India Retort Pouches Market Size, Share, Trends and Forecast by Product Type, Capacity, Closure Type, Material Type, Application, and Region, 2025-2033

India Retort Pouches Market Summary:

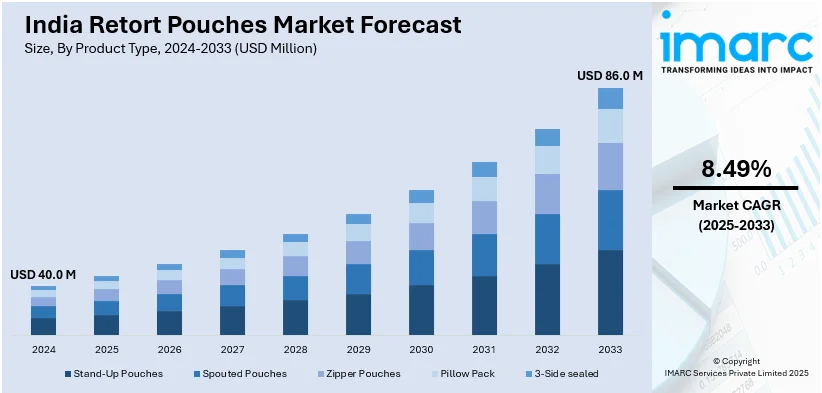

The India retort pouches market size reached USD 40.0 Million in 2024. The market is expected to reach USD 86.0 Million by 2033, exhibiting a growth rate (CAGR) of 8.49% during 2025-2033. The market growth is attributed to increasing demand for convenient, ready-to-eat food products, rising consumer preference for longer shelf life, expanding e-commerce platforms, growing urbanization, changing lifestyles, rising disposable incomes, and the food industry's focus on packaging innovations to ensure product safety and maintain nutritional value.

Market Insights:

- Based on region, the market is divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of product type, the market is categorized as stand-up pouches, spouted pouches, zipper pouches, pillow pack, and 3-side sealed.

- Based on the capacity, the market is segmented into low and high.

- On the basis of closure type, the market is categorized as with cap and without cap.

- Based on the material type, the market is segmented into polypropylene, aluminum foil, polyester, nylon, paper & paperboard, and others.

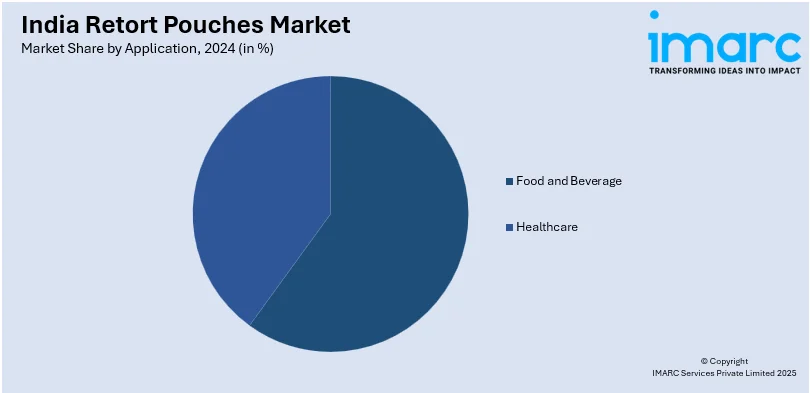

- On the basis of application, the market is categorized as food and beverage and healthcare.

Market Size and Forecast:

- 2024 Market Size: USD 40.0 Million

- 2033 Projected Market Size: USD 86.0 Million

- CAGR (2025-2033): 8.49%

Retort pouches are heat-resistant flexible packages used in the packaging of pharmaceutical products and convenient food items. These pouches undergo sterilization at high temperatures to prevent the contents from spoilage. As they are laminated with layers of plastic and lightweight PET films, retort pouches also enhance shelf life, retain flavors for a prolonged time and make the storage and handling of the product convenient.

To get more information on this market, Request Sample

The Government of India has undertaken numerous initiatives, which is a significant factor augmenting the India retort pouches market share. For instance, the 2016 agreement between the Indian Railway Catering and Tourism Corporation (IRCTC) with the Defense Food Research Laboratory (DFRL) to provide convenient, hygienic and ready-to-eat (RTE) food to the passengers has increased the demand for retort pouches. Moreover, the escalating demand for single-serve food products, on account of hectic lifestyles and the burgeoning foodservice sector, is strengthening the market growth in India. However, the retort pouches market has been adversely affected due to the imposition of lockdown and the ongoing coronavirus disease (COVID-19) pandemic.

India Retort Pouches Market Trends:

Government Support and Policy Incentives

The government has been progressively encouraging modern packaging technologies through supportive policies aimed at improving food processing efficiency and reducing post-harvest losses. Moreover, schemes under the Ministry of Food Processing Industries have promoted infrastructure development, including cold chains and packaging facilities, which in turn support the India retort pouches market growth. These pouches are especially suitable for ready-to-eat and long shelf-life food products, aligning with the government's goal to minimize food wastage and enhance value addition. Government initiatives aimed at boosting food processing infrastructure and promoting sustainable packaging are also contributing to market expansion. Besides this, state-level industrial policies often provide financial incentives, such as capital subsidies and tax exemptions, for enterprises involved in packaging innovation. Regulatory updates on labelling, quality standards, and safety compliance are also being streamlined to accommodate flexible packaging solutions like retort pouches. As per the India retort pouches market research report, government's "Make in India" initiative further motivates domestic production of high-barrier films and sealing technology used in retort pouches, thereby strengthening the manufacturing ecosystem and encouraging local players to adopt advanced packaging solutions at scale.

Rising Demand for Convenience and Urban Consumption

India's rapid urbanization and the increasing number of nuclear families and working professionals have significantly influenced consumer eating habits, resulting in a strong demand for convenience-based packaging formats like retort pouches. These pouches offer long shelf life without refrigeration, are lightweight, easy to store, and suitable for single-serve portions—features that cater to the fast-paced lifestyle of urban consumers. In addition to this, the growing popularity of ready-to-eat meals, instant curries, and heat-and-serve snacks has led food processors to favor retort pouches over traditional cans or glass containers. Additionally, the pouch format allows for better space utilization, both during transportation and on retail shelves, which adds to its commercial appeal. Apart from this, the rapid growth of food and beverage sector in India is a significant trend driving the India retort pouches market demand. Besides that, innovations such as spouted pouches, easy-tear notches, and microwave-compatible materials further enhance user convenience and brand differentiation. This trend is reinforced by the expanding presence of online grocery platforms and food delivery services, which require packaging that is durable, leak-proof, and aesthetically appealing for consumer satisfaction and retention.

Challenges and Opportunities in India Retort Pouches Market:

The market presents a dynamic mix of challenges and opportunities shaped by evolving consumer preferences, regulatory shifts, and technological advancements. One of the key challenges lies in recycling complexities due to multi-layered film structures, which limit large-scale adoption amid rising environmental concerns and regulatory pressure for sustainable packaging. Additionally, high initial investment costs in retort processing equipment and the need for specialized sealing and sterilization infrastructure pose entry barriers for small and medium enterprises. However, as per the India retort pouches market analysis, the market offers significant opportunities. The growing demand for ready-to-eat meals, increasing penetration of modern retail and e-commerce platforms, and expanding food service industry create a fertile ground for market growth. Innovations in recyclable mono-material pouches and microwave-compatible formats are opening new avenues for eco-conscious and convenience-driven consumers. With supportive government policies aimed at strengthening food processing and packaging sectors, the market is well-positioned to capitalize on rising urban consumption and technological upgrades.

India Retort Pouches Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India retort pouches market report, along with forecasts at the country level from 2025-2033. Our report has categorized the market based on product type, capacity, closure type, material type, and application.

Breakup by Product Type:

- Stand-Up Pouches

- Spouted Pouches

- Zipper Pouches

- Pillow Pack

- 3-Side sealed

Breakup by Capacity:

- Low

- Medium

- High

Breakup by Closure Type:

- With Cap

- Without Cap

Breakup by Material Type:

- Polypropylene

- Aluminum Foil

- Polyester

- Nylon

- Paper & Paperboard

- Others

Breakup by Application:

- Food and Beverage

- Healthcare

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

India Retort Pouches Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product Type, Capacity, Closure Type, Material Type, Application, Region |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India retort pouches market was valued at USD 40.0 Million in 2024.

We expect the India retort pouches market to exhibit a CAGR of 8.49% during 2025-2033.

The rising adoption of retort pouch packaging across numerous organizations for brand differentiation, as these pouches offer aesthetic appeal, customizable packaging, and convenient labelling solutions, is primarily driving the India retort pouches market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous end-use industries for retort pouches.

Based on the product type, the India retort pouches market can be segmented into stand-up pouches, spouted pouches, zipper pouches, pillow pack, and 3-side sealed. Among these, stand-up pouches currently hold the majority of the total market share.

Based on the capacity, the India retort pouches market has been divided into low, medium, and high. Currently, medium exhibits a clear dominance in the market.

Based on the closure type, the India retort pouches market can be categorized into with cap and without cap, where without cap accounts for the majority of the total market share.

Based on the material type, the India retort pouches market has been segregated into polypropylene, aluminum foil, polyester, nylon, paper & paperboard, and others. Among these, polypropylene currently exhibits a clear dominance in the market.

Based on the application, the India retort pouches market can be bifurcated into food and beverage and healthcare. Currently, the food and beverage industry holds the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)