India Refurbished Medical Equipment Market Size, Share, Trends and Forecast by Product Type, Application, End-User, and Region, 2025-2033

India Refurbished Medical Equipment Market Overview:

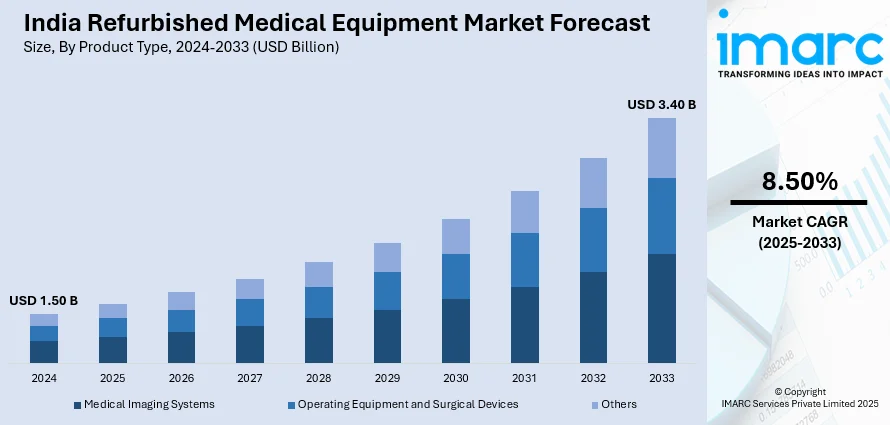

The India refurbished medical equipment market size reached USD 1.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.40 Billion by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The market is fueled by rising prices of new medical devices which have encouraged healthcare providers to opt for cost-saving options in terms of refurbished equipment. Improvements in refurbishment technologies have also increased the performance and dependability of refurbished equipment, making them an acceptable choice for healthcare facilities. Government programs enhancing healthcare infrastructure and access to medical care are further promoting the India refurbished medical equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.50 Billion |

| Market Forecast in 2033 | USD 3.40 Billion |

| Market Growth Rate 2025-2033 | 8.50% |

India Refurbished Medical Equipment Market Trends:

Increase in Demand for Affordable Healthcare Solutions

The various upcoming changes in the Indian healthcare industry, is the reason why refurbished medical equipment is becoming a feasible alternative. The high cost of new medical devices combined with healthcare providers' budget constraints, especially in rural and underserved markets, has driven demand for refurbished equipment. These machines provide huge financial savings—usually 50% to 60% lower than their new equivalents—without losing out on quality or performance. This financial saving allows healthcare centers to make better use of resources, creating more access to vital medical care nationwide. In addition, the government's programs, including Ayushman Bharat and the National Health Mission, work to improve healthcare facilities and access, providing a supportive setting for the use of second-hand medical equipment. Therefore, refurbished equipment is being increasingly implemented in hospitals, diagnostic centers, and clinics, making it easier to provide quality healthcare services to a large population.

To get more information on this market, Request Sample

Technological Innovations and Quality Control

Technological innovations in refurbishment have greatly enhanced the reliability and quality of refurbished medical equipment in India. Current refurbishment techniques entail extensive testing, reconditioning, and calibration to make sure that equipment satisfies or surpasses original manufacturer standards. This focus on quality assurance has further increased the acceptance of refurbished equipment by healthcare professionals, as they can now count on these devices to provide precise diagnostics and effective treatment. Refurbished equipment is also increasingly being loaded with the most current software and hardware updates, improving functionality and compatibility with modern medical practice. Refurbishers and manufacturers also provide customization solutions in accordance with clinical use, in addition to addressing the varied needs of healthcare centers. These technological advancements maximize the life of medical equipment while contributing to the India refurbished medical equipment market growth.

Regulatory Issues and Market Forces

Despite the increasing popularity of refurbished medical equipment, the Indian market has some regulatory challenges that affect its dynamics. The entry of imported refurbished equipment, at times without proper calibration and certification, is creating doubts regarding the safety of patients as well as the quality of care. Industry officials have raised concerns that such a trend can impair India's advancement in medical technology and deter investment in indigenous innovation. Additionally, the existence of spurious goods in the market is highly dangerous because such devices may not go through regular refurbishment processes, hence posing safety risks. To tackle these concerns, there is an increasing demand for effective regulatory frameworks and quality control mechanisms so that refurbished medical equipment is consistent with set standards of safety and performance. Strong regulations protect patient health and promote a more sustainable and dependable refurbished medical equipment market in India.

India Refurbished Medical Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, and end-user.

Product Type Insights:

- Medical Imaging Systems

- Computed Tomography Systems

- MRI Systems

- X-Ray, C-Arm and Radiography Equipment

- Ultrasound Systems

- Mammography Equipment

- Nuclear Medicine Devices

- Others

- Operating Equipment and Surgical Devices

- Anesthesia Machines and Agent Monitors

- Endoscopes and Microscopes

- Vascular Closure Devices

- Electrosurgical Units

- Atherectomy Devices

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes medical imaging systems (computed tomography systems, MRI systems, X-ray, C-arm and radiography equipment, ultrasound systems, mammography equipment, nuclear, medicine devices, and others), operating equipment and surgical devices (anesthesia machines and agent monitors, endoscopes and microscopes, vascular closure devices, electrosurgical units, atherectomy devices, and others), and others.

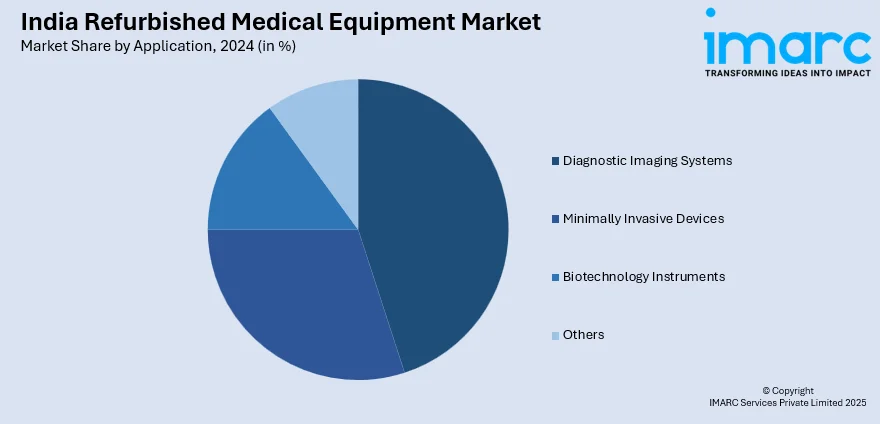

Application Insights:

- Diagnostic Imaging Systems

- Minimally Invasive Devices

- Biotechnology Instruments

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes diagnostic imaging systems, minimally invasive devices, biotechnology instruments, and others.

End-User Insights:

- Hospitals and Clinics

- Diagnostic Centers

- Ambulatory Surgical Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals and clinics, diagnostic centers, ambulatory surgical centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Refurbished Medical Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Diagnostic Imaging Systems, Minimally Invasive Devices, Biotechnology Instruments, Others |

| End-Users Covered | Hospitals and Clinics, Diagnostic Centers, Ambulatory Surgical Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India refurbished medical equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India refurbished medical equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India refurbished medical equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India refurbished medical equipment market was valued at USD 1.50 Million in 2024.

The refurbished medical equipment market in India is projected to exhibit a CAGR of 8.50% during 2025-2033, reaching a value of USD 3.40 Million by 2033.

The refurbished medical equipment market in India is driven by high-cost savings (50–60% cheaper), rising healthcare demand in rural/underserved areas, technological improvements in refurbishment, supportive government schemes (Ayushman Bharat, NHM), environmental sustainability, and growing private sector adoption due to budget constraints and quality assurance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)