India Residential Battery Storage Market Size, Share, Trends and Forecast by Battery Type, Capacity, Ownership Model, Sales Channel, Application, and Region, 2025-2033

India Residential Battery Storage Market Overview:

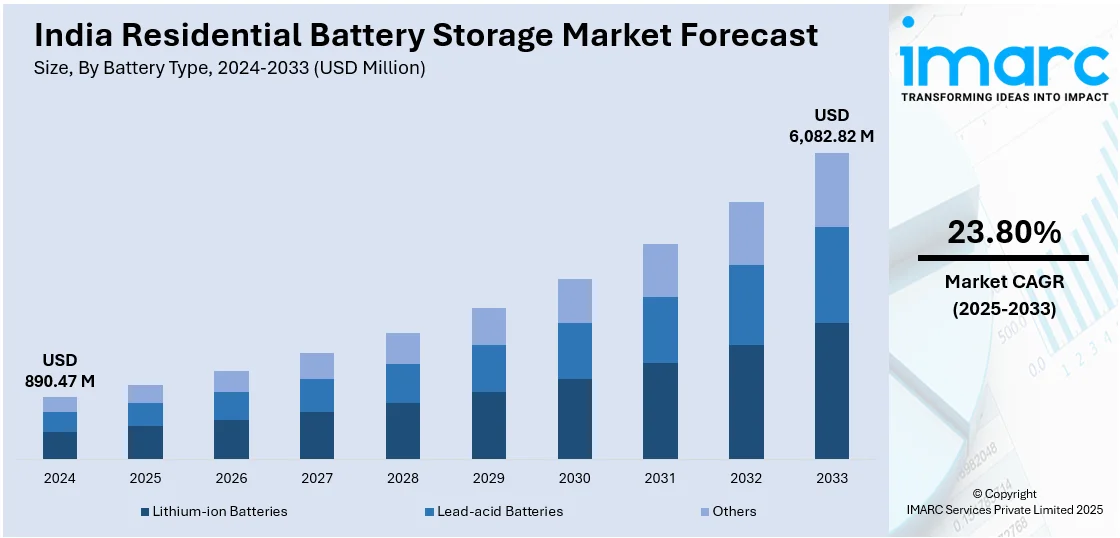

The India residential battery storage market size reached USD 890.47 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,082.82 Million by 2033, exhibiting a growth rate (CAGR) of 23.80% during 2025-2033. Rising rooftop solar adoption, growing concerns around power reliability, and increasing consumer focus on energy independence are supporting the market growth. Moreover, falling battery prices and favorable government policies are encouraging the market growth. Other key drivers include improved financing options, rising electric vehicle (EV) adoption, second-life battery use, and rapid urbanization. Apart from this, smart city initiatives, net metering reforms, advancements in battery efficiency, bundled solar-plus-storage solutions, and state-level incentives are boosting the India residential battery storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 890.47 Million |

| Market Forecast in 2033 | USD 6,082.82 Million |

| Market Growth Rate 2025-2033 | 23.80% |

India Residential Battery Storage Market Trends:

Renewable Energy Integration through Rooftop Solar

The growing adoption of rooftop solar panels in Indian households is significantly driving demand for residential battery storage. Homeowners are increasingly installing solar systems to cut down on electricity bills and take advantage of government subsidies and net metering policies. However, solar power is only available during the day, which limits its utility without a proper storage system. Battery storage helps solve this issue by capturing surplus solar energy generated during daylight hours and making it available for use at night or during outages. Residential storage also allows for greater self-consumption of solar power, which makes solar systems more efficient and financially viable. As rooftop solar becomes more popular, especially in standalone homes and gated communities, the value of pairing it with a battery system is becoming more apparent to end-users and housing developers alike.

To get more information on this market, Request Sample

Power Outages in Semi-Urban and Rural Areas

Unreliable power supply in semi-urban and rural regions continues to be a major factor behind the growing interest in residential battery storage. Many households in these areas still experience daily or weekly outages, particularly during summer months or heavy rains. Diesel generators have long been used as backups, but rising fuel costs, maintenance issues, and environmental concerns have made them less attractive. In contrast, battery storage offers a quieter, cleaner, and increasingly affordable alternative. Combined with solar panels, these systems can provide reliable electricity for essential needs such as lighting, fans, mobile charging, and small appliances. As awareness increases and more pilot programs demonstrate success, demand for home storage systems in these underserved areas is steadily picking up, offering a clear growth avenue for market players.

Government Incentives and the PLI Scheme

Government support, particularly through the Production Linked Incentive (PLI) scheme, is giving a major push to India’s battery storage ecosystem. The PLI scheme encourages domestic manufacturing of advanced chemistry cell (ACC) batteries by offering performance-linked financial incentives to companies that meet production targets. This is expected to expand battery manufacturing capacity in the country, reduce dependence on imports, and lower prices in the long run. For the residential market, this means more affordable and locally available battery solutions. In addition to this, several state-level policies are promoting solar-plus-storage systems for individual homes and housing societies, which includes capital subsidies, interest-free loans, and supportive net metering rules, further providing a thrust to the India residential battery storage market growth.

India Residential Battery Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on battery type, capacity, ownership model, sales channel, and application.

Battery Type Insights:

- Lithium-ion Batteries

- Lead-acid Batteries

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion batteries, lead-acid batteries, and others.

Capacity Insights:

- Below 5 kWh

- 5–10 kWh

- 10–20 kWh

- Above 20 kWh

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes below 5 kWh, 5–10 kWh, 10–20 kWh, and above 20 kWh.

Ownership Model Insights:

- Customer-owned Systems

- Third-party Owned/Leasing Models

The report has provided a detailed breakup and analysis of the market based on the ownership model. This includes customer-owned systems and third-party owned/leasing models.

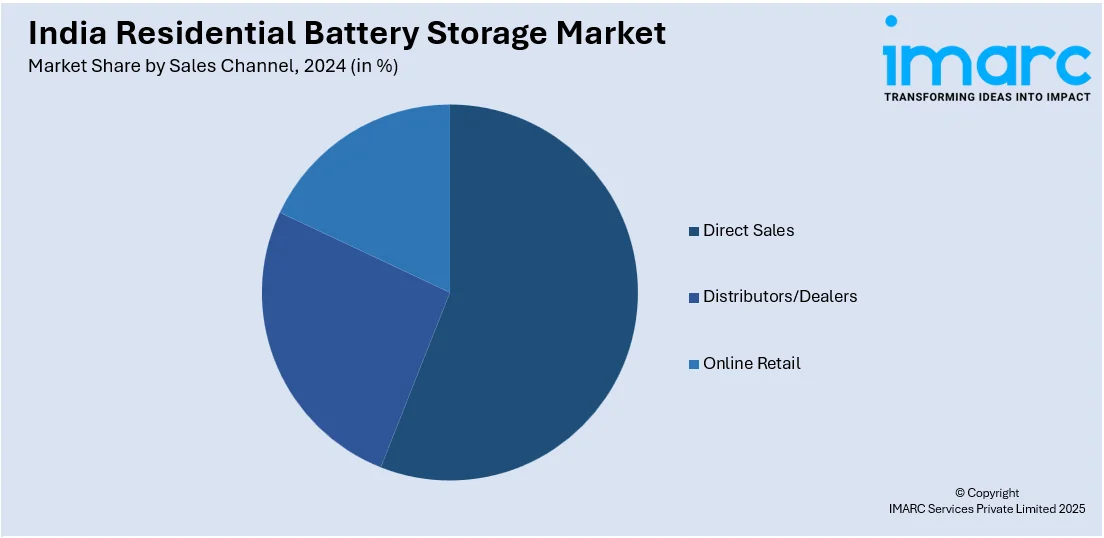

Sales Channel Insights:

- Direct Sales

- Distributors/Dealers

- Online Retail

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes direct sales, distributors/dealers, and online retail.

Application Insights:

- Backup Power Supply

- Solar Energy Storage

- Off-grid Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes backup power supply, solar energy storage, off-grid systems, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Residential Battery Storage Market News:

- In 2024, JSW Energy and South Korea's LG Energy Solution are negotiating USD $1.5 billion joint venture to manufacture batteries for electric vehicles and renewable energy storage in India. The proposed plant would have a capacity of 10 GWh, with 70% of production for JSW's use and 30% for LGES.

India Residential Battery Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-ion Batteries, Lead-acid Batteries, Others |

| Capacities Covered | Below 5 kWh, 5–10 kWh, 10–20 kWh, Above 20 kWh |

| Ownership Models Covered | Customer-owned Systems, Third-party Owned/Leasing Models |

| Sales Channels Covered | Direct Sales, Distributors/Dealers, Online Retail |

| Applications Covered | Backup Power Supply, Solar Energy Storage, Off-grid Systems, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India residential battery storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India residential battery storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India residential battery storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The residential battery storage market in India was valued at USD 890.47 Million in 2024.

The India residential battery storage market is projected to exhibit a CAGR of 23.80% during 2025-2033, reaching a value of USD 6,082.82 Million by 2033.

The market is driven by the rising adoption of rooftop solar systems, increasing demand for uninterrupted power supply, and government initiatives promoting clean energy solutions. Declining lithium-ion battery costs and advancements in energy management systems further support market growth. Additionally, growing concerns over grid reliability and power outages are accelerating residential energy storage installations across urban and semi-urban areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)