India Sales Acceleration Technology Market Size, Share, Trends and Forecast by Type, End Use Industry, and Region, 2025-2033

India Sales Acceleration Technology Market Overview:

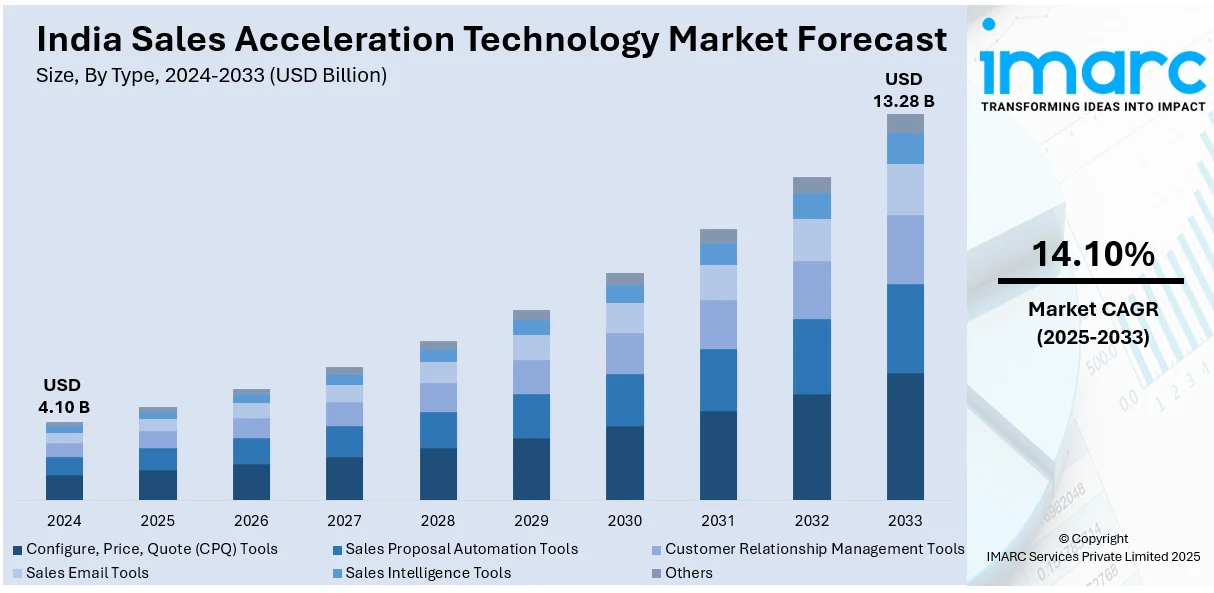

The India sales acceleration technology market size reached USD 4.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.28 Billion by 2033, exhibiting a growth rate (CAGR) of 14.10% during 2025-2033. The sales acceleration technology market in India is growing on account of increasing digital adoption, AI-based automation, and cloud-based integration of CRM. At the same time, the market is being driven by the increasing need for customer interaction, predictive analytics, and workflow automation, which is being aided by strong enterprise adoption and evolving sales tactics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.10 Billion |

| Market Forecast in 2033 | USD 13.28 Billion |

| Market Growth Rate 2025-2033 | 14.10% |

India Sales Acceleration Technology Market Trends:

Growing Adoption of AI-Powered Sales Tools

AI-driven sales acceleration solutions are increasingly being adopted by Indian businesses to boost productivity. Also, companies are spending on predictive models, lead scoring, and AI-driven analytics to make informed decisions. Simultaneously, the technology minimizes manual intervention and boosts productivity by enabling sales teams to focus on high-value leads and free themselves of redundant work. At the same time, generative AI facilitates mass personalized communication in consumer interactions. AI-driven chatbots and virtual assistants provide real-time feedback, enhancing interaction. Sales projections are also improving due to machine learning algorithms, which support corporate planning. AI utilization in sales process optimization is becoming inevitable as companies seek increased conversion rates. Similarly, the trend is being fueled by the growth of cloud-based systems. Furthermore, companies are looking for SaaS-based solutions that provide seamless connectivity with existing CRM systems and immediate access to data. Meanwhile, this shift is enhancing collaboration and providing remote sales teams with greater autonomy. The market is seeing high demand for smart sales automation solutions, and companies are still on the hunt for next-generation AI.

To get more information on this market, Request Sample

Increased Demand for Data-Driven Sales Insights

Indian companies are turning to data-driven strategies to drive sales acceleration. Businesses are using advanced analytics to monitor customer behavior, tailor sales pitches, and maximize marketing campaigns. Additionally, sales acceleration platforms with integrated analytics are emerging as a top investment for companies seeking to boost performance. One of the most significant trends is the convergence of big data with real-time sales intelligence tools. Furthermore, these tools offer actionable insights, enabling sales teams to make data-driven decisions. Companies are also implementing customer data platforms (CDPs) to bring sales and marketing data together, allowing for more precise targeting. In line with this, data-driven decision-making is becoming an area of competitive differentiation as consumers' behavior grows in complexity. Increased automation across lead management further fuels this phenomenon. Businesses are applying automated processes in segmenting leads and tailoring outreach efforts. Response time decreases, and customer interactions improve with this process. Moreover, predictive analytics is assisting sales teams in finding prospective buyers as well as streamlining sales pipelines, thereby positively impacting the market growth.

India Sales Acceleration Technology Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and end use industry.

Type Insights:

- Configure, Price, Quote (CPQ) Tools

- Sales Proposal Automation Tools

- Customer Relationship Management Tools

- Sales Email Tools

- Sales Intelligence Tools

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes configure, price, quote (CPQ) tools, sales proposal automation tools, customer relationship management tools, sales email tools, sales intelligence tools, and others.

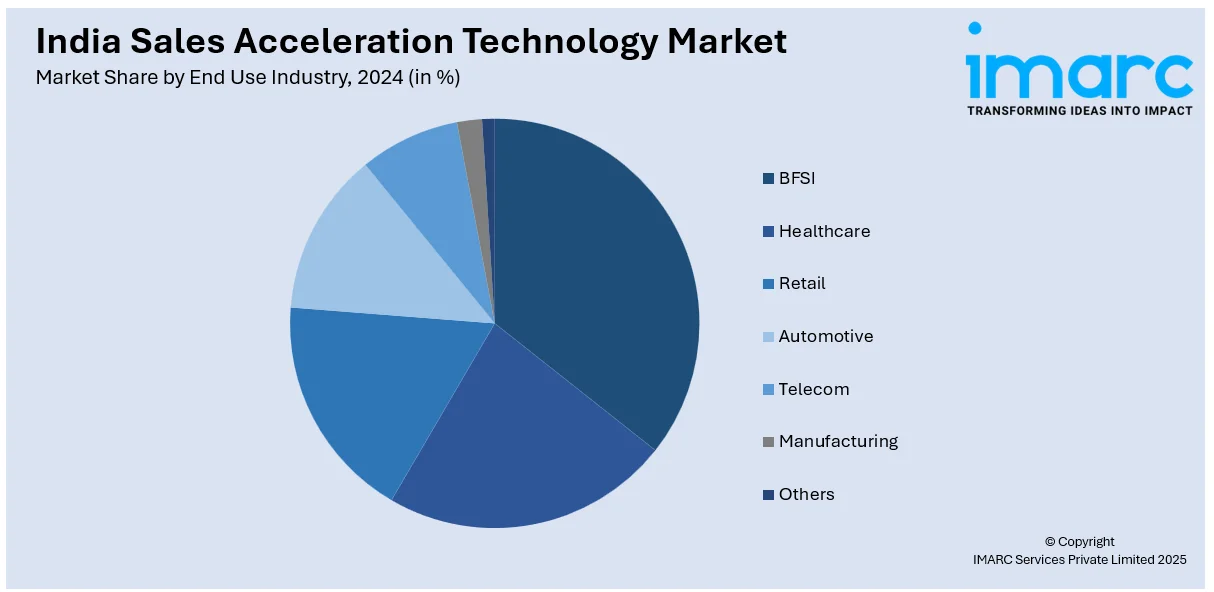

End Use Industry Insights:

- BFSI

- Healthcare

- Retail

- Automotive

- Telecom

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, healthcare, retail, automotive, telecom, manufacturing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Sales Acceleration Technology Market News:

- May 2024: Denave introduced AI-powered sales acceleration solutions, integrating Generative AI, predictive insights, and data-driven GTM strategies. This innovation enhances targeting accuracy, sales intelligence, and outreach personalization, resulting in faster deal cycles, increased win rates, and improved ROI, driving India’s sales acceleration technology sector growth.

- February 2024: Movate launched Movate SalesEdge, integrating AI-powered, human-led sales acceleration solutions. This innovation enhances lead generation, customer engagement, and sales conversion through predictive analytics and automation, driving faster deal cycles, increased sales efficiency, and improved ROI, boosting India’s sales acceleration technology industry growth.

India Sales Acceleration Technology Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Configure, Price, Quote (CPQ) Tools, Sales Proposal Automation Tools, Customer Relationship Management Tools, Sales Email Tools, Sales Intelligence Tools, Others |

| End Use Industries Covered | BFSI, Healthcare, Retail, Automotive, Telecom, Manufacturing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India sales acceleration technology market performed so far and how will it perform in the coming years?

- What is the breakup of the India sales acceleration technology market on the basis of type?

- What is the breakup of the India sales acceleration technology market on the basis of end use industry?

- What are the various stages in the value chain of the India sales acceleration technology market?

- What are the key driving factors and challenges in the India sales acceleration technology market?

- What is the structure of the India sales acceleration technology market and who are the key players?

- What is the degree of competition in the India sales acceleration technology market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sales acceleration technology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sales acceleration technology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sales acceleration technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)