India Respiratory Care Devices Market Size, Share, Trends and Forecast by Product Type, Indication, End User, and Region, 2025-2033

India Respiratory Care Devices Market Overview:

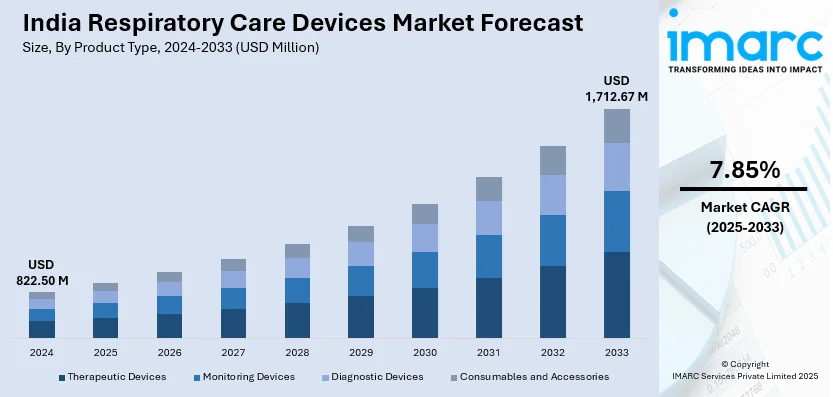

The India respiratory care devices market size reached USD 822.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,712.67 Million by 2033, exhibiting a growth rate (CAGR) of 7.85% during 2025-2033. The market is experiencing steady growth due to the rising respiratory disorders, an aging population, and technological advancements. Increased healthcare investments and demand for portable, non-invasive devices are also driving market growth, enhancing patient care and treatment accessibility across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 822.50 Million |

| Market Forecast in 2033 | USD 1,712.67 Million |

| Market Growth Rate 2025-2033 | 7.85% |

India Respiratory Care Devices Market Trends:

Technological Advancements

Technological advancements are transforming the India respiratory care devices market, with innovations such as portable oxygen concentrators, non-invasive ventilators and smart inhalers improving patient outcomes. These advancements are boosting India respiratory care devices market share by enhancing accessibility and efficiency. The integration of AI-driven monitoring and IoT-enabled respiratory devices is further optimizing treatment ensuring real-time health tracking and better disease management. For instance, in December 2024, Cipla launched CipAir, a mobile application for asthma screening in India available on Android and soon on iOS. This free tool uses acoustic analysis and AI to assess asthma risk and guide users to appropriate actions enhancing patient care and empowering individuals to manage their lung health effectively. Increasing demand for home-based respiratory care solutions is also driving innovation in compact, user-friendly and cost-effective devices. As healthcare infrastructure strengthens and awareness rises, the India respiratory care devices market outlook remains positive, with continued advancements expected.

To get more information on this market, Request Sample

Expanding Geriatric Population

India’s expanding geriatric population is significantly driving the demand for respiratory care devices as aging individuals are more susceptible to conditions like chronic obstructive pulmonary disease (COPD), asthma and sleep apnea. According to the data published by UNFPA, India's elderly population is set to soar from 153 million (aged 60 and above) to 347 million by 2050, highlighting significant demographic shifts. With rising life expectancy and an increasing elderly population there is a growing need for advanced respiratory support solutions, including oxygen concentrators, ventilators and CPAP devices. Additionally, healthcare providers are focusing on home-based respiratory care to enhance convenience and reduce hospital dependency. The integration of smart AI-powered monitoring systems is further improving patient management by enabling real-time tracking of respiratory health. Government initiatives to strengthen geriatric healthcare coupled with increasing investments in medical technology are also contributing to market expansion. Furthermore, the rising burden of air pollution and lifestyle-related disorders is exacerbating respiratory issues among the elderly, reinforcing the need for effective treatment solutions. These factors are fueling India respiratory care devices market growth.

India Respiratory Care Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, indication and end user.

Product Type Insights:

- Therapeutic Devices

- Monitoring Devices

- Diagnostic Devices

- Consumables and Accessories

The report has provided a detailed breakup and analysis of the market based on the product type. This includes therapeutic devices, monitoring devices, diagnostic devices and consumables and accessories.

Indication Insights:

- Chronic Obstructive Pulmonary Disease (COPD)

- Infectious Diseases

- Asthma

- Sleep Apnea

- Others

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes chronic obstructive pulmonary disease (COPD), infectious diseases, asthma, sleep apnea and others.

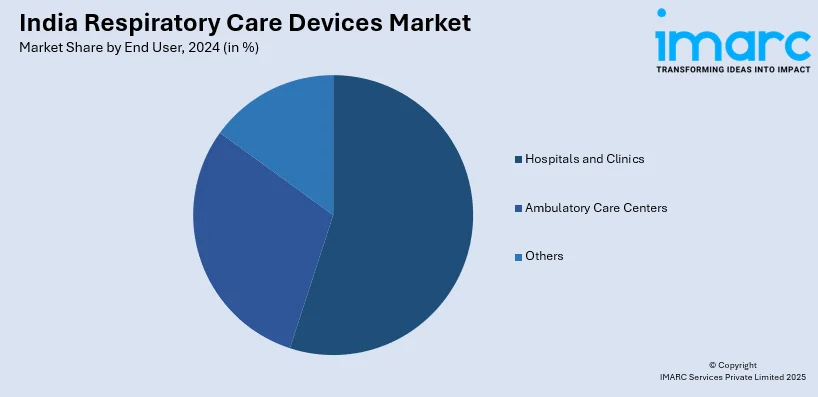

End User Insights:

- Hospitals and Clinics

- Ambulatory Care Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory care centers and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Respiratory Care Devices Market News:

- In March 2025, Aerogen, an Ireland-based medtech company, opened its headquarters in Delhi to enhance respiratory care in India, addressing the needs of over 55 million COPD patients. Inaugurated by Minister James Lawless, this expansion emphasizes collaboration and innovation in healthcare, supporting advanced aerosol drug delivery solutions in the region.

- In February 2024, Getinge launched its advanced Servo-c ventilator in India to enhance respiratory care for both pediatric and adult patients. Designed for accessibility and affordability, the device offers features like CO2 monitoring and modular components, strengthening ICU capabilities and improving patient outcomes, reaffirming Getinge's commitment to healthcare innovation in the country.

India Respiratory Care Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Therapeutic Devices, Monitoring Devices, Diagnostic Devices, Consumables and Accessories |

| Indications Covered | Chronic Obstructive Pulmonary Disease (COPD), Infectious Diseases, Asthma, Sleep Apnea, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Care Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India respiratory care devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India respiratory care devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India respiratory care devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The respiratory care devices market in India was valued at USD 822.50 Million in 2024.

The India respiratory care devices market is projected to exhibit a CAGR of 7.85% during 2025-2033, reaching a value of USD 1,712.67 Million by 2033.

The India respiratory care devices market is primarily driven by rising cases of respiratory illnesses, increasing pollution levels, and growing aging population. Demand is further supported by heightened health awareness, technological advancements in portable and home-based devices, and expanding access to healthcare infrastructure across urban and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)