India Purified Terephthalic Acid Market Size, Share, Trends and Forecast by Sales Channel, End User, and Region, 2025-2033

India Purified Terephthalic Acid Market Size and Share:

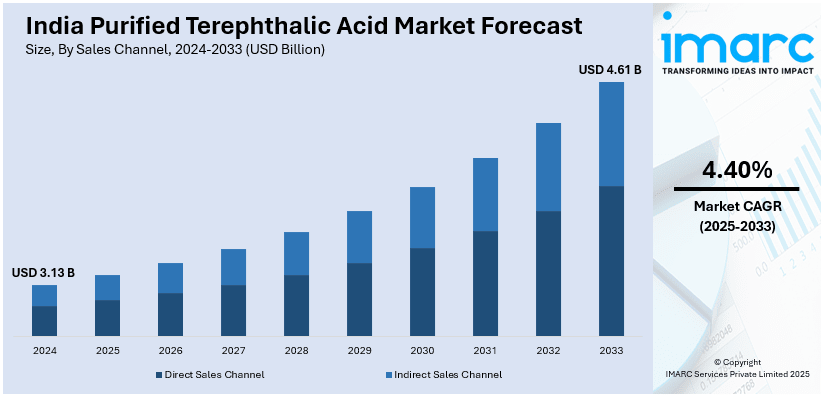

The India purified terephthalic acid market size reached USD 3.13 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.61 Billion by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. The market is driven by the escalating polyester demand in the textile industry and increasing need for polyethylene terephthalate (PET)-based packaging in the expanding food and beverage (F&B) and e-commerce sectors, further supported by sustainability trends, urbanization, inflating disposable incomes, and shifts in user preferences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.13 Billion |

| Market Forecast in 2033 | USD 4.61 Billion |

| Market Growth Rate 2025-2033 | 4.40% |

India Purified Terephthalic Acid Market Trends:

Growing Demand in Textile Industry

The rising demand for polyester, which is primarily derived from purified terephthalic acid (PTA), is bolstering the growth of the market. The textile sector, particularly the clothing industry, is witnessing swift growth driven by a rise in user demand for garments, especially synthetic materials. Polyester is becoming well-liked due to its strength, affordability, and adaptability, making it a favored choice in the fashion sector. This growing demand is further supported by the expansion of the fashion and retail industries, along with the changing user preferences for budget-friendly, low-maintenance fabrics. Moreover, inflating disposable incomes, urban development, and changing lifestyles are driving up textile utilization, which is catalyzing the demand for PTA production. As polyester is a vital part of many fabrics, PTA continues to be a crucial raw material in fulfilling market needs. According to the India Brand Equity Foundation (IBEF), the Indian textile and apparel sector is expected to expand at a compound annual growth rate (CAGR) of 10%, targeting a projected US$ 350 billion by 2030, with exports estimated to make up US$ 100 billion of this figure. This strong expansion in the textile sector supports the rising demand for PTA, boosting both local production and import needs for the substance to satisfy the growing market demands.

To get more information on this market, Request Sample

Expansion of Packaging Industry

PTA is a crucial raw material in producing polyethylene terephthalate (PET), a commonly utilized polymer for numerous packaging applications like bottles, containers, and films. With individual demand for packaged products steadily increasing, especially in the food and beverage industry, the need for PET and subsequently PTA is escalating. The swift expansion of e-commerce platforms, necessitating extensive packaging for shipping, intensifies the need for PET-based packaging options. Moreover, the increasing focus on sustainability and recyclability is promoting the use of PET products, given their strong reputation for being recyclable. This transition to environment-friendly packaging is additionally aiding the expansion of the PTA market. The IMARC Group reports that the industrial packaging market in India attained a value of USD 4.9 billion in 2024 and is projected to expand to USD 8.9 billion by 2033, with a CAGR of 6.91% from 2025 to 2033. This growth emphasizes the rising need for packaging materials, directly enhancing PTA utilization in India. The swift expansion of both local and export markets for packaged products guarantees an ongoing increase in the PTA market

India Purified Terephthalic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on sales channel and end user.

Sales Channel Insights:

- Direct Sales Channel

- Indirect Sales Channel

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes direct sales channel and indirect sales channel.

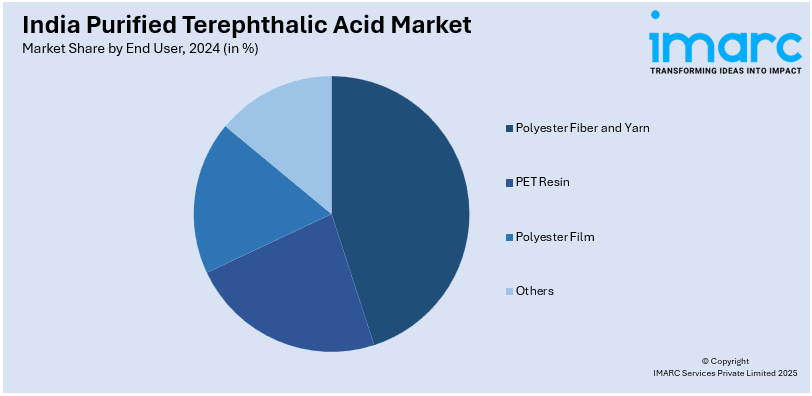

End User Insights:

- Polyester Fiber and Yarn

- PET Resin

- Polyester Film

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes polyester fiber and yarn, PET resin, polyester film, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Purified Terephthalic Acid Market News:

- In November 2024, GAIL (India) announced that its subsidiary, GAIL Mangalore Petrochemicals (GMPL), re-engaged with process licensor INEOS to revitalize its 1.25 MMTPA PTA manufacturing plant in Mangalore. The renewed collaboration aimed to enhance the plant’s efficiency and align production with market demand. This move was aligned with India’s Atmanirbhar Bharat initiative to reduce import dependency and strengthen domestic petrochemical manufacturing.

- In June 2024, Indian Oil Corp. (IOC) awarded Technip Energies a contract for a 1.5 million tpy naphtha cracking unit at the Paradip petrochemical complex in Odisha. The complex, integrated with IOC's refinery, was set to produce a variety of petrochemical products, including paraxylene-purified terephthalic acid (PX-PTA). This project was part of India's development of Petroleum, Chemicals, & Petrochemical Investment Regions (PCPIRs).

India Purified Terephthalic Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sales Channels Covered | Direct Sales Channel, Indirect Sales Channel |

| End Users Covered | Polyester Fiber and Yarn, PET Resin, Polyester Film, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India purified terephthalic acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India purified terephthalic acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India purified terephthalic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The purified terephthalic acid market in India was valued at USD 3.13 Billion in 2024.

The India purified terephthalic acid market is projected to exhibit a CAGR of 4.40% during 2025-2033, reaching a value of USD 4.61 Billion by 2033.

The growth of the India purified terephthalic acid market is driven by rising demand for polyester fibres used in garments, upholstery, and industrial textiles. Strong growth in the PET packaging segment, especially for bottles and containers, also fuels PTA consumption. Expansion of the domestic textile industry, coupled with changing consumer lifestyles and higher spending on ready-made clothing, continues to support market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)