India Propylene Market Size, Share, Trends and Forecast by Derivative, Type, End User, and Region, 2025-2033

India Propylene Market Overview:

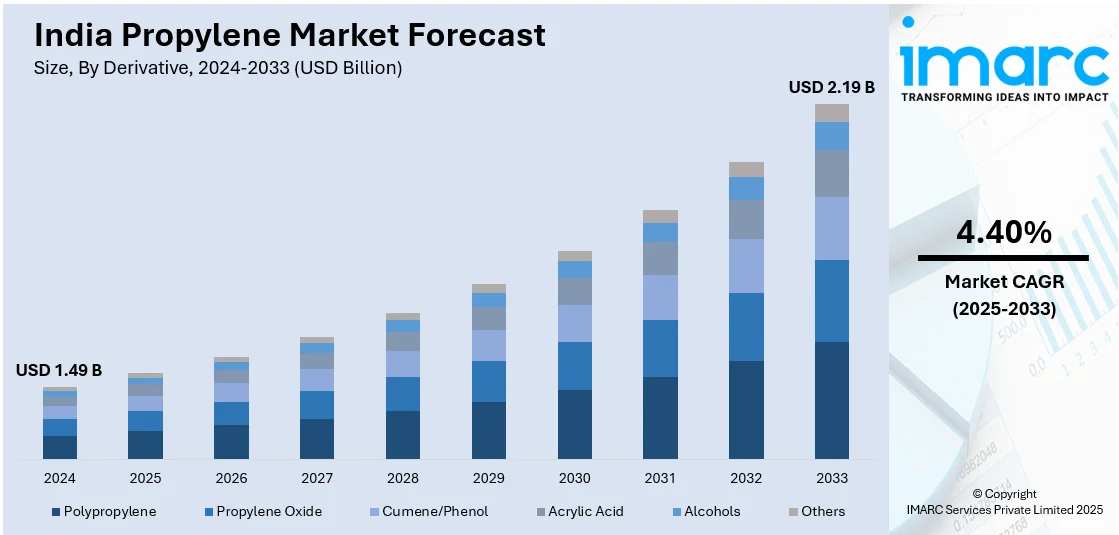

The India propylene market size reached USD 1.49 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.19 Billion by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. India's market is growing as a result of increasing demand from the packaging, automotive, and construction sectors. Investments in petrochemical infrastructure and the growing consumption of polypropylene also sustain the expansion. In addition, technological advancements and sustainable production practices are driving market dynamics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.49 Billion |

| Market Forecast in 2033 | USD 2.19 Billion |

| Market Growth Rate (2025-2033) | 4.40% |

India Propylene Market Trends:

Domestic Supply Boost with Propylene Glycol Expansion

India's propylene glycol industry has experienced strong growth, led by growing demand in the food, beverage, and pharma industries. The nation has historically depended on imports to fulfill demand, creating supply chain risks and cost variability. Concurrent with this, domestic production development efforts have been gaining traction. This trend enables increased stability in supply chains, providing consistent supplies of material to producers. For example, in October 2024, Manali Petrochemical Ltd (MPL) expanded its propylene glycol capacity by 32,000 TPA with a Rs 94 crore investment using a 50:50 debt-equity ratio. The enhanced production assures local availability and minimizes dependence on expensive imports. Propylene glycol is an essential raw material in pharmaceutical products and other food items, used as a stabilizer and humectant. With this expansion, producers have a secure and affordable source of raw materials. Furthermore, this expansion fortifies India's petrochemical industry, in line with national aspirations for self-reliance and economic development.

To get more information on this market, Request Sample

Strengthening Industrial Growth with Polypropylene Expansion

The demand for polypropylene in India has surged, driven by its versatile applications in packaging, consumer goods, and the automotive sector. Domestic production capacity has often lagged behind consumption, leading to an increased reliance on imports. To bridge this gap and support local industries, technological advancements and infrastructure expansions are taking center stage. In August 2024, Lummus Technology secured a contract from Petronet LNG to license its Novolen polypropylene (PP) technology for a 500 KTA plant in Dahej, India. This expansion significantly boosts domestic polypropylene production, reducing the country's dependence on foreign suppliers. Novolen’s efficient and sustainable technology supports cost-effective production, benefiting industries that rely heavily on polypropylene components. The automotive sector, for example, uses polypropylene for lightweight, durable parts, contributing to vehicle efficiency. Similarly, the packaging industry gains access to locally sourced, competitively priced materials. By fostering industrial growth and enhancing supply chain resilience, this project strengthens India's position as a leading player in the Indian polypropylene sector.

India Propylene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on derivative, type, and end user.

Derivative Insights:

- Polypropylene

- Propylene Oxide

- Cumene/Phenol

- Acrylic Acid

- Alcohols

- Others

The report has provided a detailed breakup and analysis of the market based on the derivative. This includes polypropylene, propylene oxide, cumene/phenol, acrylic acid, alcohols, and others.

Type Insights:

- Homopolymer

- Copolymer

The report has provided a detailed breakup and analysis of the market based on the type. This includes homopolymer and copolymer.

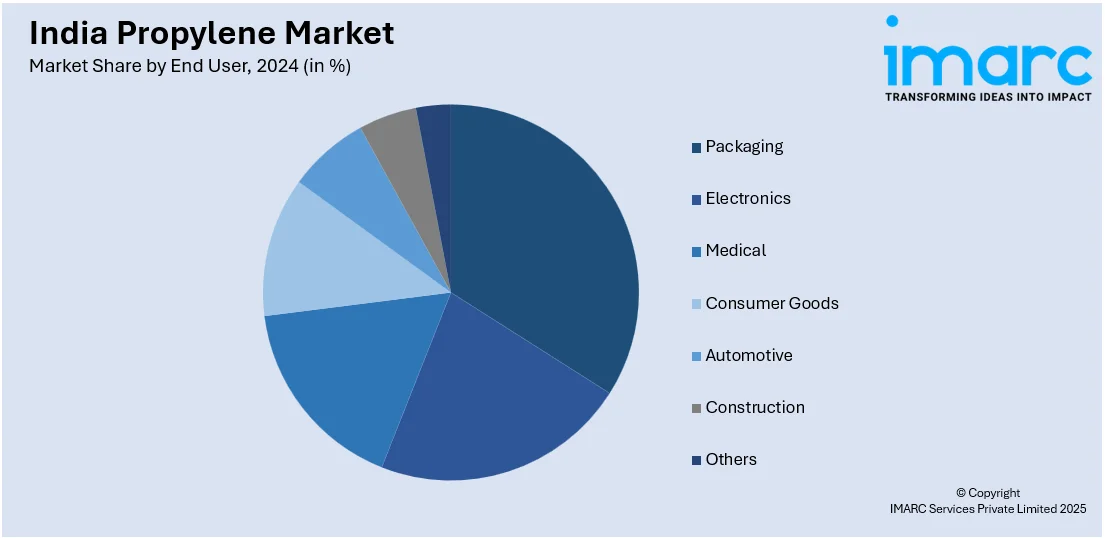

End User Insights:

- Packaging

- Electronics

- Medical

- Consumer Goods

- Automotive

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes packaging, electronics, medical, consumer goods, automotive, construction, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Propylene Market News:

- February 2025: BPCL announced a INR 5,500 Crore polypropylene unit in Kochi, with a 400 KTA capacity, set for completion by October 2027. This project enhanced domestic polypropylene production, reducing imports, supporting the packaging and industrial sectors, and strengthening India’s petrochemical industry.

- October 2024: Nayara Energy commissioned a 450 KTA UNIPOL polypropylene plant in Vadinar, Gujarat, using Grace's technology. This expansion increased India's polypropylene capacity, supporting domestic demand, reducing imports, and strengthening the petrochemical sector’s growth with enhanced product availability for pharmaceutical and hygiene applications.

India Propylene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Derivatives Covered | Polypropylene, Propylene Oxide, Cumene/Phenol, Acrylic Acid, Alcohols, Others |

| Types Covered | Homopolymer, Copolymer |

| End Users Covered | Packaging, Electronics, Medical, Consumer Goods, Automotive, Construction, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India propylene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India propylene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India propylene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The propylene market in India was valued at USD 1.49 Billion in 2024.

The India propylene market is projected to exhibit a (CAGR) of 4.40% during 2025-2033, reaching a value of USD 2.19 Billion by 2033.

The market is supported by increasing demand from the packaging, automotive, and textile segments. Polypropylene (PP), which finds application in plastics and fibers, is a key driver of growth. Rising infrastructure development, domestic consumption, and petrochemicals downstream expansion also support growth, while investment in propylene derivatives and domestic refining capacity provide supply chain strength.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)