India Propane Market Size, Share, Trends and Forecast by Form, Grade, End Use Industry, and Region, 2026-2034

India Propane Market Overview:

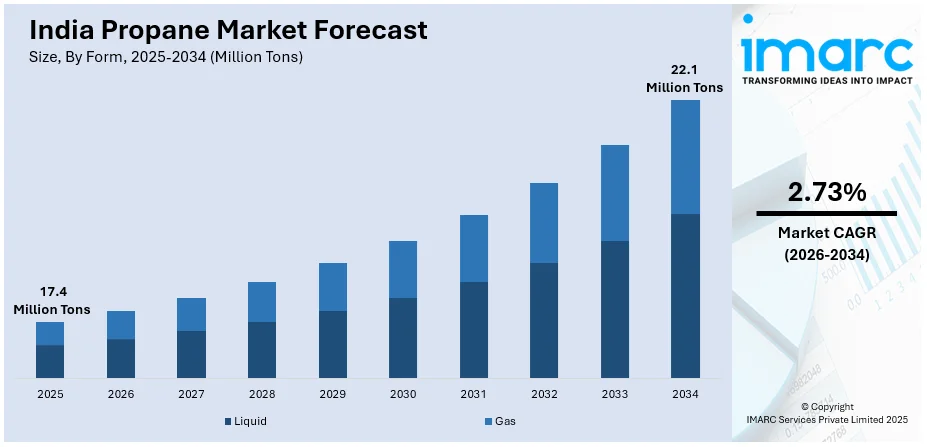

The India propane market size reached 17.4 Million Tons in 2025. Looking forward, IMARC Group expects the market to reach 22.1 Million Tons by 2034, exhibiting a growth rate (CAGR) of 2.73% during 2026-2034. The market includes rising demand for cleaner fuels in transportation and industry due to stricter emission regulations, especially the shift toward Autogas in vehicles. Expanding industrialization and urbanization increase propane use in manufacturing and heating. Infrastructure improvements like enhanced storage, distribution networks, and import capacity ensure stable supply. Additionally, government initiatives promoting liquid petroleum gas (LPG) for rural energy access and environmental policies targeting pollution reduction boost propane consumption thus strengthening the India propane market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 17.4 Million Tons |

| Market Forecast in 2034 | 22.1 Million Tons |

| Market Growth Rate 2026-2034 | 2.73% |

India Propane Market Trends:

Growing Focus on Environmental Sustainability

Environmental sustainability is fast becoming a dominant trend in India's propane market. With growing awareness about climate change and pollution, there is a big thrust towards cleaner energy sources. Propane as a cleaner-burning hydrocarbon with lower carbon footprints than coal and diesel is finding great favor as a transition fuel. Government regulations and incentives to curtail air pollution and carbon emissions are spurring the adoption of propane in household cooking, transportation, and industrial use. Propane-based technologies are also being invested in by firms to meet ESG objectives and legislative standards. Not only is this drive for sustainability pushing demand, but it is also promoting innovation around propane storage, handling, and usage to enhance its environmental advantages further.

To get more information on this market Request Sample

Rising Demand from Automotive and Industrial Sectors

India’s propane market is experiencing strong growth, fueled by rising demand from both automotive and industrial sectors. Gas consumption by industries (excluding refineries and petrochemicals) surged 136% from FY2019-20 to FY2023-24, driven by greater availability of domestic gas and a shift toward cleaner fuels like propane. Propane is increasingly used as an alternative fuel in Autogas for vehicles, supported by government policies such as Bharat Stage emission norms that promote cleaner transportation fuels. Additionally, propane’s role as a key feedstock in industries like petrochemicals, refrigeration, and heating boosts its demand. Urbanization and industrial expansion further encourage manufacturers to adopt propane and LPG for cost efficiency and environmental compliance. This combined demand from automotive and industrial users is expected to sustain robust India propane market growth over the next decade.

Infrastructure Expansion and Supply Chain Improvements

The India propane market is changing very fast owing to tremendous investments in infrastructure and supply chain upgradation. Adding capacity to storage terminals, pipeline networks, and distribution centers is improving the availability of propane in the entire country. The government's incentives for LPG usage in rural and distant locations are backed by improved supply logistics that cut back on use of conventional fuels. City gas distribution (CGD) network expansion is making propane more accessible for residential, commercial, and industrial users. Better facilities at major ports are also steadying propane supply since India depends on imports to a large extent to fulfill demand. Growth in such infrastructure reduces supply disruptions, brings down the cost, and increases market penetration, making India a more effective propane market.

India Propane Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on form, grade, and end use industry.

Form Insights:

- Liquid

- Gas

The report has provided a detailed breakup and analysis of the market based on the form. This includes liquid and gas.

Grade Insights:

- HD-5 Propane

- HD-10 Propane

- Commercial Propane

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes hd-5 propane, hd-10 propane, and commercial propane.

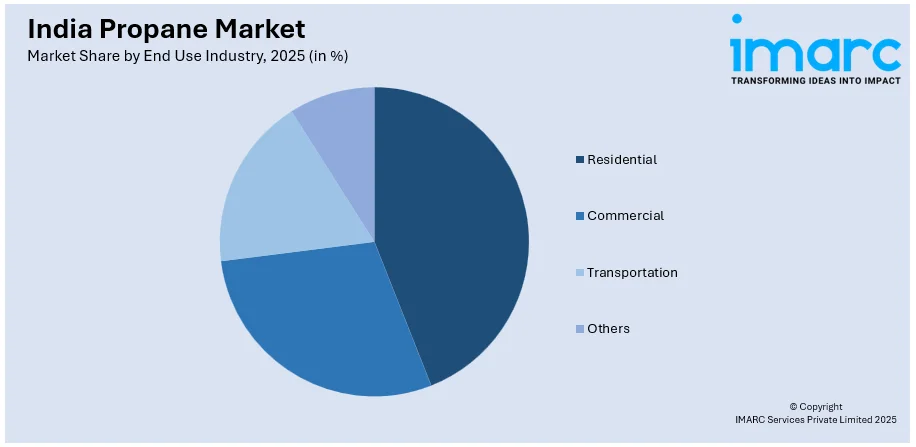

End Use Industry Insights:

Access the Comprehensive Market Breakdown Request Sample

- Residential

- Commercial

- Transportation

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes residential, commercial, transportation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Propane Market News:

- In February 2025, Bharat Petroleum Corporation Ltd (BPCL) signed a one-year strategic agreement with Equinor India, a subsidiary of Equinor ASA, for the supply of propane and butane. The deal ensures a steady flow of vital petrochemical feedstocks at competitive rates. BPCL said the partnership strengthens bilateral ties and supports its long-term strategy in the petrochemical segment.

India Propane Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Liquid, Gas |

| Grades Covered | HD-5 Propane, HD-10 Propane, Commercial Propane |

| End Use Industries Covered | Residential, Commercial, Transportation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India propane market performed so far and how will it perform in the coming years?

- What is the breakup of the India propane market on the basis of form?

- What is the breakup of the India propane market on the basis of grade?

- What is the breakup of the India propane market on the basis of end use industry?

- What is the breakup of the India propane market on the basis of region?

- What are the various stages in the value chain of the India propane market?

- What are the key driving factors and challenges in the India propane?

- What is the structure of the India propane market and who are the key players?

- What is the degree of competition in the India propane market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India propane market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India propane market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India propane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)