India Protective Coatings Market Size, Share, Trends and Forecast by Technology, Resin Type, End Use Industry, and Region, 2025-2033

India Protective Coatings Market Overview:

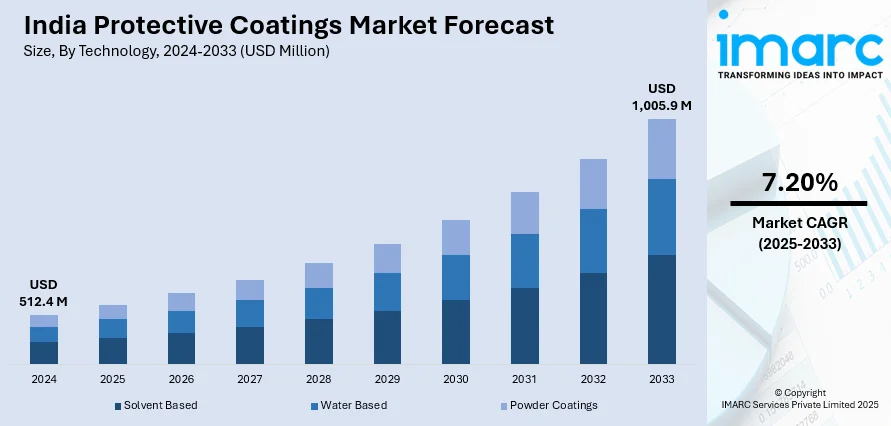

The India protective coatings market size reached USD 512.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,005.9 Million by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The growing number of infrastructure projects and the robust automotive sector in India is driving the demand for advanced protective coatings that offer durability, corrosion resistance, and aesthetic enhancement, ensuring the longevity and functionality of both public infrastructure and vehicles.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 512.4 Million |

| Market Forecast in 2033 | USD 1,005.9 Million |

| Market Growth Rate 2025-2033 | 7.20% |

India Protective Coatings Market Trends:

Growing Infrastructure Development

The rising emphasis of the governing body on developing smart cities, growing transportation systems, and improving residential and commercial infrastructure is driving the need for resilient, high-quality coatings. These coatings are crucial for protecting infrastructure from environmental elements such as corrosion, abrasion, and deterioration. The increasing number of projects like bridges, highways, airports, and industrial facilities is catalyzing the demand for coatings that offer enduring protection against the severe Indian climate. In 2024, India's Cabinet approved 12 new smart industrial cities under the National Industrial Corridor Development Programme (NICDP), with an investment of INR 286.02 billion (US$ 3.41 billion). These cities aimed to boost the manufacturing ecosystem, create 1 million direct jobs, and attract INR 1.52 trillion in investments. Additionally, the approval included railway projects and a hydro-power initiative to enhance logistics and power infrastructure. As these smart city initiatives expand, the need for protective coatings to maintain the visual charm and structural soundness of buildings and infrastructure increases. The rise in construction endeavors is encouraging manufacturers to create and provide enhanced protective coatings tailored for different uses, ensuring a competitive edge in the market.

To get more information on this market, Request Sample

Expansion of Automotive Sector

With the nation remaining one of the biggest automotive manufacturing centers in the world, the need for coatings that safeguard vehicles from corrosion, scratches, and abrasion is essential. As the popularity of electric vehicles (EVs) rises and user demand for automotive aesthetics and endurance increases, notable progress is being made in the automotive coatings market. Producers are concentrating on creating coatings that provide not only practical protection but also improved aesthetic appeal, like shiny finishes, metallic layers, and scratch-resistant surfaces. The automotive sector likewise emphasizes the use of lightweight coatings that enhance vehicle efficiency and sustainability. With production increasing in both local and international markets, the demand for advanced, long-lasting coatings is on the rise, establishing the protective coatings market as a crucial part of the industry's development and supporting its ongoing growth in India. In 2024, Toyota Kirloskar Motor launched "T-Gloss," a professional car detailing brand in India, offering services, such as underbody coating, ceramic coating, silencer coating, internal panel protection, and AC duct cleaning. The brand aimed to provide high-quality car care solutions to Toyota and other car owners. T-Gloss focused on durability, maintenance, and enhancing vehicle longevity.

India Protective Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology, resin type, and end use industry.

Technology Insights:

- Solvent Based

- Water Based

- Powder Coatings

The report has provided a detailed breakup and analysis of the market based on the technology. This includes solvent based, water based, and powder coatings.

Resin Type Insights:

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Others

A detailed breakup and analysis of the market based on the resin type have also been provided in the report. This includes epoxy, polyurethane, acrylic, alkyd, and others.

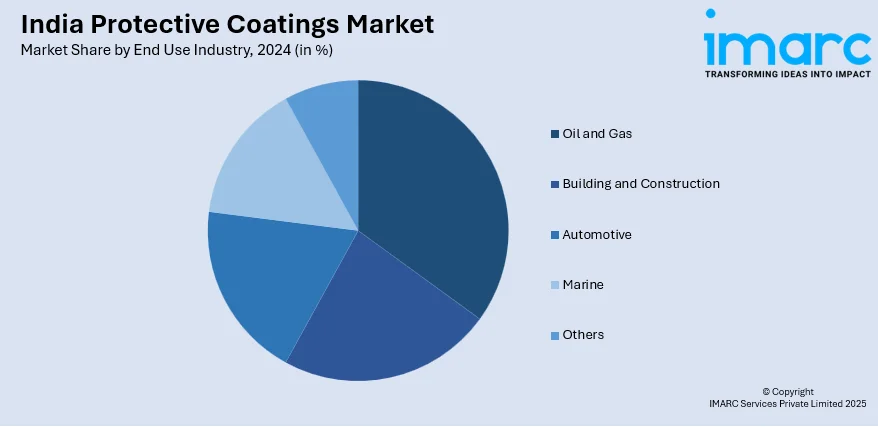

End Use Industry Insights:

- Oil and Gas

- Building and Construction

- Automotive

- Marine

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes oil and gas, building and construction, automotive, marine, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Protective Coatings Market News:

- In April 2024, BASF revealed the expansion of its e-coat manufacturing facility in Mangalore, India, to meet the growing demand from automotive manufacturers in India and South Asia. The expansion included the production of high-performance e-coats like CathoGuard 800 RE, ideal for electric vehicles. BASF aimed to leverage innovations and sustainability to serve the local market effectively.

- In April 2024, Nippon Paint introduced its automotive body and paint repair service brand, Mastercraft, in India. The brand offered advanced services like velocity repairs, expert bodywork, and paint protection using ceramic and graphene coatings. Mastercraft's first store in Gurugram aimed to fulfill the need for premium, environment-friendly automotive refinishing options.

India Protective Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Solvent Based, Water Based, Powder Coatings |

| Resin Types Covered | Epoxy, Polyurethane, Acrylic, Alkyd, Others |

| End Use Industries Covered | Oil and Gas, Building and Construction, Automotive, Marine, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India protective coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the India protective coatings market on the basis of technology?

- What is the breakup of the India protective coatings market on the basis of resin type?

- What is the breakup of the India protective coatings market on the basis of end use industry?

- What is the breakup of the India protective coatings market on the basis of region?

- What are the various stages in the value chain of the India protective coatings market?

- What are the key driving factors and challenges in the India protective coatings market?

- What is the structure of the India protective coatings market and who are the key players?

- What is the degree of competition in the India protective coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India protective coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India protective coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India protective coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)