India Safety Valves Market Size, Share, Trends and Forecast by Material, Size, Industry, and Region, 2026-2034

India Safety Valves Market Overview:

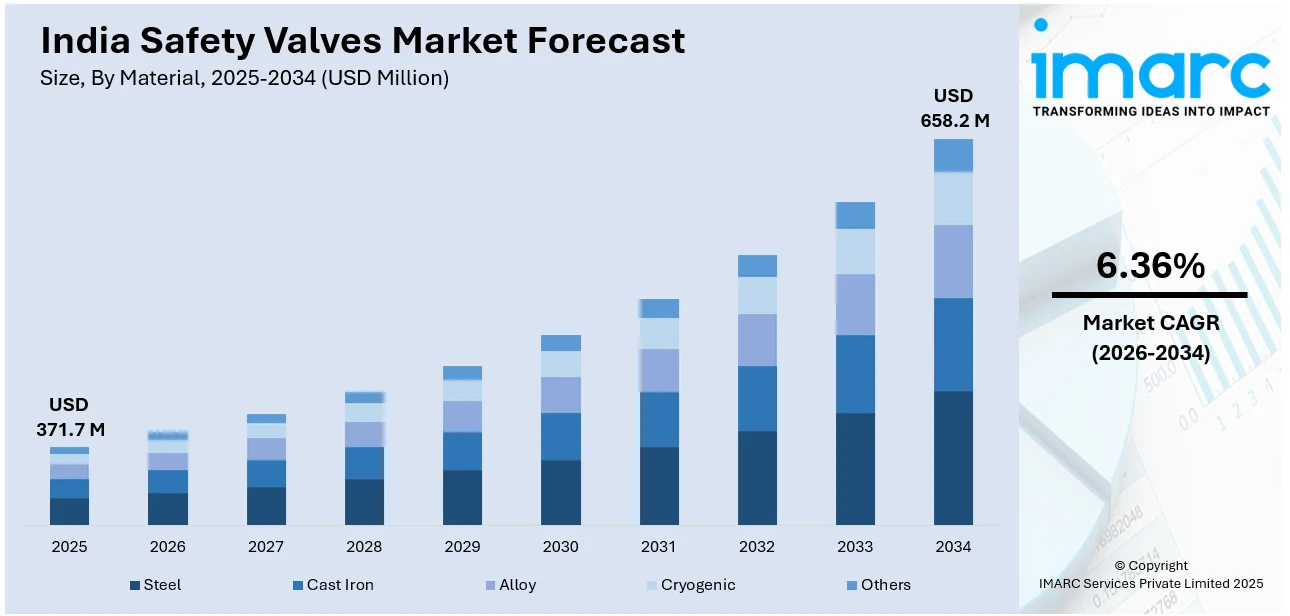

The India safety valves market size reached USD 371.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 658.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.36% during 2026-2034. The India safety valves market share is driven by expanding industrial safety regulations, rising power generation demand, and the growing infrastructure projects. Moreover, increasing automation and smart valve adoption further enhance safety, efficiency, and operational reliability across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 371.7 Million |

| Market Forecast in 2034 | USD 658.2 Million |

| Market Growth Rate (2026-2034) | 6.36% |

India Safety Valves Market Trends:

Increasing Demand in Power Generation

Industries are increasingly prioritizing workplace safety to prevent accidents, equipment failures, and hazardous material leaks. Government regulations and industry standards are mandating the installation of safety valves across various industrial sectors. These regulations ensure compliance with pressure management protocols, reducing risks associated with overpressure conditions. The oil and gas industry is widely adopting safety valves to mitigate potential fire and explosion hazards. In power plants, safety valves are crucial for preventing steam and pressure build-up in boilers. The pharmaceutical and chemical industries require advanced safety valves to handle volatile substances safely. Growing infrastructure projects including water treatment plants, demand high-performance safety valves for pressure control applications, which is a key factor strengthening the India safety valves market growth. Besides this, the rising adoption of automation in industrial operations is also catalyzing the demand for smart safety valves. In June 2024, AMETEK Land launched a thermal imager retraction system to enhance safety in steel, glass, cement, and power plants. Featuring automated retraction, it protects sensors from extreme heat while ensuring continuous monitoring. These technologically advanced solutions provide real-time monitoring and predictive maintenance capabilities for improved safety. Expanding manufacturing activities are increasing the need for reliable safety systems to avoid operational disruptions, improving efficiency and industrial safety.

To get more information on this market Request Sample

Expanding Requirement for Industrial Safety

The increasing demand for safety valves in power generation is positively influencing the India safety valves market outlook. Rapid urbanization and industrial expansion are leading to higher electricity usage across various sectors. Power plants require safety valves to regulate steam pressure and prevent potential equipment failures. Thermal power plants extensively use safety valves in boilers, turbines, and pipelines for operational safety. The expansion of renewable energy projects including solar and wind power is also increasing safety valve demand. Hydroelectric power plants depend on safety valves to manage water pressure and prevent structural damage. Nuclear power plants require highly reliable safety valves to control coolant flow and ensure reactor safety. The Government of India is planning to add at least 80 GW of new coal-based power capacity by 2031-32 to meet the base load requirements. This expansion is expected to drive significant demand for safety valves in coal-fired power plants. The integration of smart grids and advanced energy systems further necessitates efficient pressure control mechanisms, increasing the adoption of high-performance safety valves across the power sector.

India Safety Valves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on material, size, and industry.

Material Insights:

- Steel

- Cast Iron

- Alloy

- Cryogenic

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes steel, cast iron, alloy, cryogenic, and others.

Size Insights:

- Up To 1”

- 1” to 6”

- 6” to 25”

- 25” to 50”

- 50” and Larger

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes up to 1”, 1” to 6”, 6” to 25”, 25” to 50”, 50” and larger.

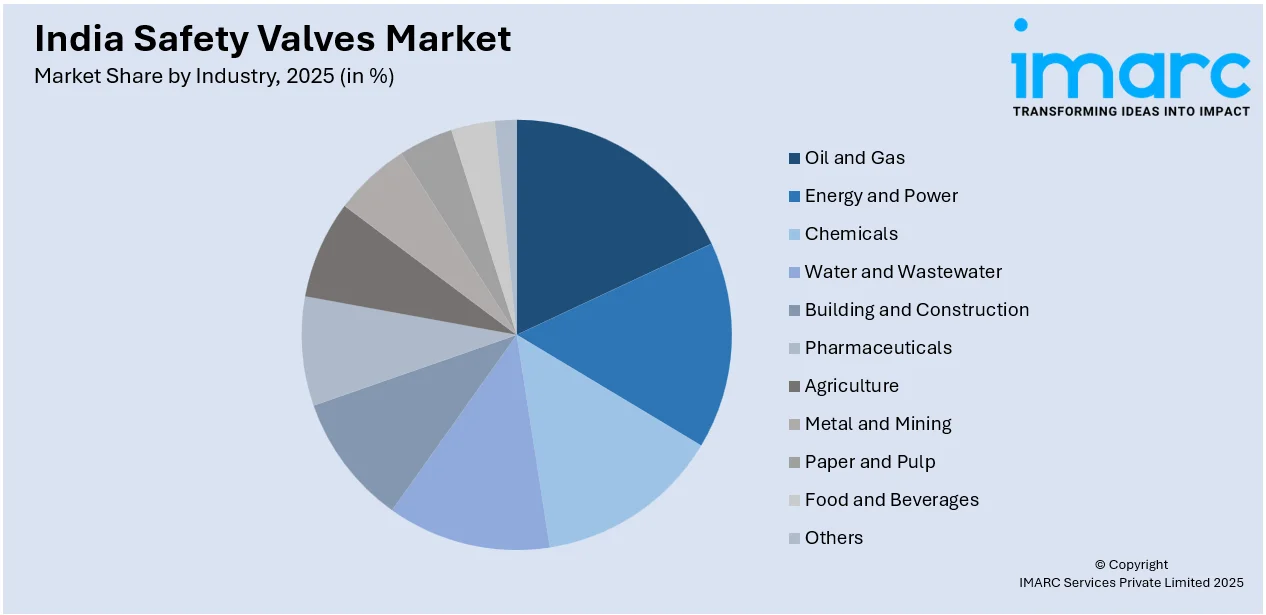

Industry Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Energy and Power

- Chemicals

- Water and Wastewater

- Building and Construction

- Pharmaceuticals

- Agriculture

- Metal and Mining

- Paper and Pulp

- Food and Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the industry. This includes oil and gas, energy and power, chemicals, water and wastewater, building and construction, pharmaceuticals, agriculture, metal and mining, paper and pulp, food and beverages, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Safety Valves Market News:

- In August 2024, LESER inaugurated a ₹50 crore brownfield expansion at its Paithan facility, Aurangabad, to increase safety valve production. The expansion integrates automation and advanced manufacturing to enhance efficiency and transparency, aligning with global quality standards.

India Safety Valves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Steel, Cast Iron, Alloy, Cryogenic, Others |

| Sizes Covered | Up To 1”, 1” to 6”, 6” to 25”, 25” to 50”, 50” and Larger |

| Industries Covered | Oil and Gas, Energy and Power, Chemicals, Water and Wastewater, Building and Construction, Pharmaceuticals, Agriculture, Metal and Mining, Paper and Pulp, Food and Beverages, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India safety valves market performed so far and how will it perform in the coming years?

- What is the breakup of the India safety valves market on the basis of material?

- What is the breakup of the India safety valves market on the basis of size?

- What is the breakup of the India safety valves market on the basis of industry?

- What are the various stages in the value chain of the India safety valves market?

- What are the key driving factors and challenges in the India safety valves market?

- What is the structure of the India safety valves market and who are the key players?

- What is the degree of competition in the India safety valves market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India safety valves market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India safety valves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India safety valves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)