India Recloser Market Size, Share, Trends and Forecast by Phase Type, Control Type, Voltage Rating, Sectionalizer Control Type, and Region, 2025-2033

India Recloser Market Overview:

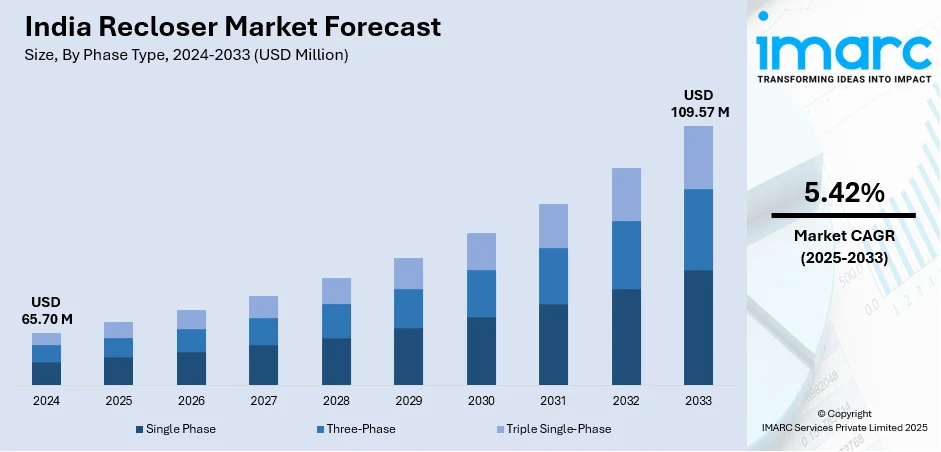

The India recloser market size reached USD 65.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 109.57 Million by 2033, exhibiting a growth rate (CAGR) of 5.42% during 2025-2033. The India recloser market is being driven by rapid grid modernization, increasing renewable energy integration, rising power demand, government initiatives for smart grid deployment, rural electrification projects, and the elevating need for reliable power distribution, in addition to advancements in automation and remote monitoring technologies enhancing grid resilience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 65.70 Million |

| Market Forecast in 2033 | USD 109.57 Million |

| Market Growth Rate 2025-2033 | 5.42% |

India Recloser Market Trends:

Expansion of Transmission and Distribution (T&D) Networks

India's electricity sector is undergoing a transformative phase propelled by increasing electricity consumption, urbanization, and government-driven policies aimed at improving energy access. The electricity demand in India has accelerated with fast-paced industrial expansion, urbanization, and the electrification of rural areas. In line with this, the government has initiated large-scale schemes, such as the Integrated Power Development Scheme (IPDS) and the Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY), which aim to augment distribution infrastructure and last-mile connectivity. Reclosers play the key role here, as they improve the dependability of the power supply through automatic fault detection, isolation of the affected part, and automated restoration of the service without requiring human intervention. Circuit breakers need to be operated manually upon a fault before they can reset, resulting in extended power cut-offs. Through reclosers, however, there is provision for continuous flow of power with transient faults handling, which makes up a vast majority of electric disturbances.

To get more information on this market, Request Sample

Integration of Renewable Energy Sources

India has ambitious plans for renewable energy growth, with a target of achieving 500 GW of non-fossil fuel capacity by 2030. Solar and wind power projects are being implemented at a fast pace to minimize dependence on coal-based electricity and meet sustainability targets. These sources of energy have specific challenges because of their intermittent generation patterns, which can cause grid instability. Unlike traditional power stations that offer constant output, the solar energy wavers depending on sunlight exposure and wind power changing with varying winds. Reclosers serve a central role in the solutions to these problems by promoting grid flexibility to varied power inputs. When random voltage surges or frequency deviations appear as a result of irregular renewable energy generation, reclosers stabilize the grid by immediately separating trouble zones with minimal interruption to the network overall. This is particularly relevant for hybrid grids where traditional and renewable energy generation come together.

India Recloser Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on phase type, control type, voltage rating, and sectionalizer control type

Phase Type Insights:

- Single Phase

- Three-Phase

- Triple Single-Phase

The report has provided a detailed breakup and analysis of the market based on the phase type. This includes single-phase, three-phase, and triple single-phase.

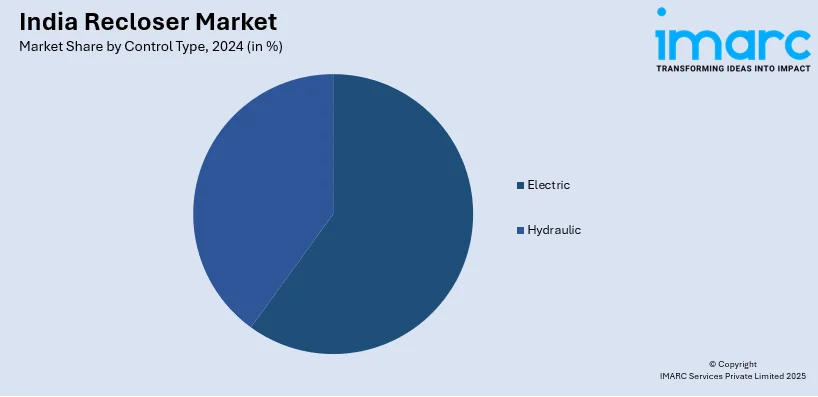

Control Type Insights:

- Electric

- Hydraulic

A detailed breakup and analysis of the market based on the control type have also been provided in the report. This includes electric and hydraulic.

Voltage Rating Insights:

- Up to 15 kV

- 16 to 27 kV

- 28 to 38 kV

The report has provided a detailed breakup and analysis of the market based on the voltage rating. This includes up to 15 kV, 16 to 27 kV, and 28 to 38 kV.

Sectionalizer Control Type Insights:

- Resettable Electronic Sectionalizer

- Programmable Resettable Sectionalizer

A detailed breakup and analysis of the market based on the sectionalizer control type have also been provided in the report. This includes resettable electronic sectionalizer and programmable resettable sectionalizer.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Recloser Market News:

- March 2025: Power Grid Corporation of India (POWERGRID) secured a project to evacuate 4.5 GW of renewable energy from Andhra Pradesh's Kurnool-III substation. In such large-scale transmission systems, reclosers are typically employed to enhance grid reliability.

- January 2025: Larsen & Toubro (L&T) secured substantial orders for its Power Transmission & Distribution business in India and the Middle East, valued between INR 2,500 crore and INR 5,000 crore. The projects include implementing an advanced distribution management system in West Bengal, which enhances grid reliability through real-time monitoring and rapid fault isolation. Such systems typically incorporate automatic circuit reclosers to swiftly restore power after transient faults, thereby improving overall grid resilience.

India Recloser Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Phase Types Covered | Single Phase, Three-Phase, Triple Single-Phase |

| Control Types Covered | Electric, Hydraulic |

| Voltage Ratings Covered | Up to 15 kV, 16 to 27 kV, 28 to 38 kV |

| Sectionalizer Control Types Covered | Resettable Electronic Sectionalizer, Programmable Resettable Sectionalizer |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India recloser market performed so far and how will it perform in the coming years?

- What is the breakup of the India recloser market on the basis of phase type?

- What is the breakup of the India recloser market on the basis of control type?

- What is the breakup of the India recloser market on the basis of voltage rating?

- What is the breakup of the India recloser market on the basis of sectionalizer control type?

- What are the various stages in the value chain of the India recloser market?

- What are the key driving factors and challenges in the India recloser market?

- What is the structure of the India recloser market and who are the key players?

- What is the degree of competition in the India recloser market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India recloser market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India recloser market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India recloser industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)