, is improving access to healthcare, particularly during critical times. Vernacular telemedicine solutions are addressing language barriers, enabling doctors and patients to communicate more effectively. These platforms allow for remote consultations, ensuring that even the most distant populations can access quality healthcare. Similarly, the integration of Electronic Health Records (EHR) in multiple languages is ensuring better patient data management, fostering continuity of care and in turn expanding the private healthcare market size in India. The rise of mobile health apps and AI-driven diagnostic tools is not only enhancing healthcare delivery but also supporting a proactive approach to health. As the government continues to push for healthcare digitalization, these innovations are becoming more mainstream, and India is gradually moving toward more inclusive, tech-enabled healthcare solutions. The ease of access, affordability, and convenience are further propelling the shift towards digital healthcare platforms.

Focus on Preventive Healthcare and Wellness Tourism Growth

The shift towards preventive healthcare is gaining momentum, driven by an increasing awareness of health and wellness is augmenting the private healthcare industry share in India. With rising disposable incomes and changing lifestyles, Indian consumers are increasingly investing in proactive health management rather than waiting for illness to occur. This trend has spurred growth in wellness tourism, particularly around Ayurveda and Yoga, which are deeply rooted in India’s cultural heritage. As people from across the globe seek natural therapies and holistic wellness experiences, India is positioning itself as a hub for Ayurveda, Yoga, and wellness retreats. Moreover, the integration of traditional AYUSH services with modern medicine is becoming a notable trend in urban healthcare systems, combining the best of both worlds to cater to health-conscious individuals and contributing to the private healthcare industry size in India. With government support through initiatives like the National Ayush Mission, the country is expanding its capacity to offer authentic, holistic wellness services, tapping into the growing global market for alternative and preventive healthcare solutions. This is driving a new segment of healthcare in India, aligning with global demands for natural health alternatives and therapies.Bottom of Form

Some of the Other Key Factors Shaping the Market Include:

- Expansion of PPP Models for Rural Healthcare Delivery and Disaster Response: Public-Private Partnerships (PPP) are playing a pivotal role in rural healthcare delivery, addressing gaps in medical infrastructure and enhancing disaster response capabilities. These models leverage private sector expertise alongside government support, ensuring healthcare services are delivered effectively to underserved regions.

- Private Sector Inclusion and Calls for Streamlined PPP Frameworks: There has been a growing call for the inclusion of the private sector in healthcare delivery, particularly through PPP frameworks. These frameworks provide a collaborative platform for government and private players to join forces in expanding healthcare services, improving infrastructure, and increasing efficiency.

- Vernacular Telemedicine Solutions and Multilingual Electronic Health Records: Vernacular telemedicine solutions and multilingual electronic health records are becoming crucial in enhancing healthcare access in India. With the country’s vast linguistic diversity, these platforms ensure that patients in remote and rural areas can communicate with healthcare providers in their native languages.

- Pollution-Responsive Healthcare Units and Climate-Driven Disease Adaptation: Pollution-responsive healthcare units are gaining attention in India due to the rising levels of environmental pollution and the associated health risks. These units are designed to respond to environmental stressors such as air pollution, providing medical assistance to patients suffering from respiratory diseases, allergies, and other pollution-induced health conditions.

- Integration of AYUSH Services and Ayurveda/Yoga Medical Tourism: The integration of AYUSH services (Ayurveda, Yoga, Unani, Siddha, and Homeopathy) into the mainstream healthcare system is driving the growth of wellness and medical tourism in India. With an increasing number of international tourists seeking alternative medicine and natural healing methods, the private healthcare industry in India is positioning itself as a global leader.

- City-Level Care Networks in Metros, Tier-2 Cities, and Pilgrimage Centres: City-level care networks are expanding across metropolitan and tier-2 cities, offering both general and specialized healthcare services. In addition to urban areas, there is also an emphasis on creating healthcare hubs in pilgrimage centres, where millions of domestic and international visitors converge annually.

India Private Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, and application.

Type Insights:

- Trauma and Orthopedics

- General Surgery

- Oncology

- Maternity and OB-Gyn

- Cardiology

- Urology

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes trauma and orthopedics, general surgery, oncology, maternity and OB-Gyn, cardiology, urology, and others.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Private Acute Care Hospitals

- Private Patient Care Clinics

- Private Specialist Services

- Private Diagnostics and Imaging Centers

- Private Urgent Care Centers

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes private acute care hospitals, private patient care clinics, private specialist services, private diagnostics and imaging centers, private urgent care centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Private Healthcare Market News:

- In July 2025, Sanofi India and Emcure Pharmaceuticals announced an exclusive distribution partnership for Sanofi's oral anti-diabetic products, including Amaryl® and Cetapin®, in India. The collaboration aims to leverage Emcure’s vast distribution network, enhancing accessibility for the over 100 Million Indians living with type 2 diabetes.

- In June 2025, Manipal Health Enterprises bid INR 6,838 Crore (≈ USD 800 Million) to acquire Sahyadri Hospitals, leading the auction for the Pune-based healthcare chain. With 11 hospitals across Western India, Sahyadri reported INR 1,200 Crore in revenue last year. This acquisition will boost Manipal’s presence in Maharashtra and Western India, supporting its aggressive expansion strategy.

- In February 2025, the Adani Group announced its plan to build a 1,000-bed hospital and medical college in Mumbai's Kandivali area in collaboration with the US-based Mayo Clinic. As part of a ₹6,000 crore investment, this initiative will establish integrated health campuses, known as Adani Health Cities, in both Mumbai and Ahmedabad.

- In January 2025, UMC Hospitals Group made the announcement to launch its first multi-specialty hospital in India, situated in Navi Mumbai, Maharashtra. Expected to commence operations by April 2025, this 60-bed tertiary care facility will include advanced laboratory and radiology diagnostic services, two modular operating rooms, a cardiac catheterization lab, a modern intensive care unit, and a specialized day care unit. Designed to cater to the expanding urban population of Navi Mumbai and nearby areas, the hospital focuses on delivering high-quality patient care and medical excellence.

- In December 2024, several private hospitals in Kolkata, including Woodlands, Narayana, Charnock, Ruby General, BP Poddar, and Desun, announced plans to add a combined total of 1,700 new beds by 2025. These expansions will focus on enhancing specialized care units such as cancer, gastro care, and mother-child services, with new facilities for IVF and diagnostic services. This significant growth in capacity aims to meet the rising demand for high-quality healthcare in the region.

India Private Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Trauma and Orthopedics, General Surgery, Oncology, Maternity and OB-Gyn, Cardiology, Urology, Others |

| Applications Covered | Private Acute Care Hospitals, Private Patient Care Clinics, Private Specialist Services, Private Diagnostics and Imaging Centers, Private Urgent Care Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India private healthcare market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India private healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India private healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The private healthcare market in India was valued at USD 122.6 Billion in 2025.

The India private healthcare market is projected to exhibit a CAGR of 5.29% during 2026-2034, reaching a value of USD 197.8 Billion by 2034.

The market is driven by growing demand for specialized care, faster diagnosis, and personalized treatment options. Patients increasingly seek privacy, shorter wait times, and modern facilities. With rising awareness around preventive care and health insurance coverage, more individuals are opting for private services that offer advanced equipment, skilled professionals, and a controlled environment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)