India Reflective Material Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

India Reflective Material Market Overview:

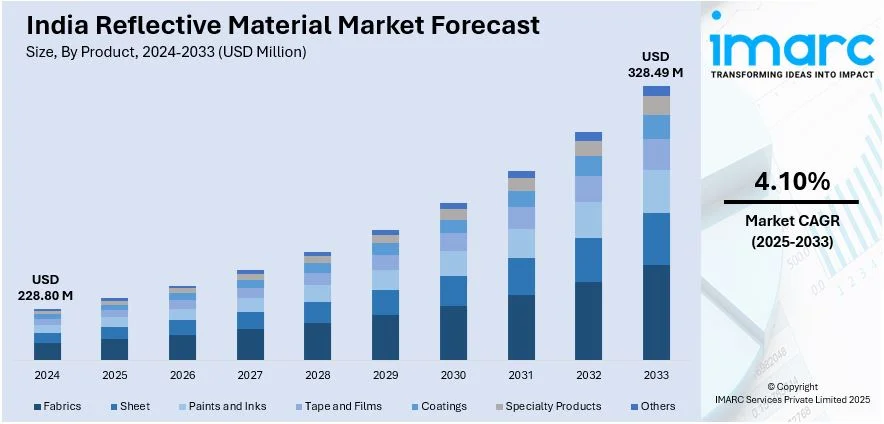

The India reflective material market size reached USD 228.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 328.49 Million by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is driven by increasing road safety regulations, government mandates for high-visibility vehicle markings, and infrastructure development projects. Rising demand for safety wear in industries and the growing textile sector’s adoption of reflective fabrics further propel the India reflective material share. Technological advancements and urbanization also contribute to the market’s expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 228.80 Million |

| Market Forecast in 2033 | USD 328.49 Million |

| Market Growth Rate (2025-2033) | 4.10% |

India Reflective Material Market Trends:

Growing Demand for Reflective Materials in Road Safety Applications

The increasing emphasis on road safety is majorly driving the India reflective material market growth. With the government’s focus on reducing road accidents and improving infrastructure, reflective materials are being widely adopted in road signs, barriers, and vehicle registration plates. The Ministry of Road Transport and Highways (MoRTH) has implemented stringent regulations mandating the use of high-visibility reflective tapes on commercial vehicles, further driving demand. Additionally, the expansion of highways and smart city projects across the country has created a rise in the need for reflective materials to enhance visibility and safety. For instance, the Indian government allocated ₹11 Lakh Crore (approximately USD 134.15 Billion) for infrastructure in 2024. These steps include the laying of 2,031 km of fresh railway lines, the construction of 6,000 km of national highways, and the expansion of telecommunications services to 10,700 villages, improving connectivity and manufacturing capabilities. The Union Minister states that India is emerging as an economic powerhouse with the highest growth rate of 6.5 percent in the world against the global average of 3.2 percent. Besides this, manufacturers are innovating with advanced micro-prismatic and glass bead technologies to meet these requirements. As urbanization and vehicle ownership continue to rise, the demand for reflective materials in road safety applications is expected to grow steadily in the coming years.

To get more information on this market, Request Sample

Rising Adoption of Reflective Materials in the Textile and Apparel Industry

The increasing use in the textile and apparel industry is further creating a positive India reflective material market outlook. Reflective fabrics are gaining popularity for manufacturing high-visibility clothing, such as safety wear for construction workers, traffic police, and industrial laborers. The growing awareness of workplace safety standards and government regulations mandating the use of reflective gear in hazardous environments are major drivers of this trend. Additionally, the fashion industry is incorporating reflective materials into sportswear, casual wear, and accessories to cater to the rising demand for stylish yet functional clothing. Technological advancements, such as the development of lightweight and durable reflective fabrics, are further enhancing their adoption. With the textile industry being a significant contributor to India’s economy, the integration of reflective materials is expected to open new growth opportunities for market players in this segment. According to a research report published by the IMARC Group, the Indian textile and apparel market was valued at USD 222.08 Billion in 2024. This new growth of the market is estimated to reach USD 646.96 Billion by 2033, growing at a CAGR of 11.98% from 2025-2033.

India Reflective Material Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Fabrics

- Sheet

- Paints and Inks

- Tape and Films

- Coatings

- Specialty Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes fabrics, sheet, paints and inks, tape and films, coatings, specialty products, and others.

Application Insights:

.webp)

- Textiles

- Construction and Roads

- Automotive

- Electronics and Semiconductors

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes textiles, construction and roads, automotive, electronics and semiconductors, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Reflective Material Market News:

- August 22, 2024: AM/NS India launched the Optigal car, a new premium brand of color-coated steel that has a proprietary intervention featuring a state-of-the-art Zinc-Aluminium-Magnesium (ZAM) coating system delivering leading durability performance. This is the first time that this product has been manufactured in India, and it comes with a warranty of up to 25 years, making it ideal for applications in roofing, cladding, and reflective materials in construction. Strengthening India's specialty steel and sustainable manufacturing value chain, the company will thus ramp up its production capacity to one million tonnes by 2026.

India Reflective Material Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Fabrics, Sheet, Paints and Inks, Tape and Films, Coatings, Specialty Products, Others |

| Applications Covered | Textiles, Construction and Roads, Automotive, Electronics and Semiconductors, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India reflective material market performed so far and how will it perform in the coming years?

- What is the breakup of the India reflective material market on the basis of product?

- What is the breakup of the India reflective material market on the basis of application?

- What is the breakup of the India reflective material market on the basis of region?

- What are the various stages in the value chain of the India reflective material market?

- What are the key driving factors and challenges in the India reflective material?

- What is the structure of the India reflective material market and who are the key players?

- What is the degree of competition in the India reflective material market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India reflective material market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India reflective material market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India reflective material industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)