India Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

Market Overview:

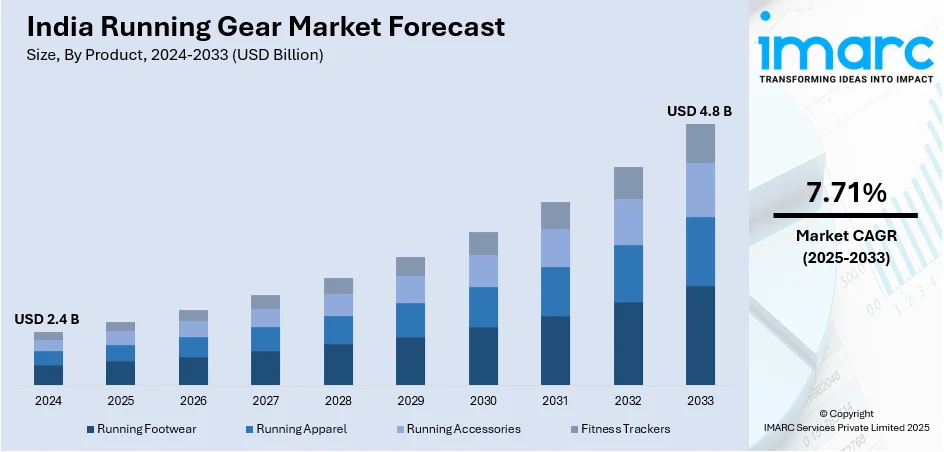

The India running gear market size reached USD 2.4 Billion in 2024. The market is expected to reach USD 4.8 Billion by 2033, exhibiting a growth rate (CAGR) of 7.71% during 2025-2033. The market growth is attributed to increasing health awareness, rising participation in fitness activities, growing urbanization, expanding disposable income, popularity of recreational running, proliferation of marathons and local races, and brand endorsements by athletes, and e-commerce growth.

Market Insights:

- Based on region, the market is divided into North India, West and Central India, South India, and East India.

- On the basis of product, the market is categorized as running footwear, running apparel, running accessories, and fitness trackers.

- Based on gender, the market is segmented into male, female, and unisex.

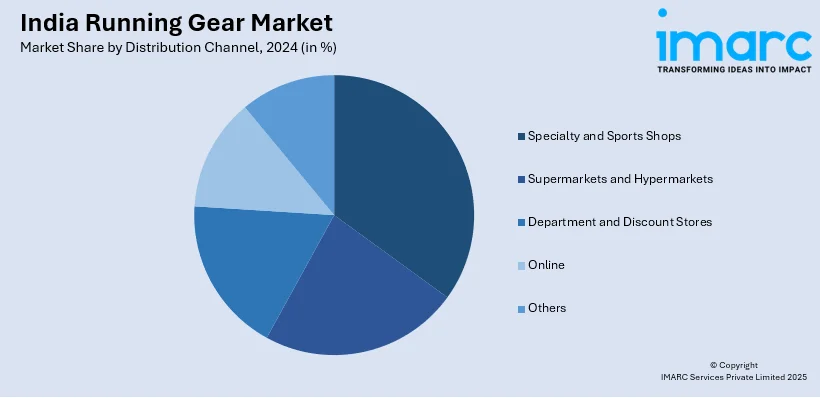

- On the basis of distribution channel, the market is categorized as specialty and sports shops, supermarkets and hypermarkets, department and discount stores, online, and others.

Market Size and Forecast:

- 2024 Market Size: USD 2.4 Billion

- 2033 Projected Market Size: USD 4.8 Billion

- CAGR (2025-2033): 7.71%

Running gear refers to various accessories and wearable products worn by individuals while running or performing sports-related activities. The commonly used products include running shoes, jackets, belts, tights and sunglasses. They are manufactured from water- and scratch-resistant materials to prevent injuries and improve air circulation for enhanced comfort. They also offer a protective layer to the wearer to avoid chafing of the skin during physical activity. Numerous wearable devices, such as smartwatches and smart patches, are also used by runners and athletes to track their fitness progress and vital signs periodically.

To get more information on this market, Request Sample

Increasing health consciousness and the widespread adoption of running as an effective form of exercise in India are among the key factors driving the India running gear market growth. Hectic schedules and rising health concerns are compelling individuals to engage in regular physical activity, thereby increasing the demand for running gear. Additionally, various product innovations, such as the development of aesthetically appealing designs with high-quality fibers, are acting as other growth-inducing factors. In line with this, the proliferation of social media platforms and e-commerce retails channels are also contributing to the market growth. Product manufacturers are collaborating with celebrities and sports personalities and offering services, such as faster delivery, discounts and cashback, to attract a broader consumer base. Other factors, such as rising disposable income levels and increasing consumer expenditure capacities, are driving the market further.

India Running Gear Market Trends:

Government Support and Policy Frameworks

Government-led initiatives have significantly contributed to the expansion of market by fostering a culture of fitness, sports participation, and infrastructure development. National schemes that promote health awareness and physical activity, such as large-scale fitness missions and youth sports programs, are driving greater demand for quality athletic gear, particularly among the urban and semi-urban population. For instance, in July 2025, the Prime Minister announced the Union Cabinet’s approval of the new National Sports Policy, titled Khelo Bharat Niti 2025. The initiative aims to integrate sports into the daily routines of students in schools and colleges, while offering full support to sports‑related startups across management, manufacturing, and coaching domains. Also, villages, underprivileged communities, and daughters would be given top priority under the policy’s inclusive framework. Furthermore, state-sponsored marathons and wellness campaigns have normalized running as a lifestyle choice, encouraging recurring purchases of running shoes, moisture-wicking apparel, compression socks, and fitness accessories. Collectively, this policy environment is supporting the India running gear market demand and a robust supply ecosystem for running gear.

Technological Advancements in Athletic Gear

Rapid innovation in materials, product design, and ergonomic engineering is transforming the running gear market in India. Athletes and recreational runners alike are seeking gear that not only enhances performance but also ensures durability, breathability, and comfort. Additionally, running shoes now incorporate lightweight foams, shock-absorbing midsoles, and advanced traction systems tailored to diverse Indian terrains, from urban pavements to trail paths. Similarly, apparel made with sweat-resistant and quick-dry fabrics enables runners to train more efficiently across different climatic zones. Moreover, wearable technology has further elevated consumer expectations; smart insoles, biometric-enabled shoes, and fitness tracking garments are gaining popularity among tech-savvy runners. Apart from this, brands are responding by investing in research and development (R&D) and integrating sensor-based features into gear that supports gait analysis and real-time feedback. This technological shift is making running gear more performance-driven and personalized, attracting a broader consumer base that includes both amateur fitness enthusiasts and serious runners looking to optimize training outcomes.

Rise of Eco-Conscious and Sustainable Products

Sustainability is emerging as a major driver augmenting the India running gear market share, reshaping product development and consumer choices. In addition, increasing awareness of environmental impact has led to a noticeable shift toward eco-friendly materials and ethical manufacturing practices. Also, runners are now prioritizing gear that aligns with their values, products made using recycled fibers, plant-based dyes, and minimal-waste production methods are gaining traction. Brands are reducing plastic packaging, offering repair-friendly gear, and launching return-and-recycle programs to promote circularity. This trend is particularly strong among millennials and Gen Z consumers who associate sustainability with long-term lifestyle goals. Additionally, the durability and versatility of sustainable gear appeal to practical users who seek long-lasting value. As this eco-conscious mindset continues to grow, companies are not only investing in green technology but also transparently communicating their sustainability efforts, building trust and brand loyalty. This evolving preference for sustainable running gear is gradually becoming a mainstream expectation across urban Indian markets.

Challenges and Opportunities in the Market:

The market presents a dynamic mix of challenges and opportunities shaped by evolving consumer preferences, economic diversity, and infrastructural disparities. One key challenge lies in catering to the vast price-sensitive population while maintaining product quality and innovation. Inauthentic goods and inconsistent distribution networks in tier II and III cities further constrain brand penetration. However, as per the India running gear market analysis, these limitations are balanced by promising opportunities. Rising health consciousness, growing participation in fitness events, and government-backed sports schemes are expanding the market’s consumer base. The surge in digital commerce allows brands to reach underserved regions, while technological innovation and sustainability trends enable differentiation and premiumization. Additionally, India’s youth-dominated demographic and increasing urbanization foster long-term market potential. Overall, while structural challenges remain, proactive investments in awareness, accessibility, and product development can unlock substantial growth in the market.

India Running Gear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India running gear market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product, gender and distribution channel.

Breakup by Product:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

Breakup by Gender:

- Male

- Female

- Unisex

Breakup by Distribution Channel:

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Developments:

- July 2025: Canadian activewear brand Lululemon Athletica has announced plans to enter the Indian market via a franchise partnership with Tata CLiQ, targeting launch in the second half of 2026. The collaboration will include Lululemon’s first physical store in India alongside exclusive online storefronts on Tata CLiQ Luxury and Tata CLiQ Fashion platforms. This move is part of Lululemon’s international expansion strategy, aimed at tapping into India’s growing premium athleisure and wellness market with its full range of athletic apparel, footwear, accessories, and community-focused wellness experiences.

- May 2025: PUMA India entered into a multi‑year agreement with NEB Sports Entertainment to become the official sportswear partner for two premier Indian road races: the 8th Mumbai Half Marathon and the 12th Wipro Bengaluru Marathon. Under this collaboration, PUMA India will provide comprehensive support across the runner’s journey, offering expert-led training runs, high-performance race-day apparel, and on-ground race assistance—including pre- and post-event logistics. This initiative underscores PUMA’s strategic commitment to nurturing India’s rapidly expanding running ecosystem.

- November 2024: Nike unveiled the Vomero 18, its newest road-running model engineered to deliver maximum cushioning via a dual‑density midsole combining ZoomX and ReactX foams and featuring the tallest stack height in Vomero franchise history, approximately 46 mm in the heel and 36 mm in the forefoot. Built with the input of women runners—using a women’s sample size as the basis for fit and design—Nike prioritized comfort, softness (18% softer than the previous model), and a smooth rocker transition from heel to toe.

- November 2024: Brandman Retail announced an exclusive distribution partnership with Wolverine Worldwide to introduce Saucony to the Indian market. Under the agreement, Brandman Retail will launch Saucony’s Autumn/Winter 2024 collection across India, covering both performance running shoes and lifestyle footwear, via a curated omni‑channel strategy. This collaboration further enhances Brandman Retail’s portfolio to capitalize on India’s growing demand for premium athletic footwear.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product, Gender, Distribution Channel, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India running gear market was valued at USD 2.4 Billion in 2024.

We expect the India running gear market to exhibit a CAGR of 7.71% during 2025-2033.

The rising adoption of high-intensity fitness activities by health-conscious individuals, along with the introduction of superior-quality fabrics with aesthetically appealing designs, is primarily driving the India running gear market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of running gear across the nation.

Based on the product, the India running gear market can be segregated into running footwear, running apparel, running accessories, and fitness trackers. Currently, running footwear holds the majority of total market share.

Based on the gender, the India running gear market has been bifurcated into male, female, and unisex. Among these, male currently exhibits a clear dominance in the market.

Based on the distribution channel, the India running gear market can be categorized into specialty and sports shops, supermarkets and hypermarkets, department and discount stores, online, and others. Currently, specialty and sports shops account for the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the India running gear market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)