India Rubber Processing Chemicals Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Rubber Processing Chemicals Market Overview:

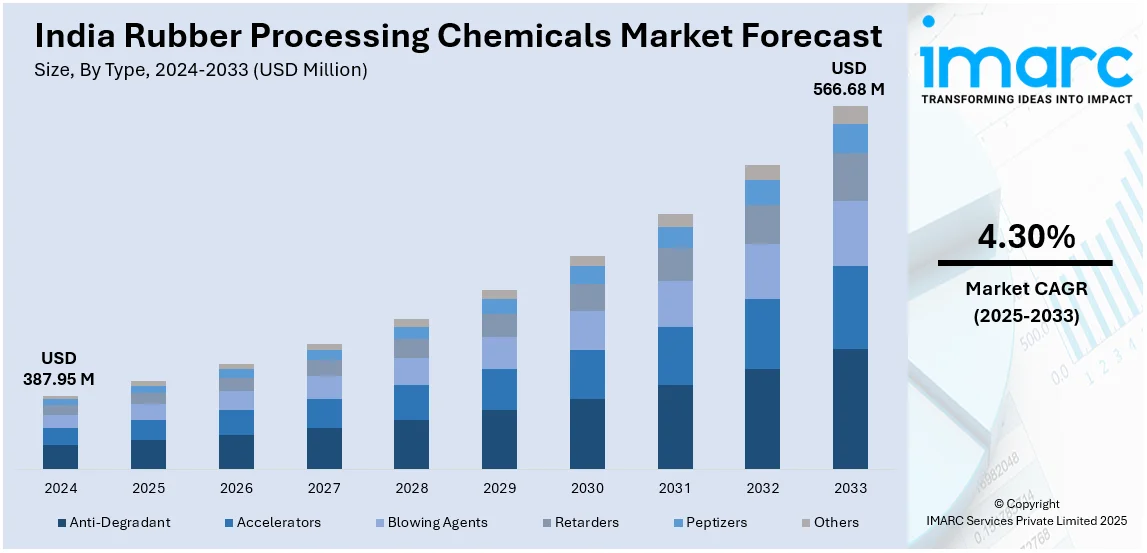

The India rubber processing chemicals market size reached USD 387.95 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 566.68 Million by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033. India's market for rubber processing chemicals is growing as a result of increasing demand from the automotive and industrial segments. Moreover, advanced rubber formulations, green additives, and process technology innovations spur growth. Also, local manufacturing growth, sustainability efforts, and technological innovation are improving product quality, durability, and industry competitiveness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 387.95 Million |

| Market Forecast in 2033 | USD 566.68 Million |

| Market Growth Rate 2025-2033 | 4.30% |

India Rubber Processing Chemicals Market Trends:

Growing Demand for High-Performance Rubber Additives

India's rubber processing chemicals industry is growing at a strong pace, led by the demand for high-performance additives in tire and non-tire applications. The automotive industry, which depends heavily on rubber components, is one of the major drivers of this demand. With the rise in vehicle production and the enforcement of stringent safety standards, producers are turning to sophisticated rubber formulations that provide increased durability, flexibility, and resistance to environmental influences. Moreover, chemicals like anti-degradants, accelerators, and processing aids are important for enhancing rubber properties, ensuring durability, and minimizing wear and tear. The government incentives towards local manufacturing and the Make in India movement are also promoting investments in rubber chemical manufacturing, minimizing import dependence. Also, the increasing emphasis on sustainability has resulted in the creation of environmentally friendly rubber processing chemicals that have low environmental footprints but high performance.

To get more information on this market, Request Sample

Technological Innovations in Rubber Compounding

Technological innovation in rubber compounding is revolutionizing the Indian rubber processing chemicals market. Manufacturers are utilizing nanotechnology, bio-based additives, and enhanced polymer blends to enhance the mechanical properties and processability of rubber. Moreover, the tire segment is especially gaining from these developments, with products formulated to deliver improved rolling resistance, fuel economy, and wet grip. At the same time, non-tire end-use segments like industrial rubber products, conveyor belts, and footwear are also embracing specialized rubber chemicals to satisfy changing performance criteria. Businesses are making investments in cutting-edge R&D labs to create customized solutions that meet specific end-use specifications. Furthermore, manufacturing digitalization, such as AI-optimized process control, is further enhancing efficiency, quality control, and cost savings. These innovations not only enhance the competitiveness of Indian manufacturers in the global arena but also reinforce the supply chain through the minimization of production idle time and optimizing material utilization. With continued growth, the industry of rubber processing chemicals is projected to experience solid growth, supplying the growing requirements of local as well as international markets.

India Rubber Processing Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Anti-Degradant

- Accelerators

- Blowing Agents

- Retarders

- Peptizers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes anti-degradant, accelerators, blowing agents, retarders, peptizers, and others.

Application Insights:

- Tire

- Non-Tire

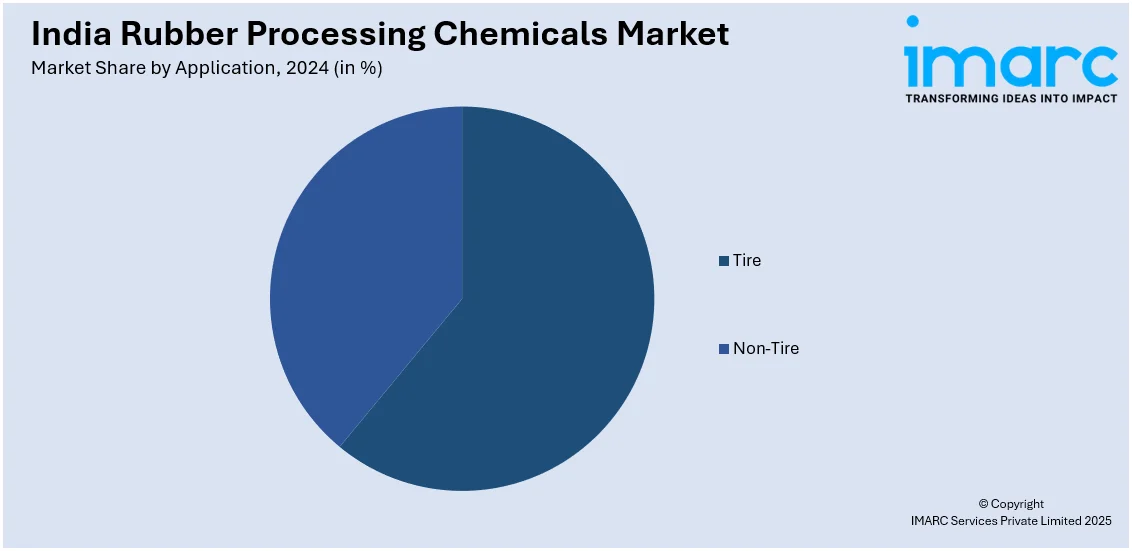

The report has provided a detailed breakup and analysis of the market based on the application. This includes tire and non-tire.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Rubber Processing Chemicals Market News:

- August 2024: NOCIL announced a USD 2.5 Billion investment to expand capacity at its Dahej plant, strengthening India’s rubber processing chemicals industry. This expansion enhances domestic production, supports rising demand from tire and automotive sectors, and reinforces India’s position as a key supplier of rubber chemicals.

- March 2024: LANXESS advanced India's rubber processing chemicals segment by introducing sustainable antidegradants, Rhenodiv release agents, and Rhenocure DR/S accelerators. These innovations enhance tire durability, reduce production waste, and improve silica dispersion, supporting India's shift toward eco-friendly rubber manufacturing and high-performance tire production.

India Rubber Processing Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Anti-Degradant, Accelerators, Blowing Agents, Retarders, Peptizers, Others |

| Applications Covered | Tire, Non-Tire |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India rubber processing chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India rubber processing chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India rubber processing chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rubber processing chemicals market in India was valued at USD 387.95 Million in 2024.

The India rubber processing chemicals market is projected to exhibit a CAGR of 4.30% during 2025-2033, reaching a value of USD 566.68 Million by 2033.

The India rubber processing chemicals market is fueled by rising demand from the automotive sector, expansion of industrial applications, and increasing use of synthetic and natural rubber in tire manufacturing. Growing infrastructure development, coupled with advancements in chemical formulations for durability and performance, further accelerates market growth across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)