India Quick Service Restaurants Market Size, Share, Trends and Forecast by Cuisine, Outlet, Location, and Region, 2026-2034

Market Overview:

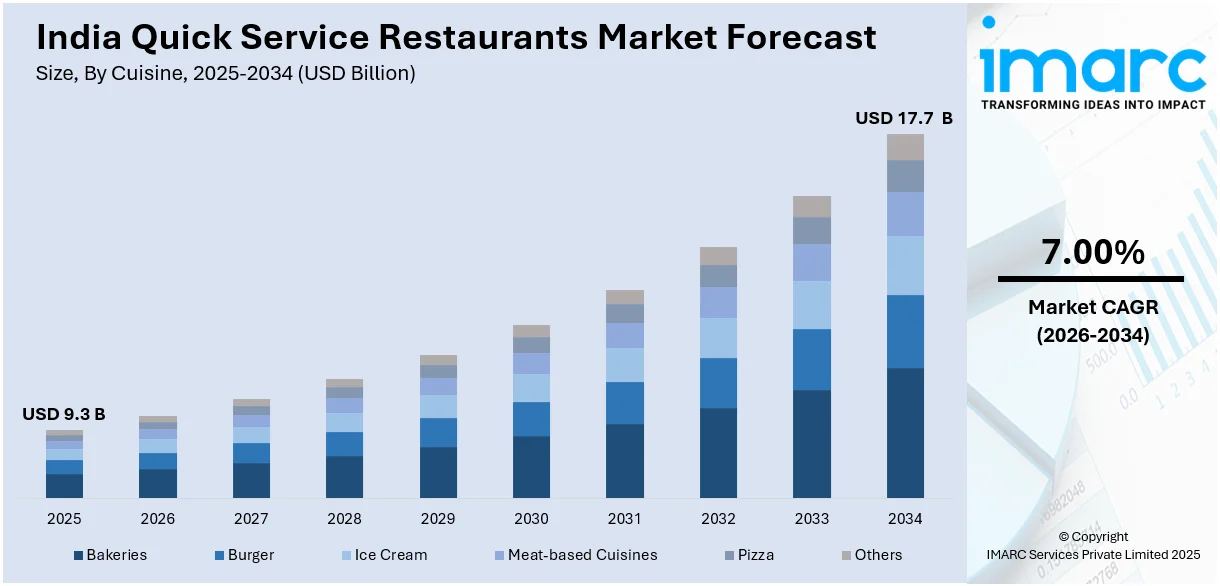

The India quick service restaurants market size reached USD 9.3 Billion in 2025. The market is expected to reach USD 17.7 Billion by 2034, exhibiting a growth rate (CAGR) of 7.00% during 2026-2034. The market growth is attributed to the increasing integration of technology, such as online ordering platforms, mobile apps, and self-service kiosks, which enhances customer experience and operational efficiency.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of cuisine, the market has been divided into bakeries, burger, ice cream, meat-based cuisines, pizza, and others.

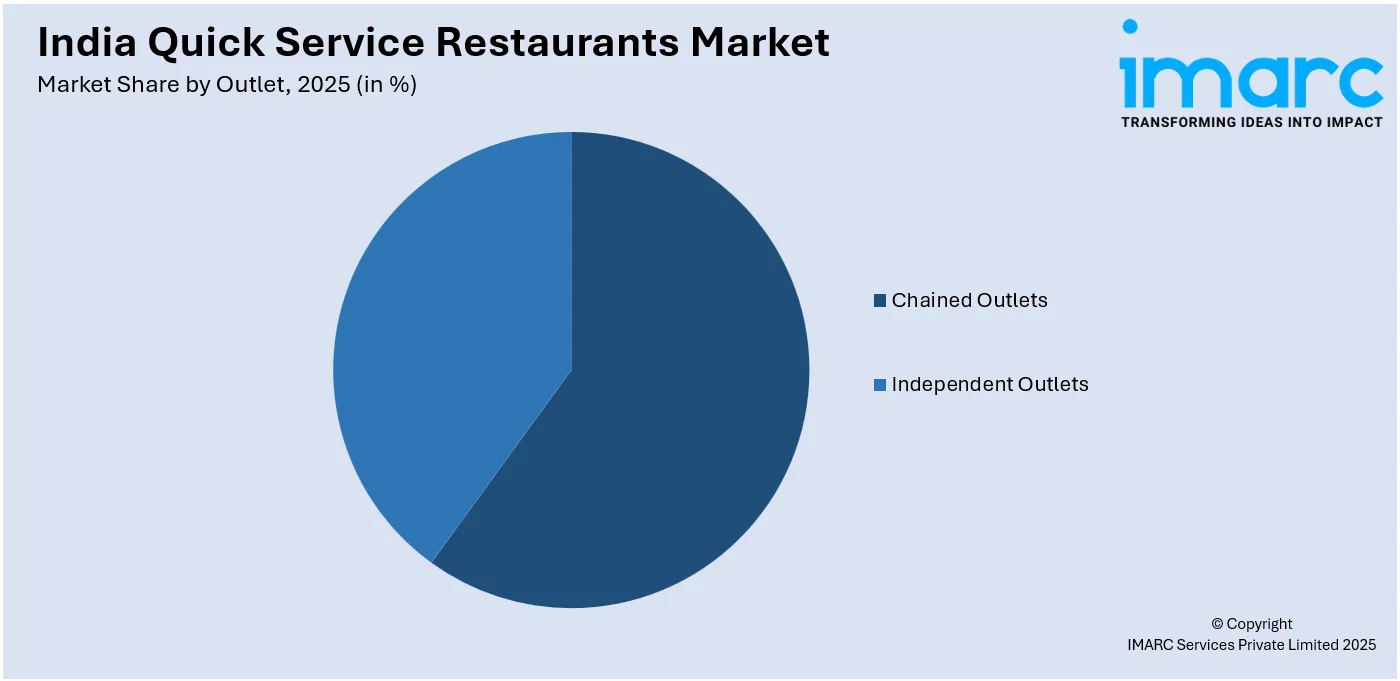

- On the basis of outlet, the market has been divided into chained outlets and independent outlets.

- On the basis of location, the market has been divided into leisure, lodging, retail, standalone, and travel.

Market Size and Forecast:

- 2025 Market Size: USD 9.3 Billion

- 2034 Projected Market Size: USD 17.7 Billion

- CAGR (2026-2034): 7.00%

Quick service restaurants (QSRs) are dining establishments that prioritize fast and efficient service, catering to customers seeking convenient, on-the-go meals. Known for their streamlined operations, QSRs focus on speedy food preparation and minimal wait times. These establishments often feature limited menus with popular and easily prepared items, such as burgers, fries, sandwiches, and salads. QSRs leverage efficient ordering systems, including drive-thrus, self-service kiosks, and mobile apps, enhancing the overall dining experience. The emphasis on speed does not compromise the quality of food, as QSRs strive to maintain consistent taste and freshness. Examples of well-known QSR chains include McDonald's, Subway, and Taco Bell. The QSR model has become increasingly popular in response to the fast-paced lifestyles of modern consumers, offering a convenient solution for those seeking a quick and satisfying meal.

To get more information on this market Request Sample

The quick service restaurants market in India is experiencing robust growth, driven by several key factors. Firstly, the increasing pace of modern lifestyles has led to a surge in demand for convenient and quick dining options, propelling the QSR industry forward. Additionally, the growing trend of on-the-go consumption and busy work schedules has heightened the preference for fast and efficient food services, reinforcing the market's upward trajectory. Moreover, the widespread adoption of digital technologies has significantly contributed to the expansion of the QSR sector. Online ordering platforms, mobile apps, and contactless payment options have streamlined the customer experience, fostering convenience and accessibility. The India quick service restaurants market share continues to expand as establishments embrace technological innovations that enhance operational efficiency and customer satisfaction. Furthermore, the emphasis on diverse and customizable menus, catering to evolving consumer preferences and dietary requirements, has positioned QSRs as versatile and appealing dining choices. In tandem, the regional urbanization trend has accelerated the QSR market's growth, particularly in densely populated areas where quick, affordable, and tasty meals align with the needs of the bustling population. The relentless pace of urban life, coupled with an increasing focus on cost-effective dining solutions, consolidates the QSR market's position as a key player in the modern food industry. In conclusion, the confluence of changing lifestyles, technological advancements, and urbanization acts as potent drivers propelling the regional QSR market towards sustained expansion.

India Quick Service Restaurants Market Trends:

Digital Integration and Contactless Solutions

The market in India is directly impacted by the faster adoption of digital technologies and contactless service solutions. QSR chains are now putting more investments into advanced mobile applications that provide personalized ordering experiences, loyalty programs, and real-time tracking features. The combination of artificial intelligence and machine learning algorithms allows restaurants to offer customized menu suggestions according to customer preferences and ordering history. Self-service kiosks are now part of the norm in city centers, cutting down wait times and enhancing order accuracy while letting customers largely personalize their meals. Contactless payments through digital wallets, UPI payments, and QR code payments have become the new norm, especially boosted by post-pandemic consumer trends. Sophisticated point-of-sale systems now interface easily with inventory control and customer relationship management software, allowing restaurants to refine operations and interact more effectively with customers through promotional and marketing campaigns and special offers.

Health-Focused Menu Innovation

The India quick service restaurants market forecast shows a major move toward health-focused menu items as consumers grow more concerned about nutritional value and dietary restrictions. QSR chains are extending their offerings to include plant-based substitutes, organic produce, and low-calorie offerings without sacrificing flavor or convenience. Menu clarity has become paramount with restaurants offering extensive nutritional information, source details of ingredients, and allergen alerts to foster consumer confidence. The addition of superfood ingredients, high-protein offerings, and gluten-free alternatives addresses varying dietary needs and lifestyle preferences. Functional foods and drinks that are probiotic, vitamin, and natural supplement fortified are increasingly popular among health-driven consumers. Indian Quick Service Restaurants Industry operators are tying up with nutritionists and healthcare practitioners to create items on the menu that are compatible with wellness trends without compromising on the convenience and affordability for which QSR stands.

Some of the other market trends are,

- Quick Commerce Platforms: The market is is transforming food delivery with hyperfast delivery promises of 15-30 minutes, compelling QSR chains to open micro-fulfillment centers and cloud kitchens in strategic locations.

- Hyper Local Delivery: A combination of hyperlocal delivery networks and collaborations with various aggregator platforms has allowed QSRs to extend their footprint beyond dine-in consumers.

- Expansion in Tier 1 and Tier 2 Cities: QSR chains are rapidly increasing their footprint in tier 2 and tier 3 cities due to the unserved potential and increasing disposable incomes in these cities. Sophisticated logistics optimization and real-time monitoring tools have improved delivery efficiency while preserving food quality and temperature during transportation.

Growth, Opportunities, and Challenges in the India Quick Service Restaurants Market:

- Growth Drivers: The rapid urbanization and changing lifestyle patterns of Indian consumers are driving increased demand for convenient dining solutions. The proliferation of digital payment systems and smartphone penetration has facilitated seamless ordering and payment processes. This in turn is propelling quick service restaurants industry growth in India. rising disposable incomes, particularly among the younger demographic, are supporting frequent QSR visits and higher spending per transaction.

- Market Opportunities: The untapped potential in tier 2 and tier 3 cities presents significant expansion opportunities for established QSR chains. The growing health consciousness among consumers creates opportunities for brands that can successfully combine convenience with nutritious menu options. The increasing acceptance of cloud kitchens and delivery-only models opens new avenues for market entry with lower capital investment requirements.

- Market Challenges: According to Indian quick service restaurants market analysis, intense competition from both international chains and local players is putting pressure on profit margins and market share. Rising real estate costs in prime locations and increasing labor expenses are impacting operational profitability. Regulatory compliance regarding food safety standards, licensing requirements, and taxation policies creates operational complexities for QSR operators.

India Quick Service Restaurants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on cuisine, outlet, and location.

Cuisine Insights:

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

The report has provided a detailed breakup and analysis of the market based on the cuisine. This includes bakeries, burger, ice cream, meat-based cuisines, pizza, and others.

Outlet Insights:

Access the comprehensive market breakdown Request Sample

- Chained Outlets

- Independent Outlets

A detailed breakup and analysis of the market based on the outlet have also been provided in the report. This includes chained outlets and independent outlets.

Location Insights:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

The report has provided a detailed breakup and analysis of the market based on the location. This includes leisure, lodging, retail, standalone, and travel.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In September 2025, The Burger Company introduced its innovative micro-QSR franchise model, PICO, in India, designed for affordable entry with a starting investment of INR 7.89 Lakh plus taxes and requiring only 80-100 sq ft of space. The all-inclusive package covers franchise fees, kitchen equipment, software, branding, fit-out, launch marketing, training, and initial stock, enabling franchisees to begin operations immediately without hidden costs. This supports the expansion of Indian quick service restaurants industry.

- In July 2025, Aspect Hospitality announced plans to scale up its pan-Asian QSR brand Nom Nom Express from its current footprint in cities like Mumbai, Pune, and Hyderabad to 500 outlets over the next 12 months. The company’s long-term vision includes growing to over 1,000 Nom Nom Express outlets, launching 50+ premium restaurant formats, and entering at least two international cities within five years.

India Quick Service Restaurants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cuisines Covered | Bakeries, Burger, Ice Cream, Meat-Based Cuisines, Pizza, Others |

| Outlets Covered | Chained Outlets, Independent Outlets |

| Locations Covered | Leisure, Lodging, Retail, Standalone, Travel |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India quick service restaurants market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India quick service restaurants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India quick service restaurants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India quick service restaurants market was valued at USD 9.3 Billion in 2025.

The India quick service restaurants market is projected to exhibit a CAGR of 7.00% during 2026-2034, reaching a value of USD 17.7 Billion by 2034.

Growing urbanization, shifting customer habits, and increased disposable incomes are among the primary variables driving the fast service restaurant industry in India. Growing demand for convenient, affordable food, especially among youth, fuels expansion. The rise of food delivery platforms, franchising models, and digital ordering systems further accelerates growth, particularly in tier 2 and tier 3 cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)