India Product Lifecycle Management Market Size, Share, Trends and Forecast by Type of Service, Deployment Mode, Service Type, End User Industry, and Region, 2025-2033

India Product Lifecycle Management Market Overview:

The India product lifecycle management market size reached USD 930 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,550 Million by 2033, exhibiting a growth rate (CAGR) of 5.9% during 2025-2033. The increasing digital transformation in manufacturing, rising adoption of cloud-based PLM solutions, implementation of government initiatives, increasing demand for cost-efficient product development, integration of AI and IoT in PLM, and expanding industrial sectors such as automotive and aerospace are some of the major factors augmenting India product lifecycle management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 930 Million |

| Market Forecast in 2033 | USD 1,550 Million |

| Market Growth Rate 2025-2033 | 5.9% |

India Product Lifecycle Management Market Trends:

Rising PLM Adoption in the Aerospace and Defense Sector

The increasing adoption of product lifecycle management (PLM) in India's aerospace and defense sector is driven by rising government investments, indigenous manufacturing initiatives, and expanding private sector involvement. With the aerospace and defense market projected to reach USD 70 Billion by 2030, according to IBEF, digital transformation efforts are accelerating across the industry. This shift is fueling the demand for PLM solutions, which are essential for enhancing efficiency, reducing costs, and driving innovation, thereby supporting the India product lifecycle management market growth. Furthermore, the supportive government initiatives are accelerating self-reliance in defense production, prompting Indian manufacturers to implement advanced PLM solutions to optimize design, production, and maintenance workflows. In addition to this, the complexity of aerospace and defense manufacturing, characterized by intricate supply chains, stringent regulatory requirements, and precision engineering, necessitates the adoption of PLM platforms. These solutions are critical for maintaining configuration control, reducing design errors, and ensuring compliance with global standards. The increasing involvement of private players under the Defense Procurement Procedure (DPP), along with collaborations with global aerospace firms, offset agreements, and joint ventures, is further driving PLM adoption. As Indian companies strengthen their digital infrastructure to meet interoperability and data security demands, the PLM market in India's aerospace and defense sector is witnessing strong growth.

.webp)

To get more information on this market, Request Sample

Digitalization of India's Manufacturing Sector with PLM Integration

The Indian manufacturing sector is experiencing rapid digitalization, with technology adoption recognized as a crucial driver for enhancing productivity and competitiveness. According to industry reports, the industry is expected to potentially reach USD 1 Trillion by 2026. In this evolving landscape, PLM adoption is becoming essential for integrating design, engineering, and production processes, facilitating the transition from traditional methods to data-driven operations. Additionally, the implementation of government initiatives is pushing for advanced manufacturing capabilities, and industries are investing in cloud-based and artificial intelligence (AI) driven PLM solutions to improve efficiency and competitiveness. PLM enables manufacturers to create digital threads that connect product design with real-time production monitoring, supply chain management, and predictive maintenance. Companies in automotive, heavy engineering, and consumer electronics are leveraging PLM with the Internet of Things (IoT) and Digital Twin technology to optimize performance and reduce downtime. As global OEMs set up production units in India, they are demanding high levels of digital integration from local suppliers, which is positively impacting the India product life cycle management market outlook. The rise of smart manufacturing hubs and government-backed industrial corridors is solidifying PLM's role in India's evolving industrial landscape.

India Product Lifecycle Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type of service, deployment mode, service type, and end user industry.

Type of Service Insights:

- CAX

- Discrete PLM

- Process PLM

The report has provided a detailed breakup and analysis of the market based on the type of service. This includes CAX, discrete PLM, and process PLM.

Deployment Mode Insights:

- On-Premise

- Cloud

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premise and cloud.

Service Type Insights:

- Maintenance/Support

- Implementation

- Consulting

- Others

The report has provided a detailed breakup and analysis of the market based on the service type. This includes maintenance/support, implementation, consulting, and others.

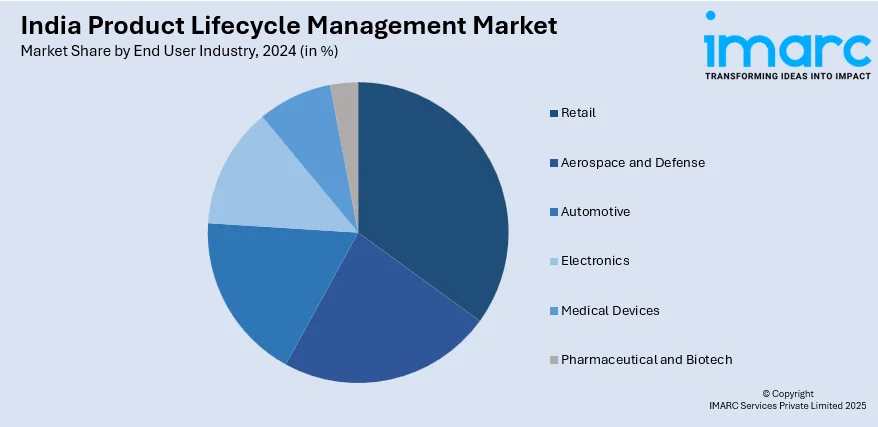

End User Industry Insights:

- Retail

- Aerospace and Defense

- Automotive

- Electronics

- Medical Devices

- Pharmaceutical and Biotech

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes retail, aerospace and defense, automotive, electronics, medical devices, and pharmaceutical and biotech.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Product Lifecycle Management Market News:

- On January 29, 2025, L&T Technology Services (LTTS), based in India, announced securing a multiyear, USD 80 Million contract with a U.S.-based industrial products manufacturer. This agreement aims to accelerate the client's digital transformation by integrating advanced technologies, including connected products and the digital thread. As part of the deal, LTTS will establish a Center of Excellence in India to serve as a global innovation hub, focusing on digital transformation and comprehensive product lifecycle management.

India Product Lifecycle Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Services Covered | CAX, Discrete PLM, Process PLM |

| Deployment Modes Covered | On-Premise, Cloud |

| Service Types Covered | Maintenance/Support, Implementation, Consulting, Others |

| End User Industries Covered | Retail, Aerospace and Defense, Automotive, Electronics, Medical Devices, Pharmaceutical and Biotech |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India product lifecycle management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India product lifecycle management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India product lifecycle management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India product lifecycle management market was valued at USD 930 Million in 2024.

The India product lifecycle management market is projected to exhibit a CAGR of 5.9% during 2025-2033, reaching a value of USD 1,550 Million by 2033.

The India product lifecycle management market is driven by increasing digitalization, demand for streamlined product development, and rising use of smart technologies. Growth in manufacturing, focus on innovation, and the need for efficient collaboration across teams and processes are also key factors encouraging PLM adoption across industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)