India Protein-Based Product Market Size, Share, Trends and Forecast by Type, and Region, 2026-2034

Market Overview:

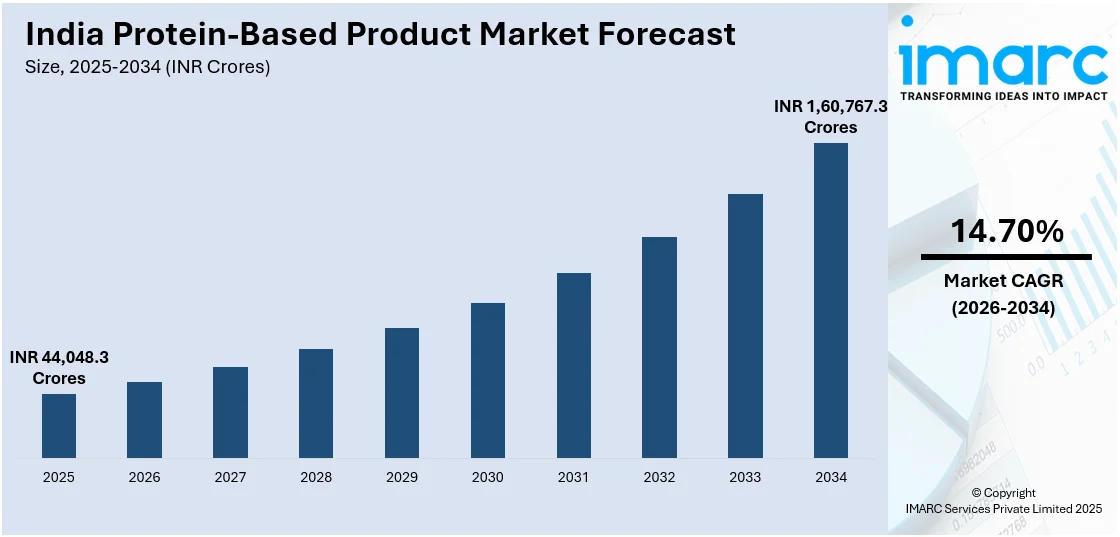

The India protein-based product market size reached INR 44,048.3 Crores in 2025. Looking forward, IMARC Group expects the market to reach INR 1,60,767.3 Crores by 2034, exhibiting a growth rate (CAGR) of 14.70% during 2026-2034. The market growth is primarily driven by the rising health and wellness consciousness among consumers, increasing vegetarian as well as vegan population, availability of affordable protein products, increasing demand for fitness and sports nutrition products among players as well as gym-going populace.

Market Insights:

- South India was the largest regional market in 2025.

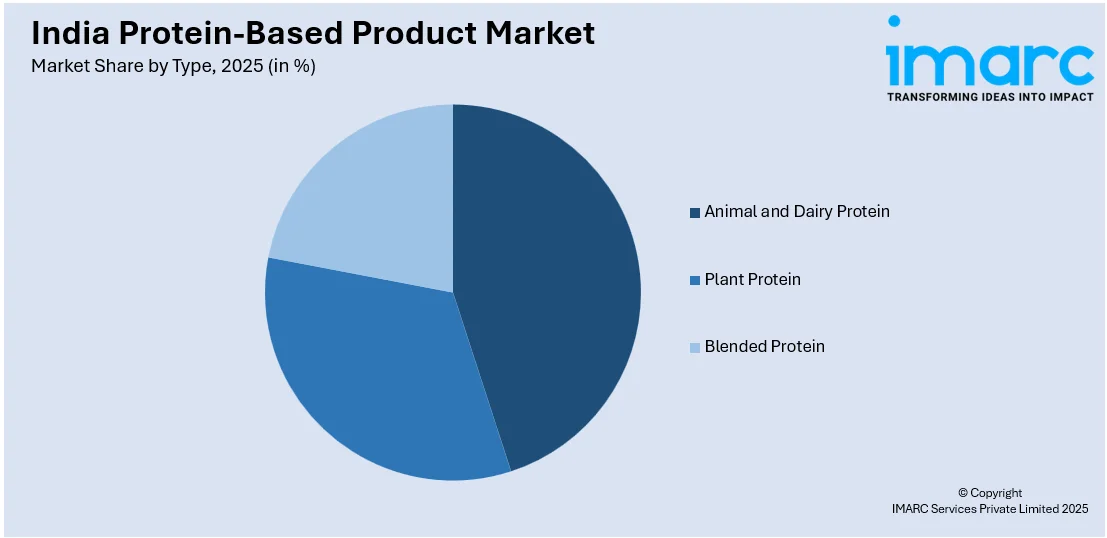

- Animal and dairy protein represented the largest segment in 2025.

Market Size and Forecast:

- 2025 Market Size: INR 44,048.3 Crores

- 2034 Projected Market Size: INR 1,60,767.3 Crores

- CAGR (2026-2034): 14.70%

- Largest market in 2025: South India

Protein-based products are food and beverage items that contain a significant amount of protein as a key component. These products are specifically formulated to provide a high protein content, which is beneficial for various purposes, including muscle building, athletic performance, satiety, and overall nutrition. Some commonly used protein-based products are protein bars, powders, supplements, drinks, ice creams, cereals, and protein-rich snacks. They also offer several health benefits, including lower saturated fat and cholesterol content, and are gaining immense popularity among individuals for increasing their protein intake. In addition, they have a higher satiety value compared to carbohydrates and fats and can be incorporated into weight management plans to promote feelings of fullness, reduce cravings, and support healthy weight loss or maintenance. Moreover, these products serve as essential protein sources for individuals following vegetarian or vegan diets, as they offer plant-based protein alternatives to animal-derived sources. They can also assist in preserving muscle mass and preventing muscle loss associated with aging and certain medical conditions. As a result, protein-based products are widely consumed by individuals across India.

To get more information on this market Request Sample

India Protein-based Product Market Trends:

Increased Demand for Ethical and Sustainable Protein Products

Sustainability is becoming a major market driver, according to the India protein-based product market analysis. With consumers becoming more aware of the environmental footprint of food production, plant proteins over animal proteins are being preferred because they have lower resources and carbon footprint. Firms are also emphasizing sustainable sourcing and eco-friendly packaging to appeal to nature-conscious consumers. As India's population is so high, the transition towards more environmentally friendly protein sources can have an important impact on lowering India's ecological footprint. Additionally, government campaigns promoting the use of green methodologies in agriculture and food production are propelling the movement forward, which accounts for the India protein-based product market share. Since more companies are emphasizing ethical sourcing and sustainability, demand for plant-based protein products is likely to increase substantially, creating new market opportunities.

Rise of Personalized Nutrition and Protein Fortification

The increasing trend of personalized nutrition is significantly influencing the market for protein-based products in India. Customers are increasingly looking for personalized products adjusted according to their individual dietary requirements and healthcare objectives. This transition is prompting protein fortification innovation, with the provision of protein-fortified foods and beverages that are targeted at specific health results, including weight management, muscle gain, or enhanced immunity, according to the India protein-based product market research report. Growing fitness culture and increased awareness of personal health requirements are also fueling demand for customized protein products. Furthermore, firms are employing cutting-edge technologies such as AI to develop personalized nutrition plans, providing protein recommendations based on age, weight, and fitness needs. With increasingly more consumers seeking customized dietary solutions, the market for personalized protein-based products is expected to expand, opening up a new avenue for innovation in the sector and supporting the India protein-based product market growth.

Some of the Other Key Factors Shaping the Market Include:

- Support by the Government for India Protein-Based Product Market: The government of India is favoring the protein-based product market through the establishment of policies that increase nutrition-oriented initiatives, such as fortification of foods with proteins. Further, encouragement of sustainable agriculture and assistance to plant-based substitutes is augmenting the development of the market. Policies that foster the growth of local plant protein manufacturing are also making plant-based proteins cheaper and more accessible.

- Growth Drivers of India Protein-Based Product Market: Key drivers include the growing health-conscious population, increasing awareness of the environmental impact of animal-based proteins, and the expanding fitness culture. The rise in disposable incomes, particularly among urban consumers, is also fueling demand for premium protein-based products. In addition, the increased availability of plant-based alternatives in retail and online platforms is further driving growth, making it easier for consumers to access protein-enriched products.

- Smart Protein Innovations, Desi Plant-Proteins Resurgence, Infrastructure and Pricing Pain Points: Smart protein innovations such as lab-grown meat and cultured proteins are offering scalable solutions to meet the growing India protein-based product market demand. At the same time, traditional plant-based proteins like soy, chickpeas, and lentils (desi proteins) are seeing a resurgence due to their cost-effectiveness and sustainability. Infrastructure challenges in the supply chain and high production costs remain pain points, affecting pricing and limiting accessibility for all consumers.

- Challenges and Opportunities of India Protein-Based Product Market: Challenges in the India protein-based product market include the high cost of production for plant-based alternatives, leading to higher retail prices that limit mass adoption. Limited awareness and misconceptions about plant-based proteins also hinder growth. However, there are immense opportunities, such as the rise in health-conscious consumers, the increasing popularity of plant-based diets, and the expanding fitness culture, creating a growing market for affordable and diverse protein-based alternatives.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India protein-based product market, along with forecasts at the regional level from 2026-2034. Our report has categorized the market based on the type.

Type Insights:

Access the comprehensive market breakdown Request Sample

- Animal and Dairy Protein

- Processed Chicken

- Whey Protein

- Cheese

- Processed Fish

- Casein Protein

- Egg Protein

- Plant Protein

- Soy

- Pea

- Rice

- Blended Protein

The report has provided a detailed breakup and analysis of the India protein-based product market based on the type. This includes animal and dairy protein (processed chicken, whey protein, cheese, processed fish, casein protein, and egg protein), plant protein (soy, pea, and rice), and blended protein. According to the report, animal and dairy protein represented the largest segment.

Regional Insights:

- South India

- North India

- West & Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West and Central India, and East India. According to the report, South India was the largest market for protein-based products. Some of the factors driving the protein-based product market in South India included the rising health consciousness among the masses, the escalating demand for sport nutritious products, and the increasing vegan population.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India protein-based product market. Also, detailed profiles of all major companies have been provided. Some of the companies covered include:

- Bio Nutrients (India) Pvt. Ltd.

- Glanbia Performance Nutrition (India) Pvt. Ltd.

- Hershey India Pvt. Ltd.

- MuscleBlaze

- MyProtein

- Nestle India

- Patanjali Foods Ltd (Patanjali Ayurved)

- Rite Bite Max Protein (Naturell India Pvt. Ltd.)

- Urban Platter

- Taali Foods India

- Nourish Organic Foods Pvt. Ltd.

- GetmyMettle (Swashthum Wellness Pvt. Ltd.)

- Plantvita

- Myfitness

- Gooddot

- Plantaway

- Wakao Foods

- Xterra Nutrition

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Latest News and Developments:

- In August 2025, Ranveer Singh’s SuperYou launched SuperYou Pro, a new protein supplement aimed at revolutionizing India’s INR 4000 Crore protein powder market. The product utilizes bio-fermented yeast protein technology, offering a gut-friendly, allergen-free formula that delivers 24-27g of complete protein per serving, enhanced with probiotics and natural enzymes. SuperYou Pro is priced at approximately INR 3000/kg and is positioned as a clean-label, high-performance protein powder.

- In June 2025, Mumbai-based plant-based startup Prot launched Prot Block, a shelf-stable plant-based protein ingredient aimed at addressing India’s protein deficiency. The innovative product offers 15g of protein and 10g of fiber per 100g serving, with pea protein as its core ingredient, and is available in plain and tandoori flavors. Priced at INR 199 (USD 2.3) per 200g, Prot Block is positioned as a healthier and allergen-free alternative in India's expanding plant protein market, catering to a growing demand for clean, nutritious, and convenient food options.

- In March 2025, GNC India launched its innovative GNC Pro Performance 100% Whey + Nitro Surge, India’s first whey protein with cardio-protective properties. The product, designed to enhance muscle performance while promoting heart health, incorporates L-arginine silicate and L-citrulline, which support vasodilation and cardiovascular function during physical activity. Available in multiple sizes, this product caters to growing consumer demand for protein supplements that also address wellness and heart health.

- In February 2025, Angel Yeast showcased its innovative yeast protein solutions at Vitafoods India 2025 in Mumbai, introducing AngeoPro, a high-digestibility, sustainable protein with an 80% protein content. The product aims to provide an economical, plant-based alternative to whey protein, catering to health-conscious consumers globally. With plans to increase its protein content to 85% and expand its production with a facility that will produce 11,000 tons annually, Angel Yeast is set to revolutionize the plant protein market, with its products already exported to over 40 countries.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Crores |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Regions Covered | South India, North India, West & Central India, East India |

| Companies Covered | Bio Nutrients (India) Pvt. Ltd., Glanbia Performance Nutrition (India) Pvt. Ltd., Hershey India Pvt. Ltd., MuscleBlaze, MyProtein, Nestle India, Patanjali Foods Ltd (Patanjali Ayurved), Rite Bite Max Protein (Naturell India Pvt. Ltd), Urban Platter, Taali Foods India, Nourish Organic Foods Pvt. Ltd., GetmyMettle (Swashthum Wellness Pvt Ltd.), Plantvita, Myfitness, Gooddot, Plantaway, Wakao Foods, Xterra Nutrition, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India protein-based product market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India protein-based product market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India protein-based product industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The protein-based product market in India was valued at INR 44,048.3 Crores in 2025.

The India protein-based product market is projected to exhibit a CAGR of 14.70% during 2026-2034, reaching a value of INR 1,60,767.3 Crores by 2034.

Growing health awareness, rising gym and fitness culture, and increasing demand for convenient nutrition are driving the India protein-based product market. Expanding urban populations, dietary shifts toward high-protein foods, and greater product availability across retail and online platforms also support market growth.

South India accounts for the largest share in the India protein-based product market due to its strong fitness culture, rising disposable incomes, and higher consumer awareness regarding nutritional supplements and protein-rich diets. The region also benefits from well-established distribution channels and growing demand across both urban and semi-urban areas.

Some of the major players in the India protein-based product market include Bio Nutrients (India) Pvt. Ltd., Glanbia Performance Nutrition (India) Pvt. Ltd., Hershey India Pvt. Ltd., MuscleBlaze, MyProtein, Nestle India, Patanjali Foods Ltd (Patanjali Ayurved), Rite Bite Max Protein (Naturell India Pvt. Ltd), Urban Platter, Taali Foods India, Nourish Organic Foods Pvt. Ltd., GetmyMettle (Swashthum Wellness Pvt Ltd.), Plantvita, Myfitness, Gooddot, Plantaway, Wakao Foods, Xterra Nutrition, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)