India Residential Energy Storage Market Size, Share, Trends and Forecast by Technology, Installation Type, End-User, and Region, 2025-2033

India Residential Energy Storage Market Overview:

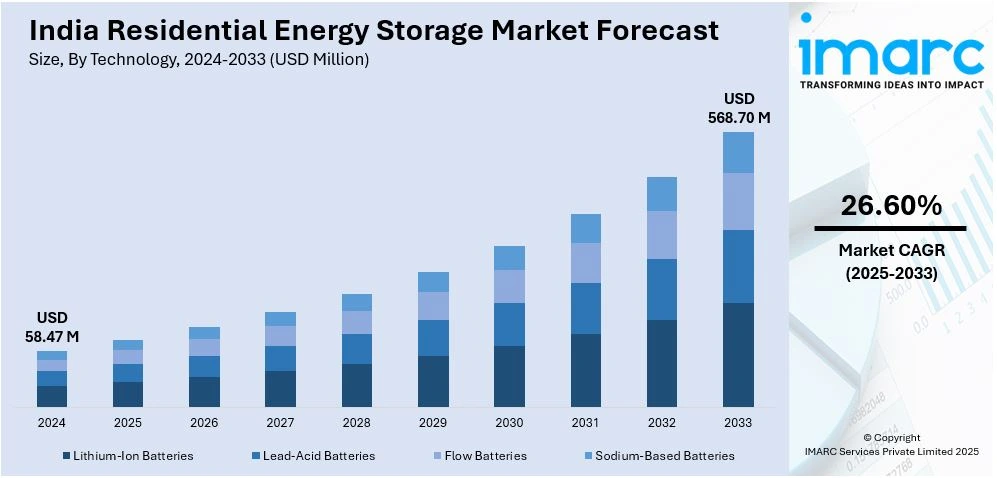

The India residential energy storage market size reached USD 58.47 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 568.70 Million by 2033, exhibiting a growth rate (CAGR) of 26.60% during 2025-2033. The rising energy demand, increasing focus on renewable energy integration, government incentives for energy storage, advancements in battery technology, growing adoption of electric vehicles, need for grid stability, industrial and residential energy backup requirements, and sustainability initiatives are expanding the India residential energy storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 58.47 Million |

| Market Forecast in 2033 | USD 568.70 Million |

| Market Growth Rate 2025-2033 | 26.60% |

India Residential Energy Storage Market Trends:

Growing Adoption of Lithium-Ion Batteries in Residential Energy Storage

The Indian residential energy storage market growth is driven by a significant shift towards lithium-ion batteries, due to their higher energy density, longer lifespan, and declining costs. With the rapid growth of renewable energy installations, particularly rooftop solar panels, homeowners are increasingly investing in energy storage solutions to ensure uninterrupted power supply and energy independence. Moreover, the implementation of government initiatives such as subsidies under the Solar Rooftop Scheme and net metering policies are further encouraging residential consumers to integrate lithium-ion battery storage with solar systems. For instance, on February 29, 2024, The PM-Surya Ghar: Muft Bijli Yojana was approved by the Union Cabinet, assigning INR 75,021 Crore (about USD 8,775 Million) to install rooftop solar systems in one crore households, delivering up to 300 units of free electricity as per month. In the scheme, subsidies range from INR 30,000 (about USD 351) for 1 kW systems to INR 78,000 (about USD 911.8) for systems of 3 kW or more. Over 25 years, this project seeks to reduce 720 Million Tons of CO₂ emissions, generate 1,000 Billion units of electricity, and add 30 GW of solar capacity. As the scheme reduces reliance on grid electricity and promotes self-sufficiency, it will further stimulate investments in home energy management systems, thereby strengthening India's residential storage ecosystem. Additionally, advancements in battery technology and domestic manufacturing under the Production-Linked Incentive (PLI) scheme are reducing dependency on imports and making lithium-ion batteries more affordable. The increasing demand for sustainable energy solutions, combined with rising electricity costs and power outages, is pushing the adoption of these batteries. As technological innovations continue, lithium-ion storage is expected to dominate the market, providing efficient and cost-effective energy solutions for Indian households.

To get more information on this market, Request Sample

Rising Demand for Modular Energy Storage Systems

Modular energy storage systems are gaining traction in India's residential sector due to their scalability, flexibility, and ability to optimize energy usage. These systems allow homeowners to expand their energy storage capacity as needed, making them a cost-effective and future-proof investment. With the growing concerns over grid instability, especially in urban and semi-urban areas, modular storage solutions enable better energy management by storing excess solar energy and using it during peak demand hours. The rising awareness regarding energy efficiency and carbon footprint reduction is further fueling their adoption, which is positively impacting India residential energy storage market outlook. For instance, on March 29, 2024, Energy solutions supplier Energeia declared that it is dedicated to using new energy solutions to improve sustainability and efficiency in Indian companies. Energeia redesigned the compressed air system in partnership with an automobile manufacturer, resulting in monthly energy savings of more than 22% on average. Additionally, by encouraging the use of clean energy and lowering greenhouse gas emissions, Energeia actively supports several UN Sustainable Development Goals, such as Affordable and Clean Energy (SDG 7) and Climate Action (SDG 13). Moreover, manufacturers are focusing on user-friendly, plug-and-play storage systems that integrate seamlessly with existing solar setups. As more consumers look for personalized and adaptive energy solutions, the demand for modular systems is expected to increase, creating opportunities for innovation and investment in India's residential energy storage market.

India Residential Energy Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on technology, installation type, and end- user.

Technology Insights:

- Lithium-Ion Batteries

- Lead-Acid Batteries

- Flow Batteries

- Sodium-Based Batteries

The report has provided a detailed breakup and analysis of the market based on the technology. This includes lithium-ion batteries, lead-acid batteries, flow batteries, and sodium-based batteries.

Installation Type Insights:

- Wall-Mounted

- Floor-Mounted

- Modular

A detailed breakup and analysis of the market based on the installation type have also been provided in the report. This includes wall-mounted, floor-mounted, and modular.

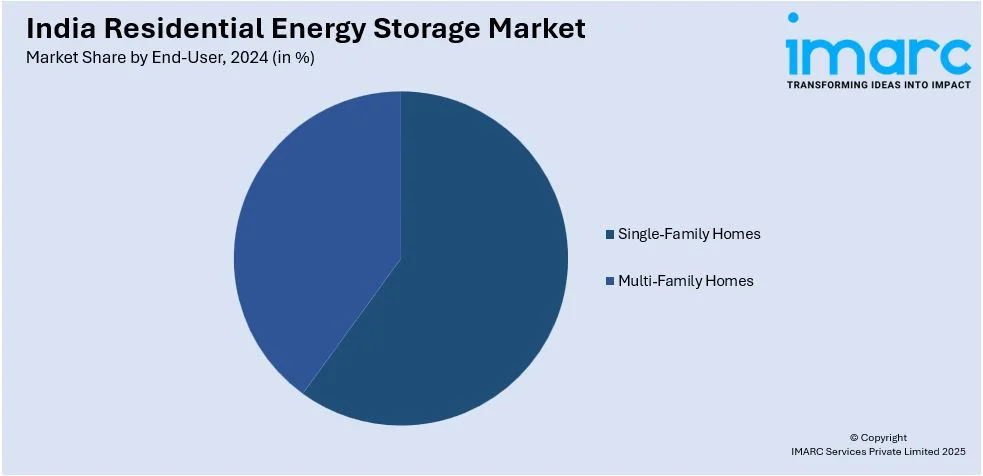

End-User Insights:

- Single-Family Homes

- Multi-Family Homes

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes single-family homes and multi-family homes.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Residential Energy Storage Market News:

- On March 25, 2025, PuRE Power unveiled their newest energy storage product with the goal of promoting the integration of renewable energy sources and improving grid stability. With a 100 megawatt-hour (MWh) storage capacity, the system aims to meet the increasing demand for dependable energy solutions. With this launch, energy storage technology in the area has advanced significantly.

India Residential Energy Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Lithium-Ion Batteries, Lead-Acid Batteries, Flow Batteries, Sodium-Based Batteries |

| Installation Types Covered | Wall-Mounted, Floor-Mounted, Modular |

| End- Users Covered | Single-Family Homes, Multi-Family Homes |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India residential energy storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India residential energy storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India residential energy storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The residential energy storage market in India was valued at USD 58.47 Million in 2024.

The India residential energy storage market is projected to exhibit a CAGR of 26.60% during 2025-2033, reaching a value of USD 568.70 Million by 2033.

Rising electricity costs and frequent power outages in many cities are encouraging homeowners to invest in energy storage systems to ensure reliable and uninterrupted power. Government incentives, subsidies, and supportive policies for solar energy adoption are further promoting the integration of storage technologies in residential setups. Moreover, advancements in battery technologies, particularly in lithium-ion batteries, are making storage systems more compact, efficient, and affordable.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)