India Router Market Size, Share, Trends and Forecast by Band Type, Product Type, Antenna Type, End User Industry, and Region, 2025-2033

India Router Market Overview:

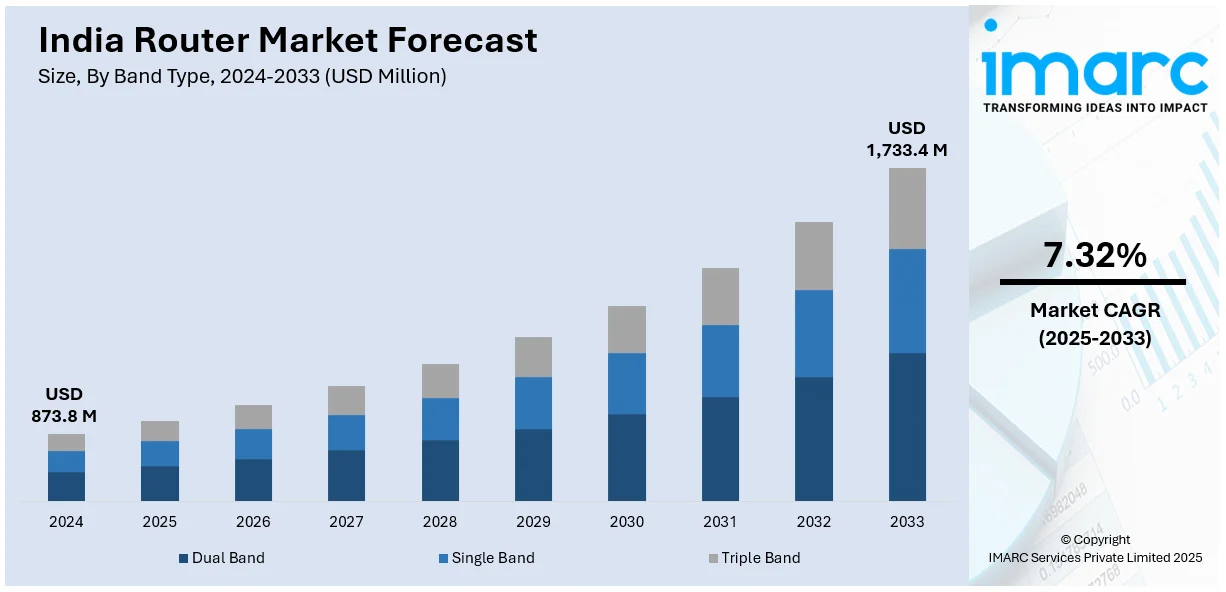

The India router market size reached USD 873.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,733.4 Million by 2033, exhibiting a growth rate (CAGR) of 7.32% during 2025-2033. The market in India is growing owing to the increased use of the internet, more broadband subscriptions, expanding digital infrastructure, and higher take-up across industrial, commercial, and residential segments, propelled by the requirement for seamless and dependable connectivity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 873.8 Million |

| Market Forecast in 2033 | USD 1,733.4 Million |

| Market Growth Rate 2025-2033 | 7.32% |

India Router Market Trends:

Growing Demand for High-Speed Internet

India's growing dependence on online services has resulted in a huge surge in demand for broadband internet solutions. With more individuals working remotely, taking online classes, and watching online content, customers look for routers that can support multiple connections without interruption. Organizations, particularly small and medium businesses, also need robust internet for day-to-day activities, such as video conferencing and online transactions. With better internet speeds throughout the nation, routers offering seamless connectivity and broad coverage are increasingly demanded. For example, in February 2023, Siemens introduced its initial industry-ready 5G routers in India to catalyze digital transformation across manufacturing. Scalance MUM856-1 and MUM853-1 provide secure, low-latency industrial and automation applications connectivity. Additionally, consumers are becoming more cognizant of aspects, such as internet stability, signal strength, and network traffic, impacting their router selection. Multi-user households would like routers that can handle multiple internet activities simultaneously without decreasing speed. Further, rural and semi-urban locations are witnessing increased take-up of broadband services, which results in growing demand for routers that offer stable connectivity in areas with limited network infrastructure.

To get more information on this market, Request Sample

Shift Towards Wireless and Mesh Networking

Wireless routers are emerging as the go-to option for Indian homes and enterprises in place of traditional cabled configurations. For instance, in July 2024, Consistent Infosystems unveiled the CT-4GR DAWI, 4G wireless router with dual antennas, 5G SIM capability, Ethernet port, and advanced encryption that provides safe and fast connectivity even in distant regions with wide temperature resistance (-10°C to +65°C). Moreover, with the rise of smart homes, IoT devices, and hybrid workplaces, there is an enhanced demand for hassle-free, high-speed internet connections in multiple rooms and floors. Mesh networking technology is picking up pace in urban and semi-urban cities by providing extended reach, removing dead spots, and providing assured internet speeds. As opposed to old-fashioned routers, mesh networks employ a plethora of nodes to share internet signals effectively, ensuring seamless connectivity for big homes, co-working premises, and business facilities. The affordability and simplicity of wireless solutions make them appealing to consumers who want to upgrade from old routers. Furthermore, the growing adoption of video conferencing applications and mobile devices has increased the demand for Wi-Fi 6 routers, which provide enhanced speeds, lower congestion of the network, and optimized efficiency, transforming wireless and mesh networking into a predominant trend within India.

Rising Adoption in BFSI and Healthcare Sectors

The demand for secure internet connectivity in India's banking, financial services, and insurance (BFSI) and healthcare industries is growing as both sectors scale up their online operations. Banks and financial institutions use solid and stable internet connectivity to process online transactions, interact with customers, and conduct internal operations. A reliable and seamless connection is needed to facilitate digital banking operations, automated workflows, and real-time data transfers. In medicine, clinics and hospitals need constant internet connectivity for operational management, remote consultations, and patient records. The increasing uptake of digital health services has ensured that both rural and urban healthcare providers need uninterrupted internet connectivity. Both sectors also need internet solutions that are characterized by low downtime and consistent performance. With BFSI and healthcare incorporating more and more online services, the need for secure internet solutions that provide vast coverage, and consistent connections will keep increasing throughout India.

India Router Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on band type, product type, antenna type, end user industry.

Band Type Insights:

- Dual Band

- Single Band

- Triple Band

The report has provided a detailed breakup and analysis of the market based on the band type. This includes dual band, single band, and triple band.

Product Type Insights:

- Wired

- Wireless

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes wired, and wireless.

Antenna Type Insights:

- Internal

- External

The report has provided a detailed breakup and analysis of the market based on the antenna type. This includes internal, and external.

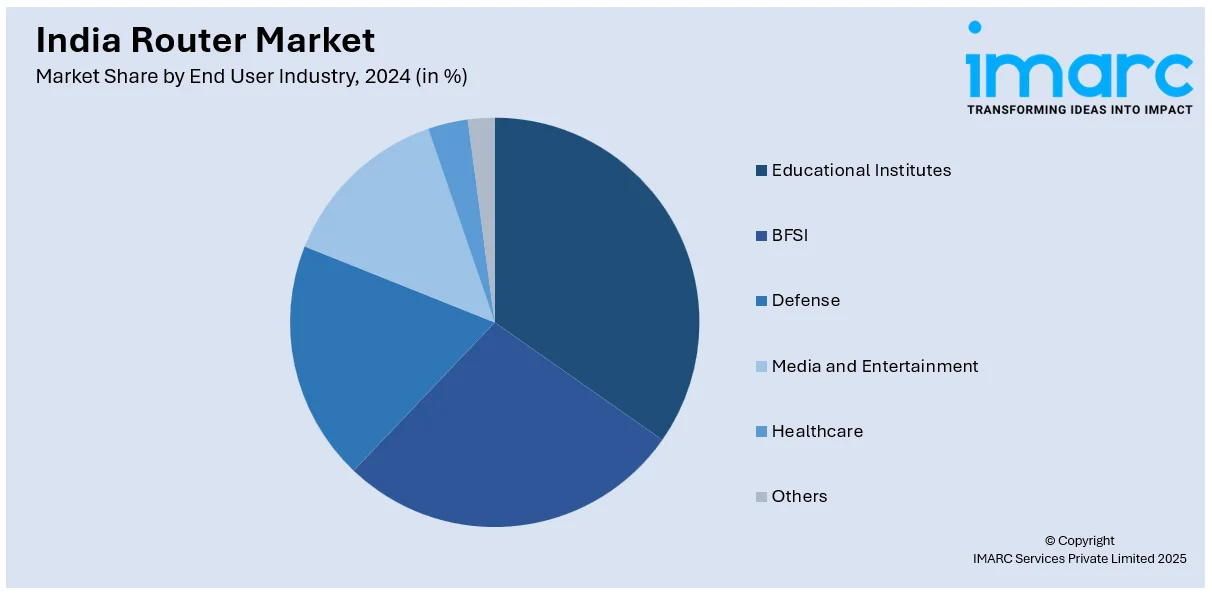

End User Industry Insights:

- Educational Institutes

- BFSI

- Defense

- Media and Entertainment

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes educational institutes, BFSI, defense, media and entertainment, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Router Market News:

- In March 2024, Union Minister Ashwini Vaishnaw inaugurated India's fastest indigenously developed IP/MPLS router, produced by Nivetti in association with the Department of Telecom and CDOT. The 2.4 tbps router improves secure, high-speed networking, constituting a significant leap in India's digital growth and indigenization of high-end networking technology.

- In September 2023, Geonix International, a fastest-growing ICT brand in India, has launched its first SIM-enabled WiFi router-cum-extender. Made for rural and semi-urban customers, it accommodates 4G/5G SIMs, provides 300+ Mbps speeds, and improves connectivity. The plug-and-play gadget is designed to increase digital reach across the country.

India Router Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Band Types Covered | Dual Band, Single Band, Triple Band |

| Product Types Covered | Wired, Wireless |

| Antenna Types Covered | Internal, External |

| End User Industries Covered | Educational Institutes, BFSI, Defense, Media and Entertainment, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India router market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India router market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India router industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The router market in India was valued at USD 873.8 Million in 2024.

The router market in India is projected to exhibit a CAGR of 7.32% during 2025-2033, reaching a value of USD 1,733.4 Million by 2033.

The router market in India is fueled by rising internet penetration, high-speed connectivity demand, and fast adoption of smart devices. Enterprise and household demand is fueled by remote work growth, online learning, and digital services. Digital India and growing 5G infrastructure government initiatives are fueling the market further. Low-cost data plan expansion, e-commerce expansion, and Wi-Fi standard innovation are the other major drivers for the growth in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)