India Pumps Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

India Pumps Market Overview:

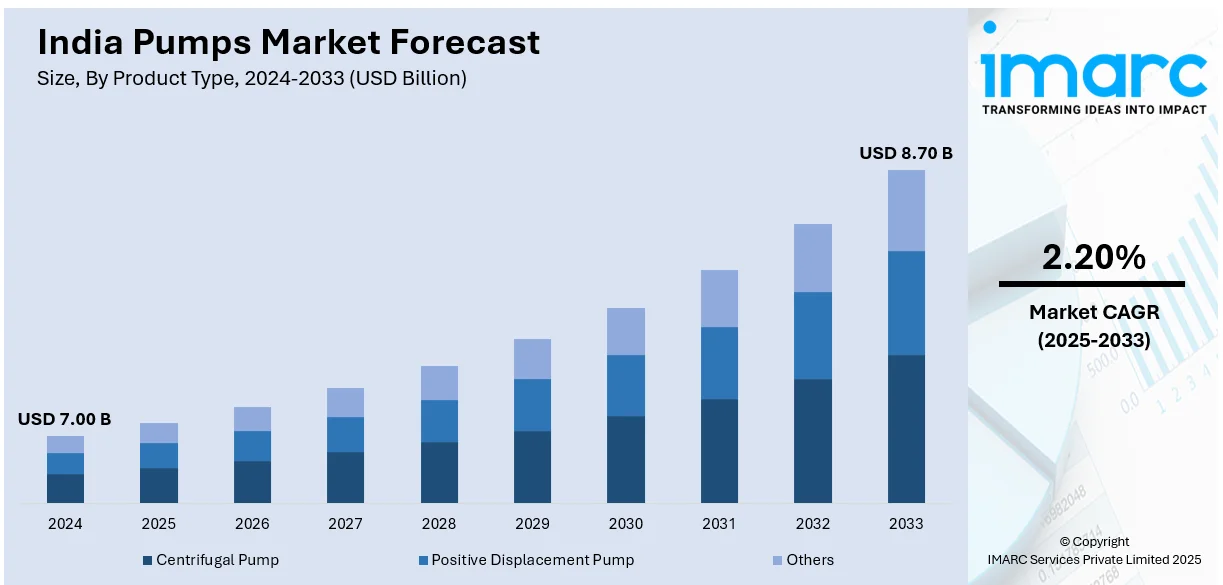

The India pumps market size reached USD 7.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.70 Billion by 2033, exhibiting a growth rate (CAGR) of 2.20% during 2025-2033. The increasing infrastructure development, rising demand for agricultural irrigation, government investments in water and wastewater treatment, the expansion of the oil & gas sector, and advancements in energy-efficient pump technologies are aiding in market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.00 Billion |

| Market Forecast in 2033 | USD 8.70 Billion |

| Market Growth Rate 2025-2033 | 2.20% |

India Pumps Market Trends:

Integration of Smart Technologies

India’s pump industry is on track to generate USD 100 billion by 2026, driven by rising infrastructure investments, according to the Indian Pump Manufacturers’ Association. The sector is undergoing technological transformation with the adoption of IoT, AI, and ML, enabling smart pumps with real-time monitoring, predictive maintenance, and remote management. These advancements enhance operational efficiency by continuously assessing parameters like temperature, pressure, vibration, and energy consumption. A key example is the iPumpnet digital solution by Pump Academy Private Limited, optimizing Bengaluru’s water supply network using AI, IoT, and ML to enhance efficiency and reliability. Furthermore, the integration of Supervisory Control and Data Acquisition (SCADA) systems with pumps is gaining popularity, enabling real-time data collecting and analysis to detect abnormalities and avoid failures. This technological transformation is consistent with the worldwide Industry 4.0 movement, which emphasizes on automation and data interchange in industrial operations. In India, it is especially important in areas such as water and wastewater management, agriculture, and industrial, where effective pump operation is critical. The rising use of smart technology in pumps is poised to transform the sector, enhancing performance, dependability, and sustainability.

To get more information on this market, Request Sample

Emphasis on Energy Efficiency

Energy efficiency is a key priority in the Indian pumps market, driven by the need to cut operational costs and minimize environmental impact. Manufacturers are integrating advanced features like Variable Frequency Drives (VFDs) and Variable Speed Drives (VSDs), which optimize pump speed based on system demands, reducing energy consumption. The agricultural sector is shifting towards solar pumps, supported by the Ministry of New and Renewable Energy’s goal of adding 34.8 GW of solar capacity by March 2026 under the PM-KUSUM scheme. As of December 2024, approximately 400 MW of solar capacity has been installed under Component A of the scheme, marking steady progress. Energy efficiency is also a growing focus in the industrial sector, where manufacturers are enhancing pump designs and materials to improve performance. The adoption of energy-efficient pumps provides multiple benefits, including lower energy costs, reduced maintenance expenses, and greater operational reliability. This trend aligns with India's broader sustainability goals and the push for cleaner, cost-effective technologies across industries.

India Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Centrifugal Pump

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating Pump

- Rotary Pump

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes centrifugal pump (axial flow pump, radial flow pump, and mixed flow pump), positive displacement pump (reciprocating pump and rotary pump), and others.

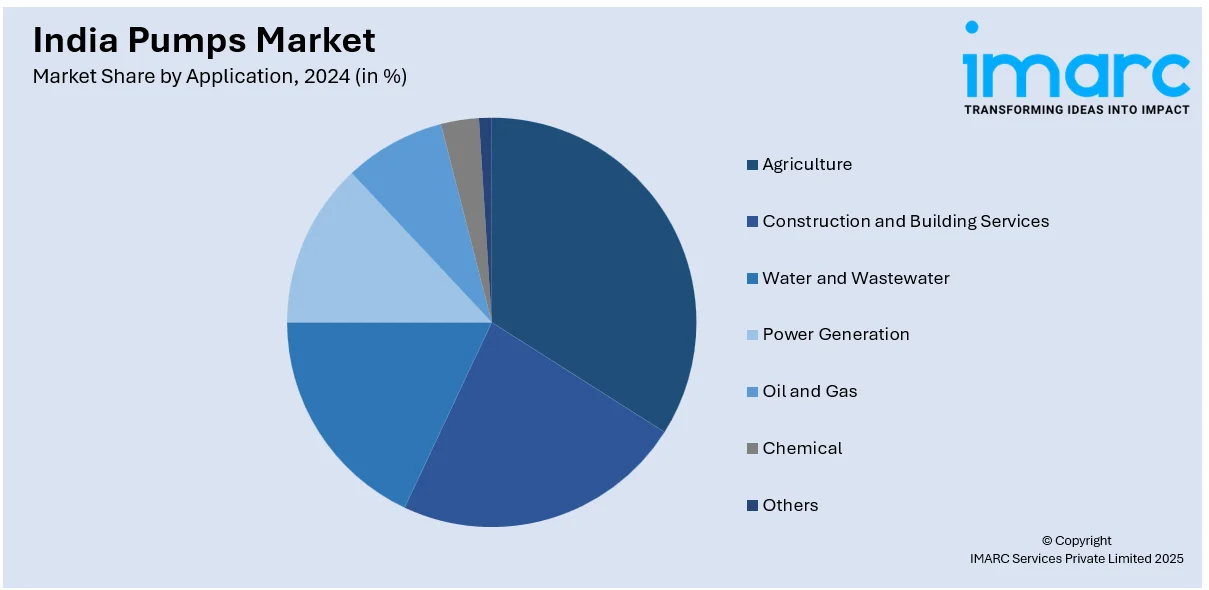

Application Insights:

- Agriculture

- Construction and Building Services

- Water and Wastewater

- Power Generation

- Oil and Gas

- Chemical

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes agriculture, construction and building services, water and wastewater, power generation, oil and gas, chemical, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pumps Market News:

- February 2025: Shakti Pumps invested Rs 6 crore in its subsidiary, Shakti EV Mobility, to expand its activities. The investment was made by subscribing to 60,000,000 equity shares with a face value of Rs 10. The total investment in Shakti EV Mobility would be Rs 45 crore.

- April 2024: Grundfos Pumps India revealed it is enroute to meet its water and energy objectives by 2030. The corporation is dedicated to being "water positive" by 2025 and net zero by 2050. The business has already begun experimenting with circulator water pumps, and its Ahmedabad factory is powered by solar energy.

India Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Agriculture, Construction and Building Services, Water and Wastewater, Power Generation, Oil and Gas, Chemical, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pumps market in India was valued at USD 7.00 Billion in 2024.

The India pumps market is projected to exhibit a CAGR of 2.20% during 2025-2033, reaching a value of USD 8.70 Billion by 2033.

The India pumps market is driven by rapid industrialization, growing infrastructure projects, and increased demand from sectors like agriculture, water management, and manufacturing. Additionally, technological advancements, government initiatives for water supply and irrigation, and rising industrial automation needs contribute to the market growth, alongside a focus on energy-efficient and durable pump solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)