India Road Construction Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Road Construction Market Overview:

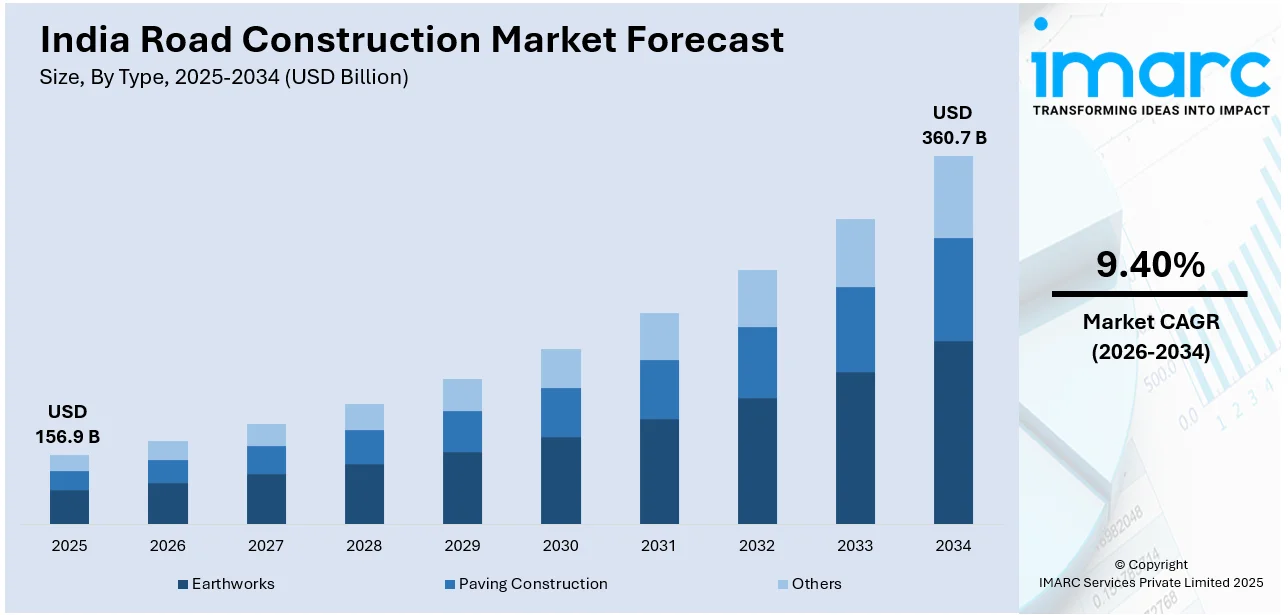

The India road construction market size reached USD 156.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 360.7 Billion by 2034, exhibiting a growth rate (CAGR) of 9.40% during 2026-2034. The market is witnessing steady growth due to government-supported infrastructure programs, increased private sector participation, and additional emphasis placed on rural and border connectivity. Additionally, enhanced execution models, digital monitoring tools, and corridor-focused planning are collectively improving project delivery, quality standards, and logistical efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 156.9 Billion |

| Market Forecast in 2034 | USD 360.7 Billion |

| Market Growth Rate 2026-2034 | 9.40% |

India Road Construction Market Trends:

Acceleration of Highway Development Through Flagship Infrastructure Programs

Highway development in India is gaining steady traction, supported by comprehensive national programs aimed at modernizing transport corridors and enhancing logistics efficiency. Initiatives led by the central government are reshaping the landscape of long-distance connectivity by streamlining approvals, encouraging private participation, and focusing on economic corridor development. For instance, as per the statements of a senior government official, the Ministry of Road Transport and Highways completed the construction of 12,349 kilometers of national highways in 2023–24, representing its second-largest accomplishment to date. This push is promoting multimodal integration and enabling smoother freight movement between key industrial and agricultural zones. In response to the need for faster execution and transparency, new models of public-private partnerships are becoming more prevalent. Moreover, these developments are addressing network gaps, easing congestion, and improving the efficiency of the road transport system. As a result, the market is seeing increasing demand for large-scale projects with faster turnaround times and strict performance benchmarks.

To get more information on this market Request Sample

Strategic Shift Toward Rural and Border Road Development

In India, road construction is shifting focus from urban and intercity corridors to rural access and strategic border regions. Rural road programs are improving mobility in previously disconnected areas, supporting agricultural trade, access to services, and rural employment generation. Concurrently, strategic road building near sensitive borders is receiving greater attention to ensure secure and rapid troop movement, especially in high-altitude or terrain-challenged zones. For instance, in July 2024, the Border Roads Organisation announced the commencement of Phase III of the India-China Border Roads project, in partnership with CPWD and NPCC. This collaboration aims to enhance connectivity in eastern Ladakh, with five new roads planned under this phase. These developments are reshaping the contractor landscape, requiring specialized equipment, localized project management skills, and familiarity with difficult geographies. In addition to improving defense preparedness, these projects are also unlocking new economic potential in underdeveloped regions by facilitating tourism, local commerce, and regional trade. However, the shift towards rural and border infrastructure is broadening the scope of the road construction market, pushing it beyond mainstream highways and metro-driven projects, and creating a more balanced and inclusive development approach.

India Road Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Earthworks

- Paving Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes earthworks, paving construction, and others.

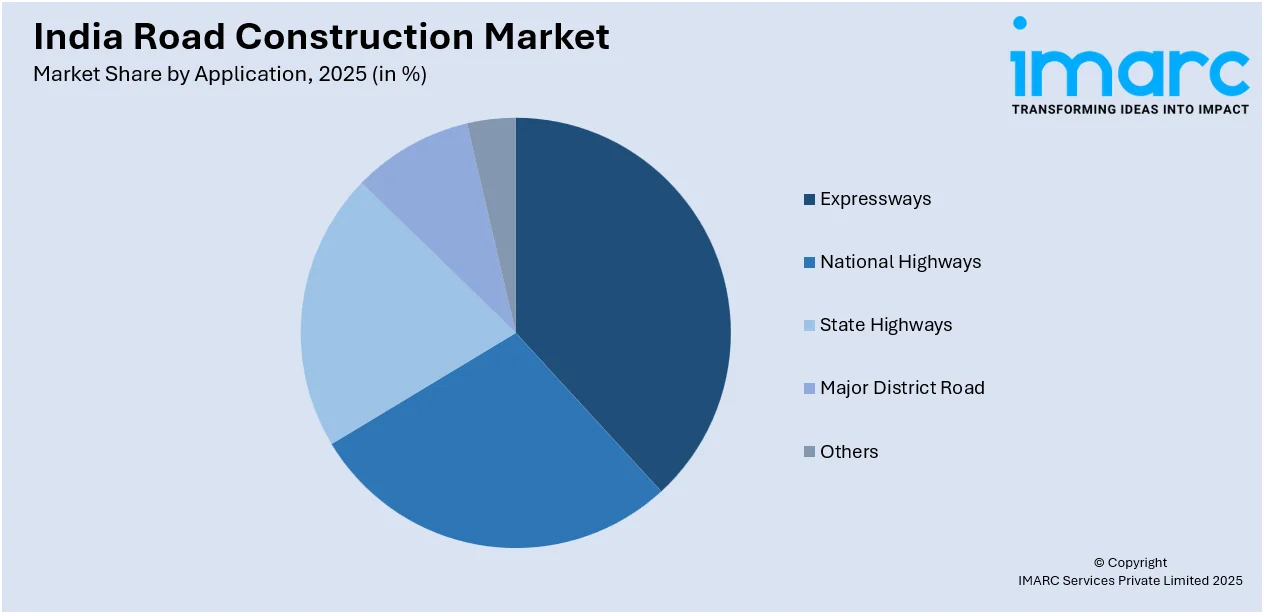

Application Insights:

Access the comprehensive market breakdown Request Sample

- Expressways

- National Highways

- State Highways

- Major District Road

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes expressways, national highways, state highways, major district road, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Road Construction Market News:

- In October 2024, the Government of India (GOI) announced the inauguration of 75 infrastructure projects executed by the Border Roads Organisation (BRO), totaling ₹2,236 crore. These projects, including roads and bridges across 11 states and Union Territories, aim to enhance regional connectivity and bolster defense preparedness.

India Road Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Earthworks, Paving Construction, Others |

| Applications Covered | Expressways, National Highways, State Highways, Major District Road, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India road construction market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India road construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India road construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India road construction market size reached USD 156.9 Billion in 2025.

The India road construction market is expected to reach USD 360.7 Billion by 2034, exhibiting a CAGR of 9.40% during 2026-2034.

Market growth is driven by rising government infrastructure investments, rapid urbanization, increasing demand for better transportation networks, and ongoing development under national programs such as Bharatmala Pariyojana and Smart Cities Mission.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)