India Roof Coatings Market Size, Share, Trends and Forecast by Roof Type, Material, Technology, End User, and Region, 2026-2034

India Roof Coatings Market Overview:

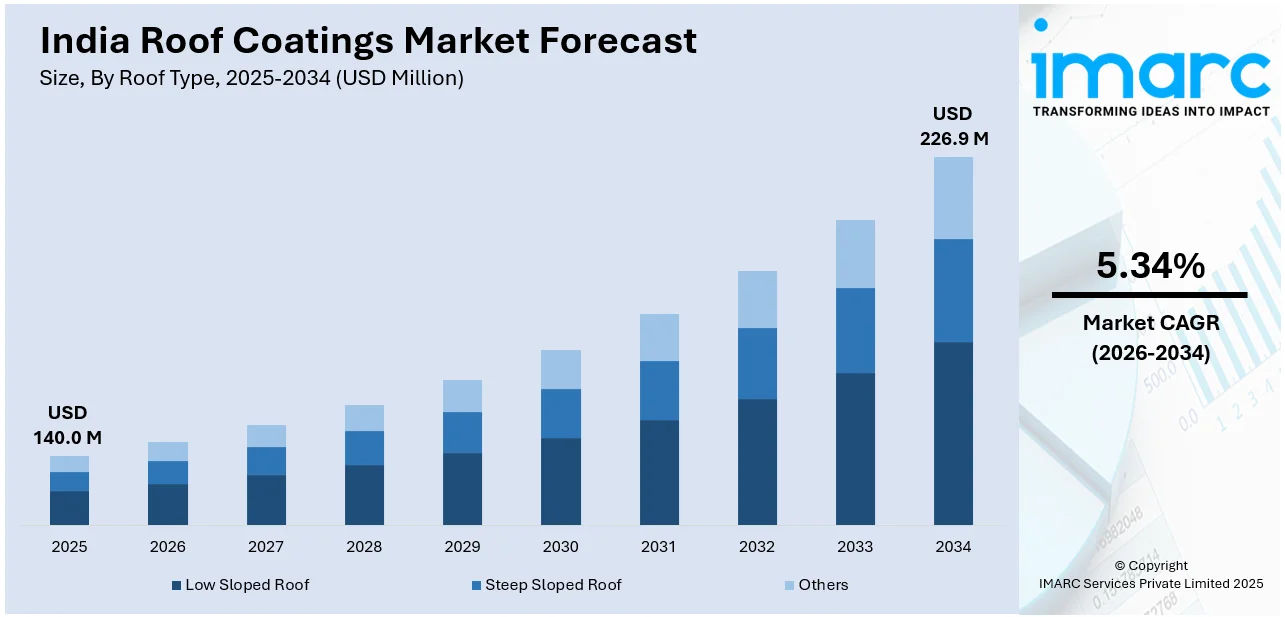

The India roof coatings market size reached USD 140.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 226.9 Million by 2034, exhibiting a growth rate (CAGR) of 5.34% during 2026-2034. The market is growing due to rapid urbanization, infrastructure expansion, and rising demand for energy-efficient, waterproof, and reflective solutions, driven by extreme weather conditions, government initiatives, and a booming construction sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 140.0 Million |

| Market Forecast in 2034 | USD 226.9 Million |

| Market Growth Rate 2026-2034 | 5.34% |

India Roof Coatings Market Trends:

Rising Demand for Cool Roof Coatings

The rising demand for cool roof coatings is boosting the India roof coating market share, as increased temperatures and heatwaves across India push manufacturers to produce more cool roof coatings due to the severe climatic conditions of the country. Cool roof coatings made from reflective materials serve three functions, which include lowering heat absorption, decreasing indoor temperatures, and enhancing energy efficiency through lower air conditioning needs. Additionally, the commercial, residential and industrial sectors use cool roof coatings because they offer sustainable thermal comfort solutions at affordable prices during a time of rising energy costs. The Indian federal government maintains an active stance on green buildings through the Energy Conservation Building Code (ECBC) along with the Smart Cities Mission, which drives quick market adoption of these coating materials. Building on its 2023 announcement, Telangana fully implemented its Cool Roof Policy in 2024, mandating cool roofs for all government, commercial, and residential buildings with plot areas exceeding 600 square yards. This initiative aims to enhance thermal comfort and reduce energy consumption across the state. Moreover, the popularity of Leadership in Energy and Environmental Design (LEED) and other green certification programs drives developers to use reflective coatings in their new projects. Furthermore, the increasing environmental regulation and energy efficiency requirements create a strong market demand for cool roof coatings, which is impelling the India roof coatings market growth.

To get more information on this market Request Sample

Growing Adoption of Waterproof Roof Coatings

The rising occurrence of heavy rainfall and flooding events along with extreme weather phenomena in the country requires immediate implementation of waterproof roof coatings. These coatings establish an effective protective layer to stop water from penetrating through roofs so buildings remain dry and free from mold development and structural deterioration. In confluence with this, real estate and construction sectors understand the permanent advantages of selecting premium waterproof solutions, which has created increased demand for sophisticated elastomeric and polyurethane-based coatings. For instance, Bostik India launched SEAL & BLOCK, a range of smart waterproofing solutions designed for applications from basements to roofs. This innovation underscores the industry's commitment to sustainable infrastructure and advanced waterproofing technology. Concurrently, the deteriorating infrastructure alongside the requirement to restore older buildings is significantly fueling the adoption of waterproof roof coating. Besides this, government programs emphasize sustainable city planning and durable construction materials for smart cities development. Furthermore, the market sees increasing acceptance of hybrid waterproofing technologies that unite thermal insulation properties with moisture barrier capabilities because they suit developers and homeowners equally well. Apart from this, building resilience strategies are maintaining waterproof roof coatings as essential elements, because uncertainty in climate patterns is anticipated to continue, thereby enhancing the India roof coatings market outlook.

India Roof Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on roof type, material, technology, and end user.

Roof Type Insights:

- Low Sloped Roof

- Steep Sloped Roof

- Others

The report has provided a detailed breakup and analysis of the market based on the roof type. This includes low sloped roof, steep sloped roof, and others.

Material Insights:

- Elastomeric

- Bituminous

- Acrylic

- Epoxy

- Silicone

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes elastomeric, bituminous, acrylic, epoxy, silicone, and others.

Technology Insights:

- Water-based

- Solvent-based

The report has provided a detailed breakup and analysis of the market based on the technology. This includes water-based and solvent-based.

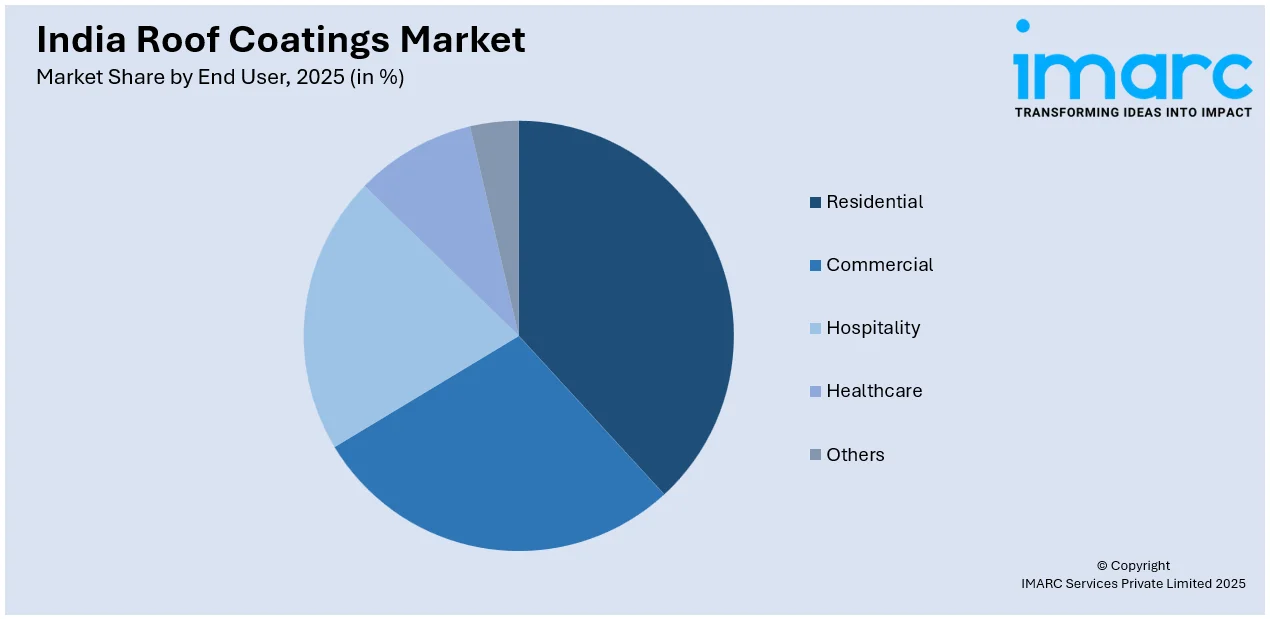

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Hospitality

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, hospitality, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Roof Coatings Market News:

- In September 2024, Pidilite Industries partnered with ADDS 2024 as an Associate Sponsor, showcasing its ‘Materials, Spaces & Emotions’ installation with totem-shaped pillars. The exhibit highlighted innovative solutions, reinforcing Pidilite’s commitment to empowering architects and designers to create elegant, durable structures.

- In May 2024, ArcelorMittal Construction India made its inaugural appearance at Roof India 2024, Asia's largest roofing and allied products event. The company's booth attracted significant attention, showcasing their sandwich panels and profiles. This participation provided an invaluable opportunity to connect with potential customers and demonstrated the company's dedication to the Indian market.

India Roof Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Roof Types Covered | Low Sloped Roof, Steep Sloped Roof, Others |

| Materials Covered | Elastomeric, Bituminous, Acrylic, Epoxy, Silicone, Others |

| Technologies Covered | Water-based, Solvent-based |

| End Users Covered | Residential, Commercial, Hospitality, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India roof coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the India roof coatings market on the basis of roof type?

- What is the breakup of the India roof coatings market on the basis of material?

- What is the breakup of the India roof coatings market on the basis of technology?

- What is the breakup of the India roof coatings market on the basis of end user?

- What is the breakup of the India roof coatings market on the basis of region?

- What are the various stages in the value chain of the India roof coatings market?

- What are the key driving factors and challenges in the India roof coatings?

- What is the structure of the India roof coatings market and who are the key players?

- What is the degree of competition in the India roof coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India roof coatings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India roof coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India roof coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)