India Respiratory Monitoring Market Size, Share, Trends and Forecast by Product, Indication, End User, and Region, 2025-2033

India Respiratory Monitoring Market Size and Share:

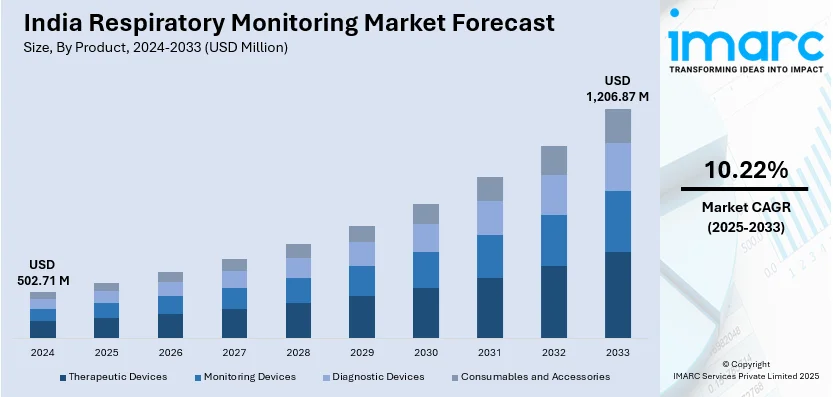

The India respiratory monitoring market size reached USD 502.71 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,206.87 Million by 2033, exhibiting a growth rate (CAGR) of 10.22% during 2025-2033. The rising respiratory diseases, increasing air pollution, growing geriatric population, continual advancements in diagnostic technologies, higher healthcare spending, implementation of government initiatives for respiratory health, expanding telemedicine adoption, and increasing awareness about early disease detection and management are some of the major factors expanding India respiratory monitoring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 502.71 Million |

| Market Forecast in 2033 | USD 1,206.87 Million |

| Market Growth Rate 2025-2033 | 10.22% |

India Respiratory Monitoring Market Trends:

Rising Demand for Respiratory Monitoring Devices Amid Increasing Respiratory Diseases

The rising prevalence of respiratory diseases such as COPD, asthma, and sleep apnea drives the India respiratory monitoring market growth. According to an industry report, respiratory system diseases account for 15.3% of all prescriptions written for all patients in India, making it the largest disease category in the country. Contributing factors include indoor pollution from biomass fuels, tobacco use by over 267 Million people, and significant air pollution. Strict public health laws, early identification, and treatment compliance are necessary to address these issues and mitigate the catastrophe. Also, the high burden of respiratory diseases leads to the requirement for respiratory monitoring across the country. Factors like increasing pollution levels, high smoking rates, and the long-term effects of COVID-19 have heightened the demand for advanced respiratory monitoring devices. Pulse oximeters, gas analyzers, and spirometers are gaining traction in hospitals, home healthcare, and emergency care settings. Additionally, growing awareness regarding early diagnosis and government-led healthcare initiatives are driving market expansion. With the adoption of telemedicine and remote monitoring solutions, patients now have greater access to real-time respiratory health tracking. Furthermore, technological advancements, including AI-integrated monitoring systems, are enhancing the accuracy and efficiency of diagnosis. As healthcare infrastructure improves and affordability increases, the respiratory monitoring market in India is poised for steady growth, offering opportunities for both domestic and international players.

To get more information on this market, Request Sample

Technological Advancements and Wearable Respiratory Monitoring Solutions

Innovations in respiratory monitoring technology are reshaping the Indian market, with wearable and portable devices seeing growing adoption. The integration of AI, IoT, and cloud-based monitoring solutions is enhancing real-time respiratory data analysis, benefiting both patients and healthcare providers. Wearable pulse oximeters, smart inhalers, and wireless spirometers are becoming popular for continuous monitoring, particularly for patients with chronic conditions. These advancements are also making respiratory monitoring more accessible, especially in rural areas where healthcare infrastructure is limited. The demand for remote patient monitoring has surged post-pandemic, prompting manufacturers to develop compact and user-friendly devices. Additionally, the increasing penetration of mobile health (mHealth) applications is improving patient compliance and facilitating proactive disease management, which in turn is positively impacting the India respiratory monitoring market outlook. As India's healthcare sector continues to embrace digital transformation, the respiratory monitoring market is expected to witness sustained growth fueled by technological innovation and increasing consumer awareness. For instance, according to an industry report on January 20, 2025, programs such as the Ayushman Bharat Digital Mission (ABDM), have successfully registered over 5 lakh health professionals and created over 73 Crore Ayushman Bharat Health Accounts (ABHA). India has the potential to become a worldwide leader in digital health by utilizing public-private partnerships, emphasizing interoperability, and establishing strong data governance frameworks. These developments are intended to improve the nation's healthcare delivery efficiency, affordability, and accessibility.

India Respiratory Monitoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, indication, and end user.

Product Insights:

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- Ventilators

- Nebulizers

- Humidifiers

- Inhalers

- Others

- Monitoring Devices

- Pulse Oximeters

- Gas Analyzers

- Others

- Diagnostic Devices

- Spirometers

- Polysomnography Devices

- Peak Flow Meters

- Others

- Consumables and Accessories

- Masks

- Disposable Resuscitators

- Breathing Circuits

- Tracheostomy Tubes

- Nasal Cannulas

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes therapeutic devices (positive airway pressure (pap) devices, ventilators, nebulizers, humidifiers, inhalers, and others), monitoring devices (pulse oximeters, gas analyzers, and others), diagnostic devices (spirometers, polysomnography devices, peak flow meters, and others), and consumables and accessories (masks, disposable resuscitators, breathing circuits, tracheostomy tubes, nasal cannulas, and others).

Indication Insights:

- Chronic Obstructive Pulmonary Disease (COPD)

- Asthma

- Sleep Apnea

- Infectious Disease

- Others

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes chronic obstructive pulmonary disease (copd), asthma, sleep apnea, infectious disease, and others.

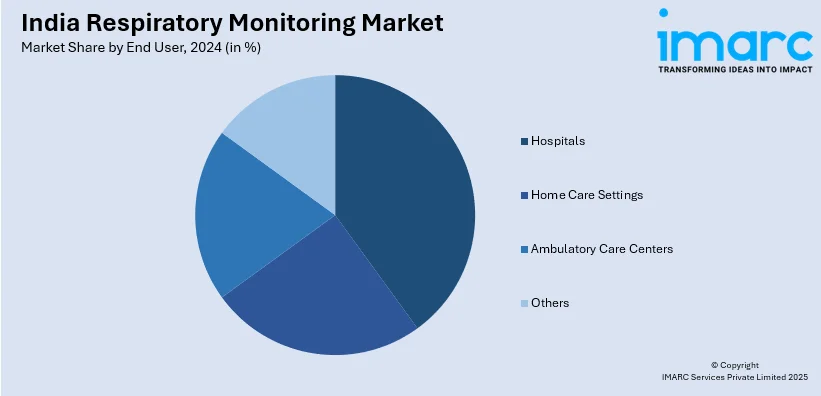

End User Insights:

- Hospitals

- Home Care Settings

- Ambulatory Care Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, home care settings, ambulatory care centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Respiratory Monitoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Indications Covered | Chronic Obstructive Pulmonary Disease (COPD), Asthma, Sleep Apnea, Infectious Disease, Others |

| End Users Covered | Hospitals, Home Care Setting, Ambulatory Care Center, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India respiratory monitoring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India respiratory monitoring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India respiratory monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The respiratory monitoring market in India was valued at USD 502.71 Million in 2024.

The India respiratory monitoring market is projected to exhibit a (CAGR) of 10.22% during 2025-2033, reaching a value of USD 1,206.87 Million by 2033.

The growth in the India respiratory monitoring market is driven by rising cases of respiratory diseases, rising pollution, and increasing geriatric population. Improvements in home-use and portable monitoring devices, together with heightened healthcare awareness, are driving adoption. Increased healthcare infrastructure and adoption of IoT-enabled respiratory devices also improve accessibility and accuracy of patient care.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)