India Rigid Plastic Packaging Market Size, Share, Trends and Forecast by Raw Material, Production Method, End User, and Region, 2026-2034

India Rigid Plastic Packaging Market Overview:

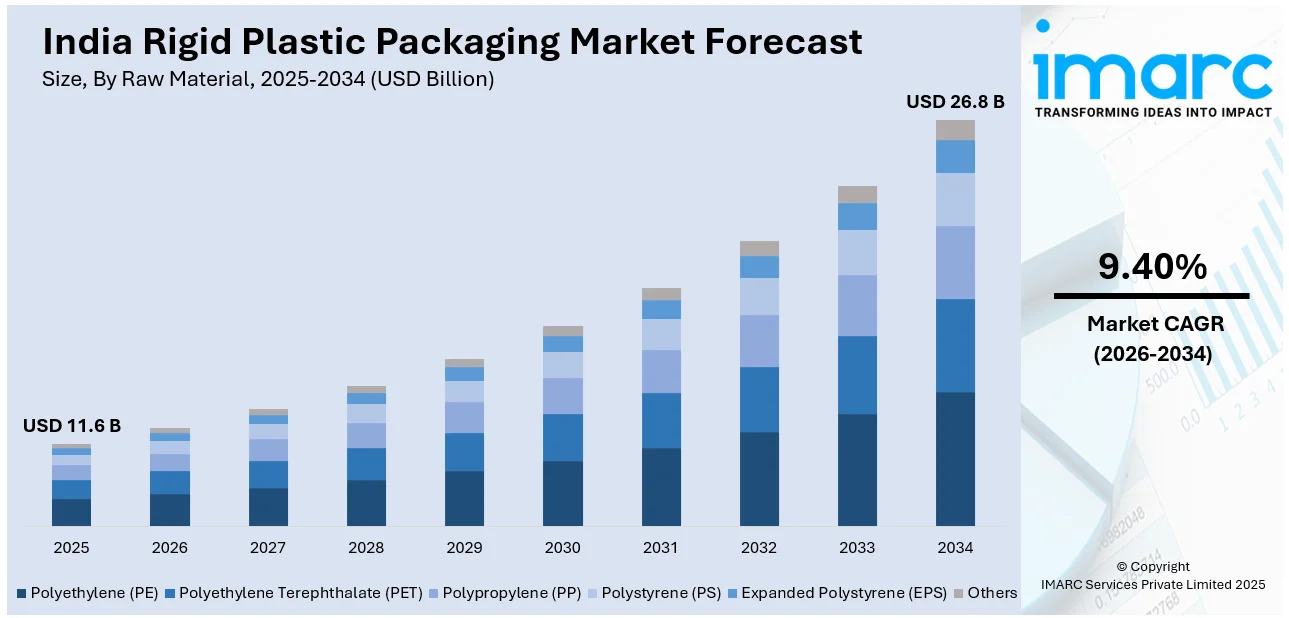

The India rigid plastic packaging market size reached USD 11.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 26.8 Billion by 2034, exhibiting a growth rate (CAGR) of 9.40% during 2026-2034. The market is driven by rising demand from the food and beverage (F&B) sector, growing urbanization, increasing preference for lightweight and durable packaging, and expanding pharmaceutical and personal care industries. Additionally, advancements in recyclable rigid plastics and evolving consumer lifestyles are further propelling market growth across sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11.6 Billion |

| Market Forecast in 2034 | USD 26.8 Billion |

| Market Growth Rate 2026-2034 | 9.40% |

India Rigid Plastic Packaging Market Trends:

Shift Toward Sustainable and Recyclable Packaging Materials

A prominent trend in India’s rigid plastic packaging market is the growing shift toward sustainable and recyclable packaging solutions, driven by growing environmental awareness and regulatory pressures, manufacturers are increasingly adopting sustainable materials such as recyclable PET, HDPE, and bio-based plastics. Additionally, they are incorporating circular economy practices, including the use of post-consumer recycled content, to reduce environmental impact. This trend is reinforced by government initiatives, including Extended Producer Responsibility (EPR) and efforts to curb single-use plastics. Notably, India aims for 100% sustainable packaging in e-commerce deliveries by 2025, underlining the nationwide transition toward green packaging. Consequently, rigid plastic packaging is being redesigned to comply with evolving sustainability standards, meeting regulatory norms and resonating with environmentally conscious consumers.

To get more information on this market Request Sample

Technological Advancements in Packaging Design and Manufacturing

Technological innovation is profoundly changing India's rigid plastic packaging, improving functionality and appearance. New molding technologies like injection stretch blow molding (ISBM) and thermoforming are allowing the manufacture of light but robust containers with intricate shapes and exact dimensions. Barrier technology innovations are also improving product shelf life, especially in the food and pharmaceutical industries. Apart from this, the smart labeling and digital printing technologies are gaining greater traction, allowing for increased brand visibility, product traceability, and counterfeiting avoidance. Industry 4.0 practices and automation are increasingly being applied across the board in packaging manufacturing lines, increasing productivity and reducing operations expense. All these developments are prompting manufacturers to provide high-performance, value-added packaging solutions for various industrial and consumer requirements.

Rising Demand from E-commerce and Organized Retail Channels

The rapid growth of e-commerce and organized retail in India is significantly influencing rigid plastic packaging preferences. With the e-commerce sector projected to exceed $350 billion by 2030, the demand for durable, tamper-proof, and visually appealing packaging solutions is accelerating. Rigid plastic containers are increasingly essential for protecting products during transit and ensuring secure deliveries. The rise of online grocery shopping and direct-to-consumer (D2C) brands is also driving demand for lightweight, convenient, and standardized packaging formats. Additionally, retailers are emphasizing shelf-ready and stackable packaging to optimize space and enhance visual appeal. As market competition intensifies, brands are leveraging innovative rigid plastic packaging designs not only for product safety but also to stand out and boost customer engagement through superior presentation.

India Rigid Plastic Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on raw material, production method and end user.

Raw Material Insights:

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polystyrene (PS)

- Expanded Polystyrene (EPS)

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP), polystyrene (PS), expanded polystyrene (EPS), and others.

Production Method Insights:

- Blow Molding

- Injection Molding

- Rotomolding

- Others

A detailed breakup and analysis of the market based on the production method have also been provided in the report. This includes blow molding, injection molding, rotomolding, and others.

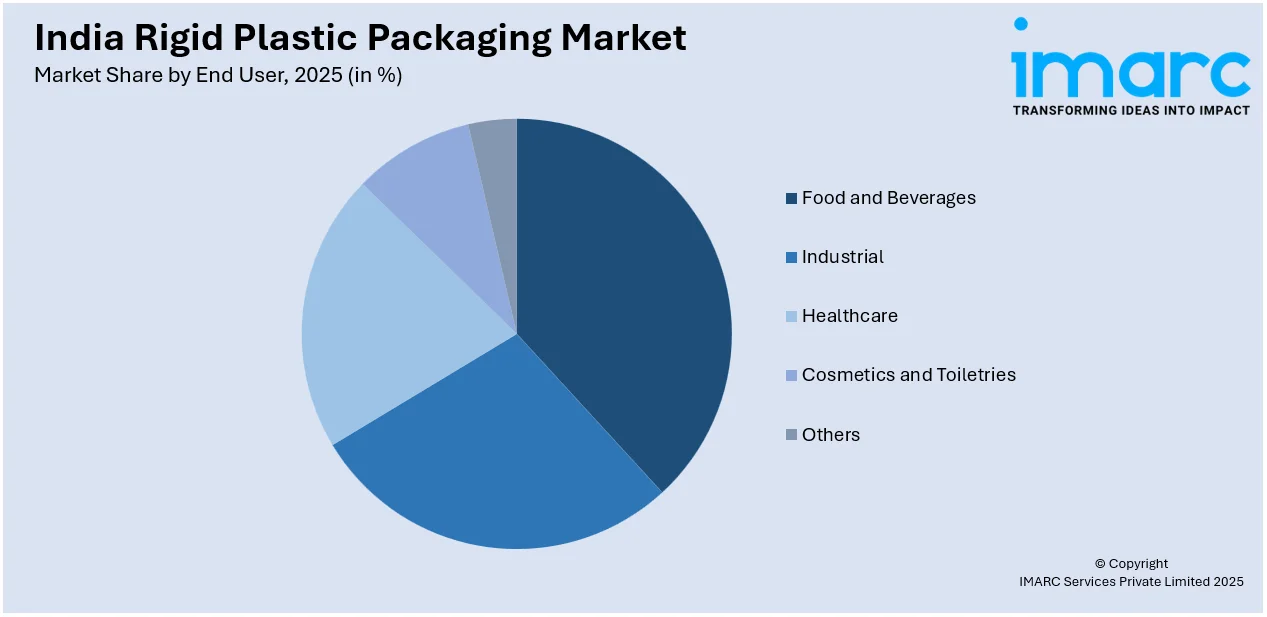

End User Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Industrial

- Healthcare

- Cosmetics and Toiletries

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes food and beverages, industrial, healthcare, cosmetics and toiletries, and others

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Rigid Plastic Packaging Market News:

- In November 2024, Asia-focused private equity firm PAG is set to acquire Manjushree Technopack Ltd., India’s largest rigid plastic packaging company, in a $1 billion deal. The acquisition marks the exit of US-based Advent International, which initially planned to list Manjushree via a ₹3,000 crore IPO but has now withdrawn its listing plans. PAG’s investment signals strong interest in India's packaging sector, with the deal highlighting a strategic shift from public listing to private ownership.

- In April 2024, Manjushree Technopack Ltd. (MTL), India’s largest rigid plastics packaging firm, has signed definitive agreements to acquire Oricon Enterprises' plastics packaging business for ₹520 crore. The deal will double MTL’s market share in caps and closures, making it India’s top player with a 15 billion-piece capacity. The acquisition includes two plants and enhances MTL’s footprint in preforms, reinforcing its leadership in the rigid plastic packaging sector and expanding operational synergies.

India Rigid Plastic Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polystyrene (PS), Expanded Polystyrene (EPS), Others |

| Production Methods Covered | Blow Molding, Injection Molding, Rotomolding, Others |

| End Users Covered | Food and Beverages, Industrial, Healthcare, Cosmetics and Toiletries, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India rigid plastic packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India rigid plastic packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India rigid plastic packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rigid plastic packaging market in India was valued at USD 11.6 Billion in 2025.

The India rigid plastic packaging market is projected to exhibit a CAGR of 9.40% during 2026-2034, reaching a value of USD 26.8 Billion by 2034.

The India rigid plastic packaging market is driven by the rising demand in the food and beverage (F&B) sector, increasing urbanization, and a growing preference for durable, cost-effective packaging solutions. Environmental regulations promoting recycling, along with advancements in packaging technologies, also play a key role in strengthening the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)