India Rubber Crawler Market Size, Share, Trends and Forecast by Equipment Type, Material, Demand Category, End Use, and Region, 2025-2033

India Rubber Crawler Market Overview:

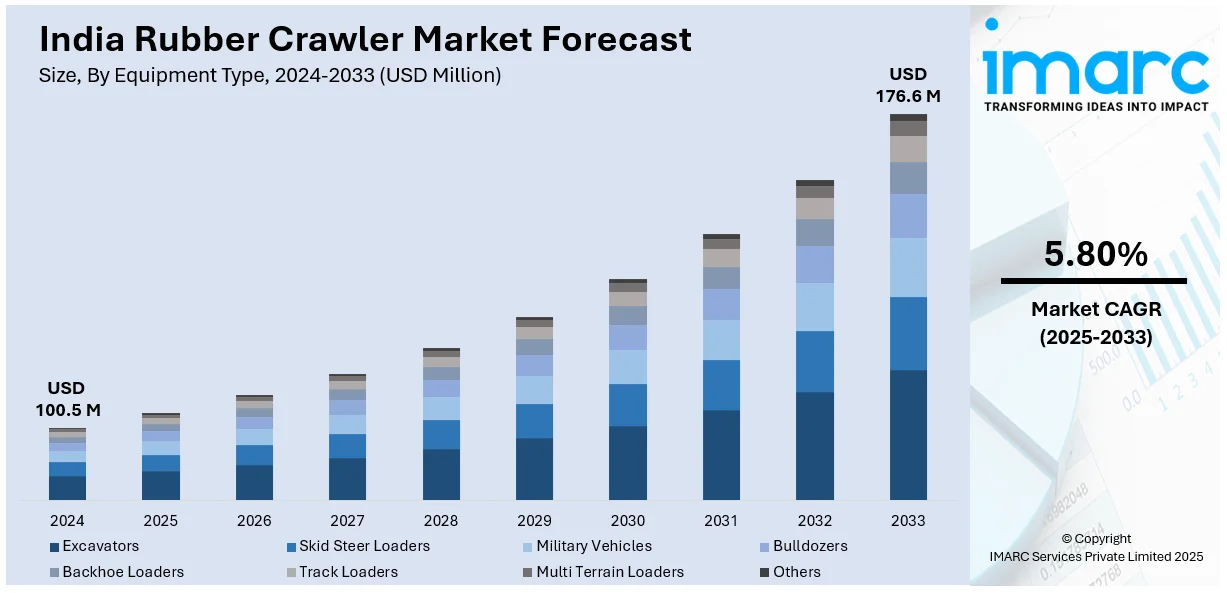

The India rubber crawler market size reached USD 100.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 176.6 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is growing steadily, driven by rising demand in agriculture, construction, and defense, ongoing technological advancements, increased mechanization, strong government support for infrastructure development, and increasing focus of manufacturers on enhancing durability, efficiency, and cost-effectiveness to meet evolving industry needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 100.5 Million |

| Market Forecast in 2033 | USD 176.6 Million |

| Market Growth Rate 2025-2033 | 5.80% |

India Rubber Crawler Market Trends:

Increasing Adoption in Agriculture and Construction Sectors

The India rubber crawler market share is witnessing significant growth due to its rising adoption in agriculture and construction industries. Rubber crawlers serve agriculture operations better than other solutions, as they deliver improved traction, reduced soil damage and enhanced system efficiency during farming on wet and rough surfaces. In line with this, increasing government support, including Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) and farm subsidies, along with the rising mechanization of Indian farms are fueling the integration of enhanced rubber crawlers in India. For instance, in 2024, an outlay of ₹29 crore has been allocated for rubber research over the next two years. This investment aims to develop rubber clones suitable for different agro-climatic regions, potentially increasing rubber production to meet the growing demand from the rubber crawler industry. Moreover, the construction market has adopted rubber crawlers for excavators and loaders because of increasing demands for long-lasting and high-capability equipment. Furthermore, fast urban development, alongside new infrastructure projects, Smart Cities, and Bharatmala government initiatives, is acting as another growth inducing factor. As a result, the adoption of rubber crawlers is expanding across these industries because they reduce noise and improve fuel efficiency and maintenance while replacing steel tracks, thus driving the India rubber crawler market growth.

To get more information on this market, Request Sample

Advancements in Material Technology and Durability

Ongoing technological advancements in rubber crawler manufacturing are playing a crucial role in enhancing their durability, efficiency, and overall performance. Additionally, manufacturers enhance rubber crawler durability and wear resistance through the application of high-quality synthetic rubber compounds strengthened by Kevlar and steel cord materials. These innovations increase rubber crawler longevity, which results in lower replacement expenses and better operational output. Concurrently, the combination of self-lubricating materials with improved tread designs produces rubber crawlers that can better grip different terrains and reduce maintenance stoppages. Besides this, sustainability concerns have resulted in the creation of environmentally friendly rubber crawlers through bio-based and recycled materials as the world embraces green solutions. For example, on September 24, 2024, Tripura Chief Minister Manik Saha announced plans to establish a second rubber park in Santirbazar, South Tripura District. This initiative aims to boost natural rubber-based industries, leveraging Tripura's position as India's second-largest rubber producer, accounting for 9% of the country's output. The new park is expected to enhance industrial growth and attract investments in rubber processing and manufacturing. Furthermore, the increasing market demand for extended-lasting rubber crawlers with high performance characteristics has motivated companies to conduct research for customized solutions across different applications. As a result, the market shows indications that these continuous technological developments are significantly enhancing the India rubber crawler market outlook.

India Rubber Crawler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on equipment type, material, demand category, and end use.

Equipment Type Insights:

- Excavators

- Skid Steer Loaders

- Military Vehicles

- Bulldozers

- Backhoe Loaders

- Track Loaders

- Multi Terrain Loaders

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes excavators, skid steer loaders, military vehicles, bulldozers, backhoe loaders, track loaders, multi terrain loaders, and others.

Material Insights:

- Natural Rubber

- Synthetic Rubber

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes natural rubber and synthetic rubber.

Demand Category Insights:

- Aftermarket

- Duplicated Products

- Genuine Products

- OEM

The report has provided a detailed breakup and analysis of the market based on the demand category. This includes aftermarket (duplicated products, genuine products) and OEM.

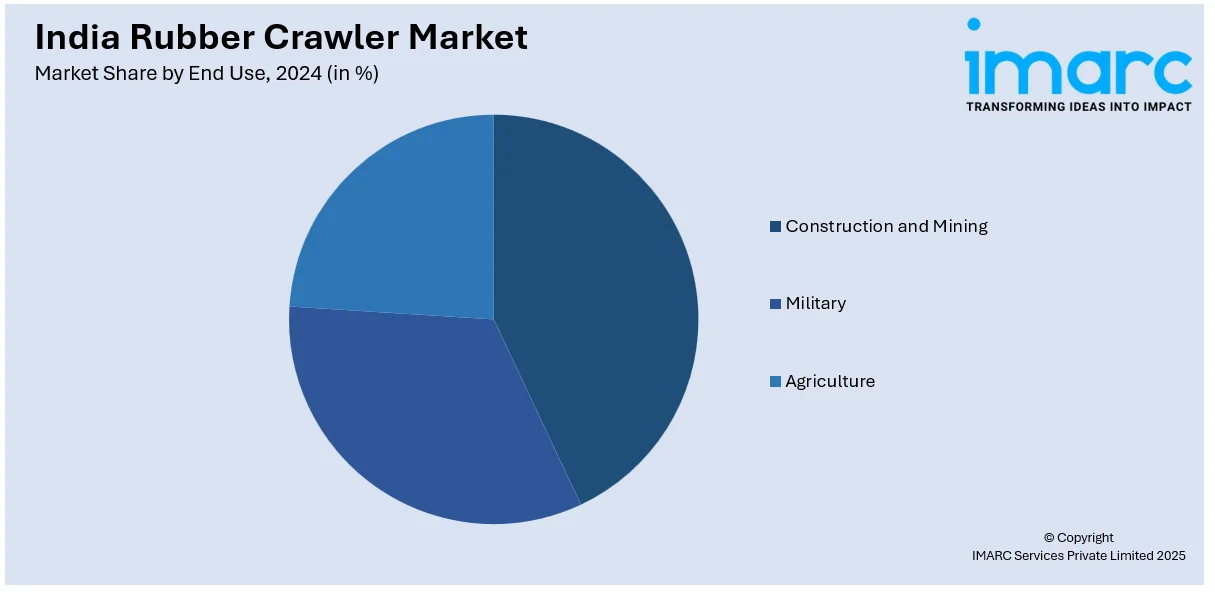

End Use Insights:

- Construction and Mining

- Military

- Agriculture

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes construction and mining, military and agriculture.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Rubber Crawler Market News:

- In December 2024, Indian tire maker CEAT acquired Michelin's Camso brand for $225 million. This strategic move allows CEAT to expand into higher-margin tires, particularly those used in heavy-duty vehicles like tractors and bulldozers, thereby strengthening its position in the off-highway tire segment.

- In March 2024, ARLANXEO showcased its sustainable and innovative synthetic rubber portfolios at the India Rubber Expo 2024, including the ISCC PLUS certified bio-circular products. These solutions cater to the growing demand for eco-friendly and high-performance synthetic rubber in India's expanding automotive and construction sectors.

India Rubber Crawler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Excavators, Skid Steer Loaders, Military Vehicles, Bulldozers, Backhoe Loaders, Track Loaders, Multi Terrain Loaders, Others |

| Materials Covered | Natural Rubber, Synthetic Rubber |

| Demand Categories Covered |

|

| End Uses Covered | Construction and Mining, Military, Agriculture |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India rubber crawler market performed so far and how will it perform in the coming years?

- What is the breakup of the India rubber crawler market on the basis of equipment type?

- What is the breakup of the India rubber crawler market on the basis of material?

- What is the breakup of the India rubber crawler market on the basis of demand category?

- What is the breakup of the India rubber crawler market on the basis of end use?

- What is the breakup of the India rubber crawler market on the basis of region?

- What are the various stages in the value chain of the India rubber crawler market?

- What are the key driving factors and challenges in the India rubber crawler?

- What is the structure of the India rubber crawler market and who are the key players?

- What is the degree of competition in the India rubber crawler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India rubber crawler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India rubber crawler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India rubber crawler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)