India Remote Health Monitoring Market Size, Share, Trends and Forecast by Devices, Application, End-User, and Region, 2026-2034

India Remote Health Monitoring Market Overview:

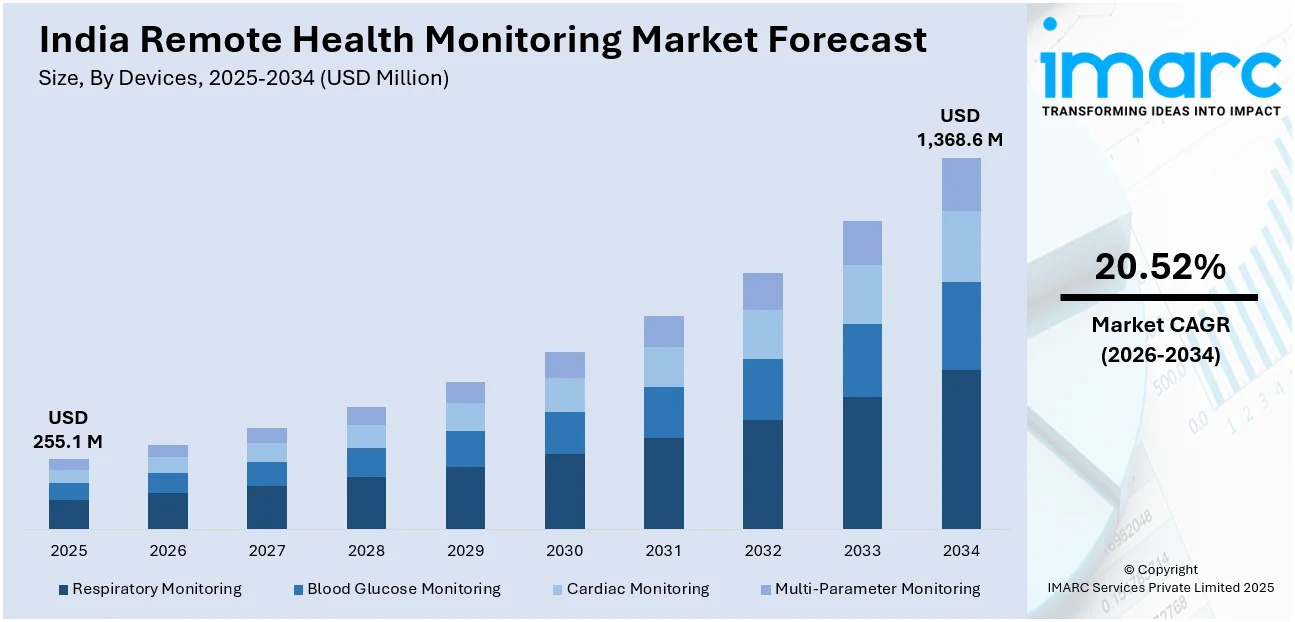

The India remote health monitoring market size reached USD 255.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,368.6 Million by 2034, exhibiting a growth rate (CAGR) of 20.52% during 2026-2034. The India remote health monitoring market is expanding due to increased digital healthcare adoption in underserved regions and growing emphasis on preventive healthcare. Government and private initiatives are enhancing rural healthcare access, while AI-integrated health platforms enable real-time monitoring, early disease detection, and proactive health management.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 255.1 Million |

| Market Forecast in 2034 | USD 1,368.6 Million |

| Market Growth Rate (2026-2034) | 20.52% |

India Remote Health Monitoring Market Trends:

Digital Health Expansion in Underserved Regions

The growing emphasis on access to rural healthcare is fueling the implementation of remote health monitoring solutions in India, with government and private sector efforts targeting healthcare inequalities. A large segment of the population lives in rural and tier III cities, where the medical infrastructure and availability of specialists are still scarce. To fill this gap, digital health platforms, artificial intelligence (AI)-driven monitoring systems, and telemedicine services are being utilized to provide ongoing patient care without needing repeated hospital visits. Cooperative efforts among healthcare providers, technology companies, and governmental bodies are facilitating the widespread deployment of remote monitoring systems, guaranteeing real-time observation of essential health metrics. The expansion of internet connectivity and mobile networks is boosting the availability of remote healthcare, enabling patients in rural regions to receive digital consultations and prompt medical care. With the increasing need for equal healthcare access, the combination of remote monitoring and rural health initiatives is vital in enhancing India's healthcare system and benefiting patient results. In 2023, LifeSigns introduced an AI-driven, round-the-clock health monitoring system designed to ensure continuous patient data transmission, regardless of whether the patient was at home, in an ambulance, or in a hospital. In collaboration with RailTel Corporation, LifeSigns aimed to extend this service to 1,000 rural and tier III cities across India over the next 1,000 days, tackling healthcare inequalities in underprivileged areas. The system facilitated continuous health tracking and prompt interventions, enhancing healthcare access for isolated communities.

To get more information on this market, Request Sample

Growing Preference for Preventive Healthcare

Individuals in India are emphasizing preventive healthcare, which boosts the need for remote health monitoring solutions that facilitate proactive disease management. As awareness about lifestyle-related diseases increases, people are looking for ways to monitor important health metrics like heart rate, blood glucose levels, and stress levels immediately. Digital health platforms are incorporating AI-enabled health insights, assisting users in making informed lifestyle decisions and identifying potential health risks at an early stage. The transition from reactive to preventive healthcare is being backed by employers, insurers, and healthcare providers who acknowledge the lasting advantages of early intervention. As individuals take a greater interest in their health and wellness, the use of remote monitoring technologies is speeding up, changing healthcare from treatment-centered models to ongoing, preventive care strategies that improve long-term health. In line with this trend, in 2025, MediBuddy joined forces with ELECOM to introduce IoT-integrated health monitoring devices in India. Devices like body composition scales and blood pressure monitors connect with MediBuddy’s platform to provide real-time health information, early detection of illnesses, and preventive measures. This partnership seeks to improve accessibility and promote proactive health management in India.

India Remote Health Monitoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on devices, application and end-user.

Devices Insights:

- Respiratory Monitoring

- Blood Glucose Monitoring

- Cardiac Monitoring

- Multi-Parameter Monitoring

The report has provided a detailed breakup and analysis of the market based on the devices. This includes respiratory monitoring, blood glucose monitoring, cardiac monitoring, and multi-parameter monitoring.

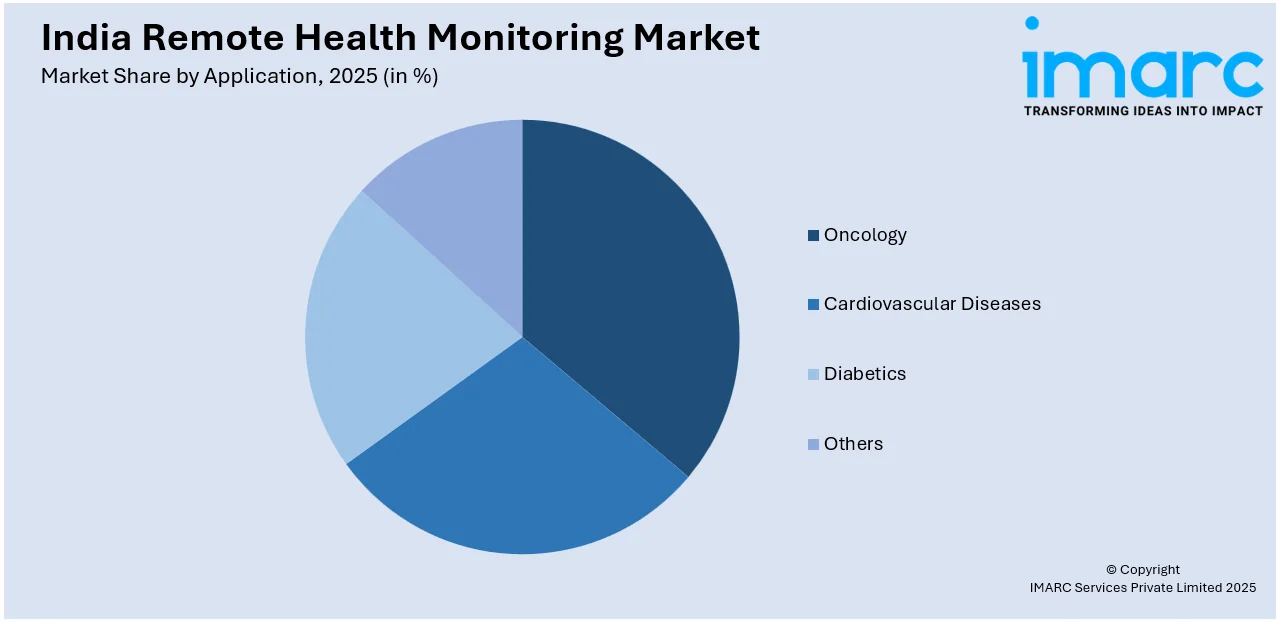

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Oncology

- Cardiovascular Diseases

- Diabetics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oncology, cardiovascular diseases, diabetics, and others.

End-User Insights:

- Hospitals

- Home Healthcare

- Diagnostic Centers

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals, home healthcare, and diagnostic centers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Remote Health Monitoring Market News:

- In November 2024, Dozee, India's first AI-based, contactless remote patient monitoring system, was introduced. It fit under a mattress and detected vibrations from heartbeats and respiratory cycles to monitor vital health parameters in real-time. The system aimed to provide continuous, non-invasive monitoring.

- In June 2024, Star Health Insurance launched the AI-driven Star Health Face Scan tool for remote health assessments. This innovative tool provided a thorough health examination in less than a minute, tracking 18 vital parameters, including blood pressure and heart rate. It aimed to enhance proactive health management and improve client engagement in the insurance sector.

India Remote Health Monitoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Devices Covered | Respiratory Monitoring, Blood Glucose Monitoring, Cardiac Monitoring, Multi-Parameter Monitoring |

| Applications Covered | Oncology, Cardiovascular Diseases, Diabetics, Others |

| End-Users Covered | Hospitals, Home Healthcare, Diagnostic Centers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India remote health monitoring market performed so far and how will it perform in the coming years?

- What is the breakup of the India remote health monitoring market on the basis of devices?

- What is the breakup of the India remote health monitoring market on the basis of application?

- What is the breakup of the India remote health monitoring market on the basis of end-users?

- What is the breakup of the India remote health monitoring market on the basis of region?

- What are the various stages in the value chain of the India remote health monitoring market?

- What are the key driving factors and challenges in the India remote health monitoring market?

- What is the structure of the India remote health monitoring market and who are the key players?

- What is the degree of competition in the India remote health monitoring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India remote health monitoring market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India remote health monitoring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India remote health monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)