India PVC Market Size, Share, Trends and Forecast by Product Type, End Use, and Region, 2025-2033

India PVC Market Size and Share:

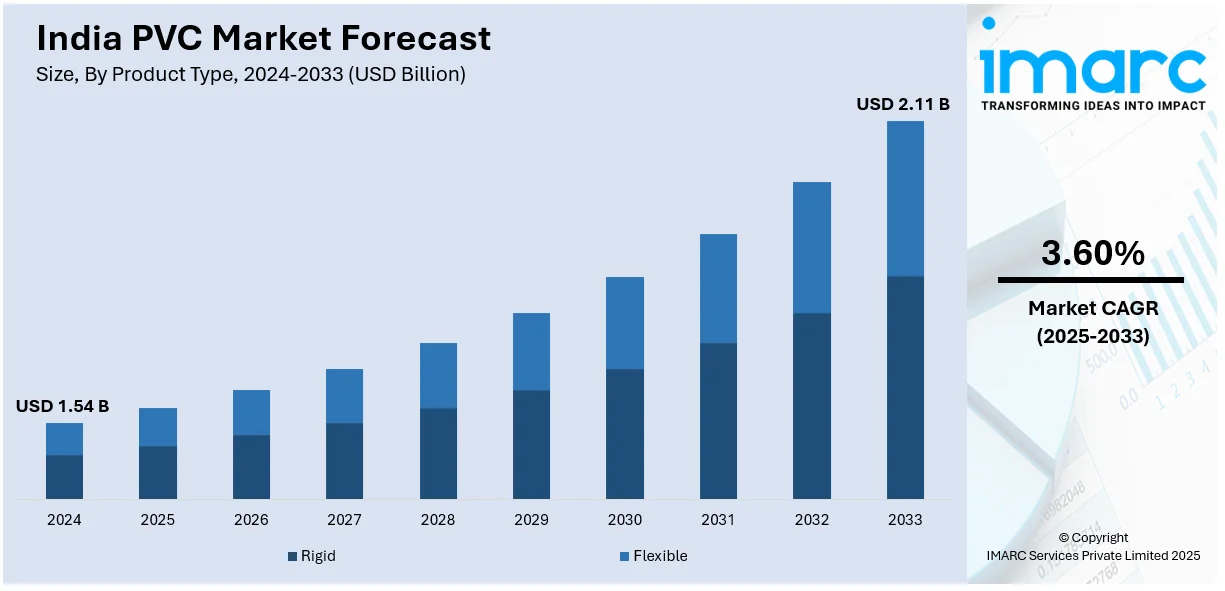

The India PVC market size reached USD 1.54 Billion in 2024. The market is expected to reach USD 2.11 Billion by 2033, exhibiting a growth rate (CAGR) of 3.60% during 2025-2033. The market growth is attributed to the augmenting demand for durable and cost-effective building materials, residential buildings increasingly adopting PVC pipes, as well as personal care products being increasingly utilized, which creates the need for PVC-based packaging solutions.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of product type, the market has been divided into rigid and flexible.

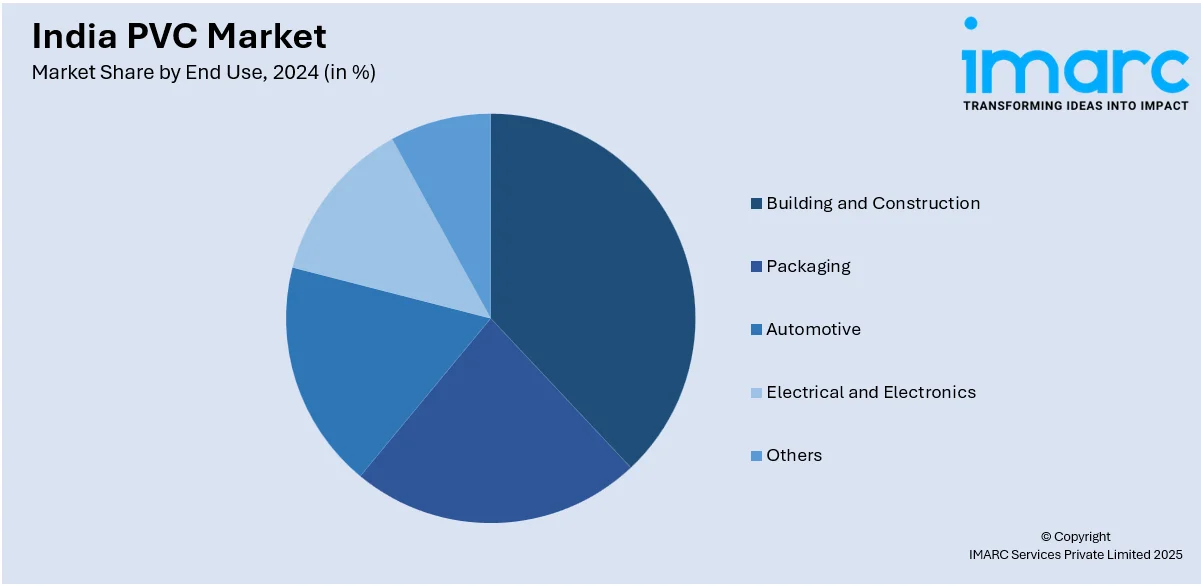

- On the basis of end use, the market has been divided into building and construction, packaging, automotive, electrical and electronics, and others.

Market Size and Forecast:

- 2024 Market Size: USD 1.54 Billion

- 2033 Projected Market Size: USD 2.11 Billion

- CAGR (2025-2033): 3.60%

India PVC Market Trends:

Growing construction and infrastructure development

The rising construction and infrastructure development is propelling the India PVC market growth. In December 2024, NBCC (India) Ltd. announced that it secured several construction projects totaling INR 9,445 Crore in the Indian states of Haryana, Karnataka, Uttar Pradesh, and Uttarakhand. PVC market size in India continues to expand, as infrastructure investments are increasing. It is commonly used in pipelines, fittings, window frames, doors, flooring, and roofing due to its lightweight nature, corrosion resistance, and extended lifespan. Government efforts, such as smart cities and affordable housing plans, are also promoting the usage of PVC. Builders and developers choose PVC over traditional materials like metal and wood because it is less expensive and easier to maintain. Additionally, the heightened emphasis on water management and sanitation is creating the need for PVC pipes and fittings in plumbing and drainage systems, augmenting the PVC market share in India. With ongoing metro rail, highway, and real estate projects, there is a high demand for sturdy and weatherproof materials. The growing utilization of PVC in modular construction and prefabricated structures is supporting the market expansion. Moreover, electrical and telecommunications industries use PVC for cable insulation and protective coatings.

To get more information on this market, Request Sample

Rising applications in packaging industry

The growing applications in the packaging industry are offering a favorable India PVC market outlook. PVC is utilized in flexible and rigid packaging, including bottles, blister packs, food wraps, and shrink films, because of its strength and resistance to moisture and chemicals. The broadening of e-commerce sites is catalyzing the demand for sturdy packaging solutions, and PVC plays a crucial role in safeguarding products during transit, as per the India PVC market forecast. In the food and beverage (F&B) industry, PVC is preferred for its ability to preserve freshness and prevent contamination. Pharmaceutical companies rely on PVC blister packs for safe and long-lasting medicine storage. The growing demand for personal care and household products is also creating the need for PVC-based packaging solutions. With rising user awareness about hygiene and product safety, manufacturers are turning to PVC owing to its protective qualities. As packaging innovations continue to evolve, PVC remains a key material. According to the IBEF, the India packaging market is set to grow at a Compound Annual Growth Rate (CAGR) of 26.7% to attain USD 204.81 Billion by 2025, which is significantly impacting the PVC market share in India.

Advancement in PVC Manufacturing Technologies and Product Innovation

The industry is experiencing significant technological transformation through the adoption of advanced manufacturing processes and innovative product formulations designed to enhance performance characteristics and environmental sustainability. This trend encompasses the development of eco-friendly PVC compounds with reduced environmental impact, implementation of sophisticated extrusion and molding technologies for improved product quality, and introduction of specialized grades tailored for specific applications such as medical devices, food contact surfaces, as well as high-temperature industrial uses. The PVC market growth in India is also impacted by manufacturing innovations, which include enhanced stabilizer systems that eliminate heavy metals, development of bio-based plasticizers to replace traditional phthalates, and implementation of closed-loop recycling processes that support circular economy principles. The is being accelerated by investments in state-of-the-art production facilities equipped with digital monitoring systems, automated quality control mechanisms, and energy-efficient processes that reduce carbon footprint while maintaining superior product standards. These technological advancements are enabling manufacturers to produce high-performance PVC products with enhanced durability, improved chemical resistance, and better thermal stability, positioning the PVC industry size in India for sustainable long-term growth while meeting evolving regulatory requirements and customer expectations for environmentally responsible materials.

Growth, Opportunities, and Challenges in the India PVC Market:

- Growth Drivers of the India PVC market: The primary growth drivers include rapid urbanization and infrastructure development supported by government initiatives like Smart Cities Mission and Housing for All schemes. Rising disposable incomes and changing consumer preferences toward durable and cost-effective building materials are accelerating market adoption. The expanding automotive and electrical sectors are creating increased demand for PVC applications in wire insulation, automotive components, and electronic housing, as per the India PVC market analysis.

- Opportunities in the India PVC market: Significant opportunities exist in the development of sustainable and recyclable PVC formulations to meet growing environmental consciousness among consumers and regulatory requirements. The expanding rural infrastructure development and agricultural modernization present substantial growth potential for PVC pipes and fittings. Strategic investments in advanced manufacturing technologies and product innovation can enable companies to capture premium market segments and improve profit margins.

- Challenges in the India PVC market: The market faces challenges from volatile raw material prices, particularly crude oil fluctuations that directly impact PVC resin costs and manufacturing economics. Environmental concerns and regulatory restrictions on certain PVC applications pose potential limitations on growth of the PVC industry in India and product development. Intense competition from alternative materials like HDPE and growing consumer preference for eco-friendly substitutes create pressure on traditional PVC applications.

India PVC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and end use.

Product Type Insights:

- Rigid

- Flexible

The report has provided a detailed breakup and analysis of the market based on the product type. This includes rigid and flexible.

End Use Insights:

- Building and Construction

- Packaging

- Automotive

- Electrical and Electronics

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes building and construction, packaging, automotive, electrical and electronics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India PVC Market News:

- In April 2025, The Supreme Industries Limited announced its plans to commit approximately USD 1,100 crores for capital expenditures, funded entirely by internal accruals, to expand its production facilities and acquire the building and infrastructure business of Wavin in India

- In March 2025, Prince Pipes and Fittings Ltd. commenced commercial production at its new manufacturing facility in Begusarai, Bihar, expanding its national footprint to eight plants. The first phase of the unit has a production capacity of 24,000 metric tons per year and will cater to the growing eastern India market. The plant is part of PPFL’s strategy to enhance regional reach, improve delivery speed, and reduce freight costs.

- In February 2025, Shiva Polymers launched a new 3.5 micron PVC lamination film, aiming to expand capacity and meet pan-India demand. Their products use recycled materials and target the MSME packaging sector.

- In January 2025, Adani Petrochemicals Ltd, part of Adani Enterprises, revealed the establishment of a joint venture with Indorama Resources named Valor Petrochemicals Ltd (VPL). The new initiative was set to have both firms owning equal shares of 50%. VPL aimed to create a refinery, petrochemical, and chemical enterprise, initially concentrating on a 2 Million Tons PVC facility that was to be constructed in two phases in India. The initial phase, which had a capacity of 1 Million Tons, is expected to be completed by 2026, whereas the second phase is projected to be finished by early 2027.

- In August 2024, Reliance Industries announced plans to build new PVC and CPVC plants at its Dahej and Nagothane sites, with a combined annual capacity of 1.5 million tons. The facilities are expected to begin operations in FY 2026–2027. The move aims to meet rising domestic demand and reduce India’s reliance on PVC imports.

- In March 2023, Finolex Industries declared that it started commercial production of PVC fittings at a new manufacturing plant in Pune, Maharashtra. The facility had an annual capacity of 12,000 MT, with a capital expenditure of around INR 100 Crore.

India PVC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Rigid, Flexible |

| End Uses Covered | Building and Construction, Packaging, Automotive, Electrical and Electronics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India PVC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India PVC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India PVC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India PVC market was valued at USD 1.54 Billion in 2024.

The PVC market in India is projected to exhibit a CAGR of 3.60% during 2025-2033, reaching a value of USD 2.11 Billion by 2033.

The PVC market in India is driven by rapid urbanization and infrastructure development, government schemes like Smart Cities and PMKSY, and the shift toward cost-effective, durable, corrosion- and weather-resistant piping. Growth in agriculture, construction, automotive, packaging, and electrical sectors further fuels demand, supported by technological innovation and sustainability trends.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)