India Pro AV Market Size, Share, Trends and Forecast by Solution, Distribution Channel, Application, and Region, 2025-2033

India Pro AV Market Overview:

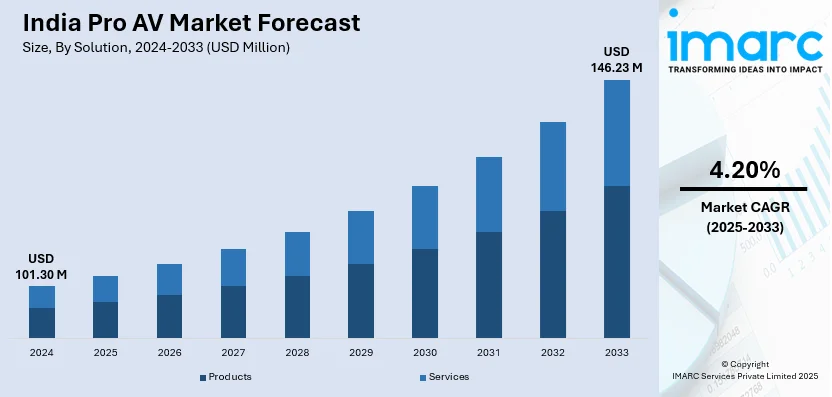

The India pro AV market size reached USD 101.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 146.23 Million by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The India pro AV market is expanding due to growing user demand for advanced home entertainment systems, the rapid rise of e-commerce, and digital marketing, where businesses increasingly rely on high-quality AV technologies to enhance client engagement, experiences, and content production across sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 101.30 Million |

| Market Forecast in 2033 | USD 146.23 Million |

| Market Growth Rate (2025-2033) | 4.20% |

India Pro AV Market Trends:

Rising Consumer Demand for Home Entertainment Solutions

The increasing need for home entertainment options is a significant factor propelling the pro AV market growth in India. As disposable income increases and user tastes change, a growing number of individuals are investing in sophisticated home entertainment systems that provide superior audio-visual experiences. According to the information published by the Ministry of Statistics & Programme Implementation in 2024, the Gross National Disposable Income (GNDI) for the year 2022-23 is projected at ₹273.99 lakh crore, in contrast to ₹239.25 lakh crore for 2021-22. This indicates a 14.5% increase for 2022-23, in contrast to an 18.8% rise in the prior year. This rise in disposable income is catalyzing the demand for high-end home theater systems, high-definition (HD) projectors, smart televisions (TVs), soundbars, and multi-room audio configurations. The shift towards immersive home entertainment experiences, such as gaming, movie watching, and music listening, is motivating individuals to adopt professional-grade audio-video (AV) equipment. With the rise of streaming platforms, the desire for high-quality, cinematic home experiences is increasing significantly. Shoppers desire to recreate the theater atmosphere in their homes, leading to the uptake of advanced AV technologies. As a result, the pro AV market is experiencing a growing user-driven demand for cutting-edge home entertainment solutions, reshaping the landscape of AV technologies in residential settings.

To get more information on this market, Request Sample

Expansion of E-Commerce and Digital Marketing

According to the India Brand Equity Foundation (IBEF), the Indian e-commerce market is projected to grow from US$ 123 billion in 2024 to US$ 292.3 billion in 2028. This swift growth of e-commerce and digital marketing platforms in India driving the need for professional AV solutions to improve user experiences. As online retailers aim to boost client interaction and enhance the digital shopping experience, they are incorporating advanced AV technologies, such as interactive product showcases, live streaming, and virtual showrooms. Digital marketing initiatives are also progressively utilizing high-quality AV content, including video ads, virtual events, and branded content, to attract user interest and boost sales. With e-commerce platforms prioritizing striking visuals and improved user engagement, the pro AV market in India is experiencing increased demand for premium video production and advanced AV systems that enhance user involvement. Through virtual try-ons, interactive product demonstrations, or live shopping experiences, these AV innovations are reshaping the way companies engage with their clients, fostering a booming market for sophisticated AV solutions in the realm of digital commerce.

India Pro AV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on solution, distribution channel, and application.

Solution Insights:

- Products

- Display

- AV Acquisition and Delivery Products

- Projectors

- Sound Reinforcement Products

- Conferencing Products

- Others

- Services

- Installation Services

- Maintenance Services

- IT Networking Services

- System Designing Services

- Others

A detailed breakup and analysis of the market based on the solution have also been provided in the report. This includes Products (display, AV acquisition and delivery products, projectors, sound reinforcement products, conferencing products, and others) and services (installation services, maintenance services, IT networking services, system designing services, and others).

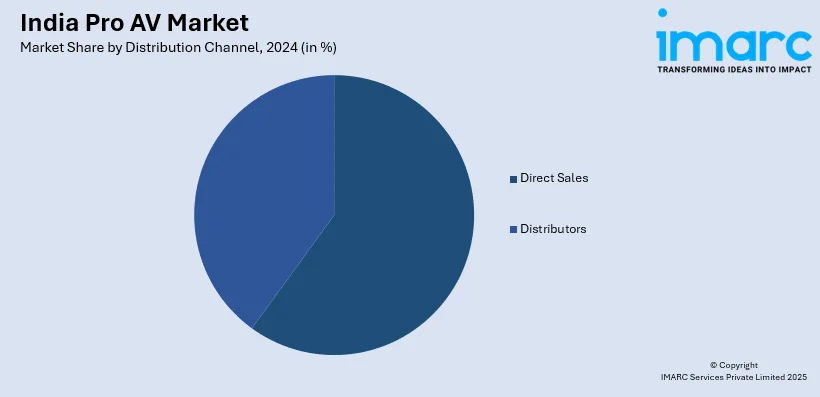

Distribution Channel Insights:

- Direct Sales

- Distributors

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales and distributors.

Application Insights:

- Home Use

- Commercial

- Education

- Government

- Hospitality

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes home use, commercial, education, government, hospitality, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pro AV Market News:

- In August 2024, InfoComm India 2024, which took place from 3-5 September 2024 at the Jio World Convention Centre in Mumbai, showcased over 250 brands, including 35 first-time exhibitors. The event featured more than 48 free summit sessions and innovative solutions across various sectors such as education, finance, and live events. Registration was open for professionals and businesses to deepen their Pro AV expertise.

- In July 2024, The INDIAN DJ EXPO 2024, scheduled from 8-10 August 2024 at Pragati Maidan, New Delhi, showcased over 250 brands in Pro Audio, Pro Light, Pro AV, and Special Effects. It aimed to bring together industry professionals and business visitors to explore a wide range of equipment.

India Pro AV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Distribution Channels Covered | Direct Sales, Distributors |

| Applications Covered | Home Use, Commercial, Education, Government, Hospitality, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pro AV market performed so far and how will it perform in the coming years?

- What is the breakup of the India pro AV market on the basis of solution?

- What is the breakup of the India pro AV market on the basis of distribution channel?

- What is the breakup of the India pro AV market on the basis of application?

- What is the breakup of the India pro AV market on the basis of region?

- What are the various stages in the value chain of the India pro AV market?

- What are the key driving factors and challenges in the India pro AV market?

- What is the structure of the India pro AV market and who are the key players?

- What is the degree of competition in the India pro AV market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pro AV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pro AV market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pro AV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)