India Rooftop Solar Panel Market Size, Share, Trends and Forecast by Type of Solar Panel, Capacity, Connectivity, End-User, and Region, 2026-2034

India Rooftop Solar Panel Market Overview:

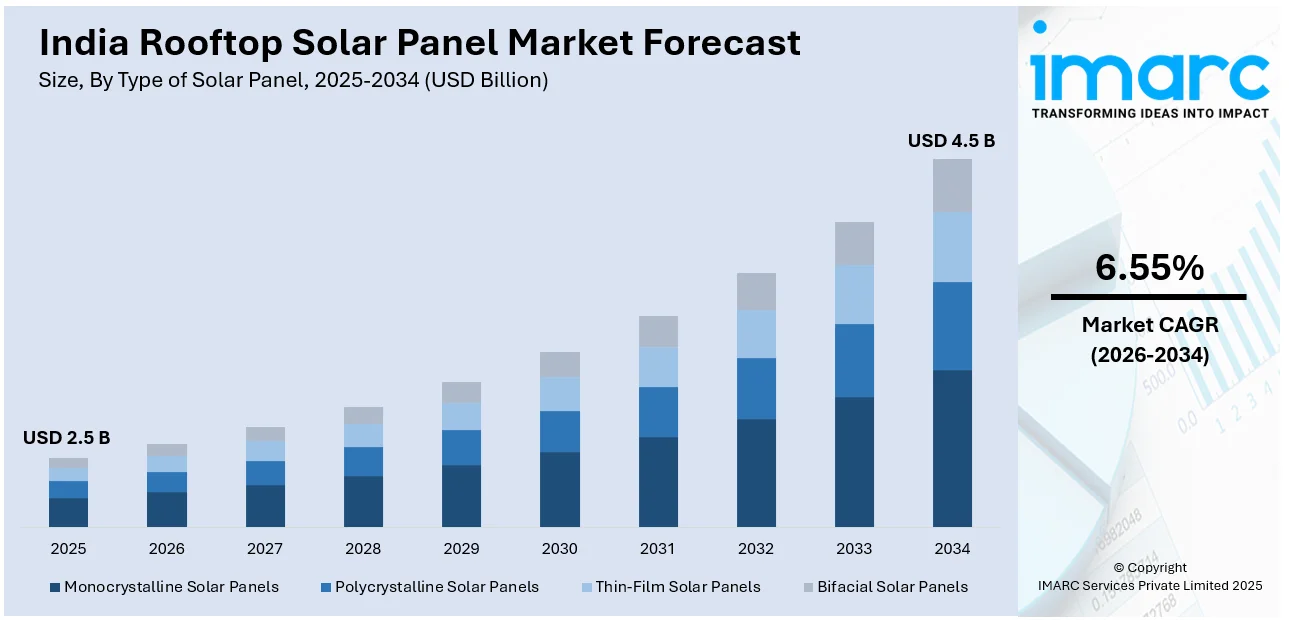

The India rooftop solar panel market size reached USD 2.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.5 Billion by 2034, exhibiting a growth rate (CAGR) of 6.55% during 2026-2034.The implementation of supportive government initiatives, rising environmental awareness, and continual advancements in solar technology, expanding adoption across residential, commercial, industrial, and public sectors, supported by favorable policies, financing options, and sustainability goals are some of the major factors augmenting the India rooftop solar panel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.5 Billion |

| Market Forecast in 2034 | USD 4.5 Billion |

| Market Growth Rate 2026-2034 | 6.55% |

India Rooftop Solar Panel Market Trends:

Government Support and Policy Push Driving Rooftop Solar Growth

Proactive government policies and financial incentives are significantly propelling the India rooftop solar panel market growth. According to an industry report, the PM Surya Ghar: Muft Bijli Yojana launched by the Indian government aims to install rooftop solar panels on 1 Crore (10 Million) homes by March 2027. The project is expected to save the government INR 75,000 Crore (approximately USD 9,036.14 Million) annually in electricity expenses and offers subsidies of up to 40%. A steady progress has been made, with a monthly installation rate of 70,000. As of December 5, 2024, a total of 630,000 installations have been completed. The government's push for renewable energy, backed by subsidies, tax benefits, and net metering policies, is encouraging widespread adoption across residential, commercial, and industrial sectors. By promoting decentralized power generation, authorities are reducing dependence on conventional energy sources while enhancing energy accessibility, particularly in remote and underserved areas. Simplified regulatory frameworks and streamlined approval processes are further facilitating the transition to solar energy. Additionally, financial institutions are offering attractive loan schemes and funding options, making solar installations more feasible. The government's commitment to sustainable energy through long-term policies ensures a stable market environment for solar investments. With continued policy support and growing awareness, rooftop solar adoption is poised to accelerate, reinforcing India's vision of a cleaner and self-reliant energy future.

To get more information on this market Request Sample

Rising Energy Costs and Demand for Sustainable Alternatives Boost Solar Adoption

The growing demand for cost-effective and sustainable energy solutions is propelling the rooftop solar panel market in India. With rising electricity prices and increasing energy consumption, households and businesses are turning to solar power to achieve long-term savings and energy security. Companies are integrating solar technology into their operations to reduce operational costs and enhance sustainability. In addition to this, continual technological advancements in solar panels, inverters, and battery storage systems are improving efficiency, making solar installations more viable and attractive, which in turn is positively impacting the India rooftop solar panel market outlook. Notably, Solplanet, a well-known leader in solar string inverter technology worldwide, and Festa Solar, a well-known solar reseller in southern India, established a strategic partnership on December 31, 2024. Through this agreement, India's shift to sustainable energy will be aided by the introduction of cutting-edge utility-scale string inverters throughout the nation. The growing industry collaborations and technological advancements are positively influencing market adoption. Additionally, the declining cost of solar technology is making it more accessible to a wider consumer base, which is enhancing the market appeal. Growing environmental consciousness among individuals and corporations is also contributing to the shift towards clean energy. As awareness about energy independence and sustainability rises, the adoption of rooftop solar solutions is expected to surge, establishing solar energy as a mainstream and reliable power source in India.

India Rooftop Solar Panel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type of solar panel, capacity, connectivity, and end-user.

Type of Solar Panel Insights:

- Monocrystalline Solar Panels

- Polycrystalline Solar Panels

- Thin-Film Solar Panels

- Bifacial Solar Panels

The report has provided a detailed breakup and analysis of the market based on the type of solar panel. This includes monocrystalline solar panels, polycrystalline solar panels, thin-film solar panels, and bifacial solar panels.

Capacity Insights:

- Below 10 kW

- 10 kW to 100 kW

- Above 100 kW

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes below 10 kw, 10 kw to 100 kw, and above 100 kw.

Connectivity Insights:

- On-Grid

- Off-Grid

The report has provided a detailed breakup and analysis of the market based on the connectivity. This includes on-grid and off-grid.

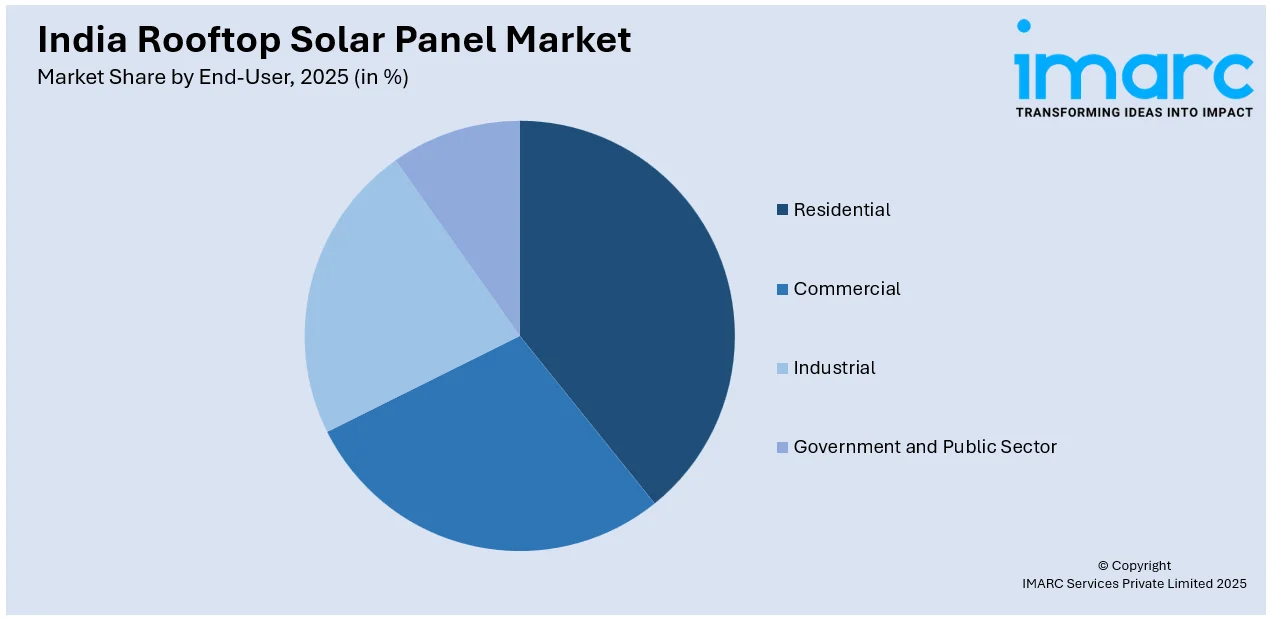

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

- Government and Public Sector

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes residential, commercial, industrial, and government and public sector.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Rooftop Solar Panel Market News:

- On December 30, 2024, Jakson Group and OMC Power announced that they will work together to build a 50-MW rooftop solar project worth INR 200 Crore (about USD 24.10 Million) that would span all 75 districts of Uttar Pradesh. It is anticipated that this project will offset 62,500 tonnes of CO₂ emissions per year, which is the same as planting 2.5 million trees. The partnership highlights a noteworthy progress in Uttar Pradesh's implementation of sustainable energy solutions.

- On June 15, 2024, the Multilateral Investment Guarantee Agency (MIGA) announced, that it will grant a USD 317.5 Million guarantee to help the State Bank of India (SBI) refinance a USD 500 Million loan for Grid-connected Rooftop Solar Photovoltaic (GRPV) systems that was first given by the World Bank in 2016. By taking the place of more costly, carbon-intensive heat generation, these systems provide clean energy and lower greenhouse gas emissions.

India Rooftop Solar Panel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Solar Panels Covered | Monocrystalline Solar Panels, Polycrystalline Solar Panels, Thin-Film Solar Panels, Bifacial Solar Panels |

| Capacities Covered | Below 10 kW, 10 kW to 100 kW, Above 100 kW |

| Connectivities Covered | On-Grid, Off-Grid |

| End-Users Covered | Residential, Commercial, Industrial, Government and Public Sector |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India rooftop solar panel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India rooftop solar panel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India rooftop solar panel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India rooftop solar panel market was valued at USD 2.5 Billion in 2025.

The India Rooftop Solar Panel market is projected to exhibit a CAGR of 6.55% during 2026-2034, reaching a value of USD 4.5 Billion by 2034.

The market is driven by government initiatives promoting solar energy, rising environmental awareness, and advancements in solar technology. Supportive policies, financial incentives, and the demand for cost-effective and sustainable energy solutions are further accelerating the adoption of rooftop solar panels across residential, commercial, and industrial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)