India Railing Market Size, Share, Trends and Forecast by Material, Application, Installation, Railing Style, Distribution Channel, End-Use, and Region, 2025-2033

India Railing Market Overview:

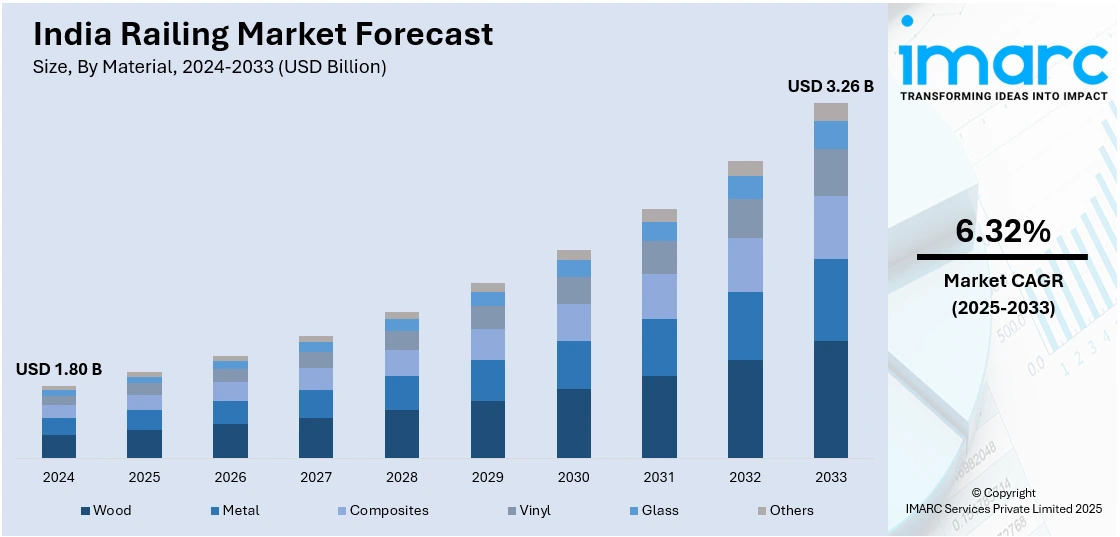

The India railing market size reached USD 1.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.26 Billion by 2033, exhibiting a growth rate (CAGR) of 6.32% during 2025-2033. Rapid urbanization and infrastructure development, increasing safety and aesthetic demands in residential and commercial construction, and the adoption of modern materials, such as aluminum and glass, are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.80 Billion |

| Market Forecast in 2033 | USD 3.26 Billion |

| Market Growth Rate 2025-2033 | 6.32% |

India Railing Market Trends:

Rising Demand for Aesthetic and Durable Railing Materials

India's rapid urbanization is reshaping preferences in architectural design, with a notable shift towards railing systems that blend functionality, aesthetics, and durability. Traditional iron and wooden railings are increasingly being replaced by modern alternatives such as stainless steel, aluminum, and glass, especially in high-rise apartments, commercial complexes, and public infrastructure. Frameless glass railings and modular railing systems are gaining popularity for their sleek appearance, corrosion resistance, and low maintenance requirements. Builders and architects now treat railing systems as essential design elements that not only ensure safety but also elevate the visual appeal of a space. In metro cities like Bengaluru, Mumbai, and Delhi, over 60% of new urban residential projects now feature stainless steel or glass railings, reflecting a strong trend toward contemporary materials. Meanwhile, the demand for aluminum railings is projected to grow by substantially over the near-term, driven by their cost-effectiveness and ease of installation. This evolution in railing preferences underscores the fusion of design innovation and urban lifestyle needs across India's construction sector.

To get more information on this market, Request Sample

Growth in Government-Led Infrastructure and Smart Cities Projects

India’s Smart Cities Mission and expansive urban infrastructure developments are propelling the demand for modern railing systems across public spaces, including metro stations, airports, pedestrian bridges, parks, and government buildings. These projects prioritize both safety and modern aesthetics, fostering the adoption of advanced materials and customized railing solutions. Stainless steel railings have become the preferred choice for public installations due to their superior strength, durability, and resistance to environmental degradation. Additionally, the shift toward pre-engineered railing systems is gaining traction, enabling quicker and more efficient implementation in large-scale projects. The Smart Cities Mission, encompassing 100 cities, has attracted investments exceeding INR 2 lakh crore, with a substantial share directed toward urban mobility and pedestrian-friendly infrastructure. This surge in infrastructure activity is not only enhancing public safety but also driving innovation and demand within India’s railing systems market.

India Railing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on material, application, installation, railing style, distribution channel, and end-use.

Material Insights:

- Wood

- Metal

- Aluminum

- Steel

- Iron

- Others

- Composites

- Vinyl

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes wood, metal (aluminum, steel, iron, and others), composites, vinyl, glass, and others.

Application Insights:

- Interior Application

- Exterior Application

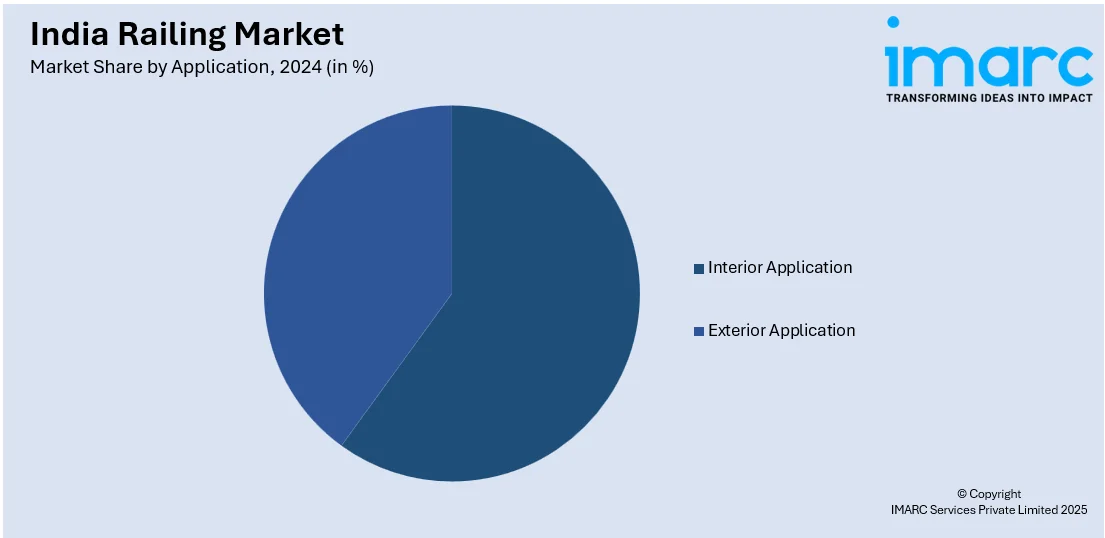

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes interior application and exterior application.

Installation Insights:

- Professional Installation

- Do-It-Yourself (DIY)

The report has provided a detailed breakup and analysis of the market based on the installation. This includes professional installation and do-it-yourself (DIY).

Railing Style Insights:

- Glass Panel

- Baluster

- Others

A detailed breakup and analysis of the market based on the railing style have also been provided in the report. This includes glass panel, baluster, and others.

Distribution Channel Insights:

- Direct

- Indirect

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct and indirect.

End-Use Insights:

- Residential

- Non-residential

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes residential and non-residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Railing Market News:

- March 2025: ArcelorMittal Nippon Steel India secured land in Andhra Pradesh to establish an integrated steel plant with an initial capacity of 7.3 million tons per annum. This expansion aligns with India's goal to increase its crude steel capacity to 300 MTPA by 2030, positively impacting the supply chain for manufacturing railings.

- December 2024: The Competition Commission of India approved Jsquare Electrical Steel Nashik Private Limited's acquisition of Thyssenkrupp Electrical Steel India Private Limited. Jsquare is a subsidiary of JSW JFE Electrical Steel Private Limited, a joint venture between JSW Steel and JFE Steel, expected to produce grain-oriented electrical steel (GOES) in India starting in 2027. Thyssenkrupp India manufactures and sells GOES.

India Railing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered |

|

| Applications Covered | Interior Application, Exterior Application |

| Installations Covered | Professional Installation, Do-It-Yourself (DIY) |

| Railing Styles Covered | Glass Panel, Baluster, Others |

| Distribution Channels Covered | Direct, Indirect |

| End-Uses Covered | Residential, Non-residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India railing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India railing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India railing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The railing market in India was valued at USD 1.80 Billion in 2024.

The railing market in India is projected to grow at a CAGR of 6.32% during 2025-2033, reaching a value of USD 3.26 Billion by 2033.

The market is driven by rapid urbanization, increasing demand for safety and aesthetics in residential and commercial spaces, and the adoption of modern materials, such as stainless steel, aluminum, and glass. Additionally, government-led infrastructure and smart city projects are increasing the demand for advanced railing systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)